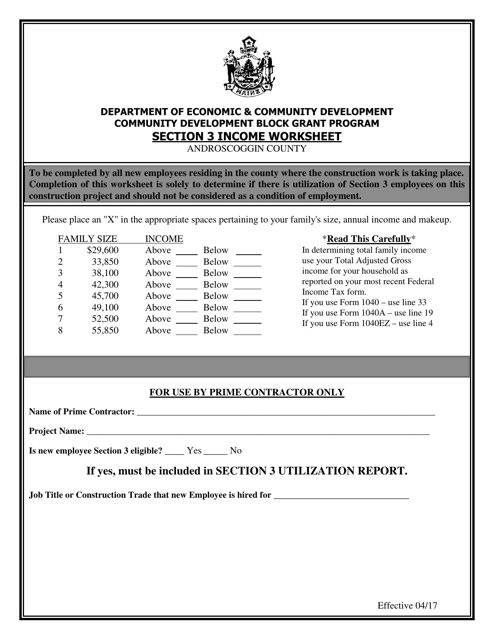

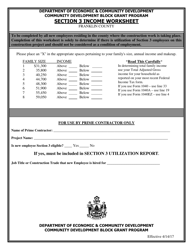

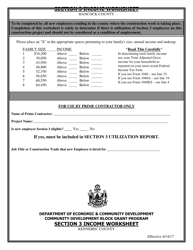

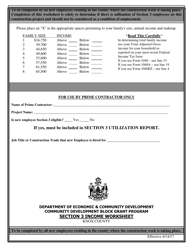

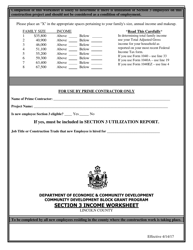

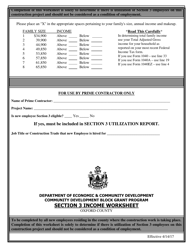

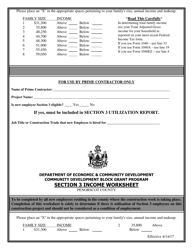

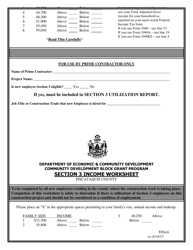

