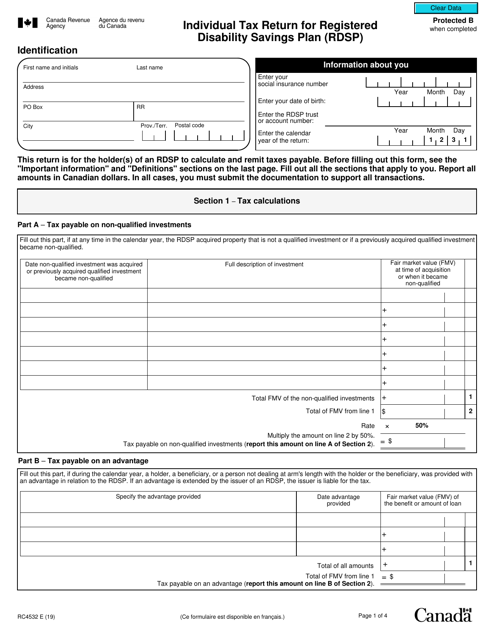

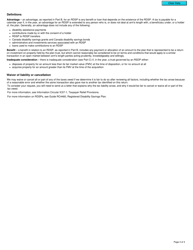

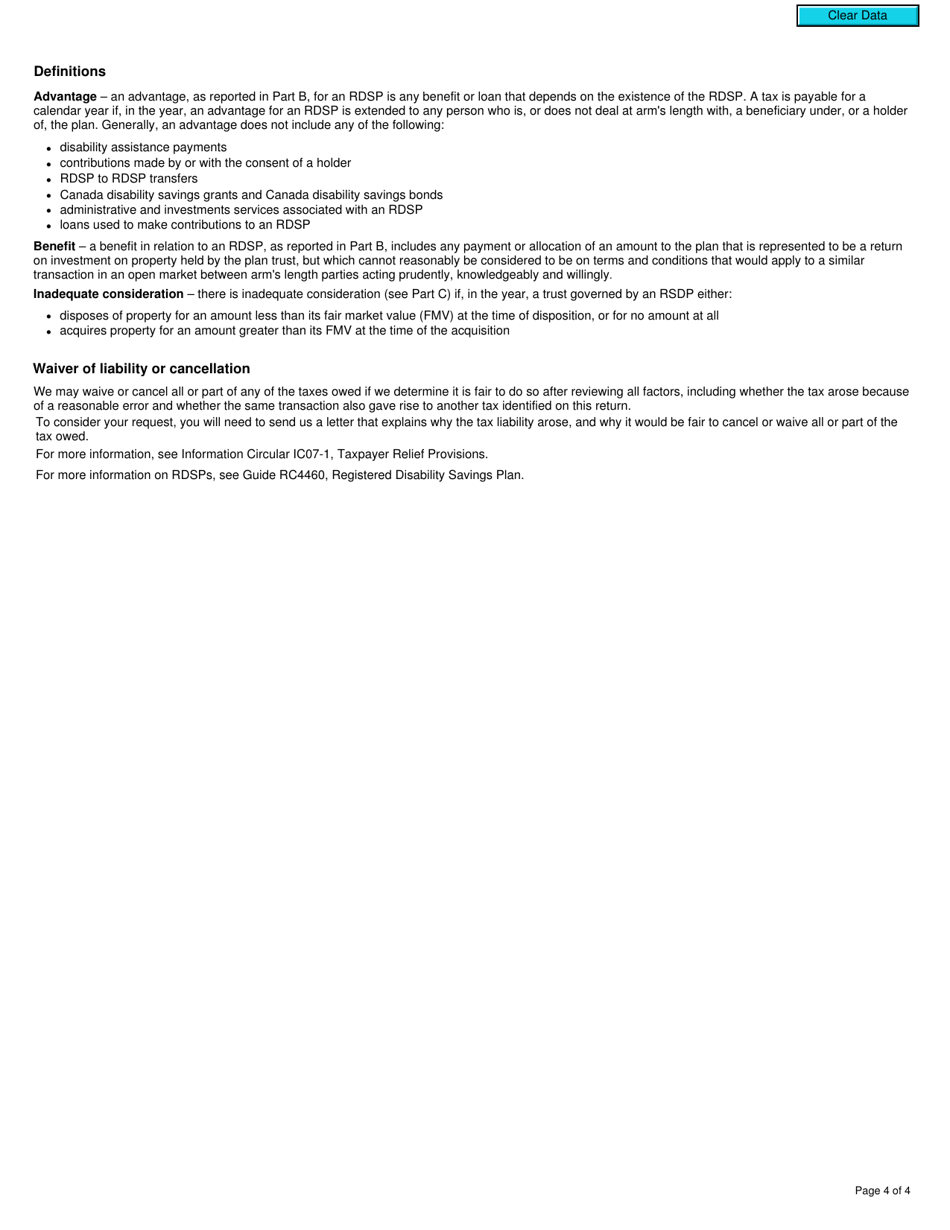

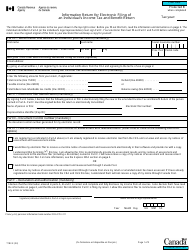

Form RC4532 Individual Tax Return for Registered Disability Savings Plan (Rdsp) - Canada

