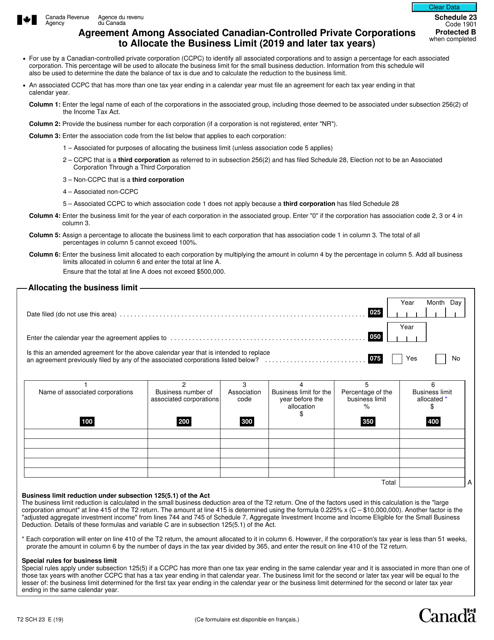

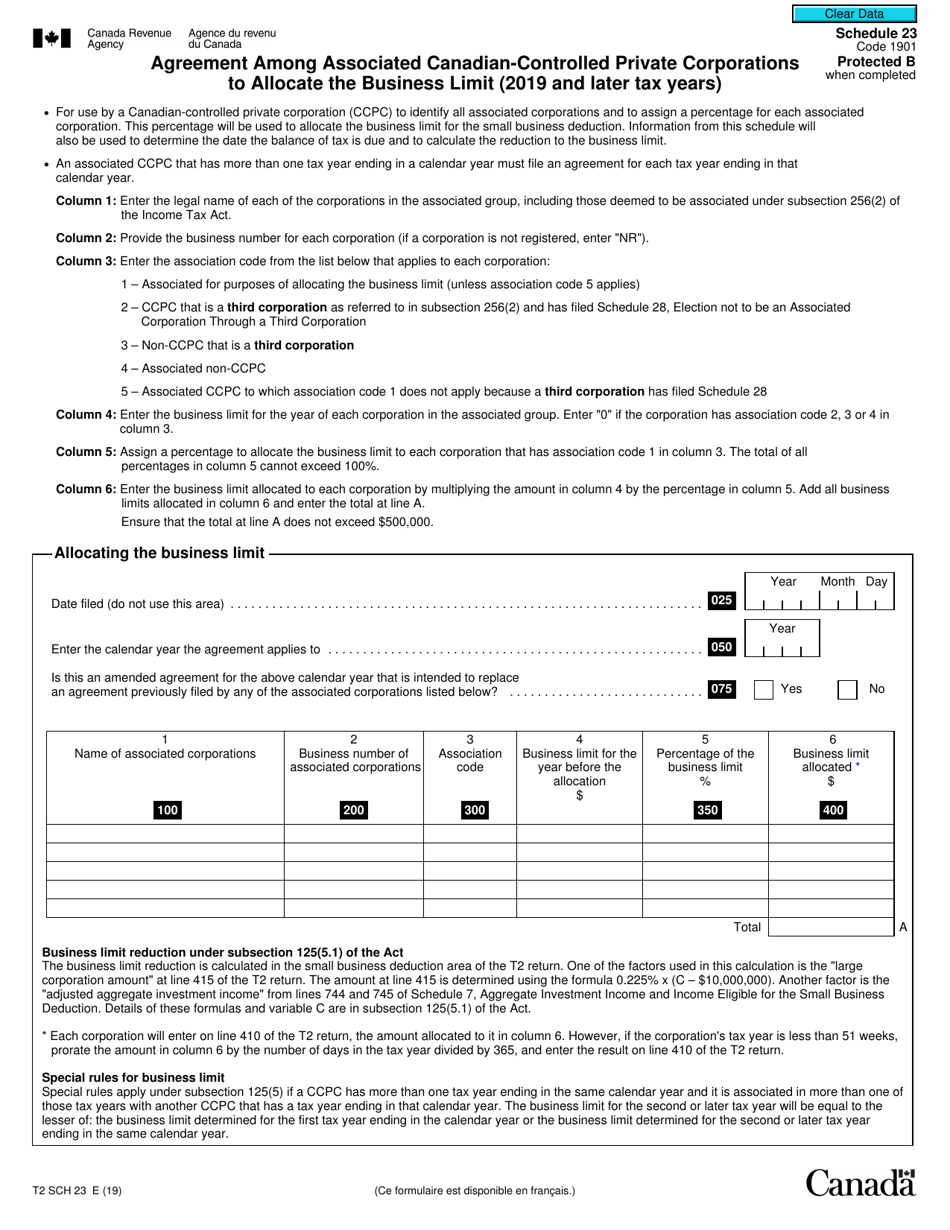

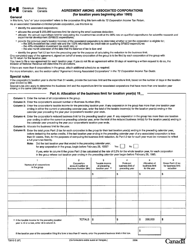

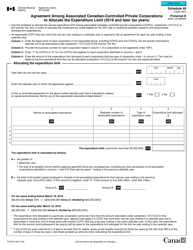

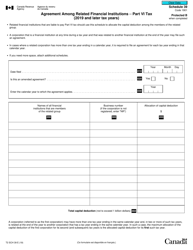

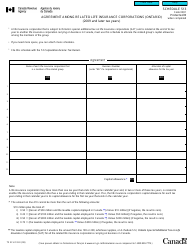

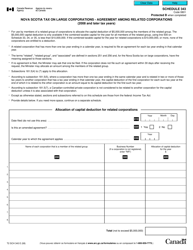

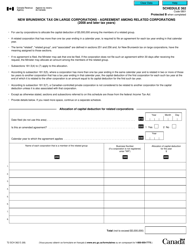

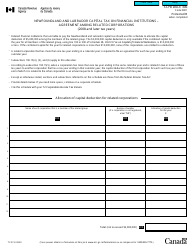

Form T2SCH23 Schedule 23 Agreement Among Associated Canadian-Controlled Private Corporations to Allocate the Business Limit - Canada

Form T2SCH23 Schedule 23 Agreement Among Associated Canadian-Controlled Private Corporations to Allocate the Business Limit is used in Canada to allocate the business limit among associated Canadian-controlled private corporations. It helps determine how much of the business limit each corporation can claim for tax purposes.

The associated Canadian-controlled private corporations (CCPCs) are responsible for filing the Form T2SCH23 Schedule 23 Agreement Among Associated Canadian-Controlled Private Corporations to Allocate the Business Limit in Canada.

FAQ

Q: What is Form T2SCH23?

A: Form T2SCH23 is a schedule used in Canada to allocate the business limit among associated Canadian-controlled private corporations.

Q: What is the purpose of Schedule 23?

A: The purpose of Schedule 23 is to determine how the business limit is distributed among the associated Canadian-controlled private corporations.

Q: Who needs to file Schedule 23?

A: Associated Canadian-controlled private corporations need to file Schedule 23 to allocate the business limit.

Q: What is the business limit?

A: The business limit is the maximum amount of the small business deduction that a corporation can claim.

Q: What are associated Canadian-controlled private corporations?

A: Associated Canadian-controlled private corporations are corporations that are related to each other in terms of ownership and control.

Q: How is the business limit allocated?

A: The business limit is allocated based on the prescribed factors determined by the associated Canadian-controlled private corporations.

Q: Are there any specific requirements for filing Schedule 23?

A: Yes, there are specific requirements and conditions that need to be met when filing Schedule 23. It is recommended to consult the official instructions or a tax professional for accurate and up-to-date information.

Q: Do I need to keep a copy of Schedule 23?

A: Yes, it is important to keep a copy of Schedule 23 and all supporting documents for record-keeping and future reference.