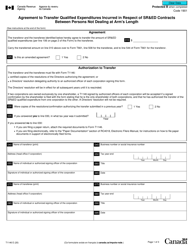

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2030

for the current year.

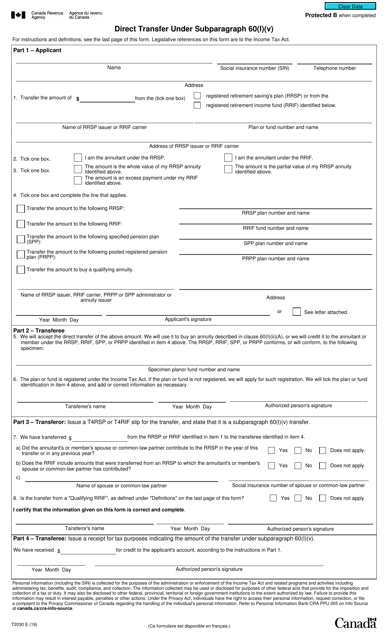

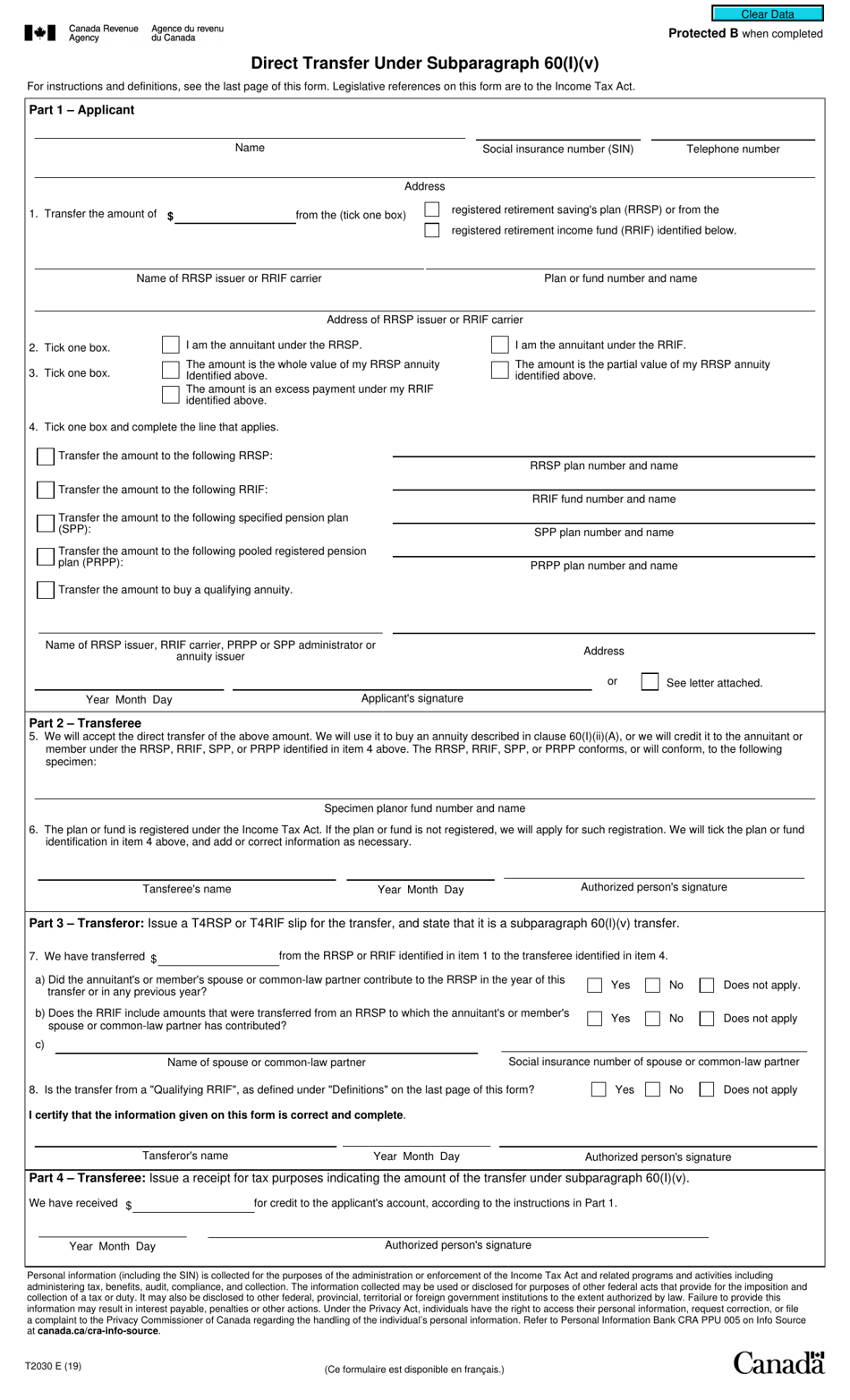

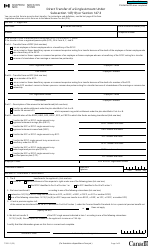

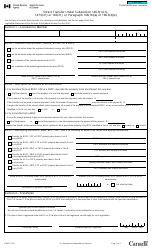

Form T2030 Direct Transfer Under Subparagraph 60(I)(V) - Canada

Form T2030, also known as "Direct Transfer Under Subparagraph 60(I)(V)", is used in Canada for reporting the direct transfer of funds from one registered retirement savings plan (RRSP) to another. It allows individuals to transfer their RRSP savings from one financial institution to another without incurring tax consequences.

I am USA and Canada document knowledge system. Canadians who want to transfer their retirement savings to another registered retirement savings plan (RRSP) or registered pension plan (RPP) in Canada file the Form T2030 Direct Transfer Under Subparagraph 60(I)(V).

FAQ

Q: What is Form T2030?

A: Form T2030 is a document used in Canada for direct transfers under subparagraph 60(I)(V).

Q: What is a direct transfer?

A: A direct transfer is a movement of funds or assets from one registered plan to another without being taxed or withdrawn.

Q: What is subparagraph 60(I)(V)?

A: Subparagraph 60(I)(V) refers to a specific provision in the Canadian Income Tax Act that allows for the tax-free transfer of funds.

Q: Who uses Form T2030?

A: Form T2030 is used by individuals or institutions in Canada who are transferring funds or assets between registered plans.

Q: Why is Form T2030 important?

A: Form T2030 is important because it ensures that the direct transfer meets the requirements set out in the Canadian Income Tax Act.

Q: Are there any fees associated with using Form T2030?

A: The Canada Revenue Agency does not charge a fee for using Form T2030.

Q: What information is required on Form T2030?

A: Form T2030 requires details about the transferor, transferee, and the assets or funds being transferred.

Q: What happens after Form T2030 is submitted?

A: After Form T2030 is submitted, the Canada Revenue Agency will review the form and process the direct transfer of funds or assets.