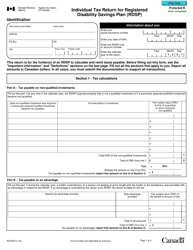

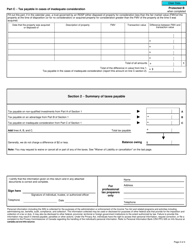

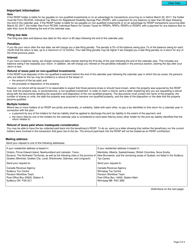

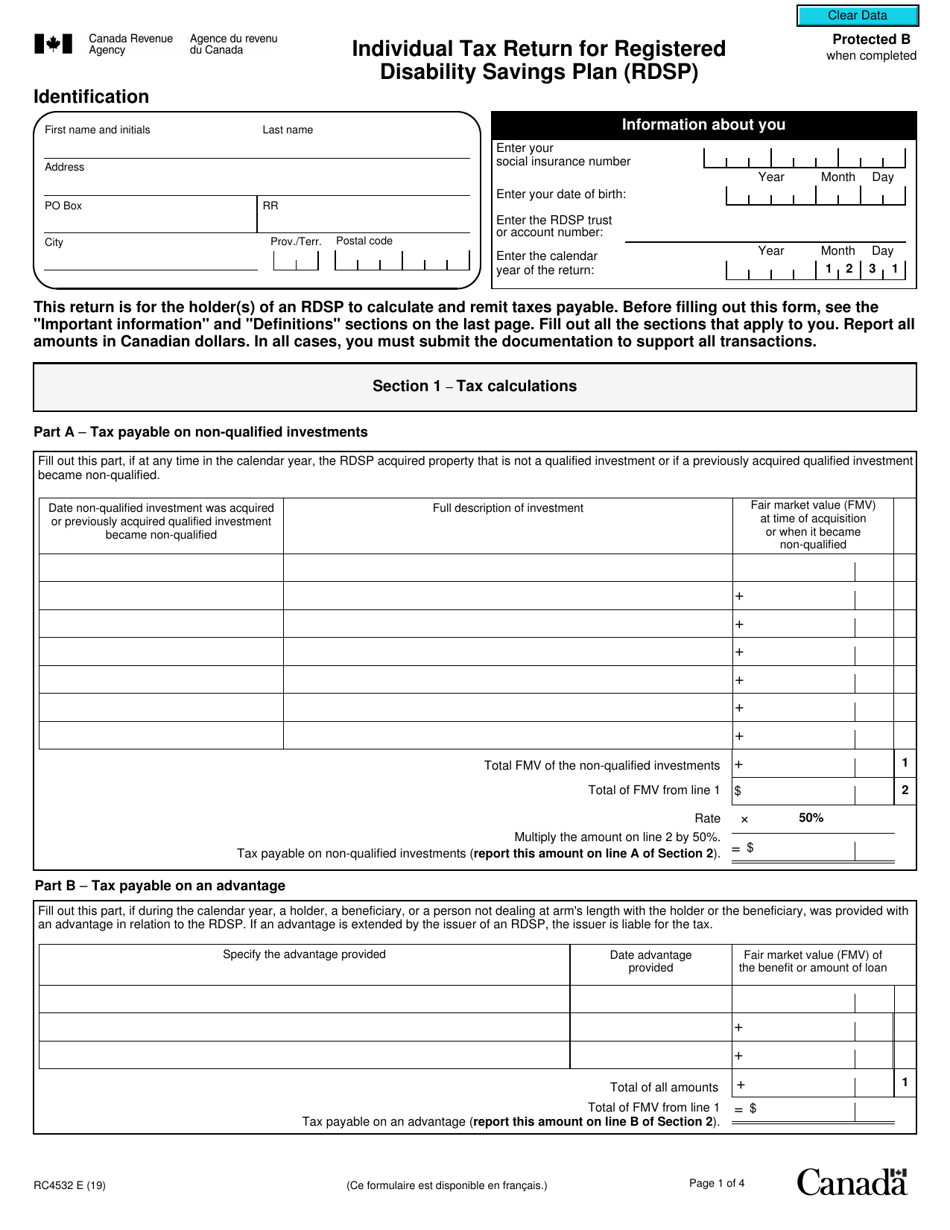

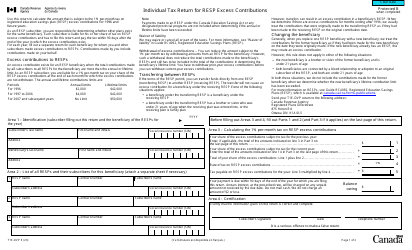

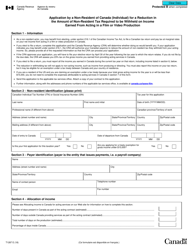

Form RC4532 Individual Tax Return for Registered Disability Savings Plan (RDSP) in Canada is used to report contributions, withdrawals, and other transactions related to an RDSP. It is important for individuals who have an RDSP to complete this form to fulfill their tax obligations and potentially claim certain tax benefits associated with the RDSP.

The individual who has a Registered Disability Savings Plan (RDSP) in Canada is responsible for filing the Form RC4532 Individual Tax Return for RDSP.

FAQ

Q: What is Form RC4532?

A: Form RC4532 is the individual tax return form for Registered Disability Savings Plan (RDSP) in Canada.