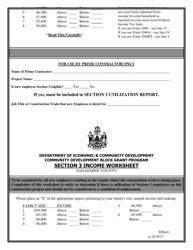

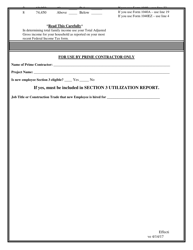

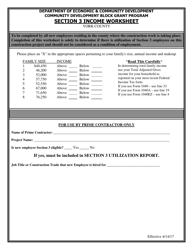

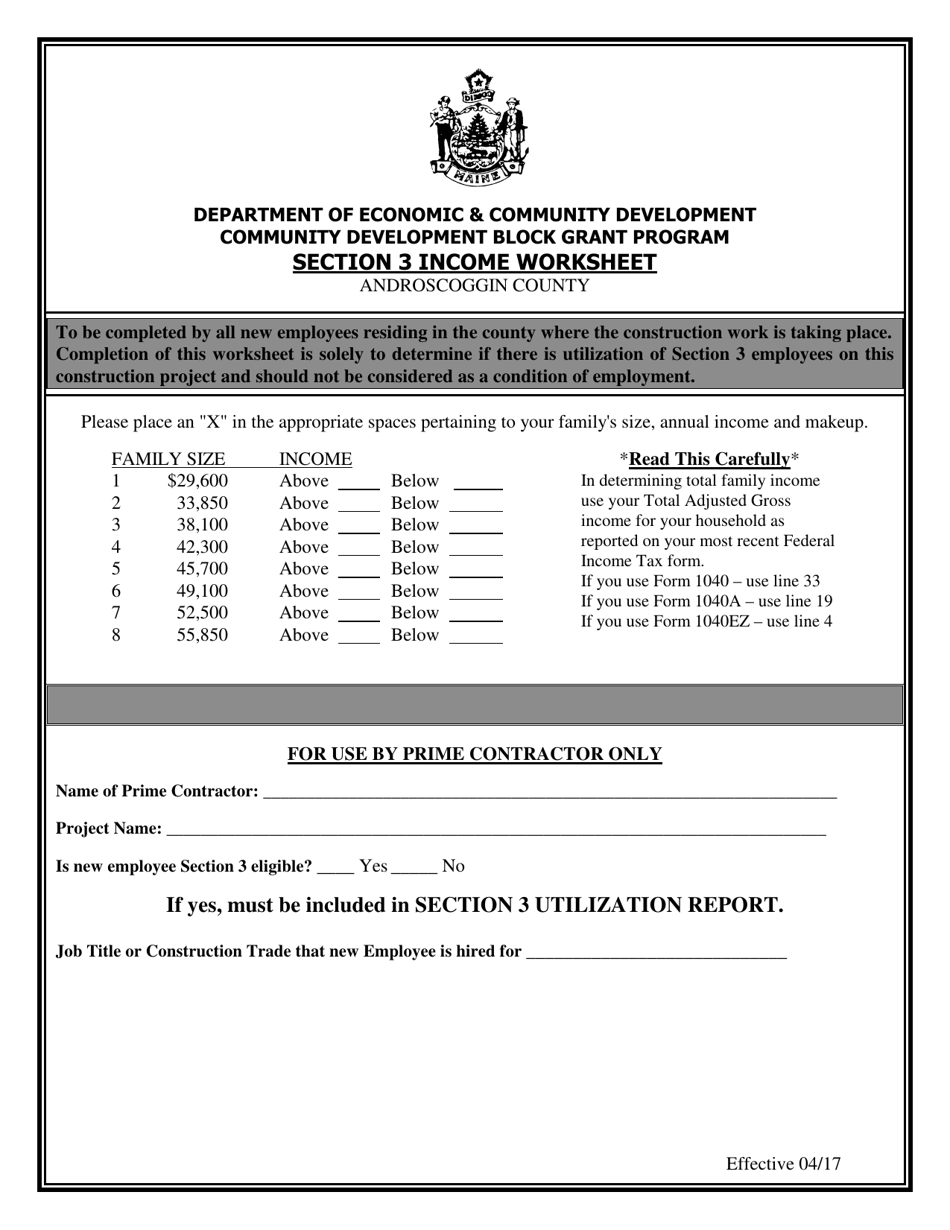

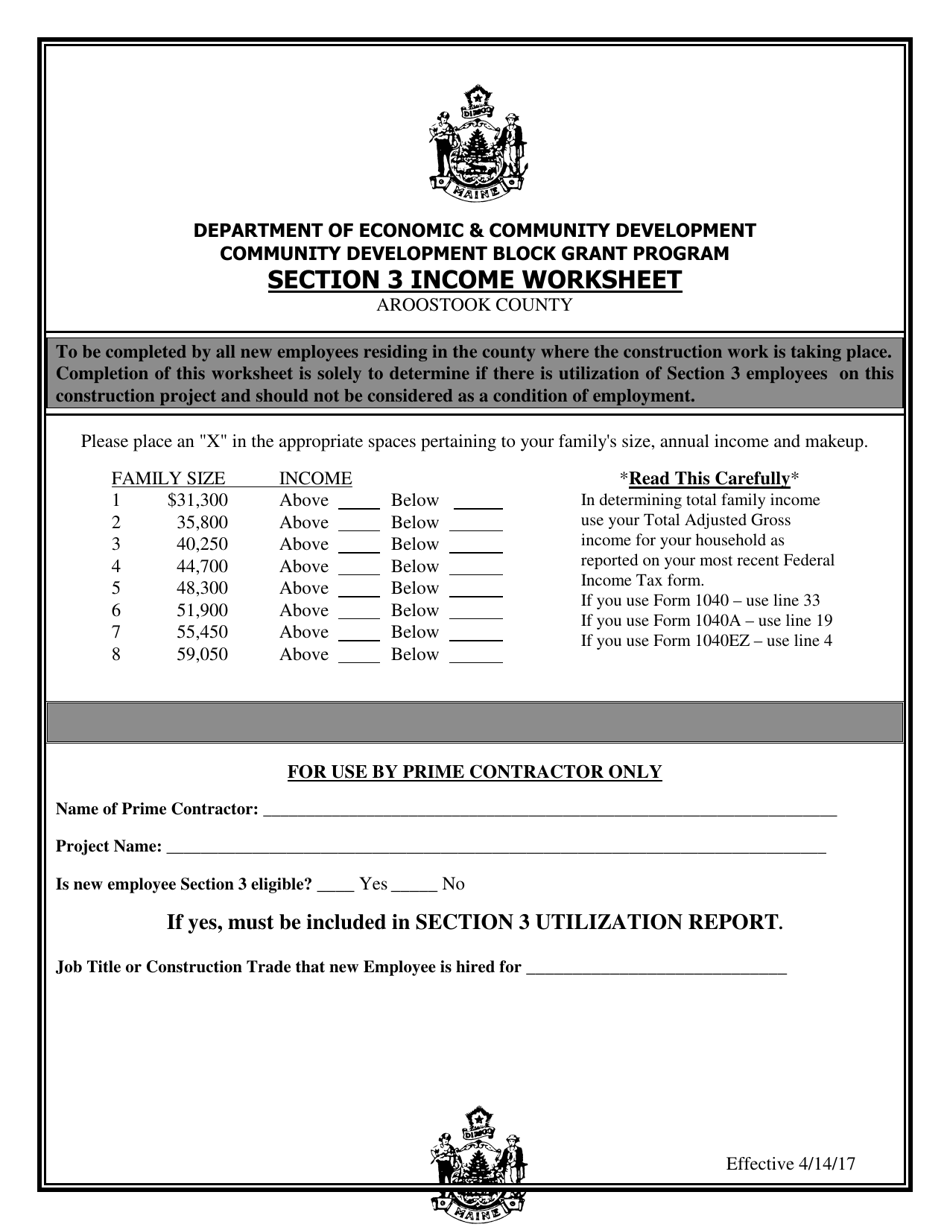

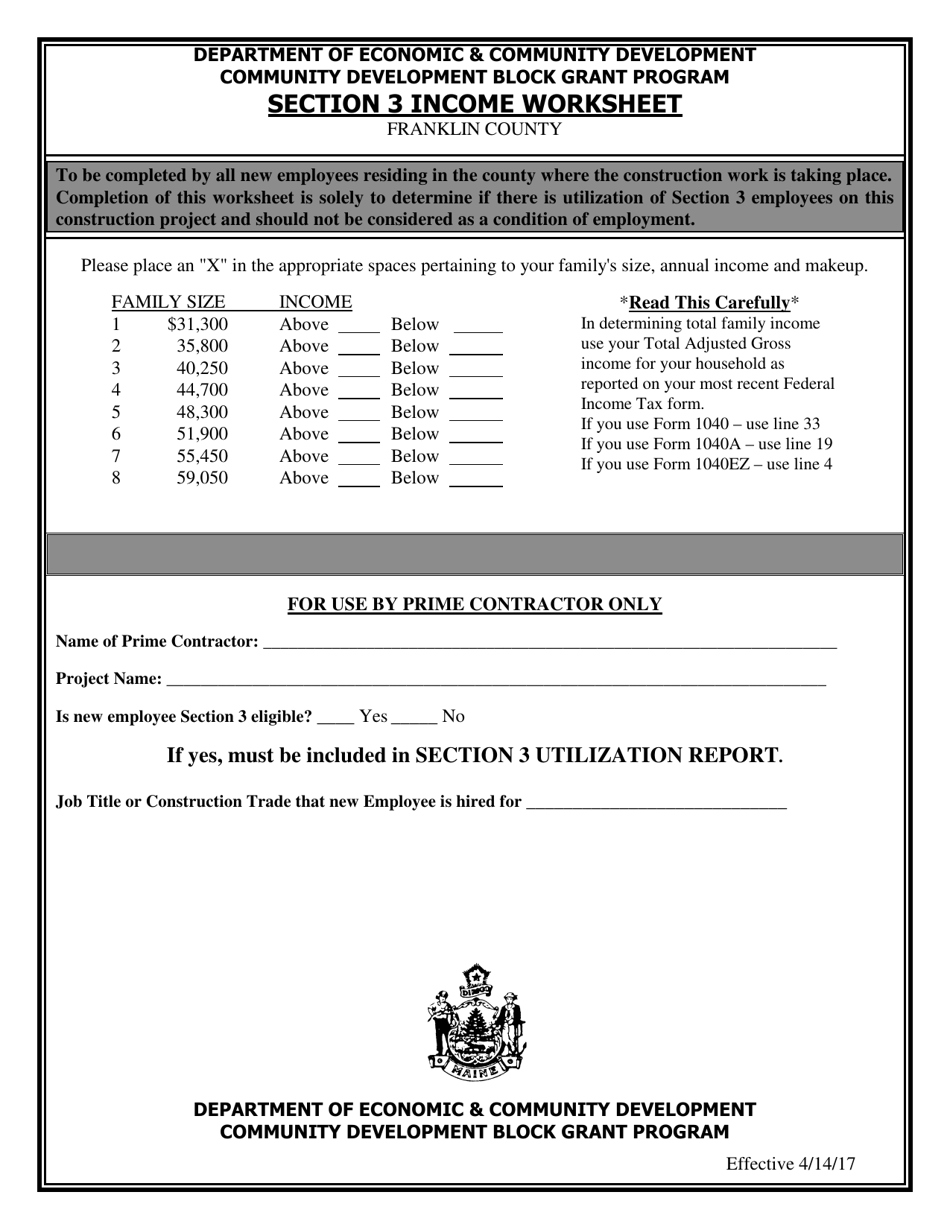

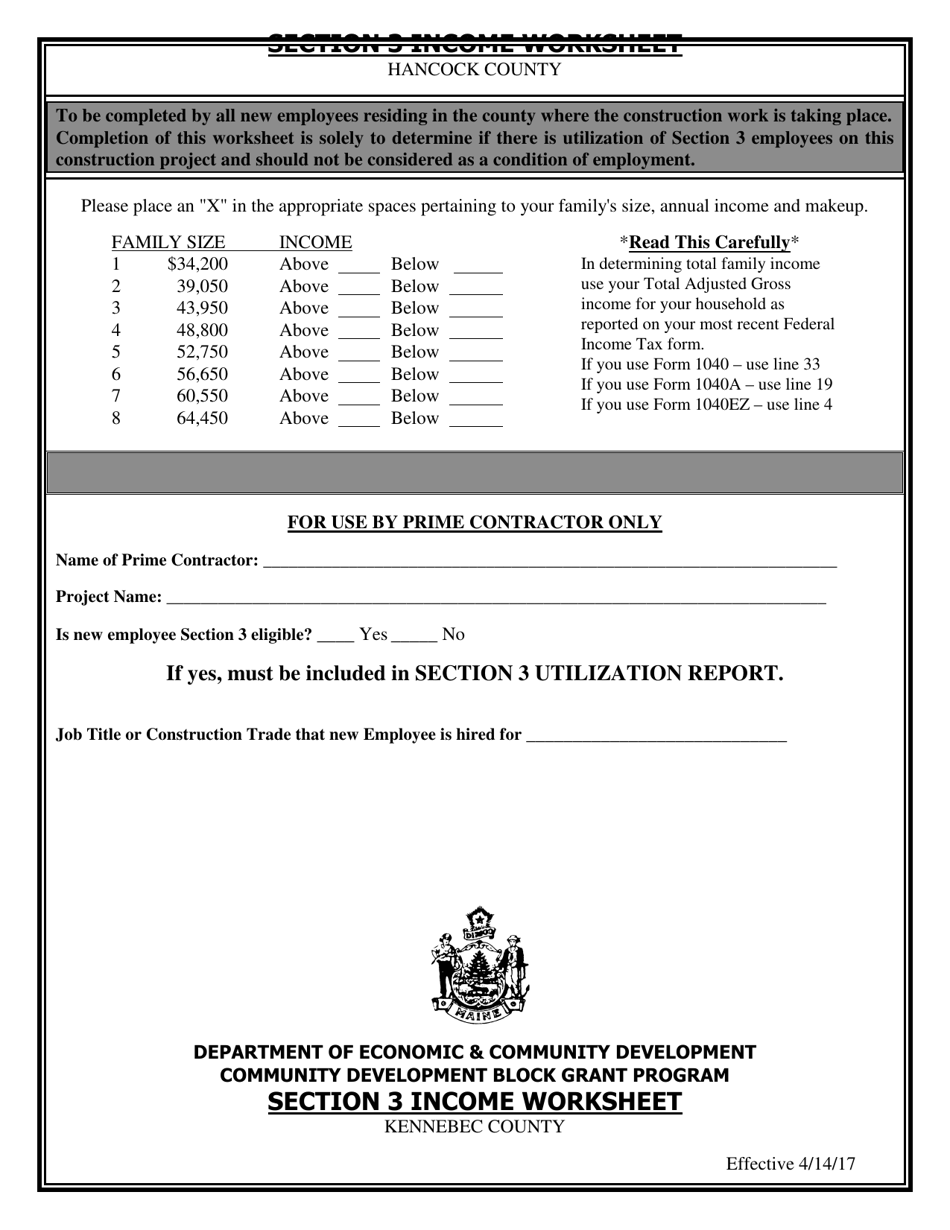

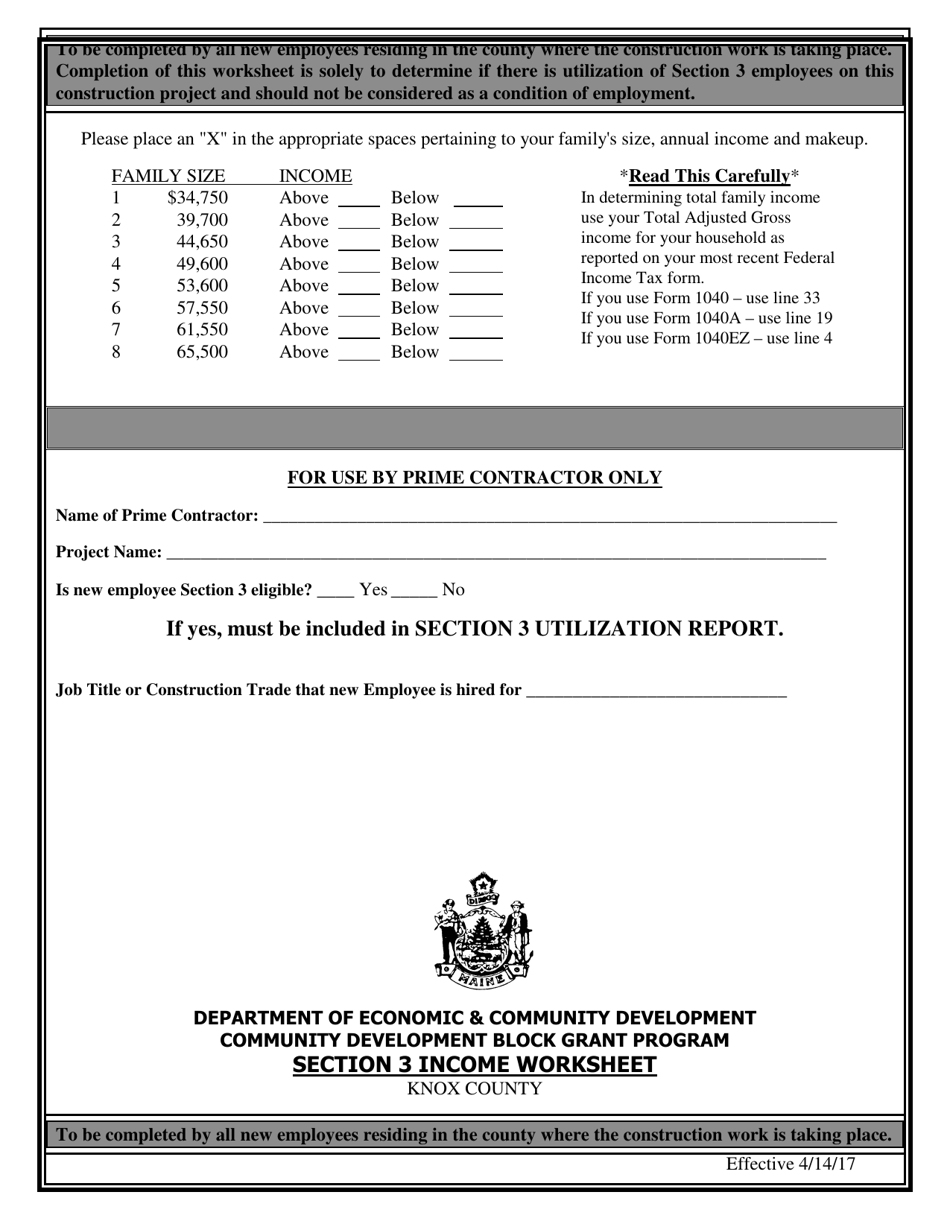

