This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3RET

for the current year.

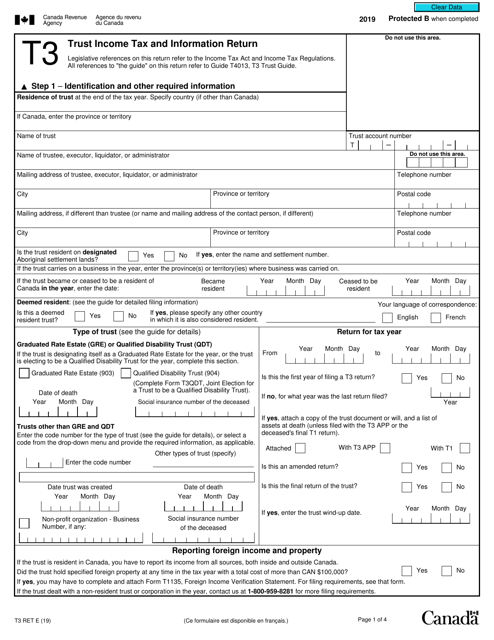

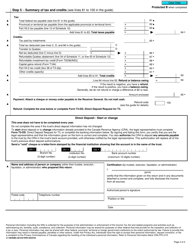

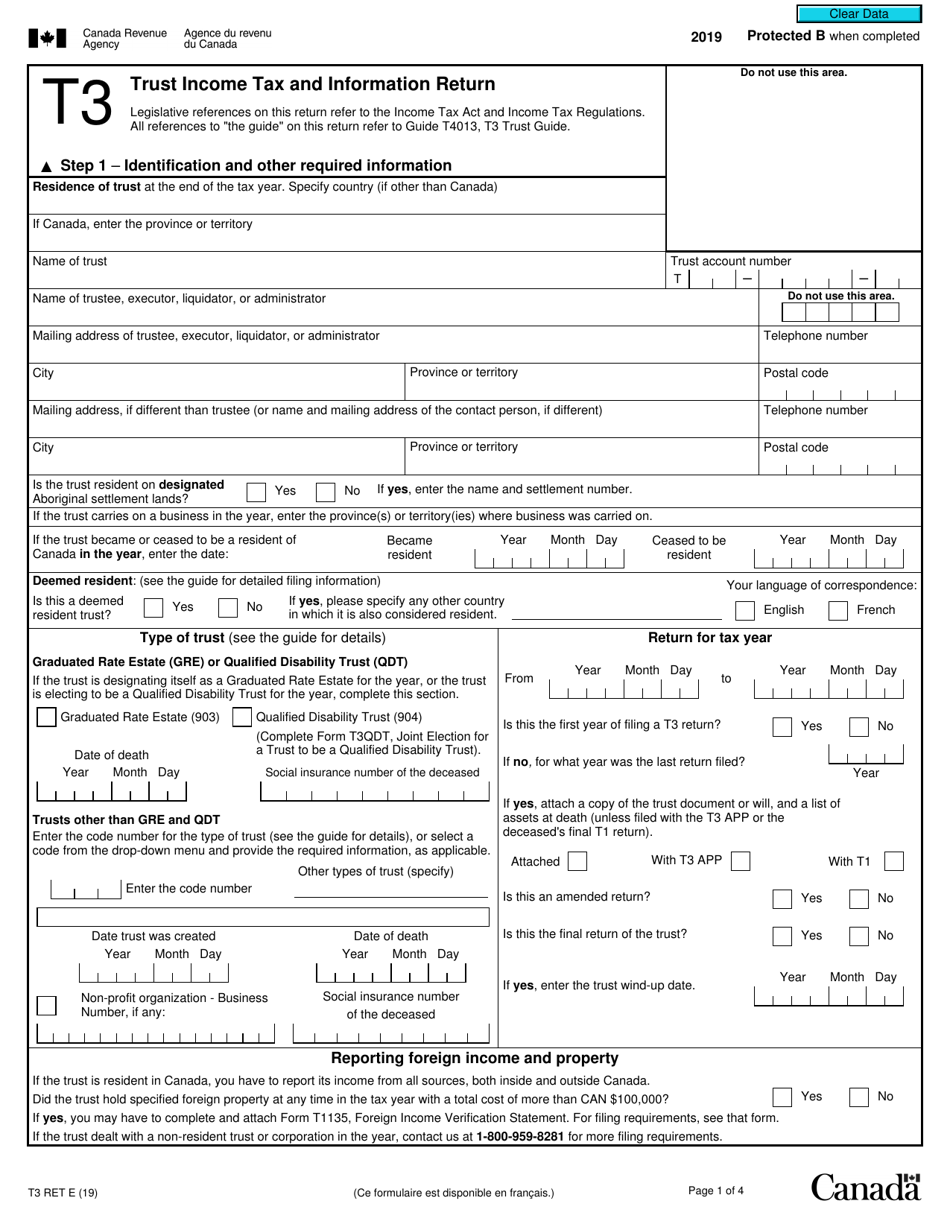

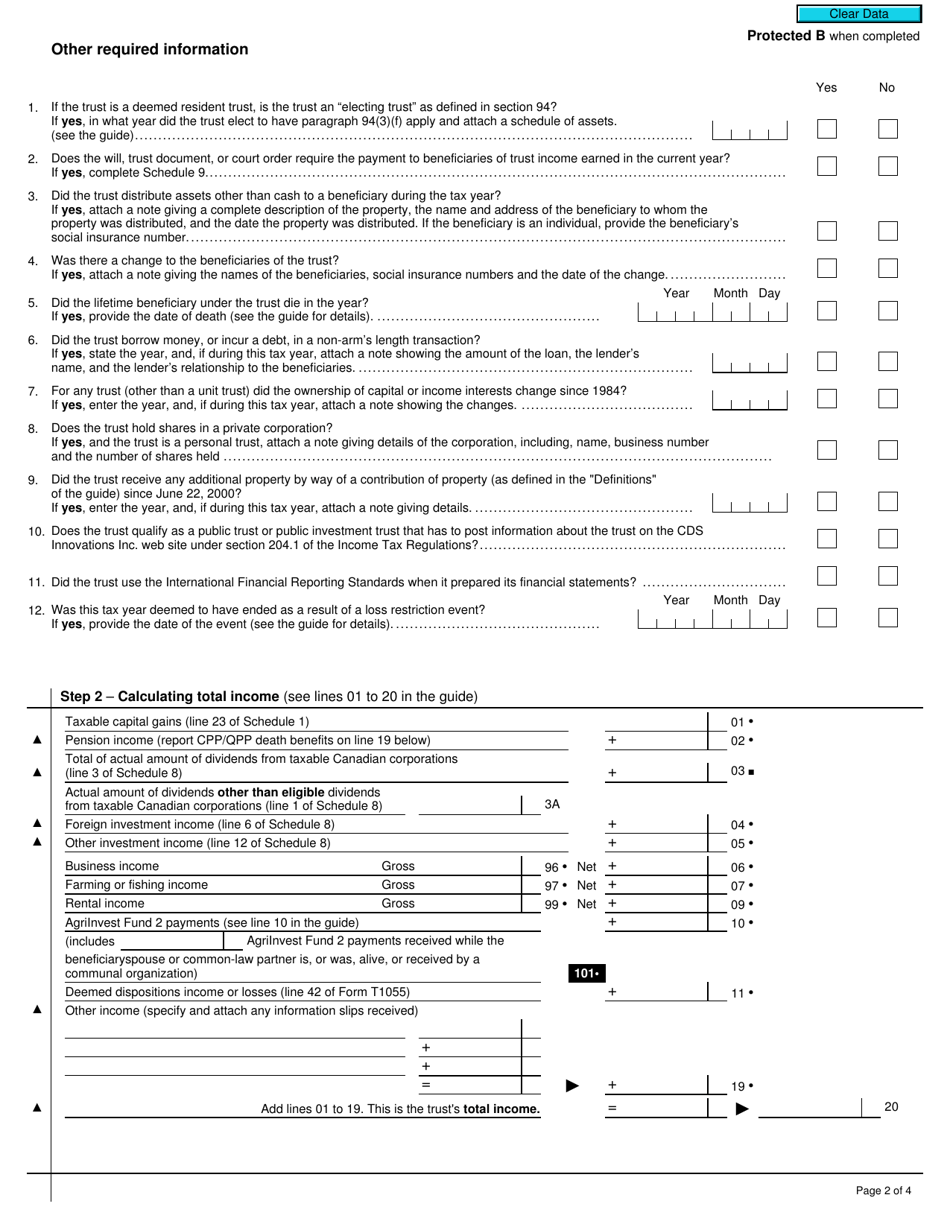

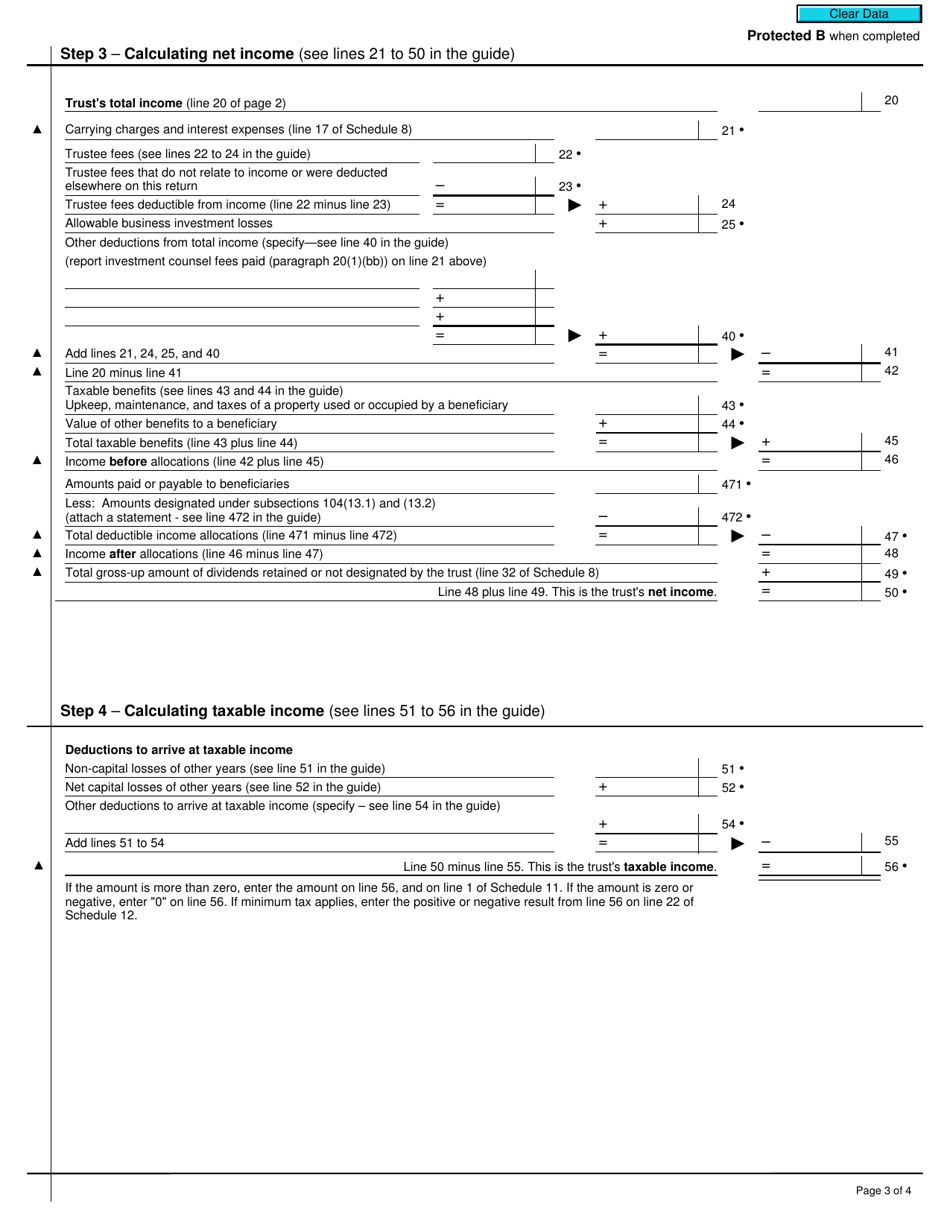

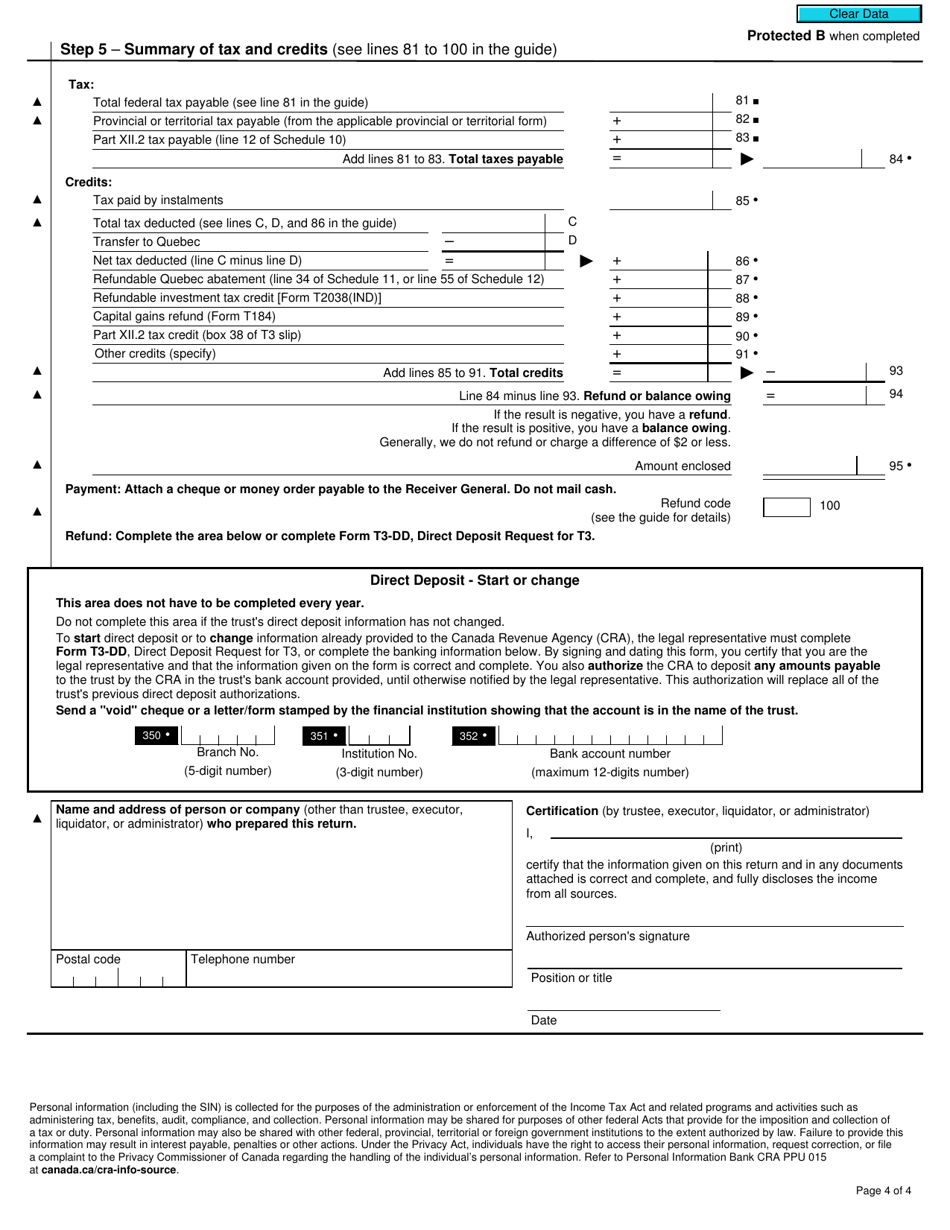

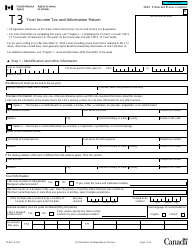

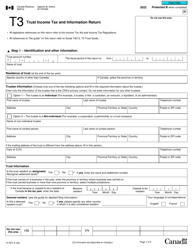

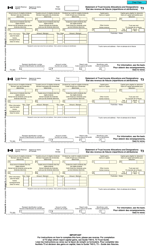

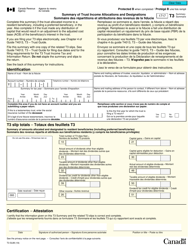

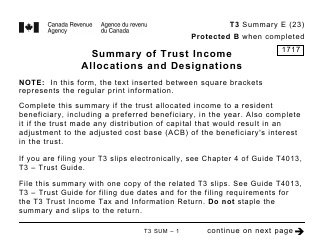

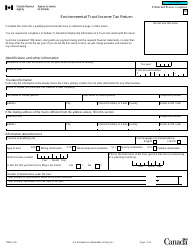

