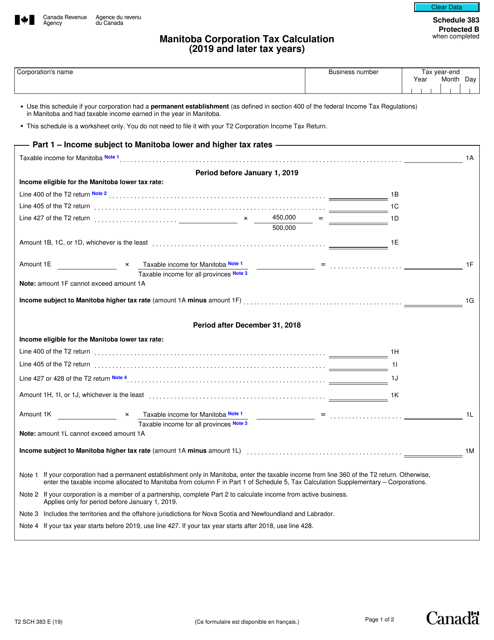

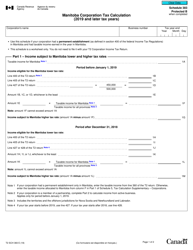

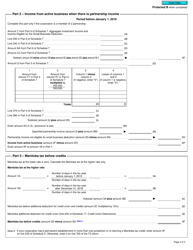

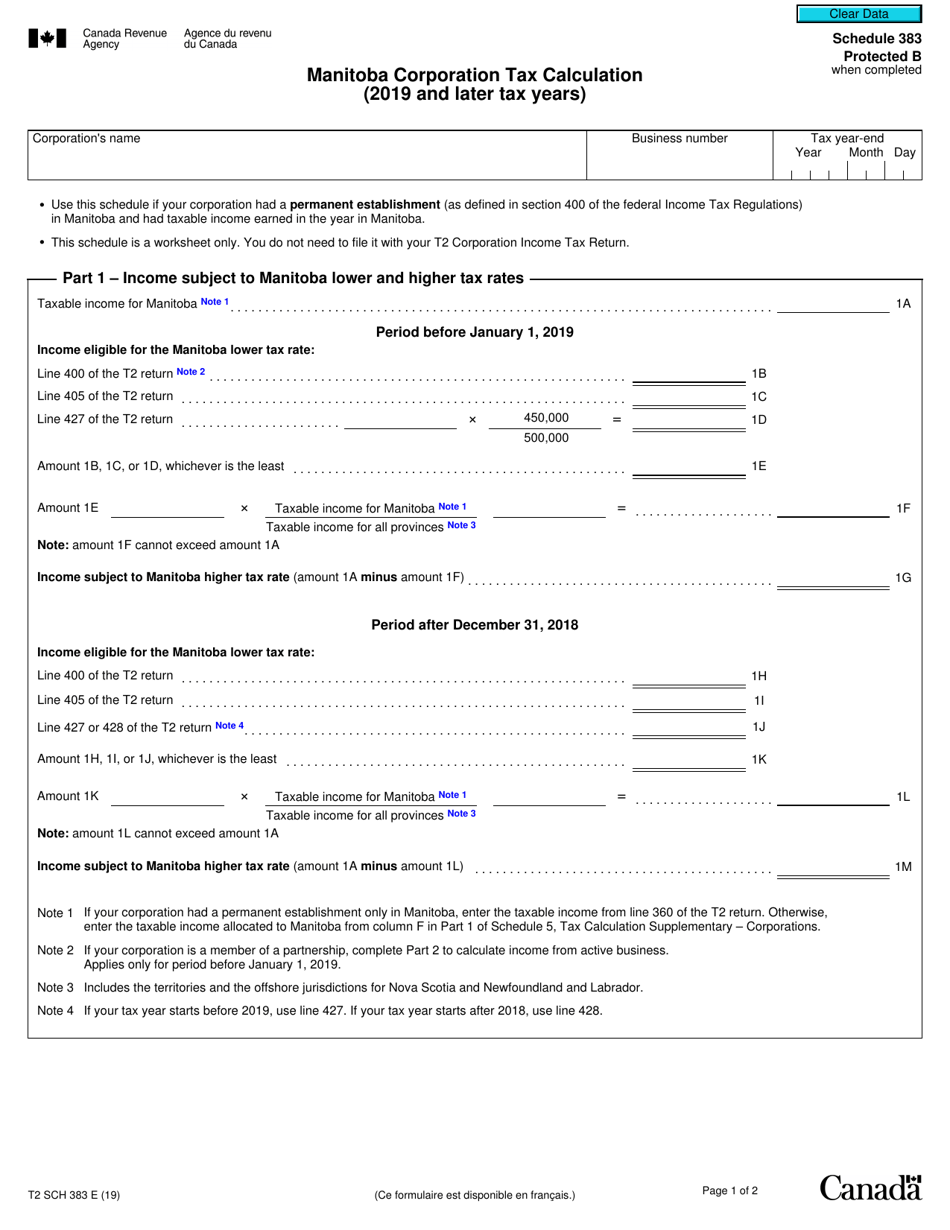

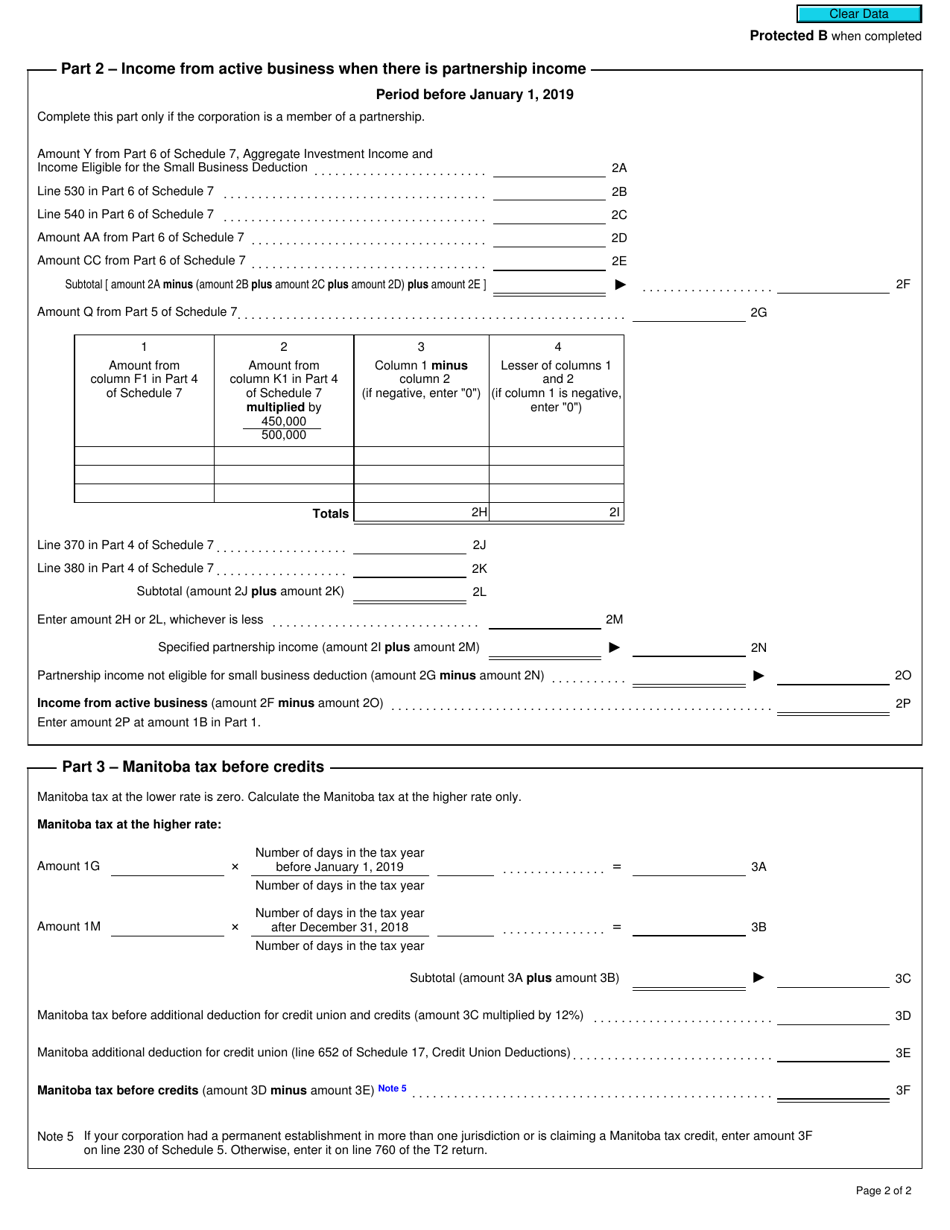

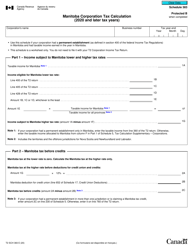

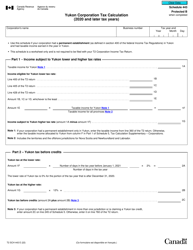

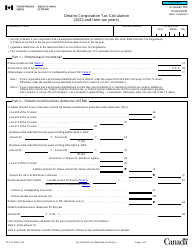

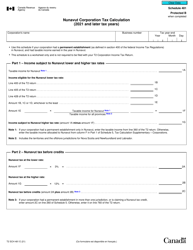

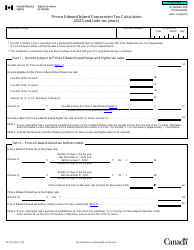

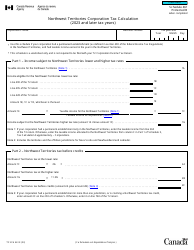

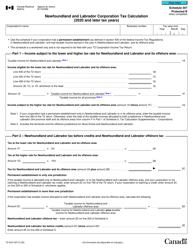

Form T2SCH383 Schedule 383 Manitoba Corporation Tax Calculation - Manitoba, Canada

Form T2SCH383 Schedule 383 Manitoba Corporation Tax Calculation is used by corporations in Manitoba, Canada to calculate their provincial corporate tax liability for the tax year.

