This version of the form is not currently in use and is provided for reference only. Download this version of

Form B400-2

for the current year.

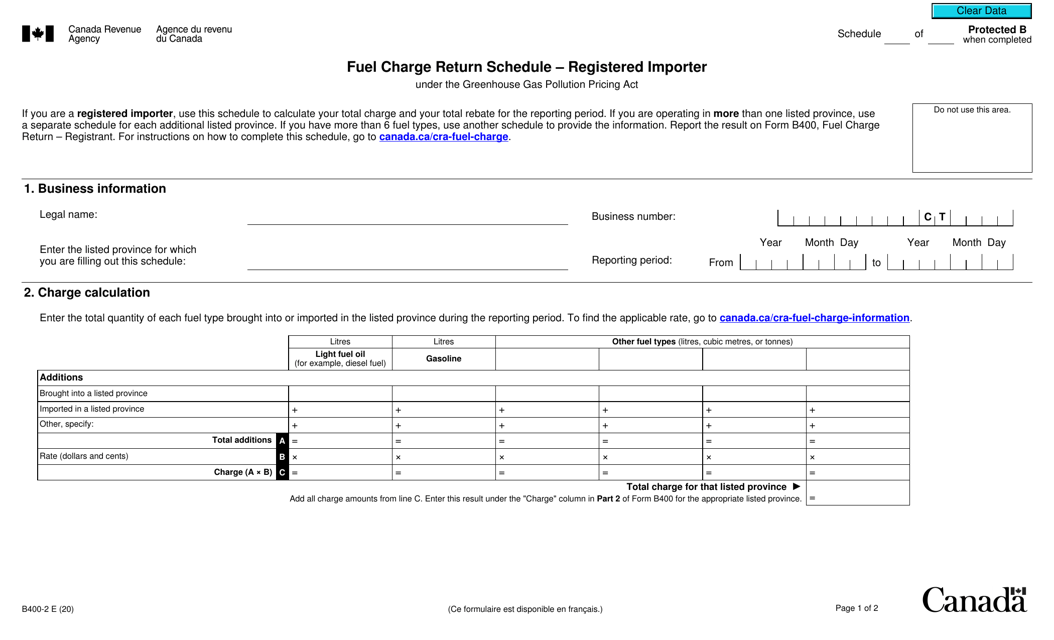

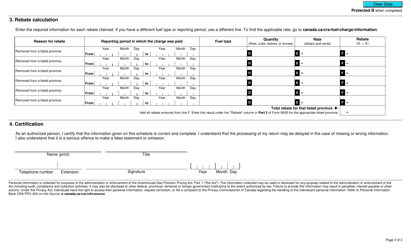

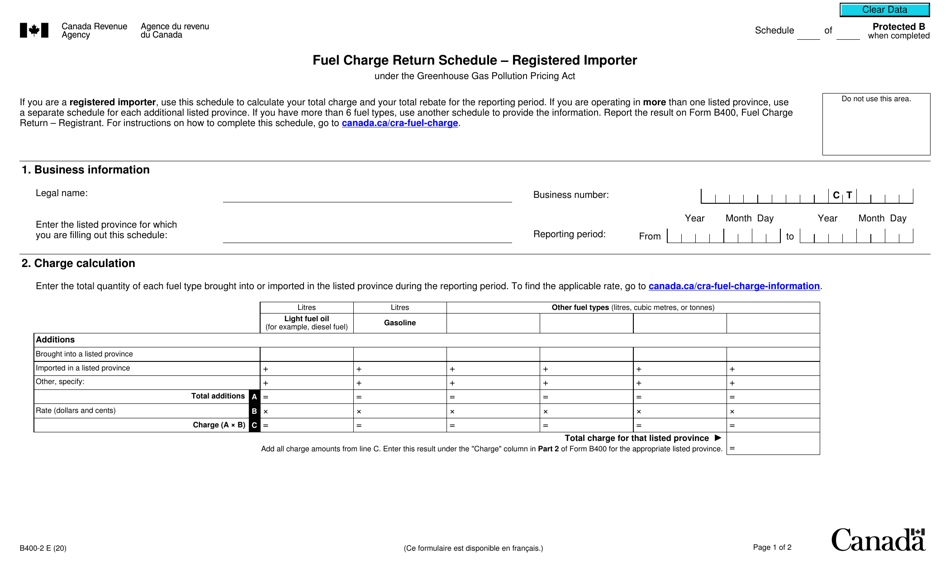

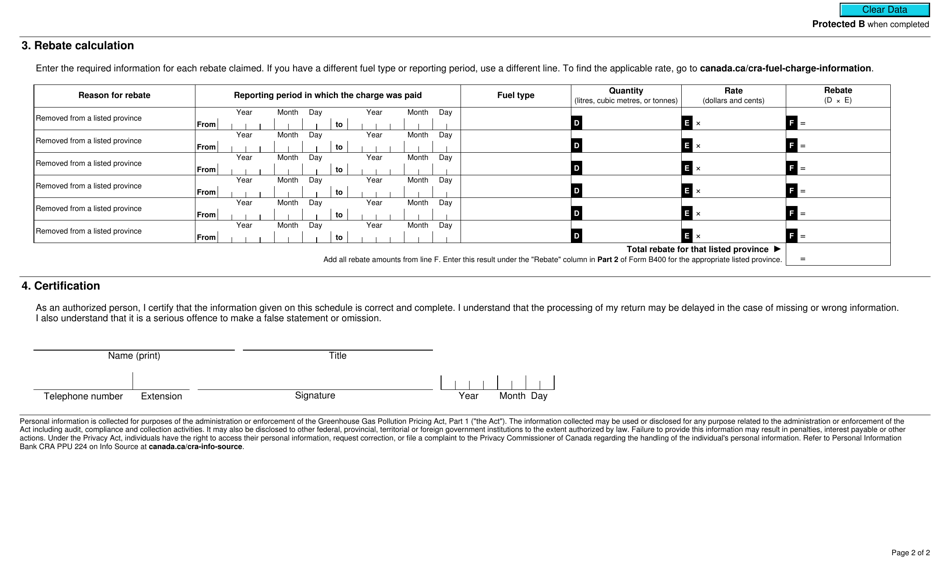

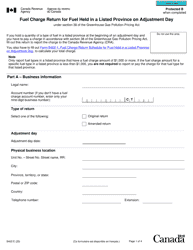

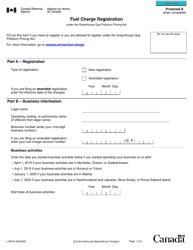

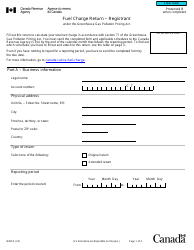

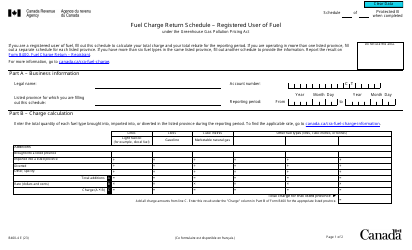

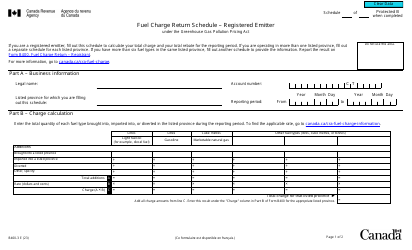

Form B400-2 Fuel Charge Return Schedule - Registered Importer Under the Greenhouse Gas Pollution Pricing Act - Canada

Form B400-2 Fuel Charge Return Schedule is used by registered importers in Canada to report and pay the fuel charge associated with imported greenhouse gases. It is required under the Greenhouse Gas Pollution Pricing Act in Canada.

The Form B400-2 Fuel Charge Return Schedule under the Greenhouse Gas Pollution Pricing Act in Canada is filed by registered importers.

FAQ

Q: What is Form B400-2?

A: Form B400-2 is a Fuel Charge Return Schedule.

Q: Who is required to use Form B400-2?

A: Registered Importers under the Greenhouse Gas Pollution Pricing Act in Canada are required to use Form B400-2.

