This version of the form is not currently in use and is provided for reference only. Download this version of

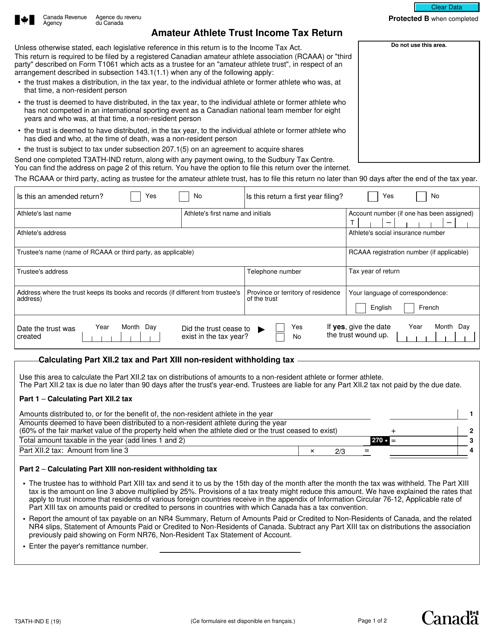

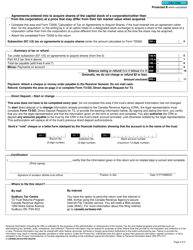

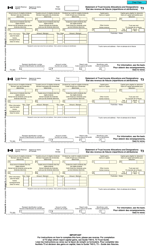

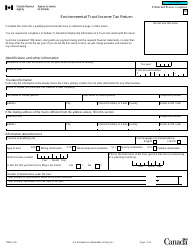

Form T3ATH-IND

for the current year.

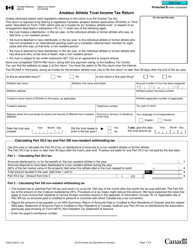

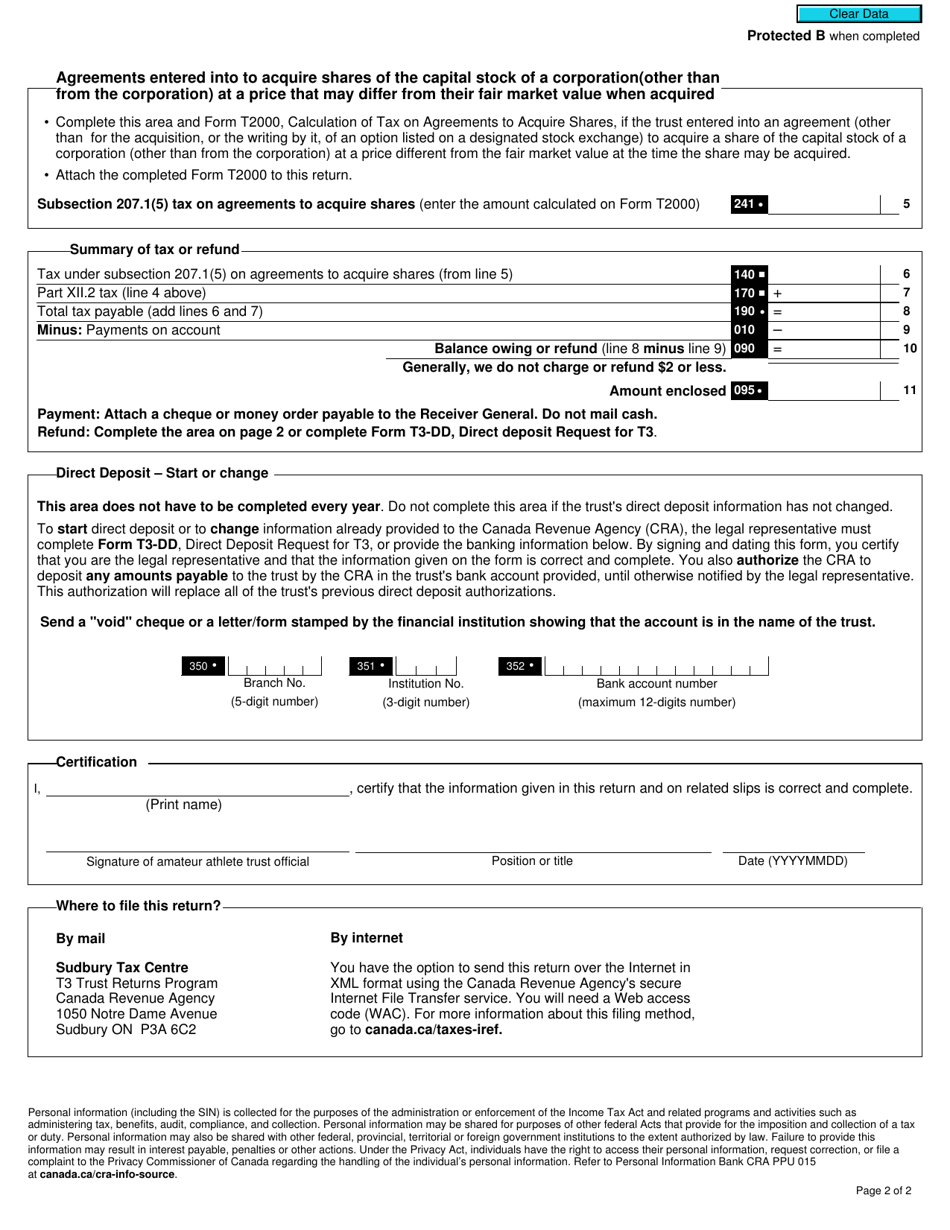

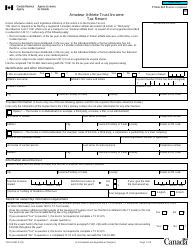

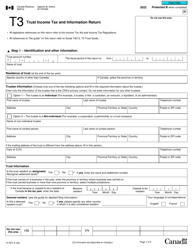

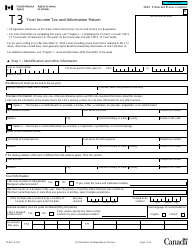

Form T3ATH-IND Amateur Athlete Trust Income Tax Return - Canada

Form T3ATH-IND, also known as the Amateur Athlete Trust Income Tax Return in Canada, is used to file income tax returns for amateur athlete trusts. This form ensures that income earned by such trusts is correctly reported and taxed.

The Form T3ATH-IND Amateur Athlete Trust Income Tax Return in Canada is filed by the trustees of the Amateur Athlete Trust.

FAQ

Q: What is Form T3ATH-IND?

A: Form T3ATH-IND is the income tax return form for the Amateur Athlete Trust in Canada.

Q: Who should file Form T3ATH-IND?

A: Amateur athletes who have received income through a trust should file Form T3ATH-IND.

Q: What is an Amateur Athlete Trust?

A: An Amateur Athlete Trust is a trust established for the benefit of amateur athletes.

Q: What types of income should be reported on Form T3ATH-IND?

A: All income received by an amateur athlete through the trust should be reported on Form T3ATH-IND.

Q: Is there a deadline for filing Form T3ATH-IND?

A: Yes, there is a deadline for filing Form T3ATH-IND. The deadline is determined by the Canada Revenue Agency and may vary depending on the tax year.