This version of the form is not currently in use and is provided for reference only. Download this version of

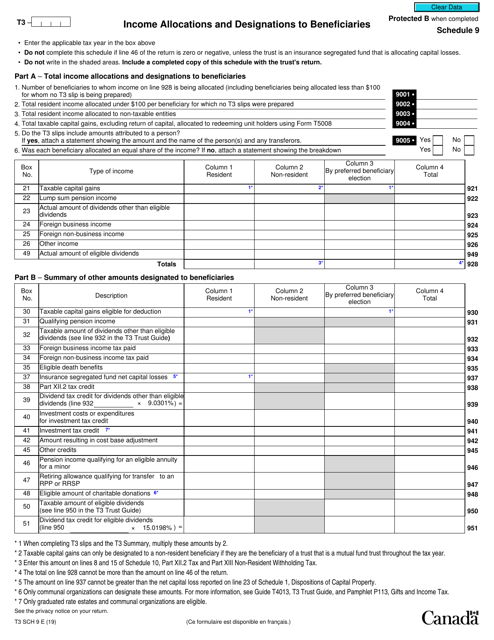

Form T3 Schedule 9

for the current year.

Form T3 Schedule 9 Income Allocations and Designations to Beneficiaries - Canada

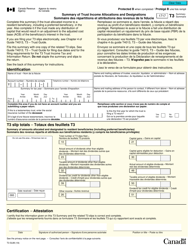

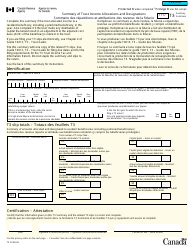

Form T3 Schedule 9 - Income Allocations and Designations to Beneficiaries is used in Canada for reporting the allocation of income and the designation of certain amounts to beneficiaries of a trust.

The Form T3 Schedule 9 Income Allocations and Designations to Beneficiaries in Canada is filed by the trustee of an estate or trust.

FAQ

Q: What is Form T3 Schedule 9?

A: Form T3 Schedule 9 is a tax form used in Canada to allocate income and designate beneficiaries for trust income.

Q: Who needs to complete Form T3 Schedule 9?

A: Individuals who are trustees of a trust in Canada and need to allocate income and designate beneficiaries for trust income will need to complete Form T3 Schedule 9.

Q: What information do I need to complete Form T3 Schedule 9?

A: To complete Form T3 Schedule 9, you will need information about the trust's income and details about the beneficiaries you are designating.

Q: Are there any deadlines for submitting Form T3 Schedule 9?

A: The deadline for submitting Form T3 Schedule 9 depends on the tax year of the trust. It is important to check with the CRA or consult a tax professional for the specific deadline.