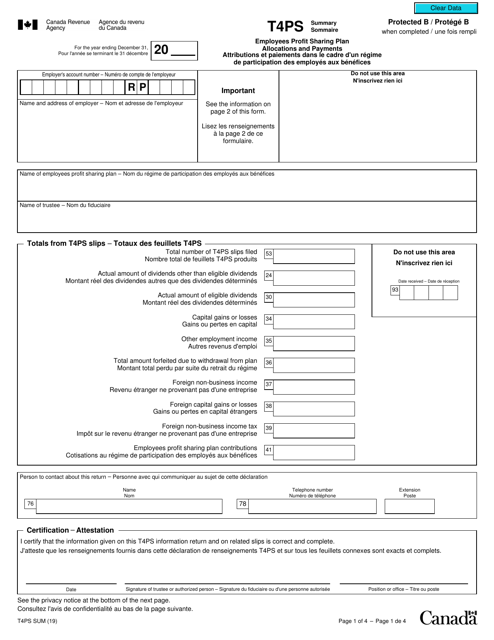

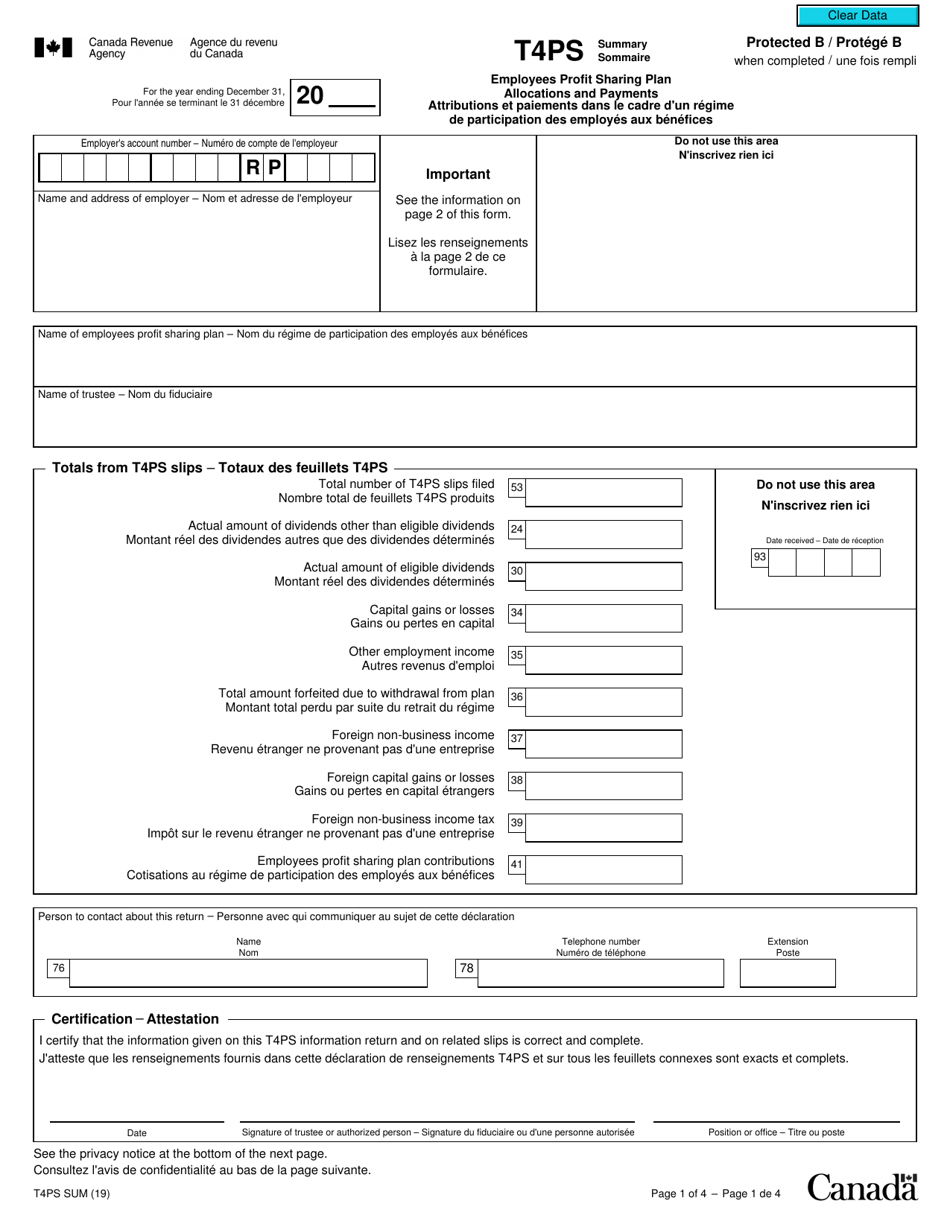

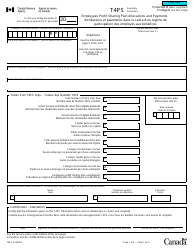

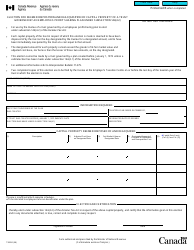

Form T4PSSUM Employees Profit Sharing Plan Allocations and Payments - Canada (English / French)

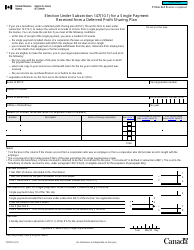

Form T4PSSUM is used in Canada to report the allocations and payments made under an Employees Profit Sharing Plan (EPSP). This form is used to provide a summary of the amounts distributed to employees from the EPSP during the tax year.

The Form T4PSSUM for Employees Profit Sharing Plan Allocations and Payments in Canada is typically filed by the employer.

FAQ

Q: What is Form T4PSSUM?

A: Form T4PSSUM is a tax form used in Canada to report employees' profit sharing plan allocations and payments.

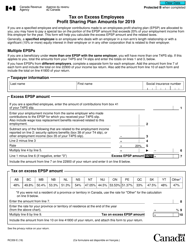

Q: What is an employees profit sharing plan?

A: An employees profit sharing plan is a plan where an employer shares a portion of the company's profits with its employees.

Q: Who should use Form T4PSSUM?

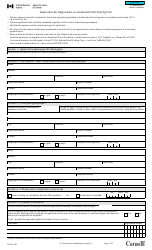

A: Employers in Canada who have a profit sharing plan for their employees should use Form T4PSSUM to report the allocations and payments made.

Q: Is Form T4PSSUM available in both English and French?

A: Yes, Form T4PSSUM is available in both English and French versions.

Q: What information is required on Form T4PSSUM?

A: Form T4PSSUM requires information such as the employer's name and address, the employees' names and SINs, and the amounts allocated and paid to each employee.

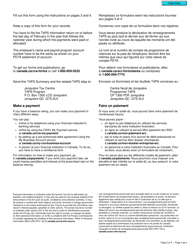

Q: Is there a deadline for filing Form T4PSSUM?

A: Yes, Form T4PSSUM must be filed and given to the employees by the last day of February following the calendar year in which the allocations and payments were made.

Q: Do I need to keep a copy of Form T4PSSUM?

A: Yes, employers should keep a copy of Form T4PSSUM for their records in case of any future audits or inquiries.

Q: Do I need to send Form T4PSSUM to the CRA?

A: Yes, employers are required to send a copy of Form T4PSSUM to the CRA along with their T4 Summary.

Q: Are there any penalties for not filing Form T4PSSUM?

A: Yes, failure to file or late filing of Form T4PSSUM may result in penalties and interest charges imposed by the CRA.