This version of the form is not currently in use and is provided for reference only. Download this version of

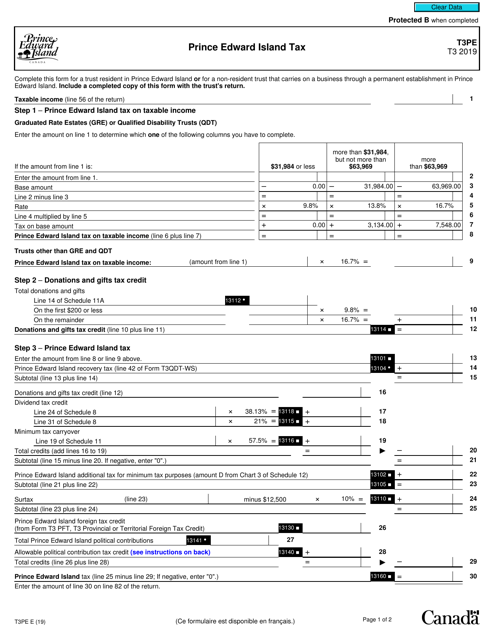

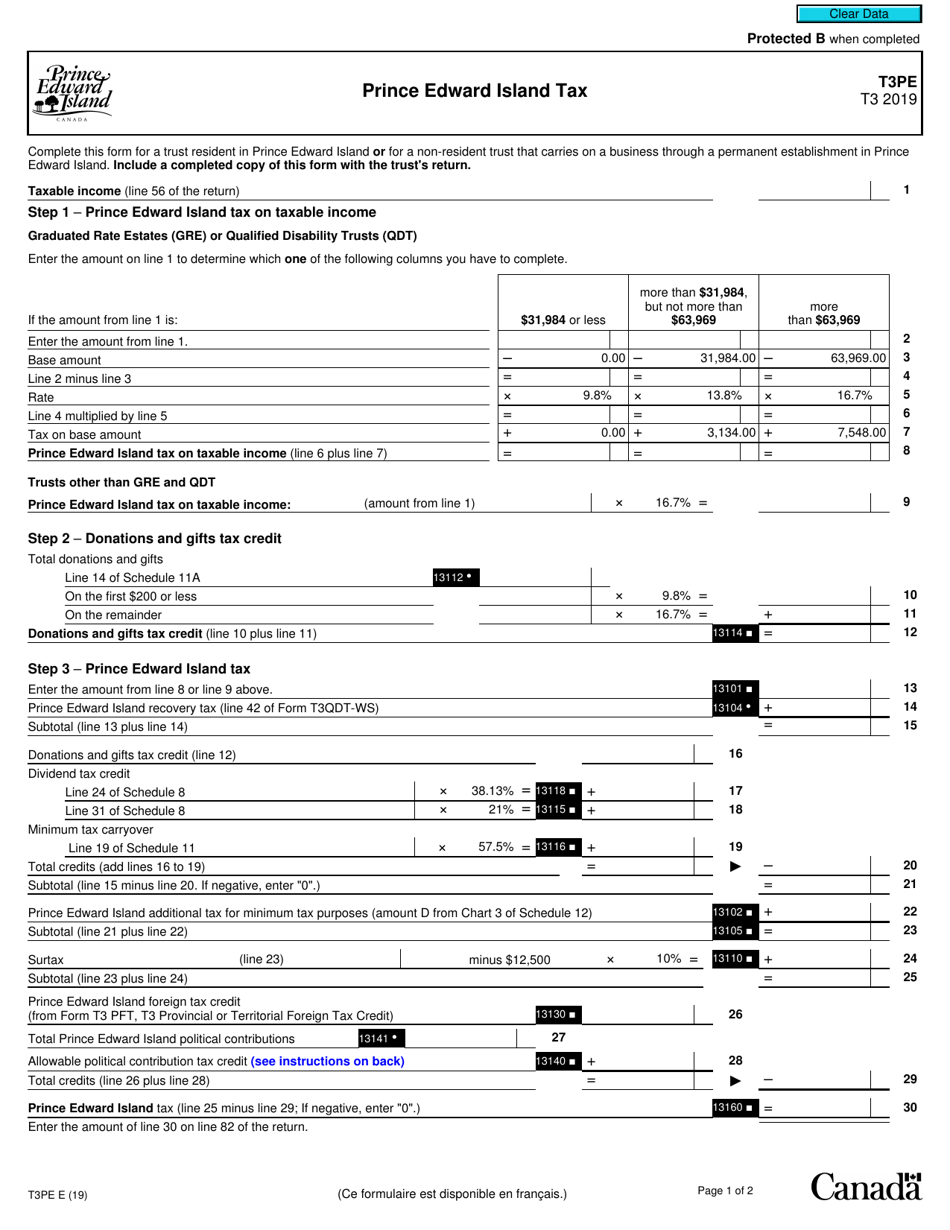

Form T3PE

for the current year.

