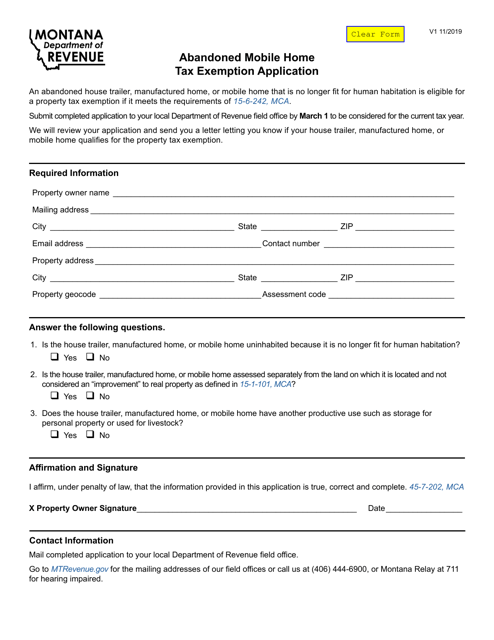

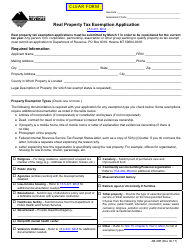

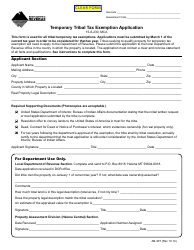

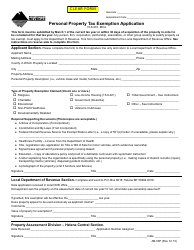

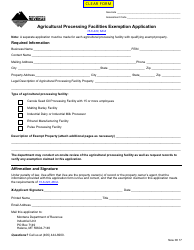

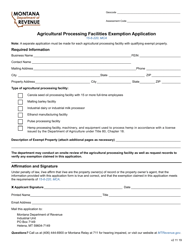

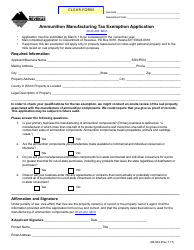

Abandoned Mobile Home Tax Exemption Application - Montana

Abandoned Mobile Home Tax Exemption Application is a legal document that was released by the Montana Department of Revenue - a government authority operating within Montana.

FAQ

Q: What is the Abandoned Mobile Home Tax Exemption Application?

A: The Abandoned Mobile Home Tax Exemption Application is a form provided by the government of Montana that allows eligible mobile home owners to apply for a tax exemption on their abandoned mobile homes.

Q: Who is eligible to apply for the Abandoned Mobile Home Tax Exemption?

A: Mobile home owners in Montana who meet certain eligibility criteria, such as the mobile home being abandoned, may be eligible to apply for the tax exemption.

Q: What is the purpose of the tax exemption?

A: The tax exemption is designed to provide relief to eligible mobile home owners in Montana by exempting them from paying property taxes on their abandoned mobile homes.

Q: Are there any deadlines for submitting the application?

A: Yes, the application must be submitted to the county treasurer's office by the designated deadline, which can vary depending on the county. It is important to check the specific deadline for your county.

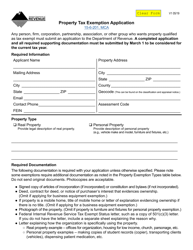

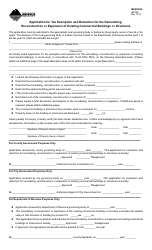

Q: What documentation do I need to include with the application?

A: You may be required to provide documentation such as the mobile home title, proof of abandonment, and proof of ownership. The exact requirements can vary by county, so it is advisable to consult with your county treasurer's office for specific instructions.

Q: What happens after I submit the application?

A: After you submit the application, it will be reviewed by the county treasurer's office. If your application is approved, you will receive a tax exemption for your abandoned mobile home.

Q: Is the tax exemption permanent?

A: No, the tax exemption is not permanent. It is granted on an annual basis, and you will need to reapply each year if you still meet the eligibility criteria.

Q: Can I appeal if my application is denied?

A: Yes, if your application is denied, you have the right to appeal the decision. You can follow the appeal process outlined by your county treasurer's office.

Form Details:

- Released on November 1, 2019;

- The latest edition currently provided by the Montana Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.