This version of the form is not currently in use and is provided for reference only. Download this version of

Form 2441-M

for the current year.

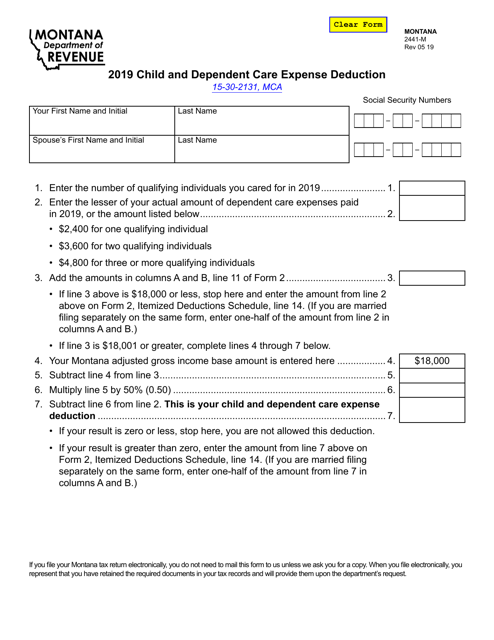

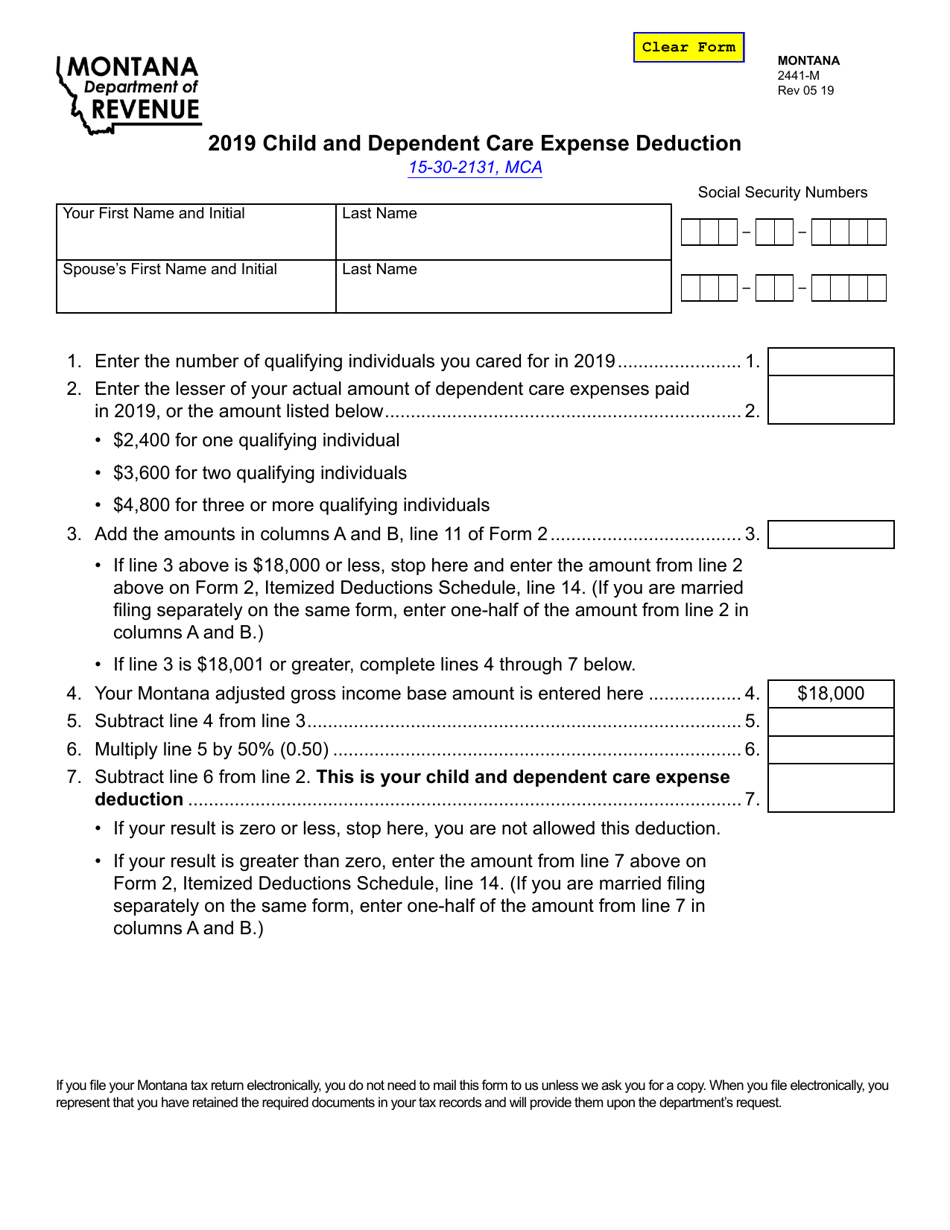

Form 2441-M Child and Dependent Care Expense Deduction - Montana

What Is Form 2441-M?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2441-M?

A: Form 2441-M is a state-specific form for claiming the Child and Dependent Care Expense Deduction in Montana.

Q: What is the Child and Dependent Care Expense Deduction?

A: The Child and Dependent Care Expense Deduction is a deduction that allows you to reduce your taxable income if you paid for child or dependent care expenses.