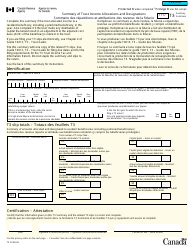

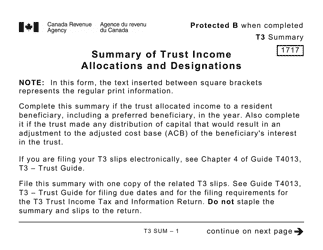

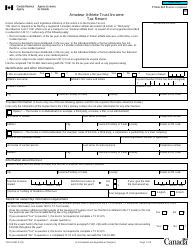

Form T3RET T3 Trust Income Tax and Information Return - Canada

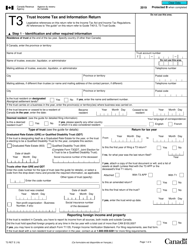

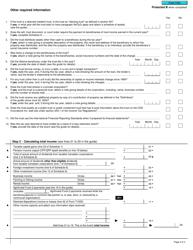

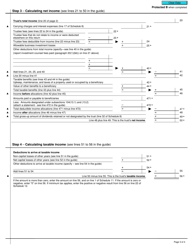

Form T3RET is used in Canada for reporting trust income and providing information about the trust. It is required to be filed by certain types of trusts, such as testamentary trusts, inter vivos trusts, and qualified disability trusts. The form