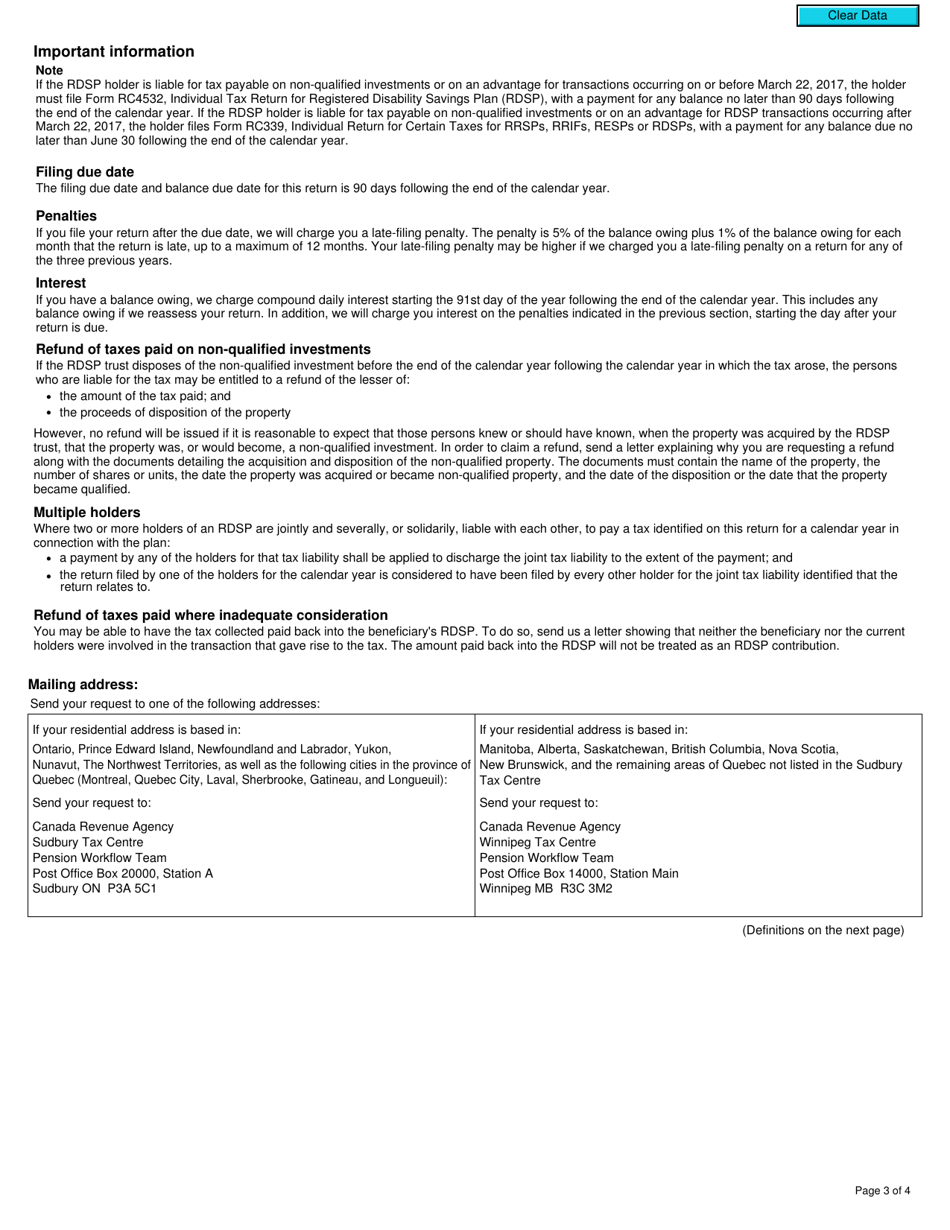

Q: What is a Registered Disability Savings Plan (RDSP)?

A: A Registered Disability Savings Plan (RDSP) is a savings plan designed to help individuals with disabilitiessave money for their long-term financial security.

Q: Who should file Form RC4532?

A: Any individual who has a Registered Disability Savings Plan (RDSP) in Canada should file Form RC4532.

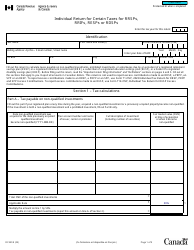

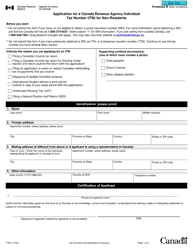

Q: What information is required to fill out Form RC4532?

A: You will need to provide your personal information, details of your RDSP contributions and withdrawals, and any applicable tax credits or grants.

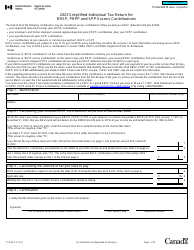

Q: Are RDSP contributions tax-deductible?

A: No, RDSP contributions are not tax-deductible.

Q: Are RDSP withdrawals taxable?

A: Yes, RDSP withdrawals are generally considered taxable income.

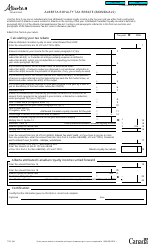

Q: Are there any tax benefits associated with RDSP?

A: Yes, RDSP may qualify for the Canada Disability Savings Grant (CDSG) and Canada Disability Savings Bond (CDSB), which provide additional financial support.