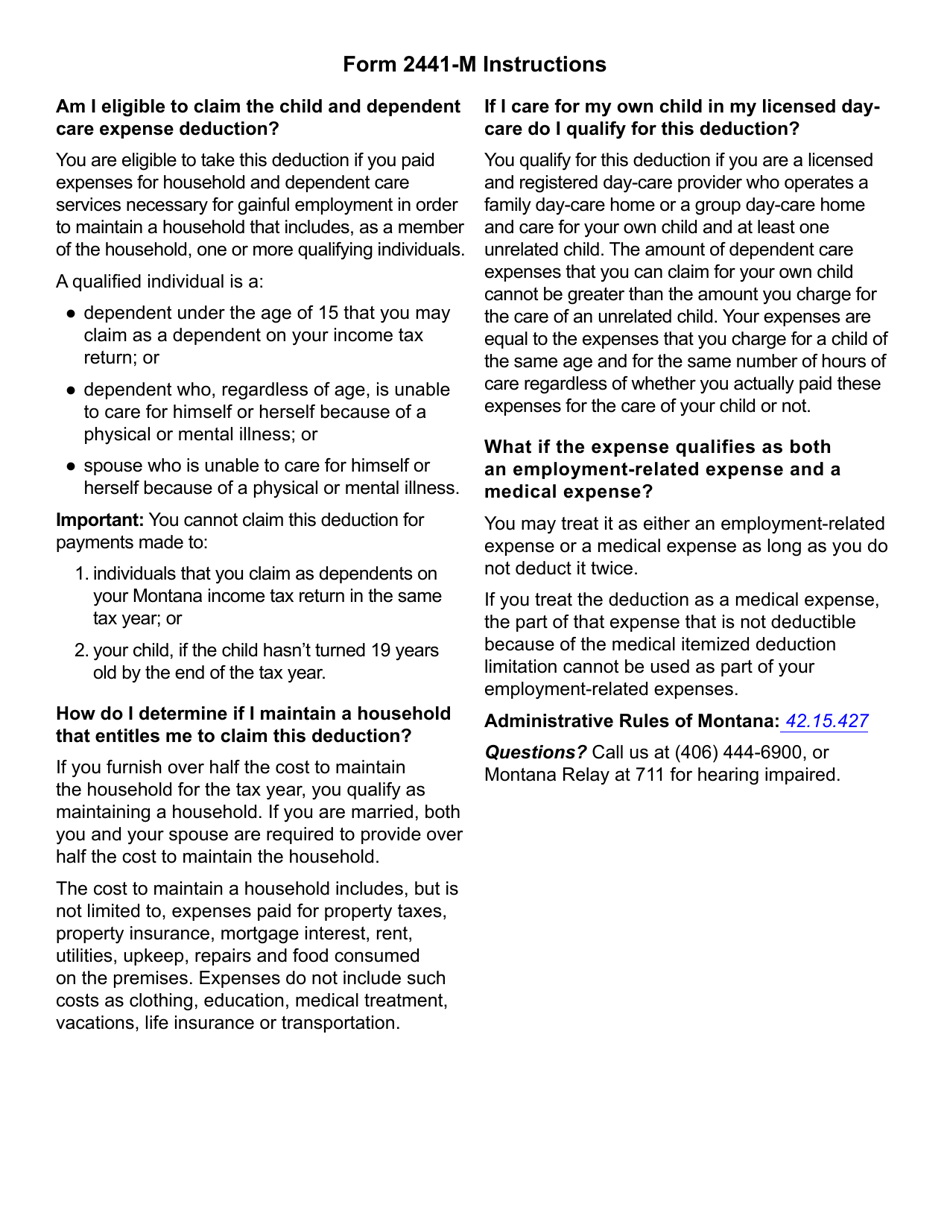

Q: Who is eligible for the Child and Dependent Care Expense Deduction?

A: You may be eligible for the deduction if you paid for child or dependent care expenses while you were working or looking for work.

Q: What expenses are eligible for the deduction?

A: Eligible expenses may include payments to a daycare provider, nanny, or babysitter, as well as expenses for before or after-school care.

Q: How do I claim the Child and Dependent Care Expense Deduction?

A: To claim the deduction, you will need to complete and attach Form 2441-M to your Montana state tax return.

Q: Is the deduction available for both child and dependent care expenses?

A: Yes, the deduction is available for both child and dependent care expenses.

Q: Are there any income limitations for claiming the deduction?

A: Yes, there are income limitations that may affect your eligibility for the deduction. It is best to refer to the instructions for Form 2441-M or consult with a tax professional for more information.

Q: Are there any other requirements to claim the deduction?

A: Yes, you will need to provide the taxpayer identification number (TIN) or social security number (SSN) of the child or dependent care provider.

Q: When is the deadline for claiming the deduction?

A: The deadline for claiming the deduction is typically the same as the deadline for filing your Montana state tax return.

Q: Can I claim the deduction if I receive employer-provided dependent care benefits?

A: Yes, you may still be able to claim the deduction, but the amount of the deduction may be reduced by the amount of employer-provided dependent care benefits you received.

Q: Is the Child and Dependent Care Expense Deduction refundable?

A: No, the deduction is not refundable. It can only be used to reduce your taxable income.

Q: Can I claim the deduction if I am married and filing separately?

A: Generally, if you are married and filing separately, you cannot claim the deduction unless you meet certain criteria. Refer to the instructions for Form 2441-M or consult with a tax professional for more information.

Q: What documentation do I need to keep to support my deduction?

A: You should keep records of your childcare expenses, such as receipts, canceled checks, or payment confirmation statements, in case the Montana Department of Revenue requests documentation to support your deduction.

Q: Are there any other tax credits or deductions related to child and dependent care expenses?

A: Yes, you may also be eligible for the federal Child and Dependent Care Credit and other state-specific credits or deductions. Consult with a tax professional or refer to the appropriate tax forms and instructions for more information.

Q: Can I claim the Child and Dependent Care Expense Deduction if my child is in school?

A: It depends on the circumstances. If the care is necessary for the child’s well-being and enables you to work or look for work, you may still be able to claim the deduction. Consult with a tax professional or refer to the instructions for Form 2441-M for more information.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2441-M by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.