includes details about the income earned by the trust, expenses incurred, and distributions made to beneficiaries. It is used by the Canada Revenue Agency (CRA) to assess and calculate the tax liability of the trust.

The trustee or the legal representative of the trust is responsible for filing the Form T3RET T3 Trust Income Tax and Information Return in Canada.

FAQ

Q: What is Form T3RET?

A: Form T3RET is the T3 Trust Income Tax and Information Return in Canada.

Q: Who needs to file Form T3RET?

A: Trusts in Canada that have to pay income tax on income earned in a particular tax year need to file Form T3RET.

Q: When is Form T3RET due?

A: The due date for filing Form T3RET varies depending on the type of trust and the fiscal period end date. It is generally due within 90 days after the end of the trust's fiscal period.

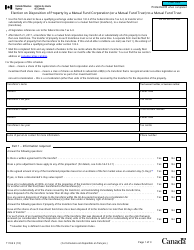

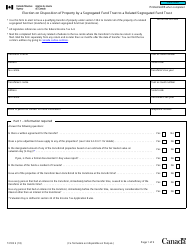

Q: What information is required to complete Form T3RET?

A: To complete Form T3RET, you will need information such as the trust's identification number, income earned, expenses incurred, and any additional information required by the CRA.

Q: Are there penalties for filing Form T3RET late?

A: Yes, there are penalties for filing Form T3RET late. The penalties may include late filing penalties, interest charges on unpaid amounts, and other penalties as determined by the CRA.

Q: Can I file Form T3RET electronically?

A: Yes, you can file Form T3RET electronically using the CRA's My Business Account or through an authorized electronic filer.

Q: Can I get an extension to file Form T3RET?

A: Yes, you can request an extension to file Form T3RET by contacting the CRA before the original due date.