The Form T2SCH383 Schedule 383 Manitoba Corporation Tax Calculation is filed by corporations in Manitoba, Canada.

FAQ

Q: What is Form T2SCH383?

A: Form T2SCH383 is a schedule used to calculate Manitoba Corporation Tax.

Q: What is Manitoba Corporation Tax?

A: Manitoba Corporation Tax is a tax imposed on corporations operating in Manitoba, Canada.

Q: Who needs to file Form T2SCH383?

A: Corporations who are liable to pay Manitoba Corporation Tax must file Form T2SCH383.

Q: What information is required on Form T2SCH383?

A: Form T2SCH383 requires information about the corporation's taxable income and tax credits.

Q: Is Form T2SCH383 specific to Manitoba?

A: Yes, Form T2SCH383 is specific to corporations operating in Manitoba, Canada.

Q: Are there any deadlines for filing Form T2SCH383?

A: Yes, the deadline for filing Form T2SCH383 is generally within six months after the end of the corporation's taxation year.

Q: What happens if I don't file Form T2SCH383?

A: If you don't file Form T2SCH383 or file it late, you may be subject to penalties and interest charges.

Q: Is Form T2SCH383 the only form for Manitoba Corporation Tax calculation?

A: No, there are several other forms and schedules that may be required for calculating Manitoba Corporation Tax, depending on the circumstances of the corporation.