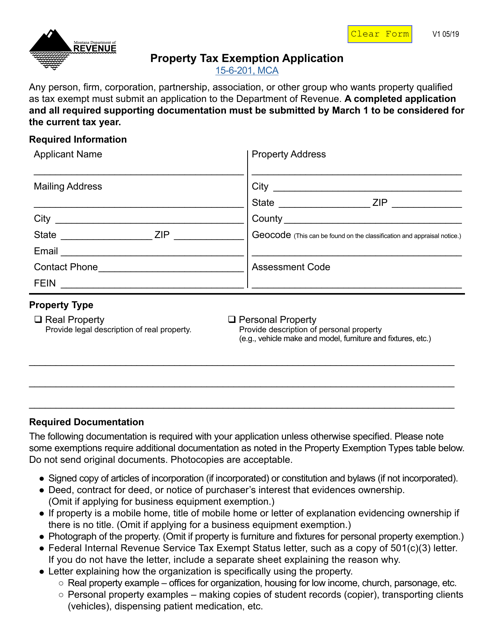

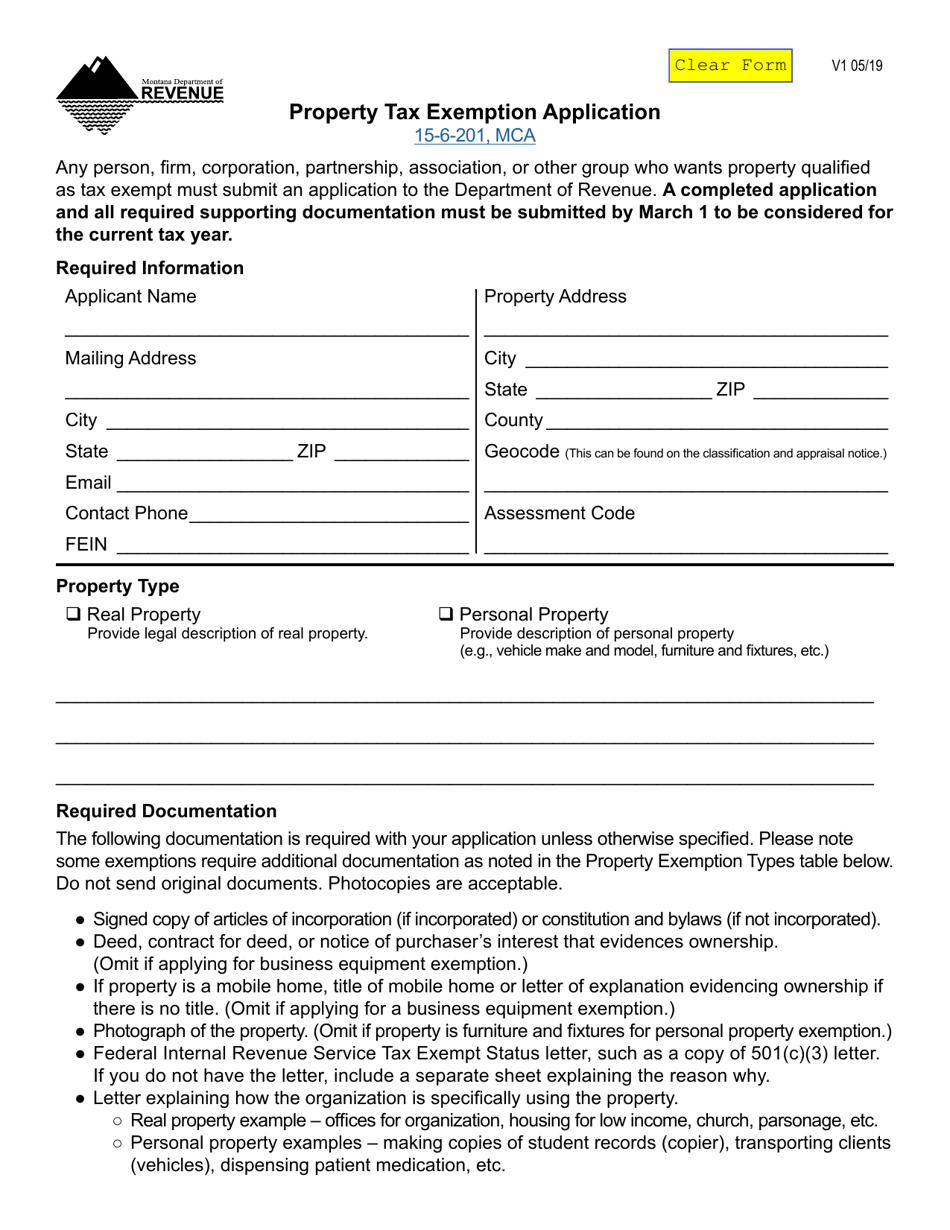

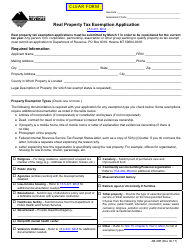

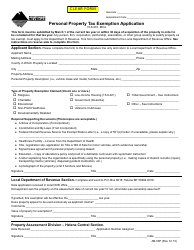

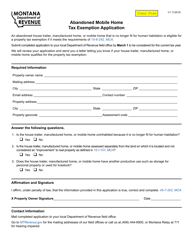

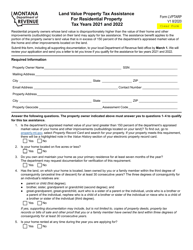

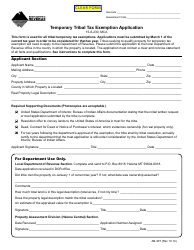

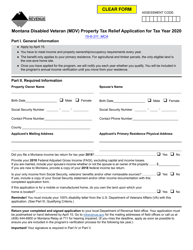

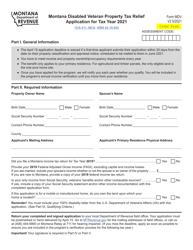

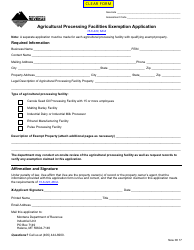

Property Tax Exemption Application - Montana

Property Tax Exemption Application is a legal document that was released by the Montana Department of Revenue - a government authority operating within Montana.

FAQ

Q: What is a property tax exemption?

A: A property tax exemption is a program that allows certain individuals or properties to be exempt from paying property taxes.

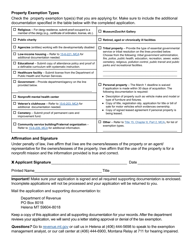

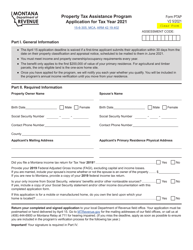

Q: Who is eligible for a property tax exemption in Montana?

A: In Montana, individuals who are disabled, veterans, or senior citizens may be eligible for a property tax exemption.

