This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

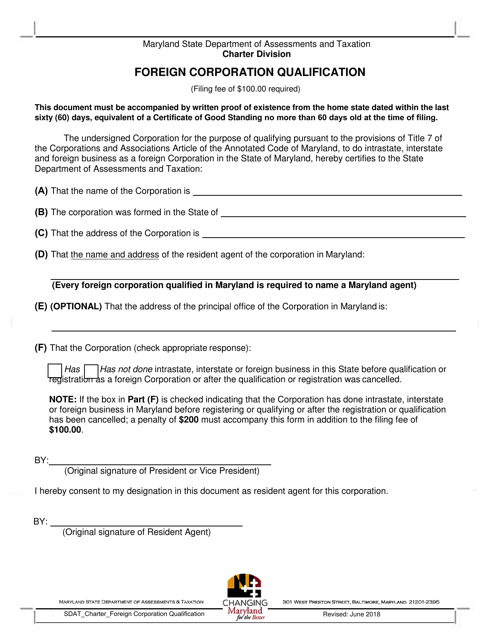

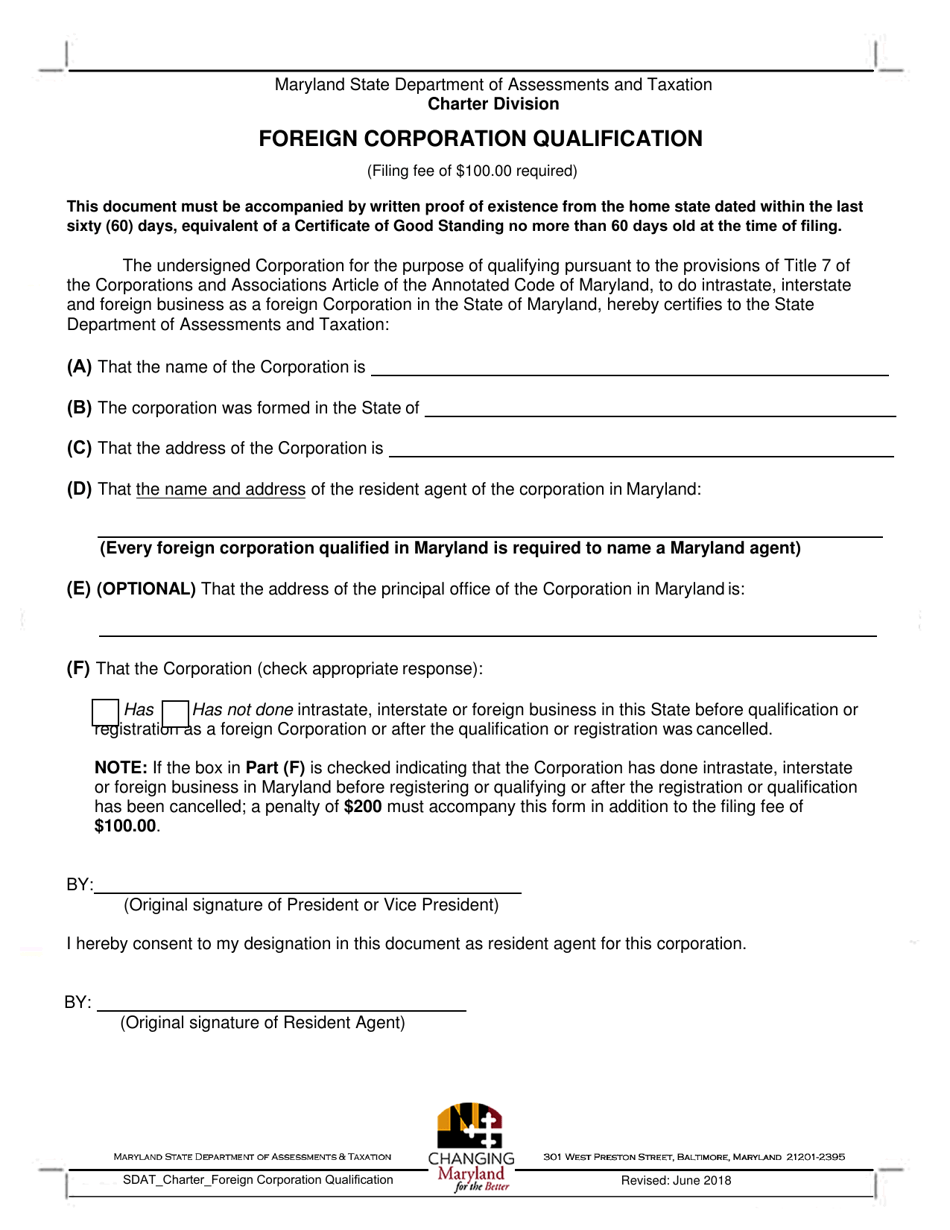

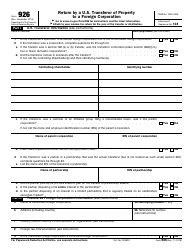

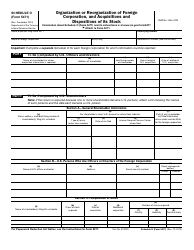

Foreign Corporation Qualification - Maryland

Foreign Corporation Qualification is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

Q: What is a foreign corporation?

A: A foreign corporation refers to a corporation that is incorporated in another state or country.

Q: What is foreign corporation qualification?

A: Foreign corporation qualification is the process by which a corporation from another state or country obtains permission to do business in Maryland.

Q: Why would a foreign corporation need to qualify in Maryland?

A: A foreign corporation needs to qualify in Maryland to legally conduct business and have certain legal protections and rights in the state.

Q: What is required to qualify a foreign corporation in Maryland?

A: To qualify a foreign corporation in Maryland, you generally need to file an application with the Maryland Department of Assessments and Taxation and pay the required fees.

Q: Are there any ongoing requirements for a qualified foreign corporation in Maryland?

A: Yes, a qualified foreign corporation in Maryland must file an annual report and pay the corresponding fees to maintain its qualification status.

Q: What are the benefits of qualifying a foreign corporation in Maryland?

A: Qualifying a foreign corporation in Maryland provides legal standing, protection of assets, access to state courts, and the ability to enter into contracts and conduct business in the state.

Q: Can a foreign corporation operate in Maryland without qualifying?

A: No, a foreign corporation cannot legally conduct business in Maryland without first obtaining the necessary qualification.

Q: Can a foreign corporation do business in Maryland before it is qualified?

A: No, a foreign corporation must first obtain qualification before it can start doing business in Maryland.

Q: How long does it take to qualify a foreign corporation in Maryland?

A: The time it takes to qualify a foreign corporation in Maryland may vary, but it typically takes a few business days or weeks.

Form Details:

- Released on June 1, 2018;

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.