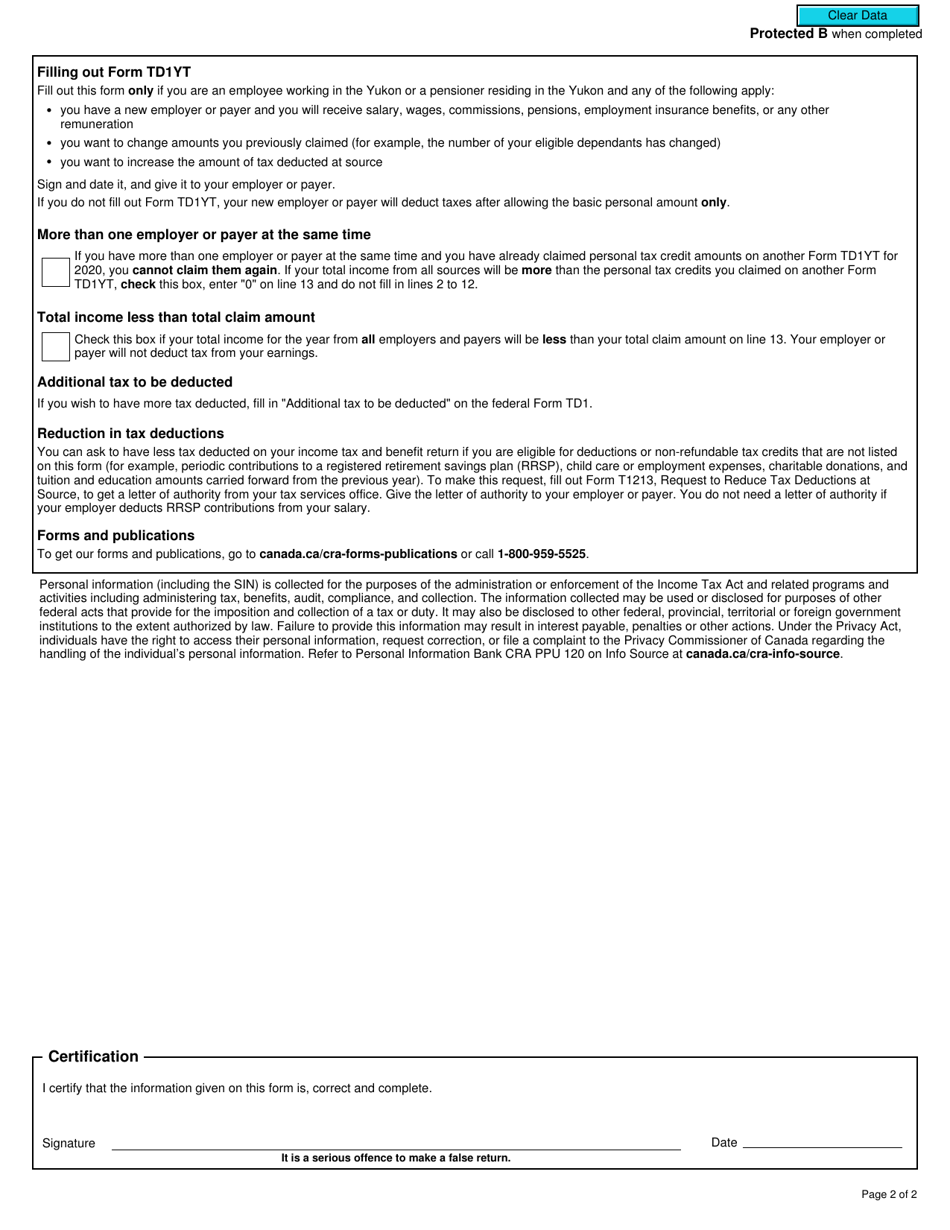

This version of the form is not currently in use and is provided for reference only. Download this version of

Form TD1YT

for the current year.

