This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3-RCA

for the current year.

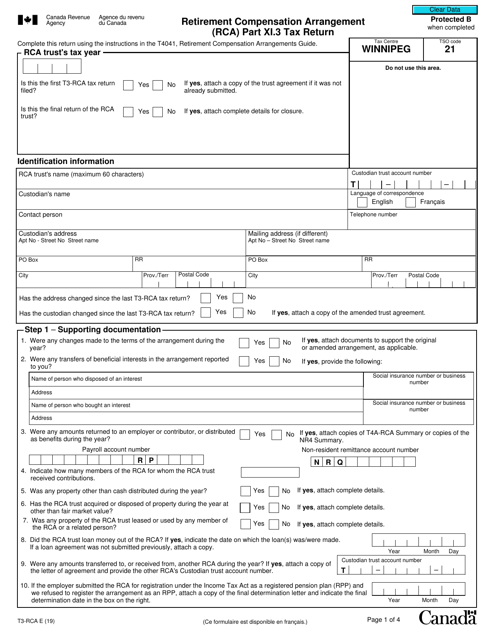

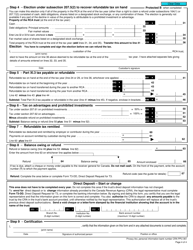

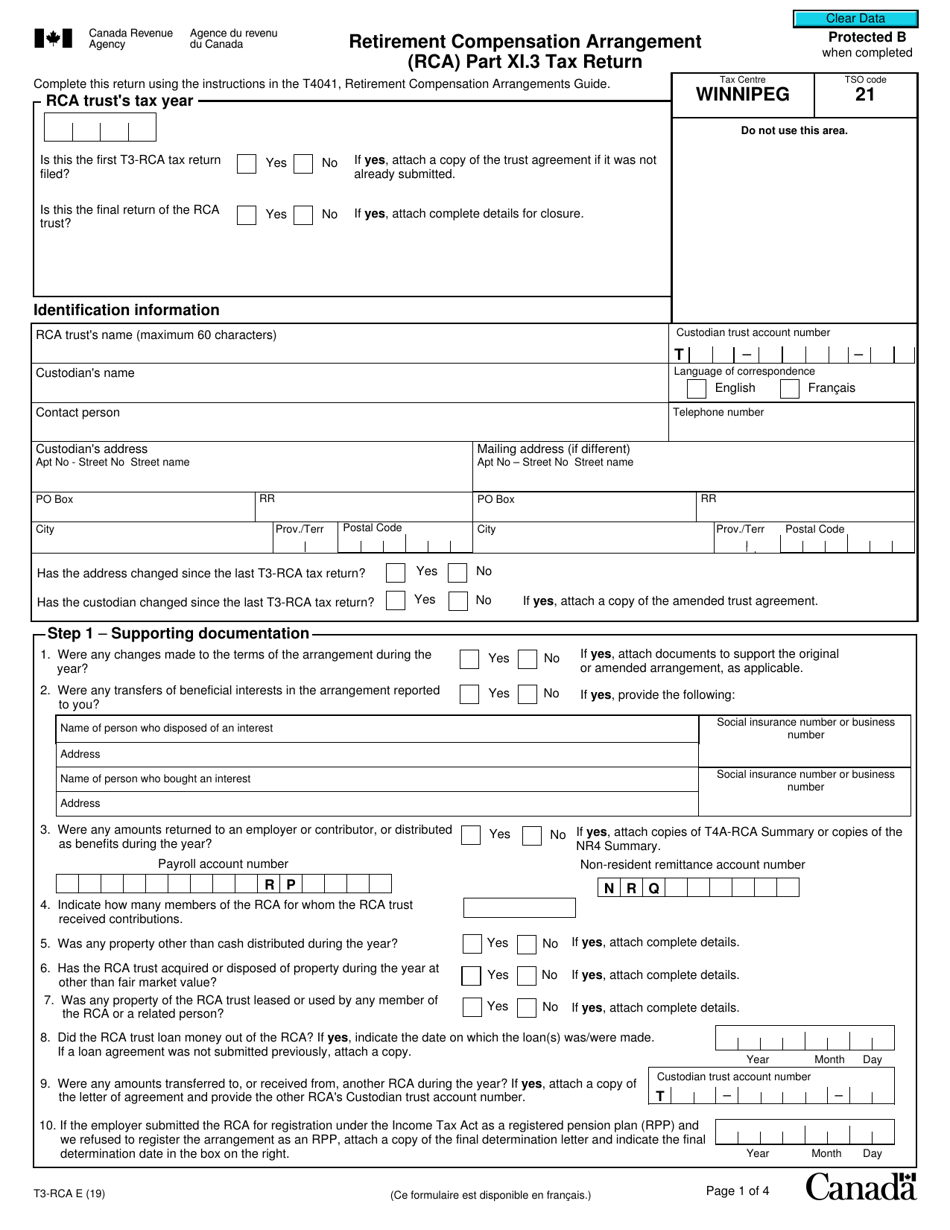

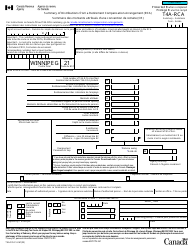

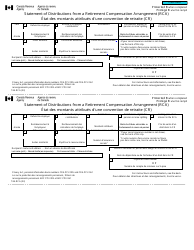

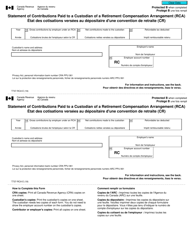

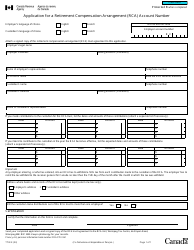

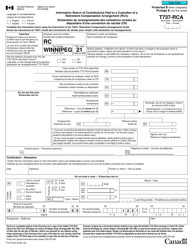

Form T3-RCA Retirement Compensation Arrangement (Rca) Part XI.3 Tax Return - Canada

The Form T3-RCA Retirement Compensation Arrangement (RCA) Part XI.3 Tax Return in Canada is used to report income and deductions related to a retirement compensation arrangement. It is specifically for individuals or corporations who participate in RCAs to calculate and submit their taxes to the Canada Revenue Agency (CRA).

The Form T3-RCA Retirement Compensation Arrangement (RCA) Part XI.3 Tax Return in Canada is filed by the trustee of the RCA.

FAQ

Q: What is Form T3-RCA?

A: Form T3-RCA is the tax return form for reporting Retirement Compensation Arrangement (RCA) in Canada.

Q: What is a Retirement Compensation Arrangement (RCA)?