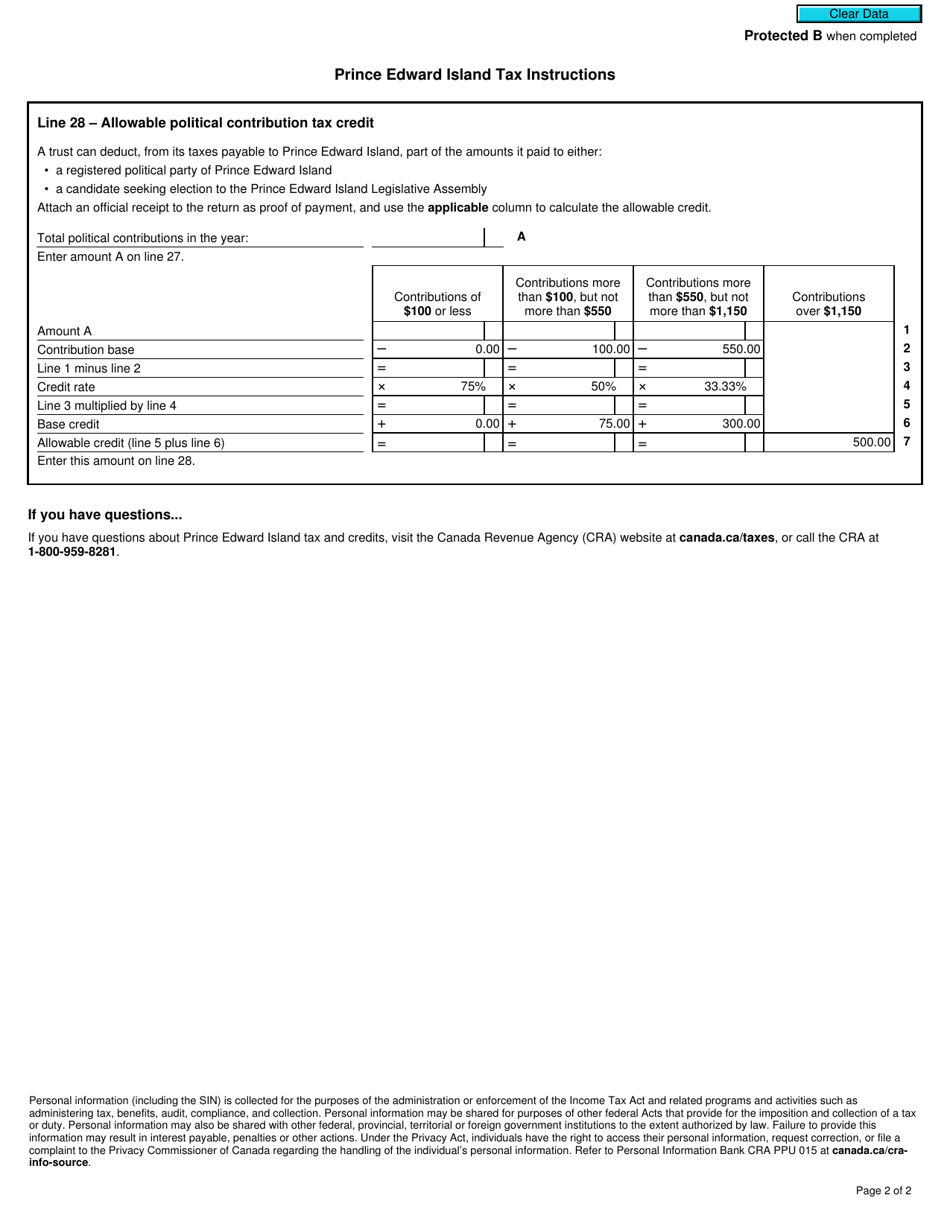

Form T3PE Prince Edward Island Tax - Canada

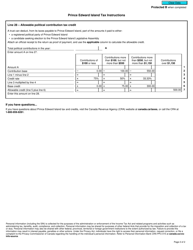

Form T3PE, Prince Edward Island Tax, is used by individuals who are residents of Prince Edward Island (PEI) in Canada to report their income and calculate the amount of provincial tax owed to the PEI government. It is specifically for individuals who have taxable income from sources such as employment, self-employment, rental properties, and investments in PEI.

Individuals who are residents of Prince Edward Island and have taxable income need to file the Form T3PE Prince Edward Island Tax in Canada.

FAQ

Q: What is Form T3PE?

A: Form T3PE is a tax form used for reporting Prince Edward Island taxes in Canada.

Q: Who needs to file Form T3PE?

A: Individuals who are residents of Prince Edward Island and have taxable income need to file Form T3PE.

Q: When is Form T3PE due?

A: Form T3PE is due on or before April 30th of each year.

Q: What information do I need to complete Form T3PE?

A: You will need information such as your personal details, income details, and any deductions or credits you are eligible for.

Q: Are there any penalties for late filing of Form T3PE?

A: Yes, there may be penalties for late filing of Form T3PE, so it's important to file on time.

Q: Can I get help with filling out Form T3PE?

A: Yes, you can seek assistance from the Prince Edward Island Tax Services Office or a tax professional to help you complete Form T3PE.