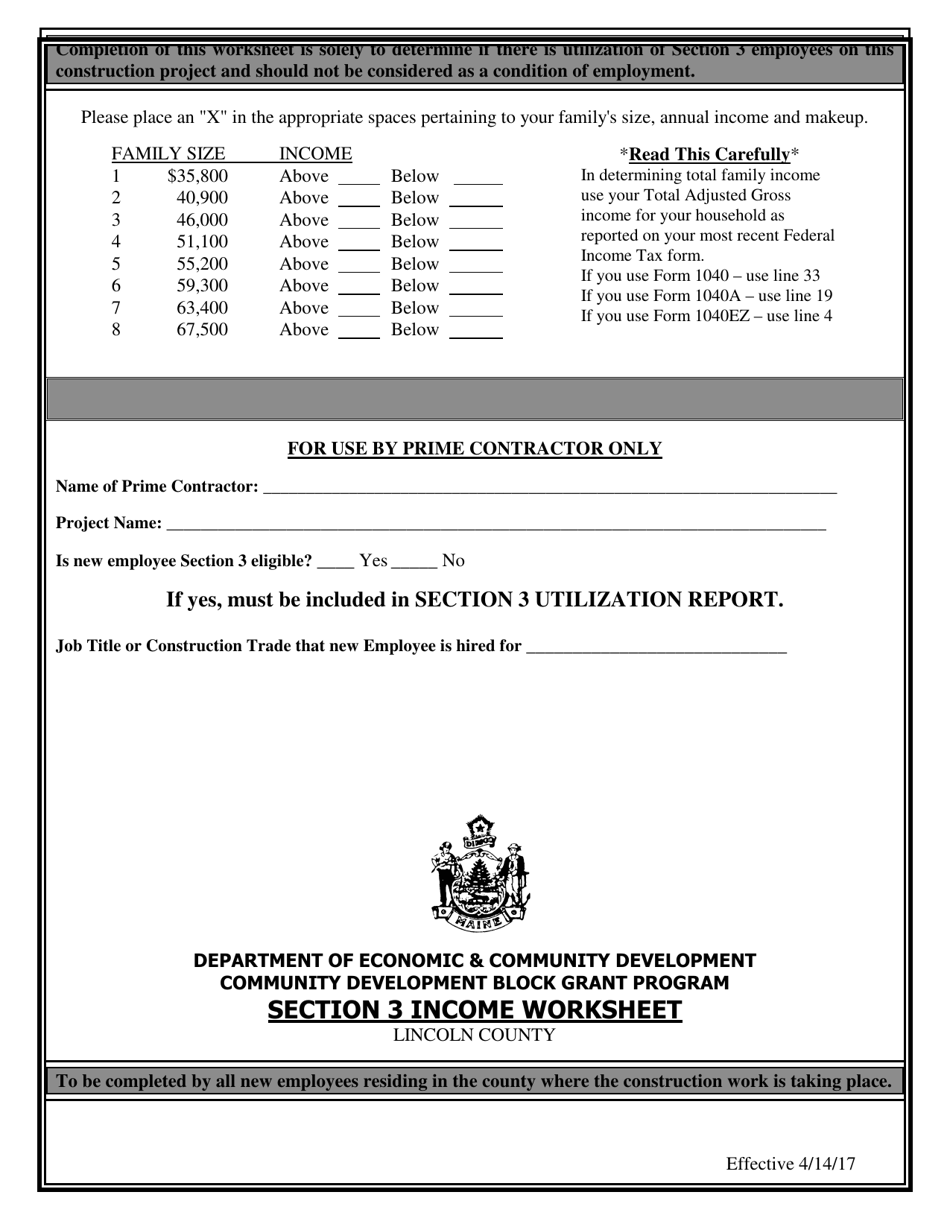

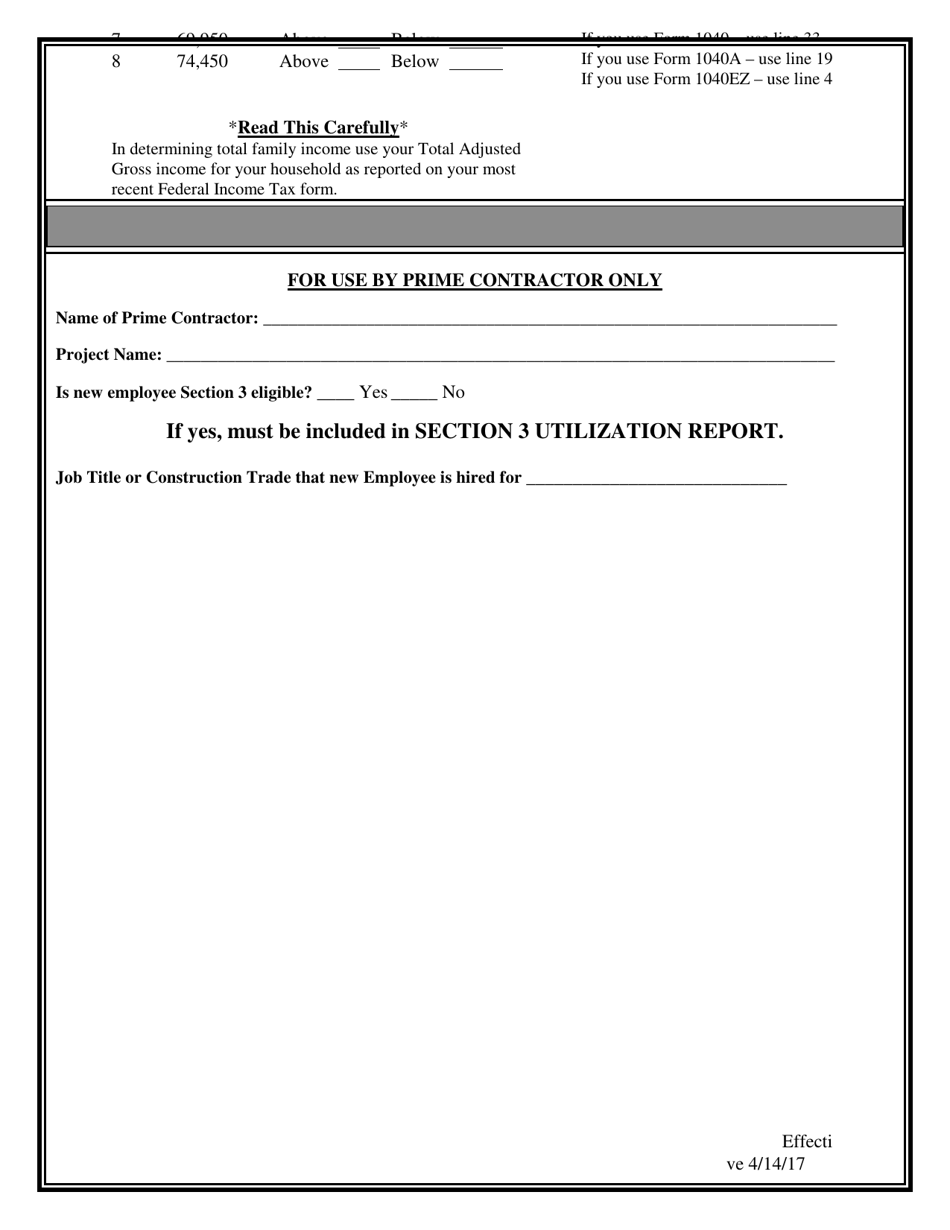

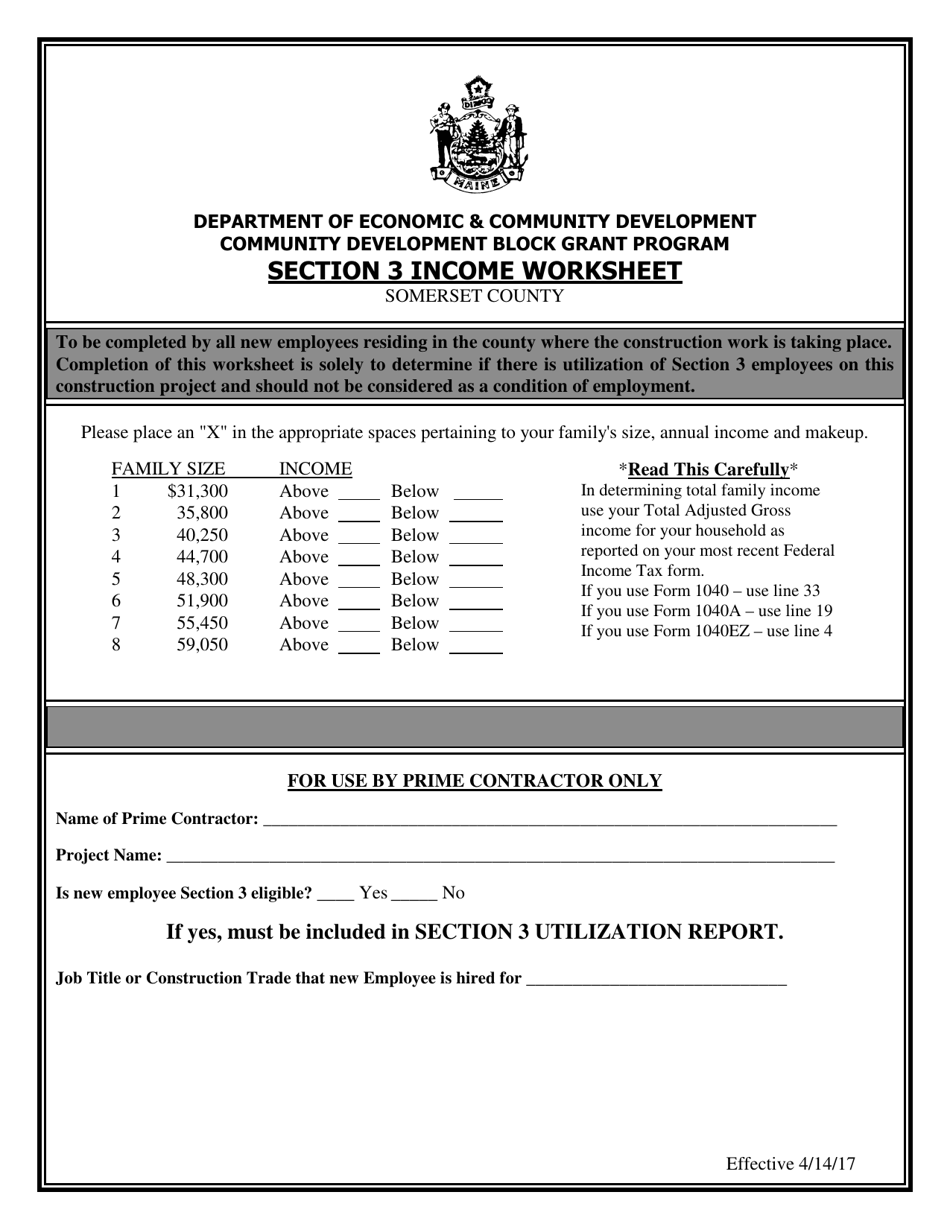

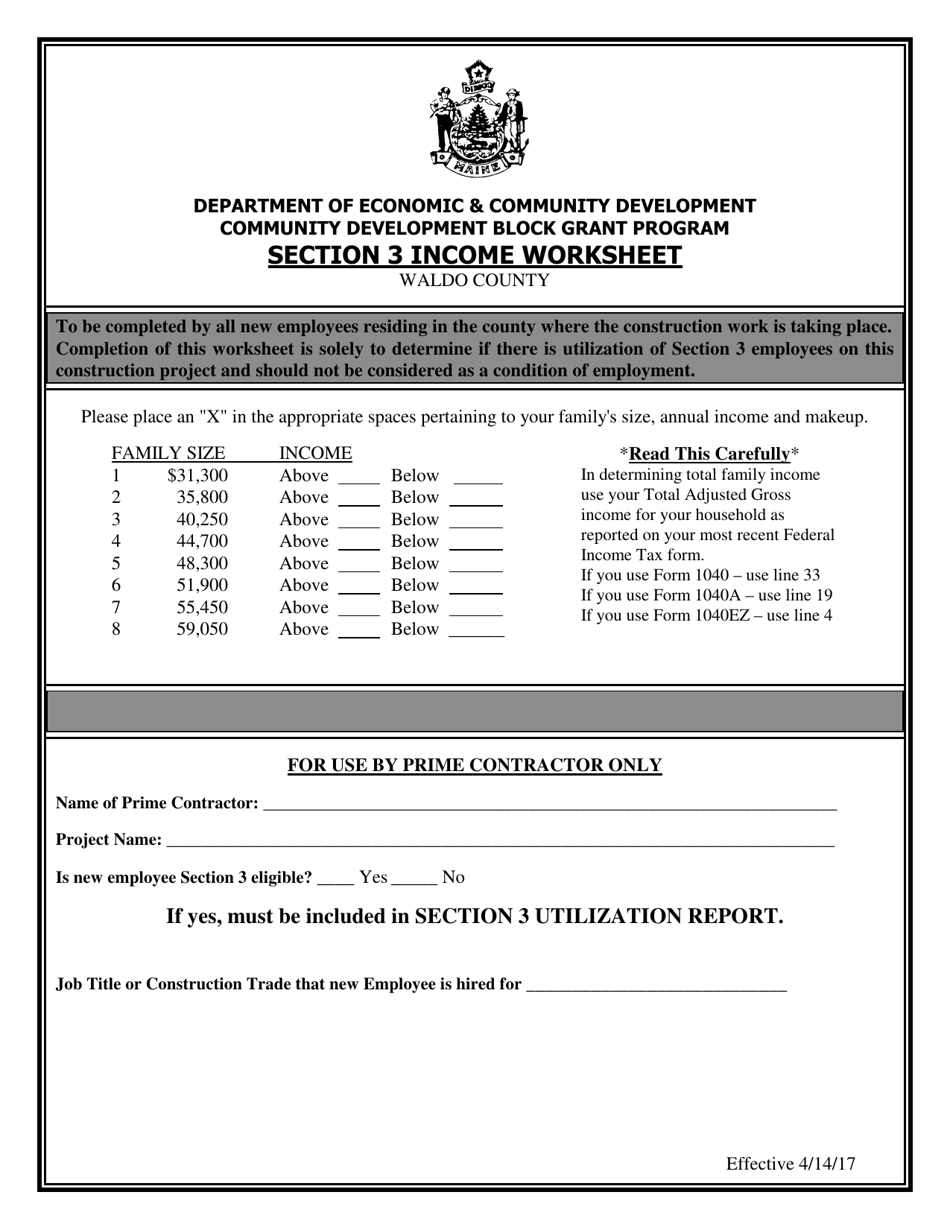

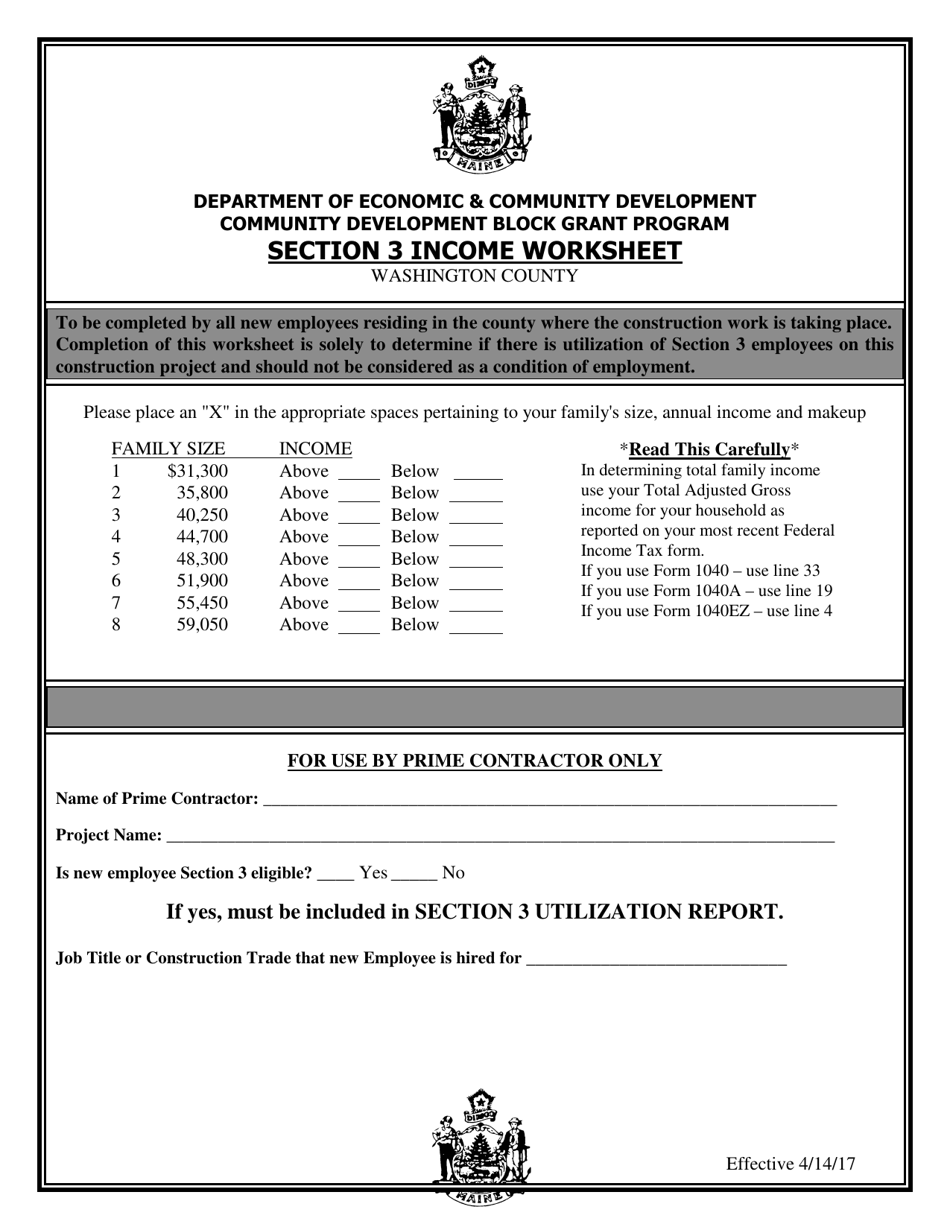

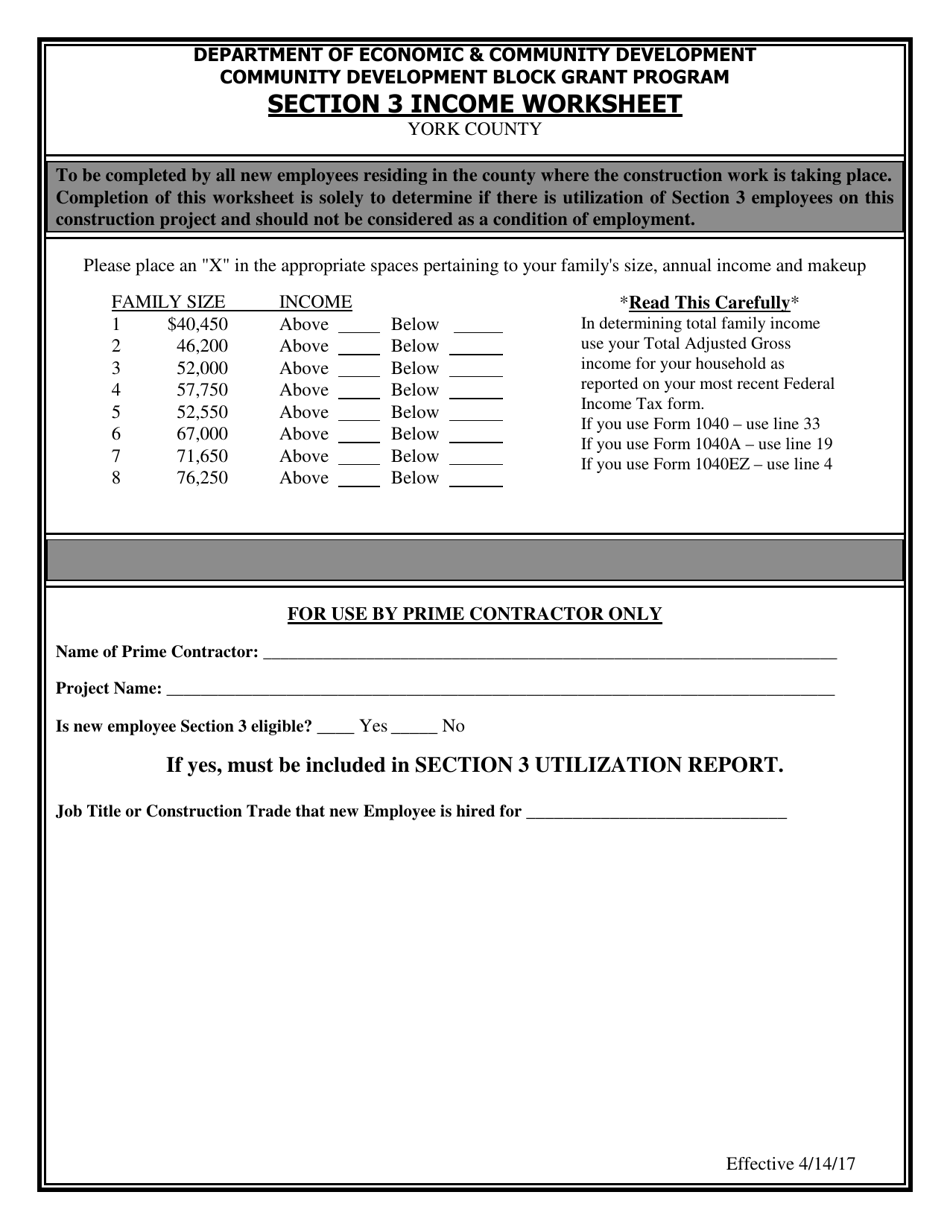

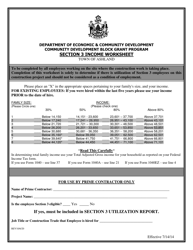

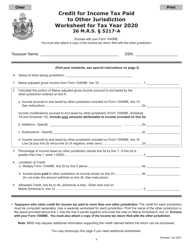

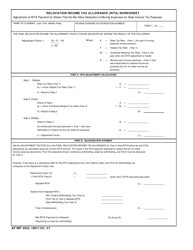