A: A Retirement Compensation Arrangement (RCA) is a type of pension plan that provides benefits for highly-compensated employees.

Q: Who needs to file Form T3-RCA?

A: Parties who have a Retirement Compensation Arrangement (RCA) in Canada need to file Form T3-RCA.

Q: What is Part XI.3 of the tax return?

A: Part XI.3 of the tax return is the section specifically for reporting RCA in Canada.

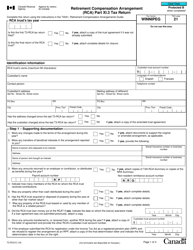

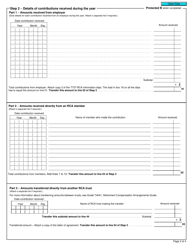

Q: What information do I need to complete Form T3-RCA?

A: You will need information about your RCA plan, contributions, and beneficiaries to complete Form T3-RCA.

Q: When is the deadline for filing Form T3-RCA?

A: The deadline for filing Form T3-RCA is usually within 90 days after the end of the tax year for which it is being filed.

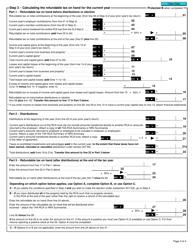

Q: What are the consequences of not filing Form T3-RCA?

A: Failure to file Form T3-RCA or providing incorrect information may result in penalties or interest charges.

Q: Is there any tax benefits associated with RCA?

A: Yes, contributions made to a Retirement Compensation Arrangement (RCA) are tax deductible for the employer.