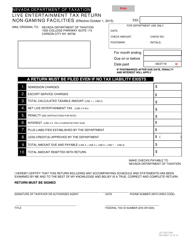

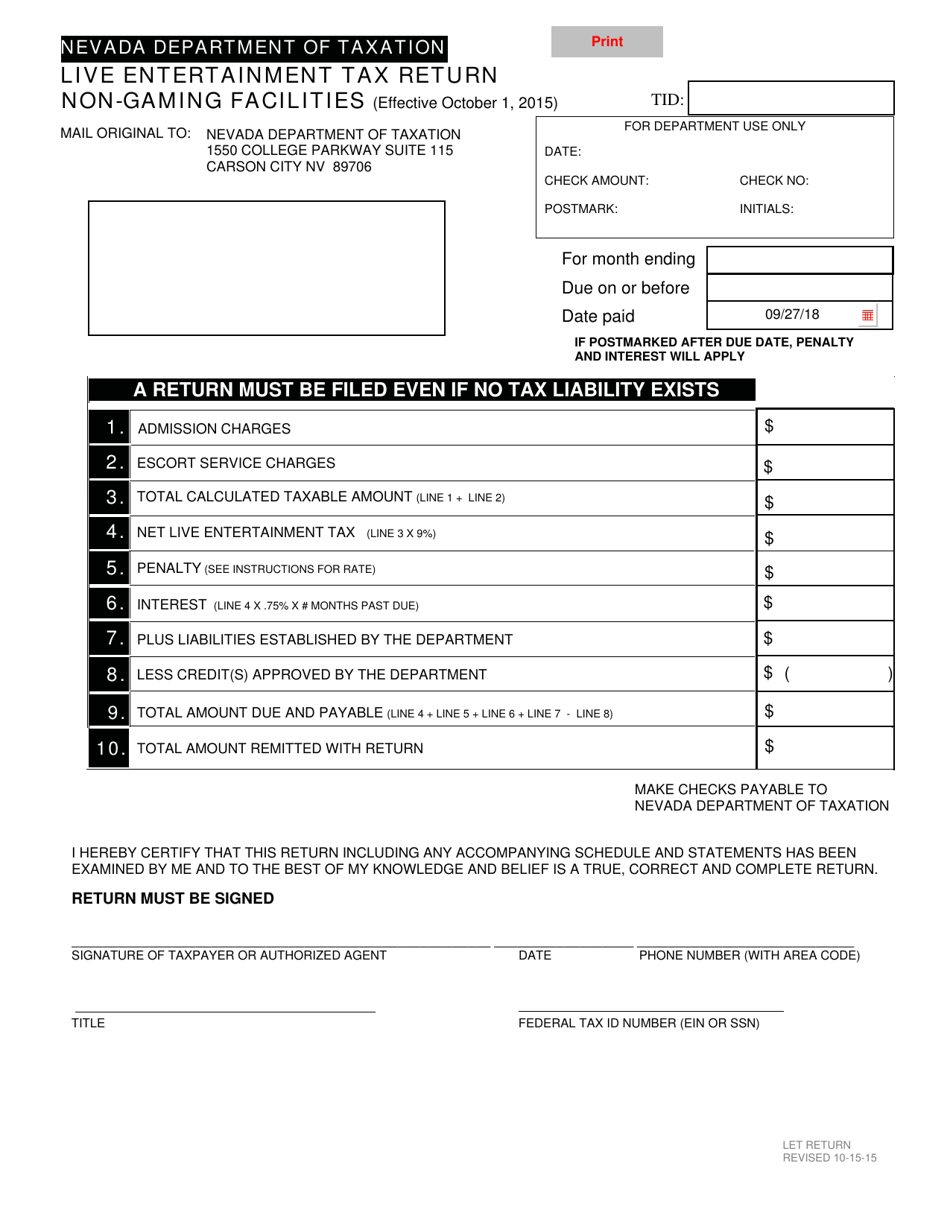

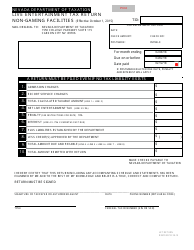

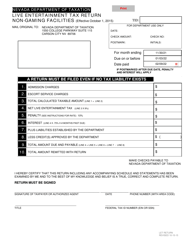

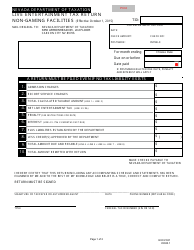

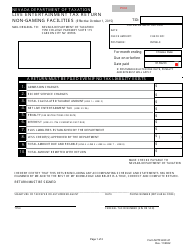

Live Entertainment Tax, Non-gaming Establishments With Occupancy of More Than 200 - Nevada

Live Entertainment Tax, Non-gaming Establishments With Occupancy of More Than 200 is a legal document that was released by the Nevada Department of Taxation - a government authority operating within Nevada.