Q: What is the purpose of Form B400-2?

A: The purpose of Form B400-2 is to report and remit the fuel charge liability for imported fuel.

Q: What is the Greenhouse Gas Pollution Pricing Act?

A: The Greenhouse Gas Pollution Pricing Act is a Canadian law aimed at reducing greenhouse gas emissions by implementing a carbon pricing system.

Q: What is a fuel charge?

A: A fuel charge is a charge imposed on fossil fuels that emit greenhouse gases when combusted.

Q: What are registered importers?

A: Registered importers are individuals or businesses who import fuel into Canada and are required to comply with the Greenhouse Gas Pollution Pricing Act.

Q: How often is Form B400-2 filed?

A: Form B400-2 is filed annually.

Q: What happens if a registered importer does not file Form B400-2?

A: If a registered importer fails to file Form B400-2, they may be subject to penalties and interest charges.

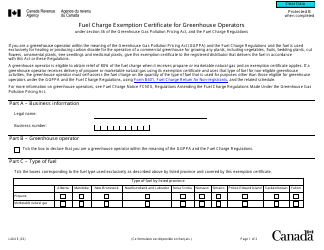

Q: Are there any exemptions from the fuel charge for registered importers?

A: Certain exemptions may apply for registered importers, such as fuels used for certain purposes or exported out of Canada. It is important to consult the CRA for specific details.