This version of the form is not currently in use and is provided for reference only. Download this version of

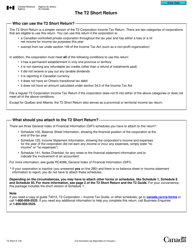

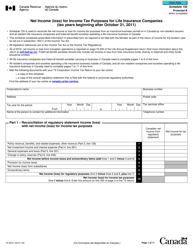

Form T3 Schedule 4

for the current year.

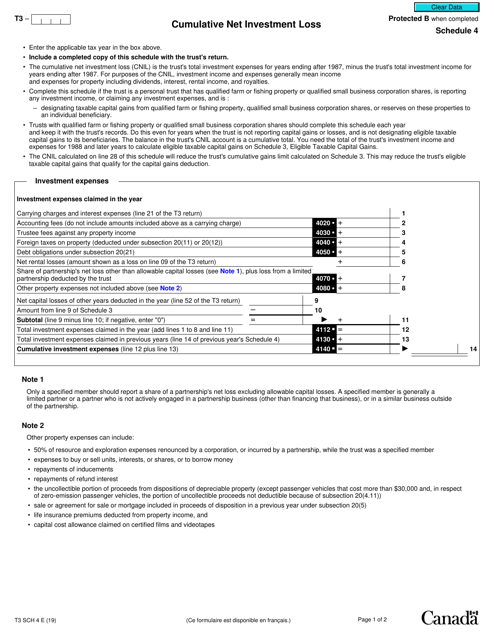

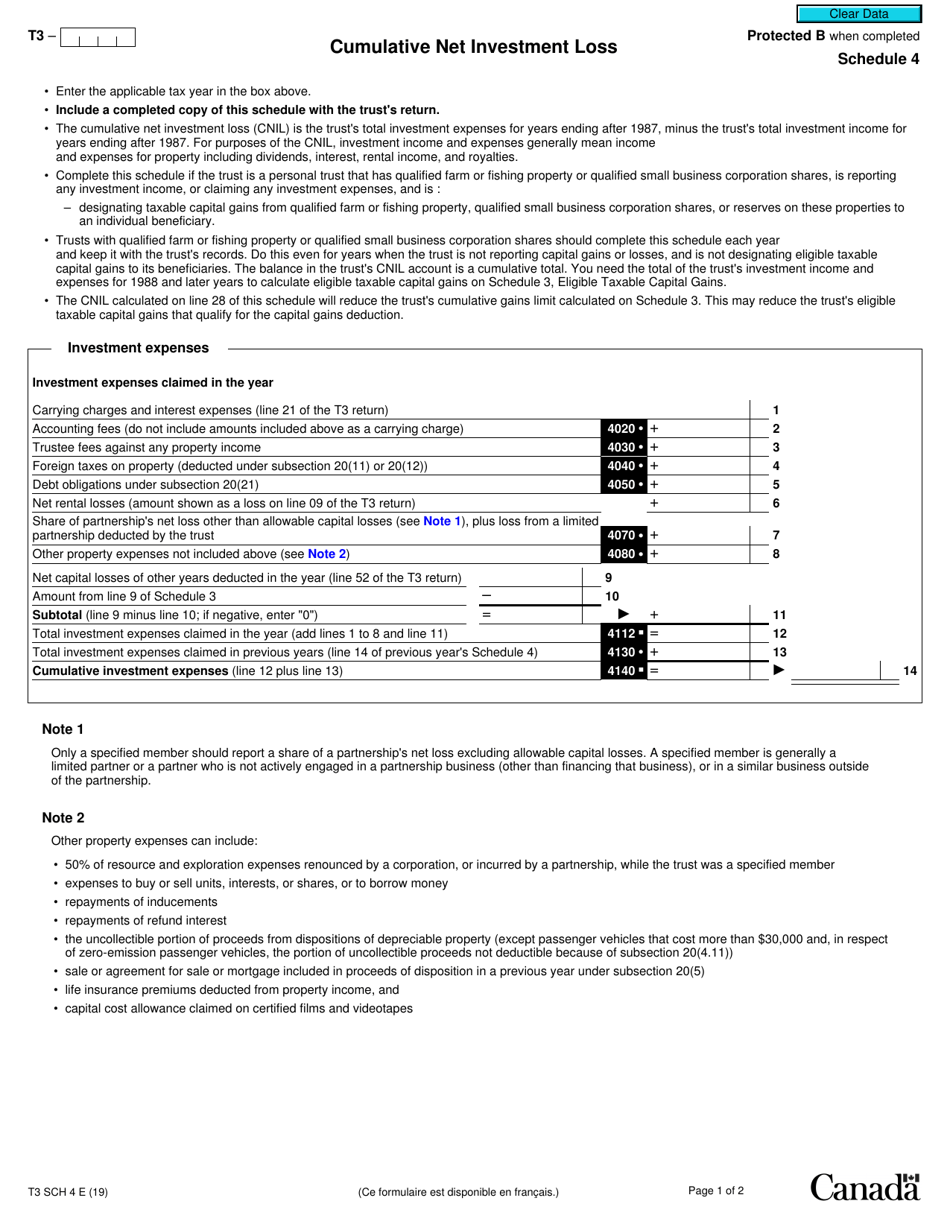

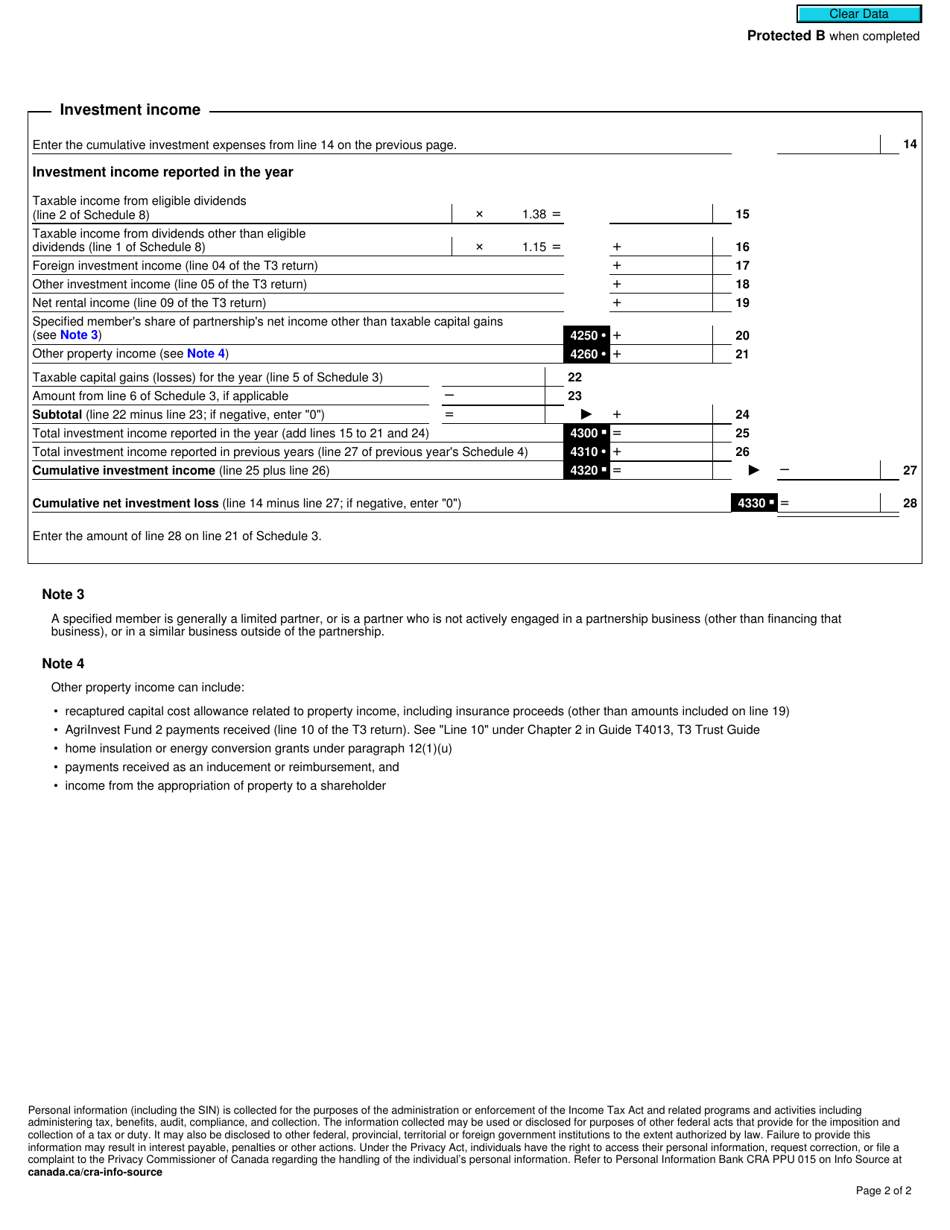

Form T3 Schedule 4 Cumulative Net Investment Loss - Canada

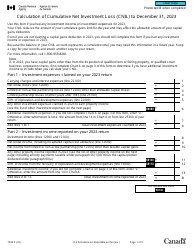

Form T3 Schedule 4 Cumulative Net Investment Loss in Canada is used to calculate and report the net investment loss that can be carried forward to future years to offset against future investment income.

The Form T3 Schedule 4 Cumulative Net Investment Loss in Canada is filed by a trust.

FAQ

Q: What is Form T3 Schedule 4?

A: Form T3 Schedule 4 is a tax form used in Canada to calculate the cumulative net investment loss.

Q: What is a cumulative net investment loss?

A: A cumulative net investment loss is the total of all investment losses that have not been offset by investment income.

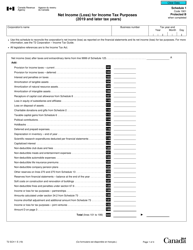

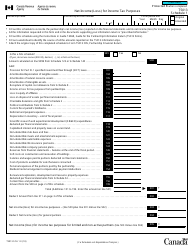

Q: How do I calculate the cumulative net investment loss?

A: To calculate the cumulative net investment loss, you subtract your investment income from your investment losses.

Q: Why is the cumulative net investment loss important?

A: The cumulative net investment loss can be used to offset future investment income and reduce your overall tax liability.

Q: Who needs to file Form T3 Schedule 4?

A: If you have any investment losses that you want to carry forward, you will need to file Form T3 Schedule 4.