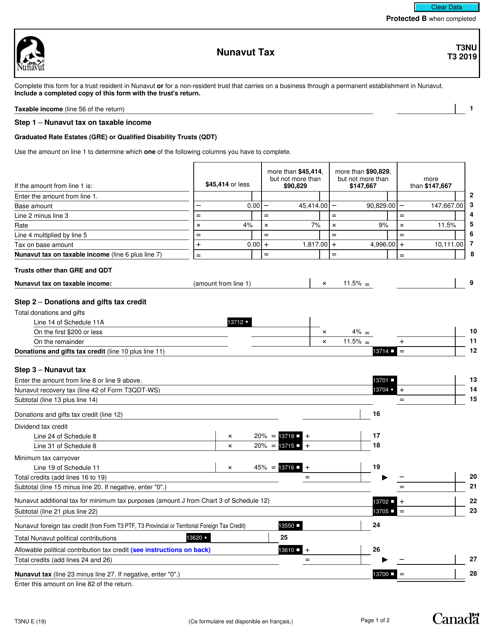

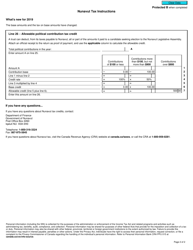

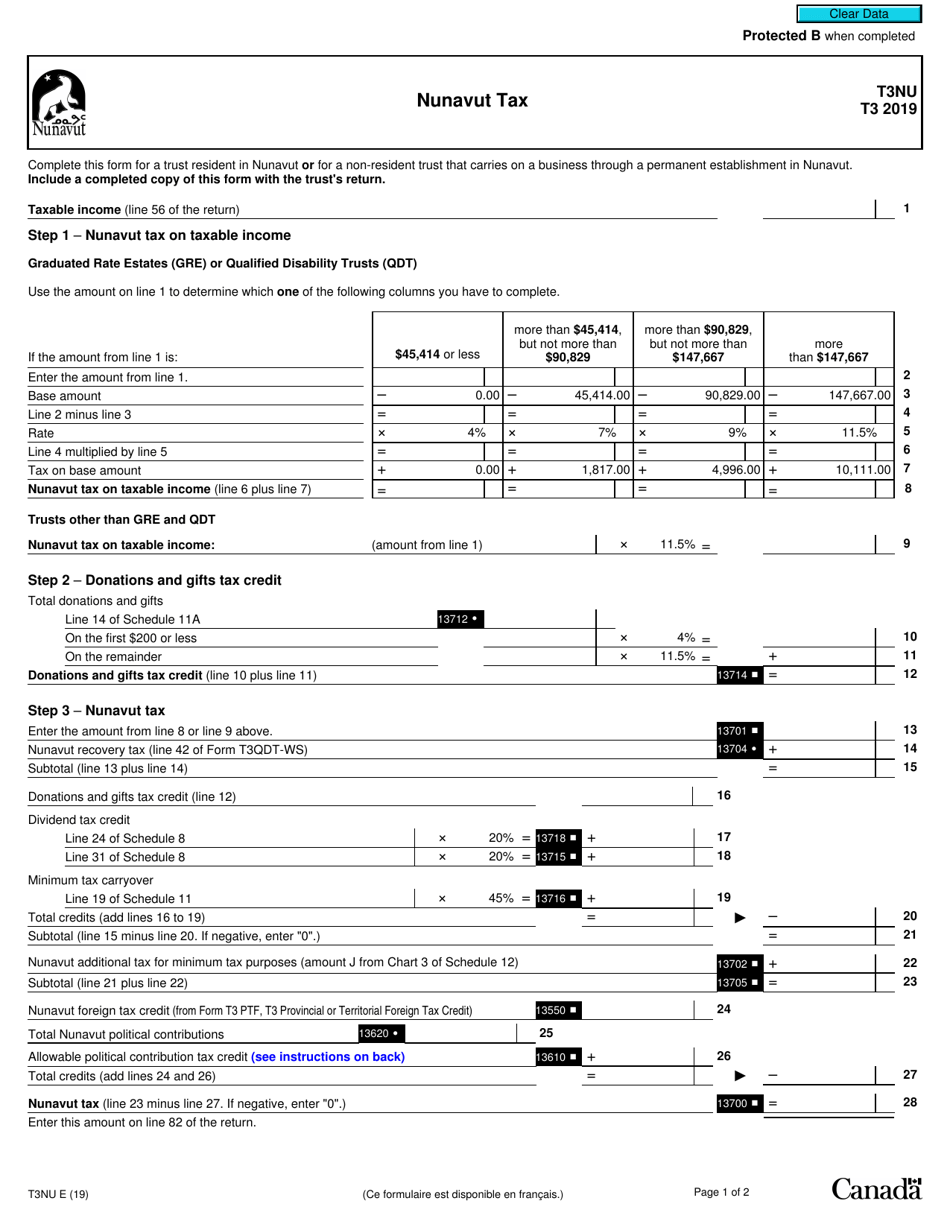

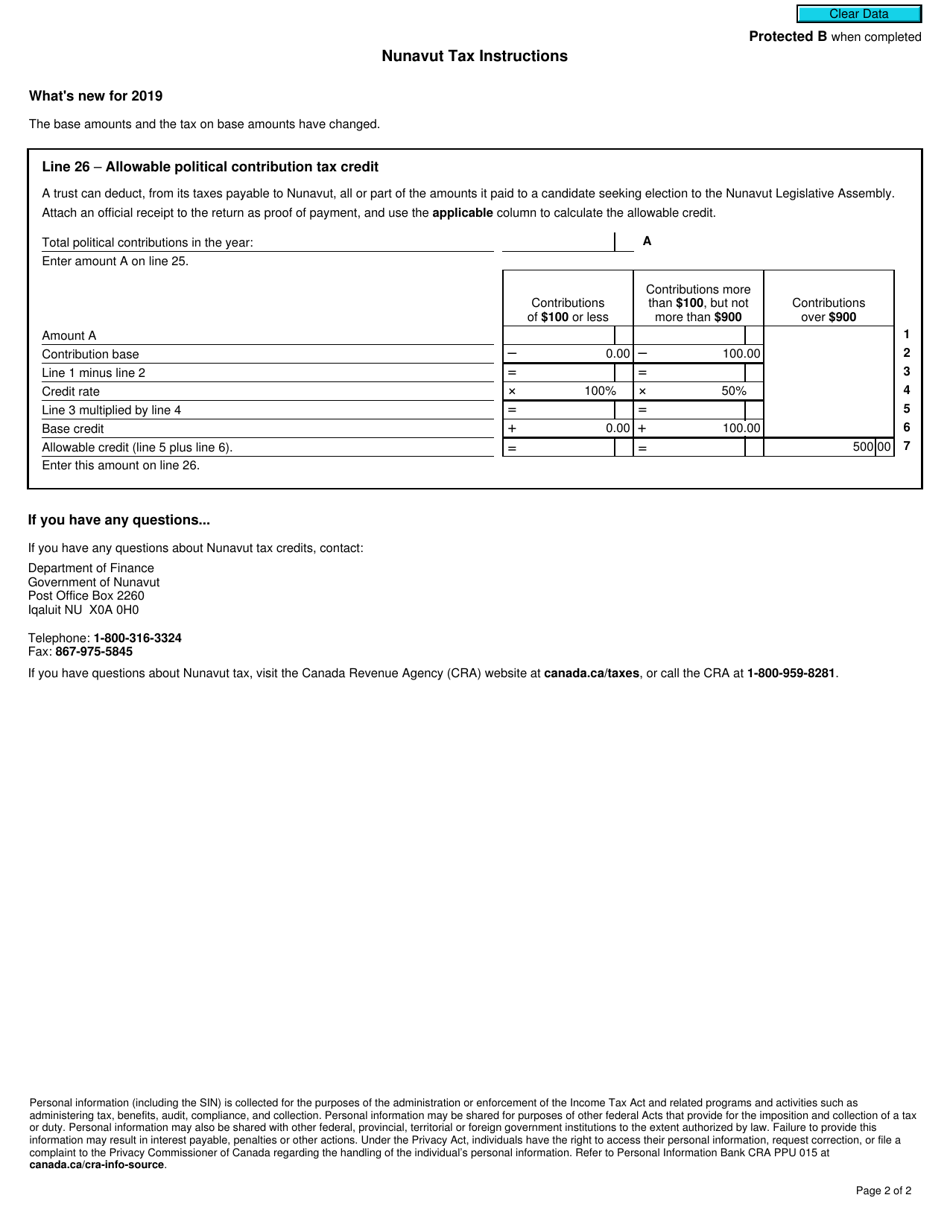

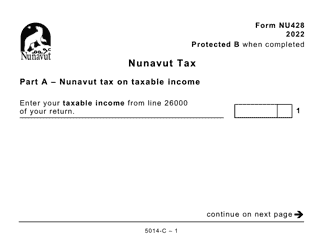

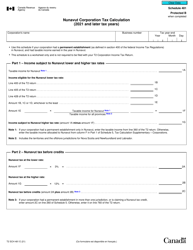

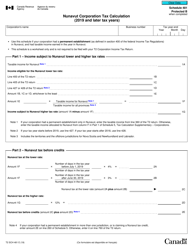

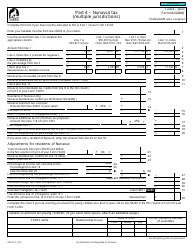

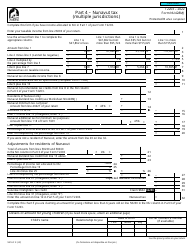

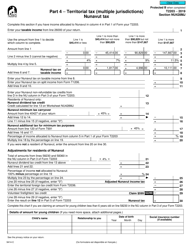

Form T3NU Nunavut Tax - Nunavut, Canada

Form T3NU, or the Nunavut Tax form, is used by residents of Nunavut, Canada to report their income and calculate the amount of provincial tax they owe to the Nunavut territorial government. It is specifically designed for individuals who reside in the territory of Nunavut and need to fulfill their tax obligations.

The Form T3NU Nunavut Tax in Nunavut, Canada is filed by individuals who reside in Nunavut and need to report their income and pay taxes to the Nunavut government.

FAQ

Q: What is Form T3NU?

A: Form T3NU is a tax form used in Nunavut, Canada.

Q: Who needs to file Form T3NU?

A: Residents of Nunavut, Canada who have federal income tax obligations must file Form T3NU.

Q: What is the purpose of Form T3NU?

A: Form T3NU is used to report and pay taxes owed to the government of Nunavut.

Q: When is the deadline to file Form T3NU?

A: The deadline to file Form T3NU is usually April 30th of each year.

Q: Are there any penalties for late filing of Form T3NU?

A: Yes, there may be penalties for late filing of Form T3NU, so it is important to file before the deadline.

Q: What should I include when filing Form T3NU?

A: You should include all relevant income, deductions, and credits when filing Form T3NU.

Q: Do I need to file both federal and provincial taxes in Nunavut?

A: Yes, residents of Nunavut are required to file both federal and provincial taxes.

Q: What happens if I make mistakes on Form T3NU?

A: If you make mistakes on Form T3NU, it is important to correct them as soon as possible by submitting an amended return.