FAQ

Q: What is the Live Entertainment Tax in Nevada?

A: The Live Entertainment Tax is a tax levied on non-gaming establishments with an occupancy of more than 200.

Q: Which establishments are subject to the Live Entertainment Tax in Nevada?

A: Non-gaming establishments with an occupancy of more than 200 are subject to the Live Entertainment Tax in Nevada.

Q: What is the purpose of the Live Entertainment Tax?

A: The Live Entertainment Tax is intended to generate revenue for the state of Nevada.

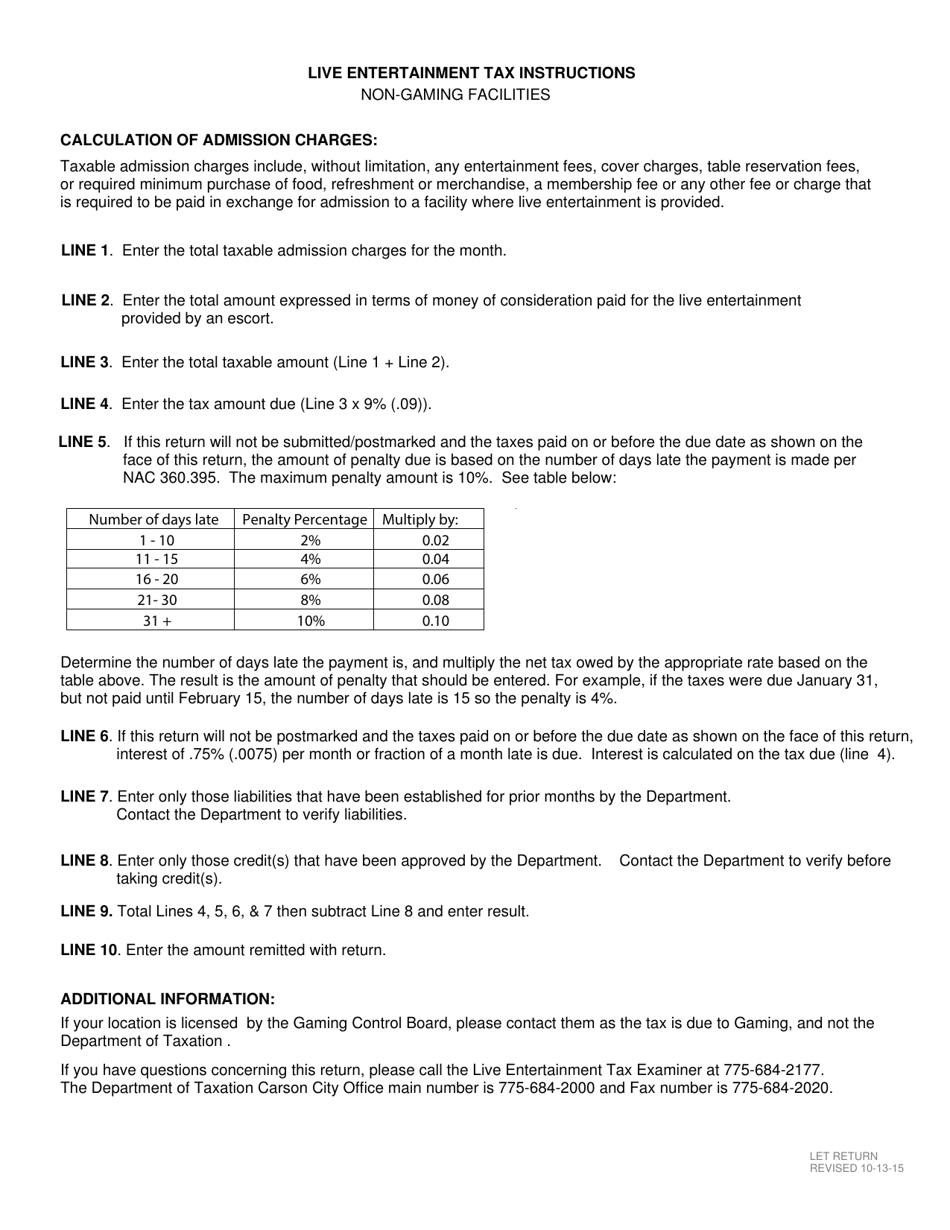

Q: How is the Live Entertainment Tax calculated?

A: The Live Entertainment Tax rate is based on the gross revenue from live entertainment admission charges at non-gaming establishments with an occupancy of more than 200.

Q: Are there any exemptions or deductions available for the Live Entertainment Tax?

A: Some exemptions and deductions may apply, but it is advisable to consult the Nevada Department of Taxation for specific details.

Form Details:

- The latest edition currently provided by the Nevada Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nevada Department of Taxation.