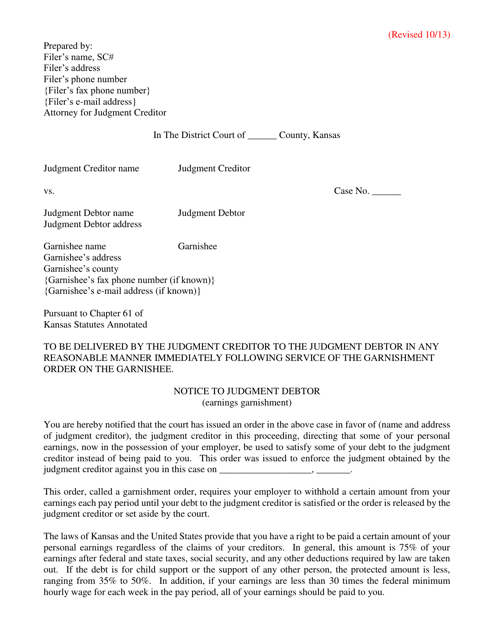

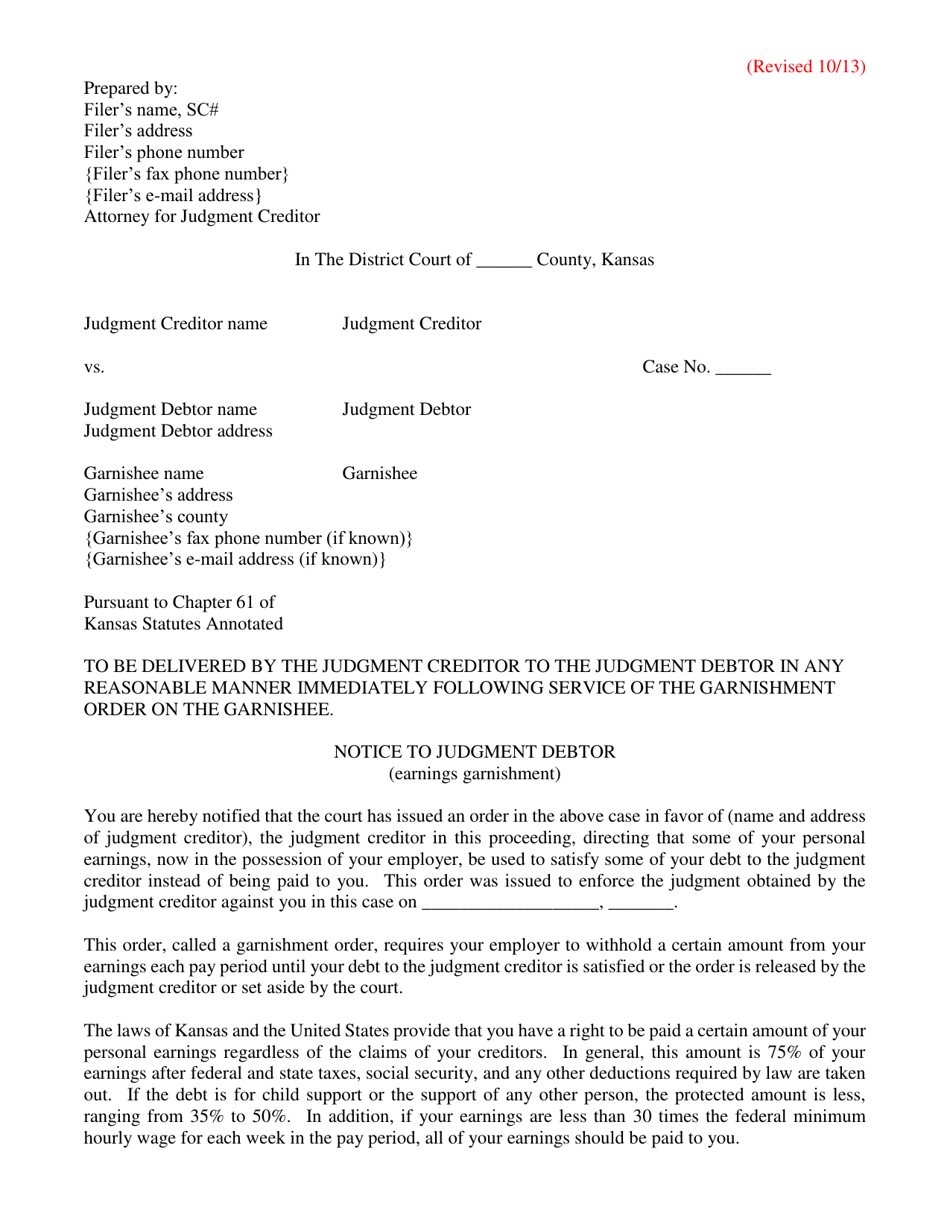

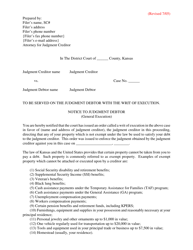

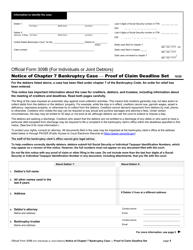

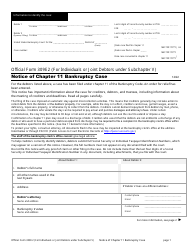

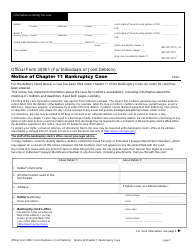

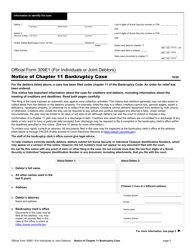

Notice to Judgement Debtor (Earnings Garnishment) - Kansas

Notice to Judgement Debtor (Earnings Garnishment) is a legal document that was released by the Kansas District Courts - a government authority operating within Kansas.

FAQ

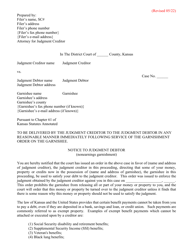

Q: What is a Notice to Judgment Debtor?

A: A Notice to Judgment Debtor is a legal document informing an individual that their earnings will be garnished to satisfy a judgment against them.

Q: What is an Earnings Garnishment?

A: An Earnings Garnishment is a legal process where a portion of an individual's wages are withheld by their employer to pay off a debt.

Q: Who sends a Notice to Judgment Debtor?

A: A Notice to Judgment Debtor is sent by the creditor or the creditor's attorney.

Q: Why would someone receive a Notice to Judgment Debtor?

A: Someone would receive a Notice to Judgment Debtor if they have an outstanding debt that has resulted in a judgment against them.