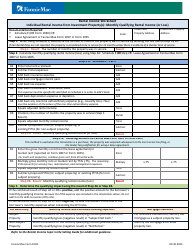

Section 3 Income Worksheet - Maine

Section 3 Income Worksheet is a legal document that was released by the Maine Department of Economic & Community Development - a government authority operating within Maine.

FAQ

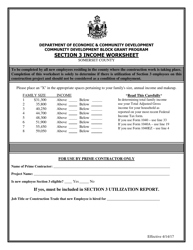

Q: What is the purpose of the Income Worksheet?

A: The purpose of the Income Worksheet is to calculate your income for tax purposes.

Q: How do I fill out the Income Worksheet?

A: You fill out the Income Worksheet by entering your various sources of income and their corresponding amounts.

Q: What information do I need to complete the Income Worksheet?

A: To complete the Income Worksheet, you will need information about your wages, self-employment income, interest earned, dividends received, and any other sources of income.

Q: Do I need to report all types of income on the Income Worksheet?

A: Yes, you need to report all types of income on the Income Worksheet, including wages, self-employment income, interest, dividends, and any other income you receive.

Q: Are there any deductions or exemptions on the Income Worksheet?

A: The Income Worksheet does not include deductions or exemptions. It is solely used to calculate your total income.

Q: What do I do with the completed Income Worksheet?

A: Once you have completed the Income Worksheet, you will use the calculated total income to determine your tax liability or eligibility for certain tax credits or deductions.

Form Details:

- Released on April 14, 2017;

- The latest edition currently provided by the Maine Department of Economic & Community Development;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Economic & Community Development.