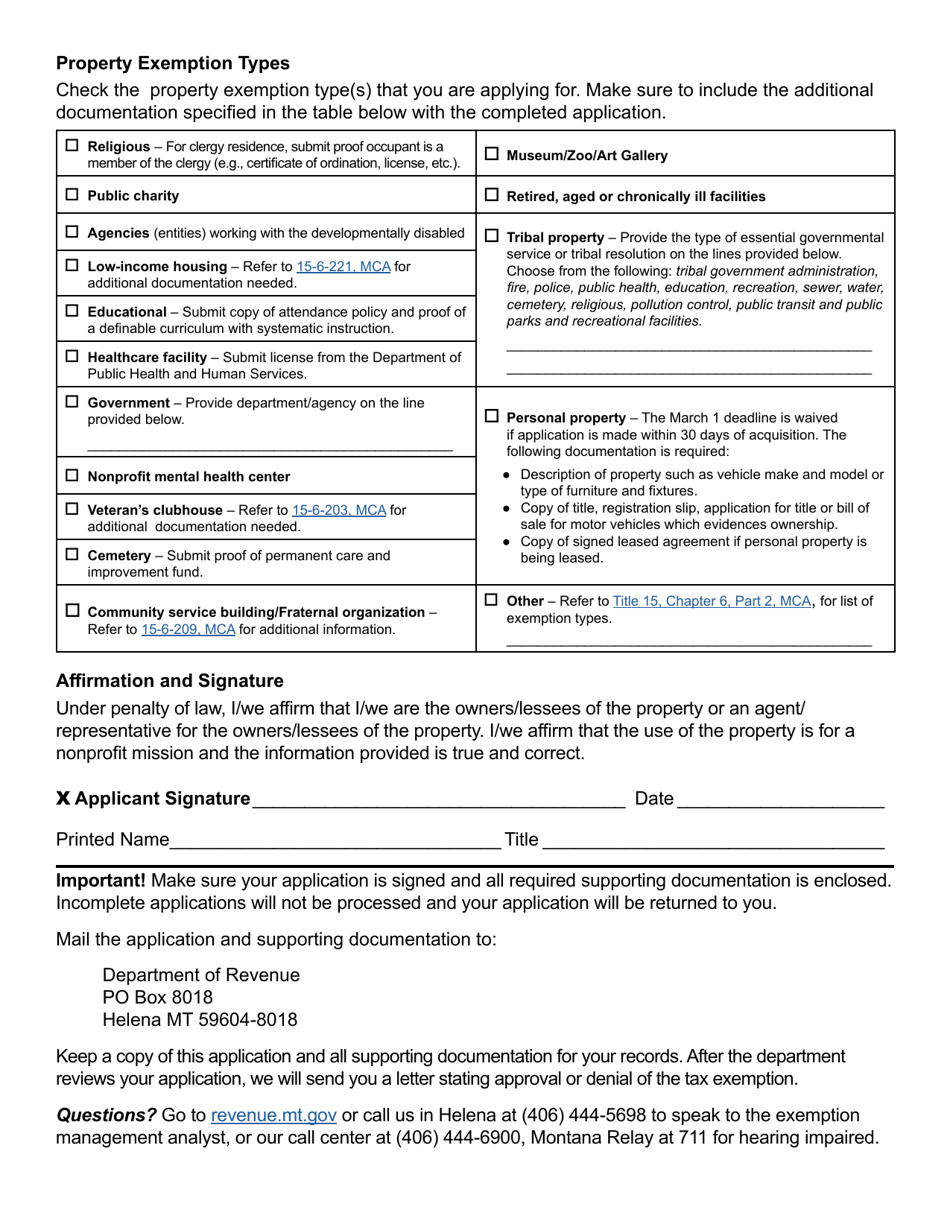

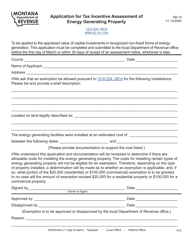

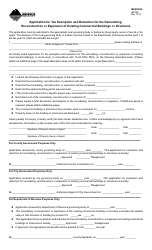

Q: How do I apply for a property tax exemption in Montana?

A: To apply for a property tax exemption in Montana, you will need to complete an application form and provide supporting documentation. The application form can be obtained from your local county assessor's office.

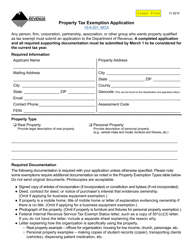

Q: What supporting documentation is required for a property tax exemption application?

A: The required supporting documentation may vary depending on the type of exemption you are applying for. Common documents include proof of disability, proof of veteran status, or proof of age.

Q: Is there a deadline to apply for a property tax exemption in Montana?

A: Yes, the deadline to apply for a property tax exemption in Montana is typically April 15th of each year.

Q: What happens after I submit my property tax exemption application?

A: After you submit your application, it will be reviewed by the county assessor's office. If approved, you will receive a notice confirming your exemption and your property tax bill will be adjusted accordingly.

Q: Do I need to reapply for a property tax exemption every year?

A: In Montana, most property tax exemptions need to be renewed annually. You will need to submit a new application each year to continue receiving the exemption.

Q: Can I receive a property tax exemption if I rent my home?

A: No, property tax exemptions in Montana are generally only available for individuals who own and occupy their homes.

Form Details:

- Released on May 1, 2019;

- The latest edition currently provided by the Montana Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.