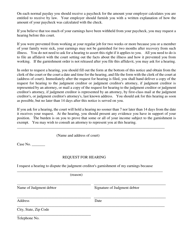

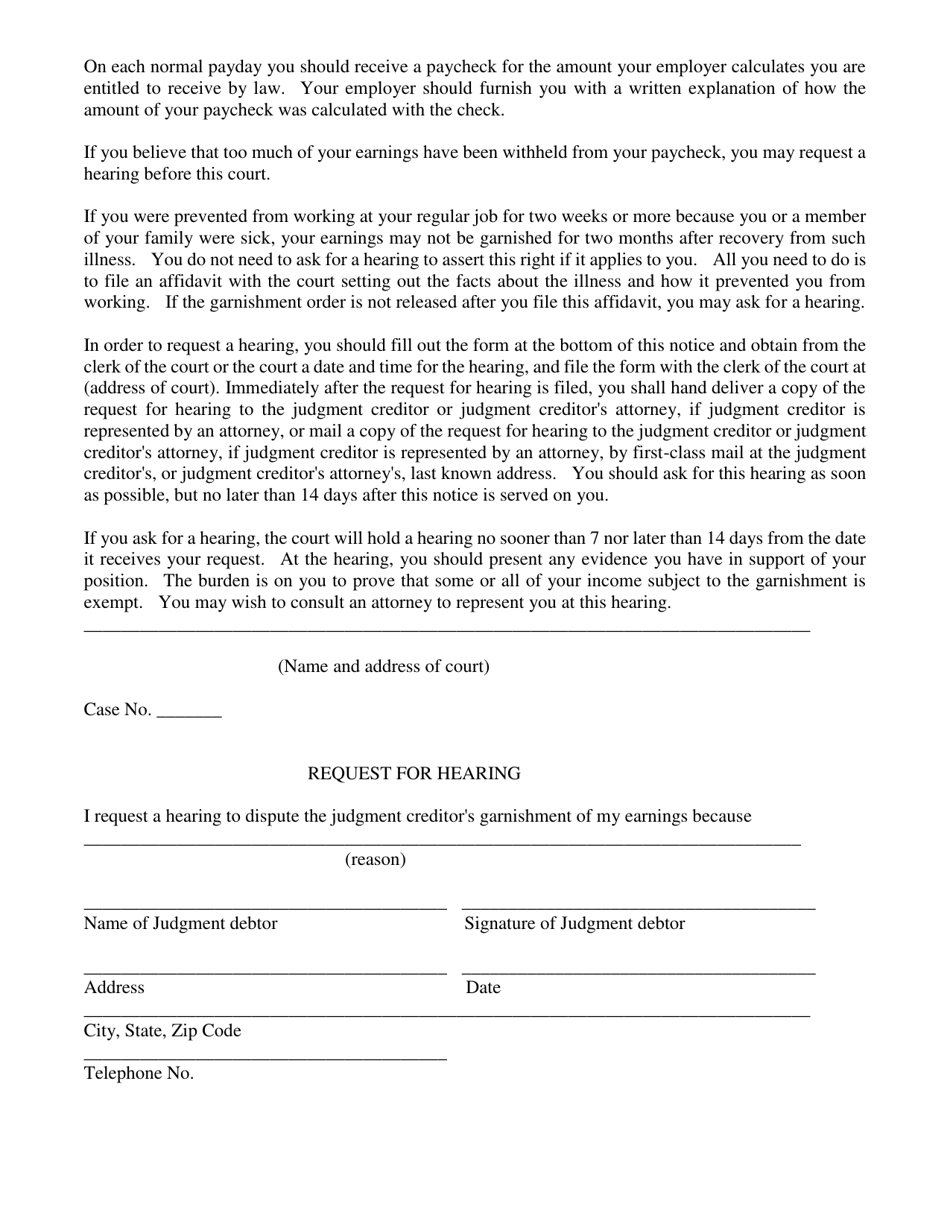

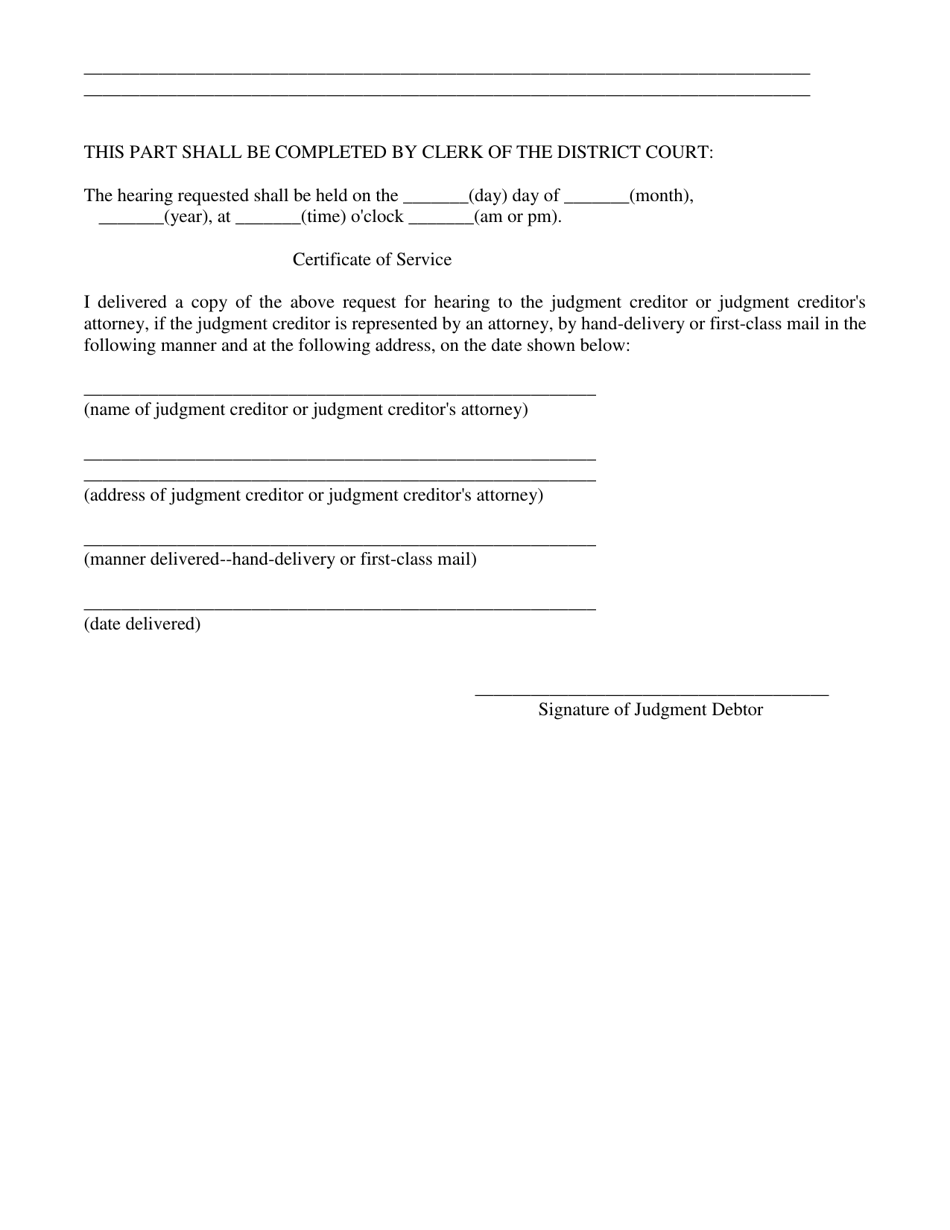

Q: What should I do if I receive a Notice to Judgment Debtor?

A: If you receive a Notice to Judgment Debtor, you should carefully review the document and seek legal advice if needed. You may have options to challenge the garnishment or negotiate a payment plan.

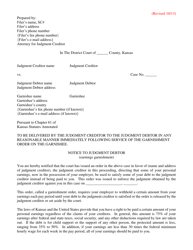

Q: How much of my earnings can be garnished?

A: The amount of earnings that can be garnished varies by state. In Kansas, up to 25% of your disposable earnings can be garnished.

Q: Can my employer fire me for having my wages garnished?

A: No, it is illegal for an employer to terminate an employee solely because their wages are being garnished.

Q: Can I stop an earnings garnishment?

A: There may be ways to stop an earnings garnishment, such as paying off the debt in full or demonstrating financial hardship. It is important to consult with an attorney for guidance.

Q: How long does an earnings garnishment last?

A: An earnings garnishment can last until the judgment debt is fully satisfied, unless the debtor successfully challenges or negotiates a different arrangement.

Q: Can I be garnished for other types of debts?

A: Yes, wages can be garnished for various types of debts, including child support, alimony, and unpaid taxes.

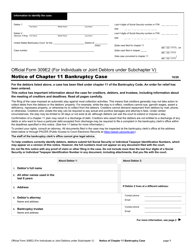

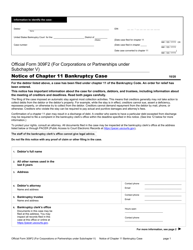

Form Details:

- Released on October 1, 2013;

- The latest edition currently provided by the Kansas District Courts;

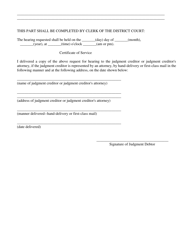

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Kansas District Courts.