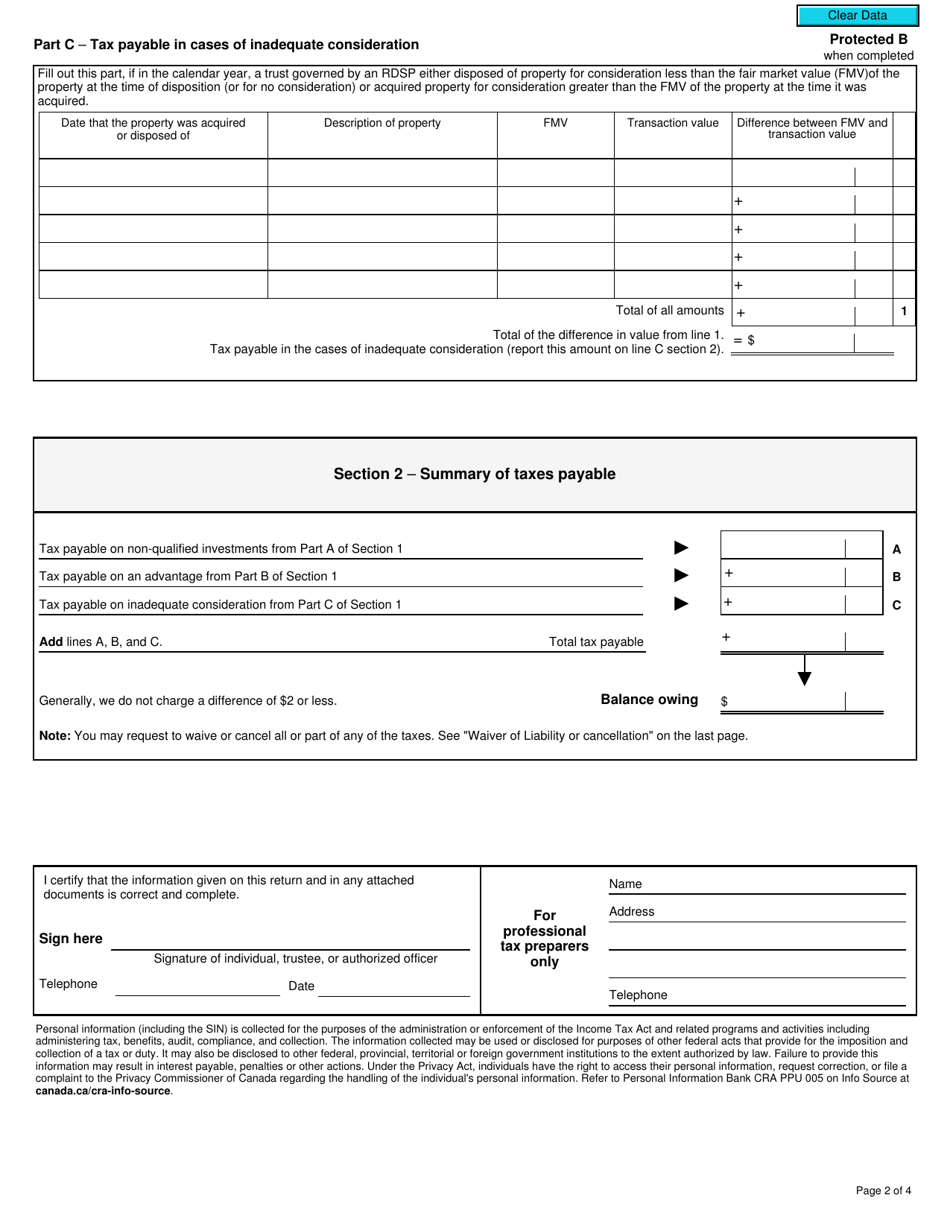

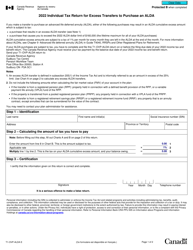

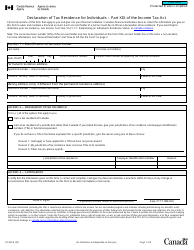

Q: When is the deadline to file Form RC4532?

A: The deadline to file Form RC4532 is usually April 30th of the following year, similar to the personal tax return deadline in Canada.