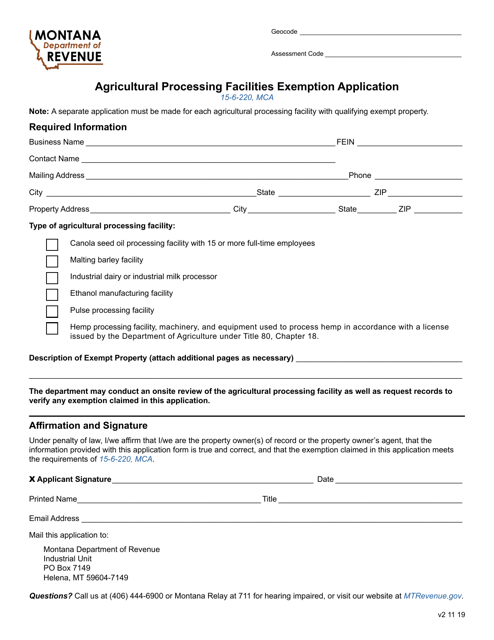

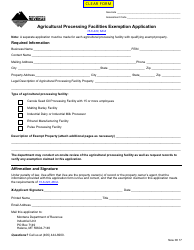

Agricultural Processing Facilities Exemption Application - Montana

Agricultural Processing Facilities Exemption Application is a legal document that was released by the Montana Department of Revenue - a government authority operating within Montana.

FAQ

Q: What is the Agricultural Processing Facilities Exemption Application?

A: The Agricultural Processing Facilities Exemption Application is a document used in Montana to request an exemption for agricultural processing facilities from certain property taxes.

Q: Who can apply for the Agricultural Processing Facilities Exemption?

A: Owners or operators of agricultural processing facilities in Montana can apply for the exemption.

Q: What is the purpose of the exemption?

A: The exemption is intended to encourage the development and expansion of agricultural processing facilities in Montana.

Q: What types of facilities are eligible for the exemption?

A: Facilities involved in processingagricultural products such as crops, livestock, dairy, or honey are eligible for the exemption.

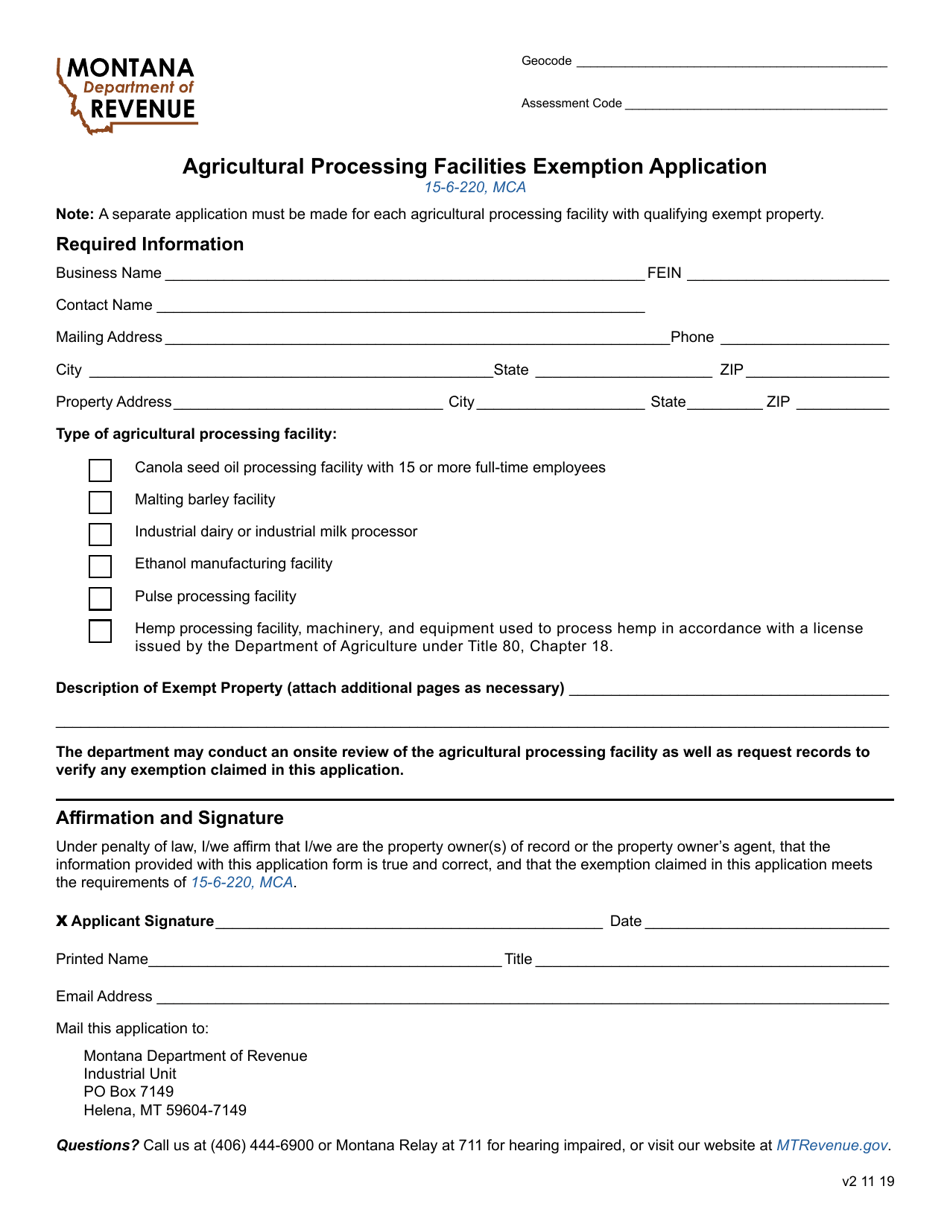

Q: Does the exemption cover all property taxes?

A: No, the exemption only applies to certain property taxes, such as improvements made to the facility.

Q: How long does the exemption last?

A: The exemption lasts for up to 10 years.

Q: Is there a deadline to submit the application?

A: Yes, the application must be submitted by March 1st of the tax year for which the exemption is requested.

Form Details:

- Released on November 1, 2019;

- The latest edition currently provided by the Montana Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.