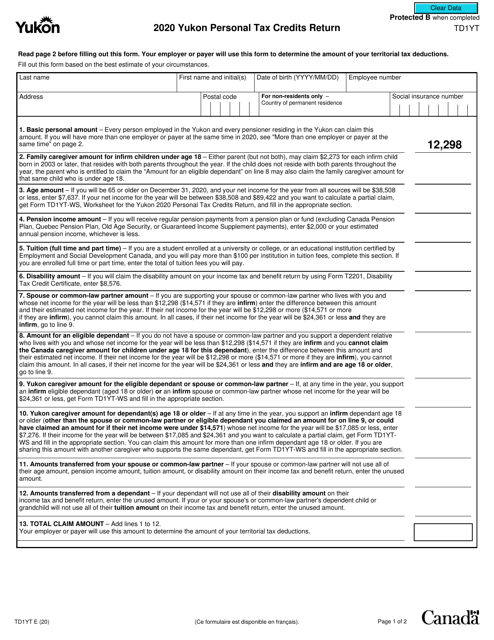

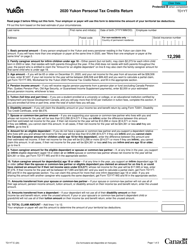

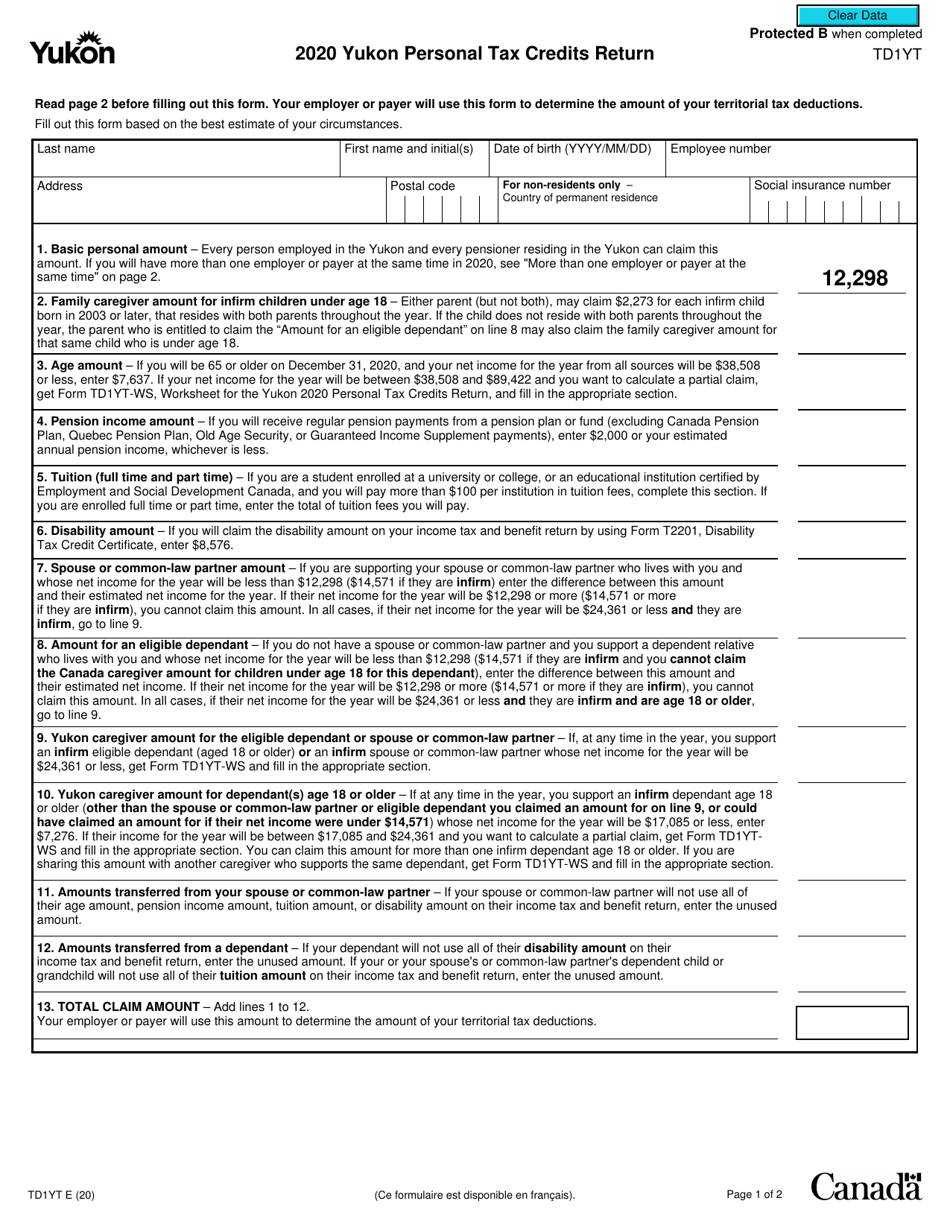

Form TD1YT Yukon Personal Tax Credits Return - Canada

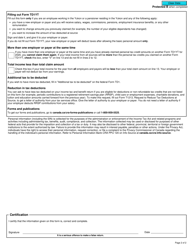

Form TD1YT Yukon Personal Tax Credits Return is used by individuals who are residents of Yukon, Canada to claim personal tax credits and reduce the amount of taxes they have to pay. It helps determine the amount of income tax to be deducted from the individual's pay.

The Form TD1YT Yukon Personal Tax Credits Return in Canada is filed by individuals who are residents of Yukon and want to claim additional tax credits.

FAQ

Q: What is Form TD1YT?

A: Form TD1YT is the Yukon Personal Tax Credits Return, which is used by taxpayers in Yukon, Canada to calculate their federal and provincial tax deductions.

Q: Who should file Form TD1YT?

A: Residents of Yukon, Canada who want to claim certain tax credits on their income taxes should file Form TD1YT.

Q: What tax credits can be claimed on Form TD1YT?

A: Form TD1YT allows taxpayers in Yukon, Canada to claim credits such as the Basic Personal Amount, the Canada Employment Amount, the Disability Amount, and various other credits.

Q: When does Form TD1YT need to be filed?

A: Form TD1YT should be filled out and submitted to your employer as soon as possible, preferably before you start receiving income for the year.

Q: Can I claim tax credits on Form TD1YT if I don't live in Yukon?

A: No, Form TD1YT is specifically for residents of Yukon, Canada. If you live in a different province or territory, you should use the appropriate form for your province or territory.