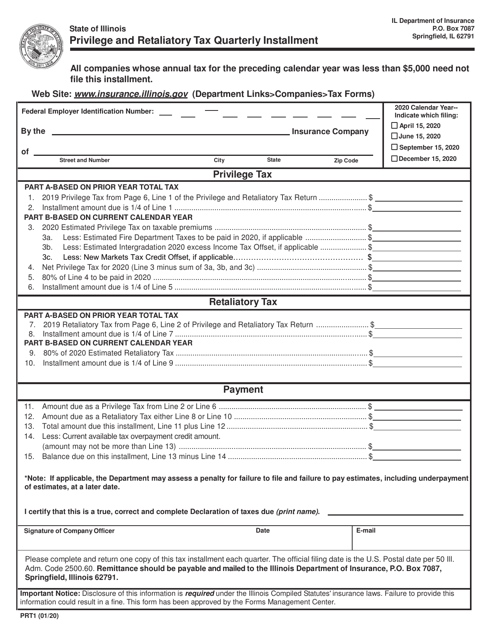

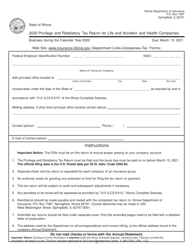

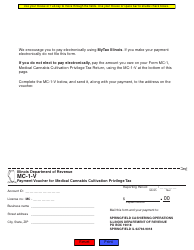

Form PRT1 Privilege and Retaliatory Tax Quarterly Installment - Illinois

What Is Form PRT1?

This is a legal form that was released by the Illinois Department of Insurance - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PRT1?

A: Form PRT1 is the Privilege and Retaliatory Tax Quarterly Installment form.

Q: What is the purpose of Form PRT1?

A: The purpose of Form PRT1 is to report and pay the Privilege and Retaliatory Tax owed quarterly by businesses in Illinois.

Q: Who needs to file Form PRT1?

A: Businesses that are subject to the Privilege and Retaliatory Tax in Illinois need to file Form PRT1.

Q: How often do I need to file Form PRT1?

A: Form PRT1 needs to be filed quarterly.

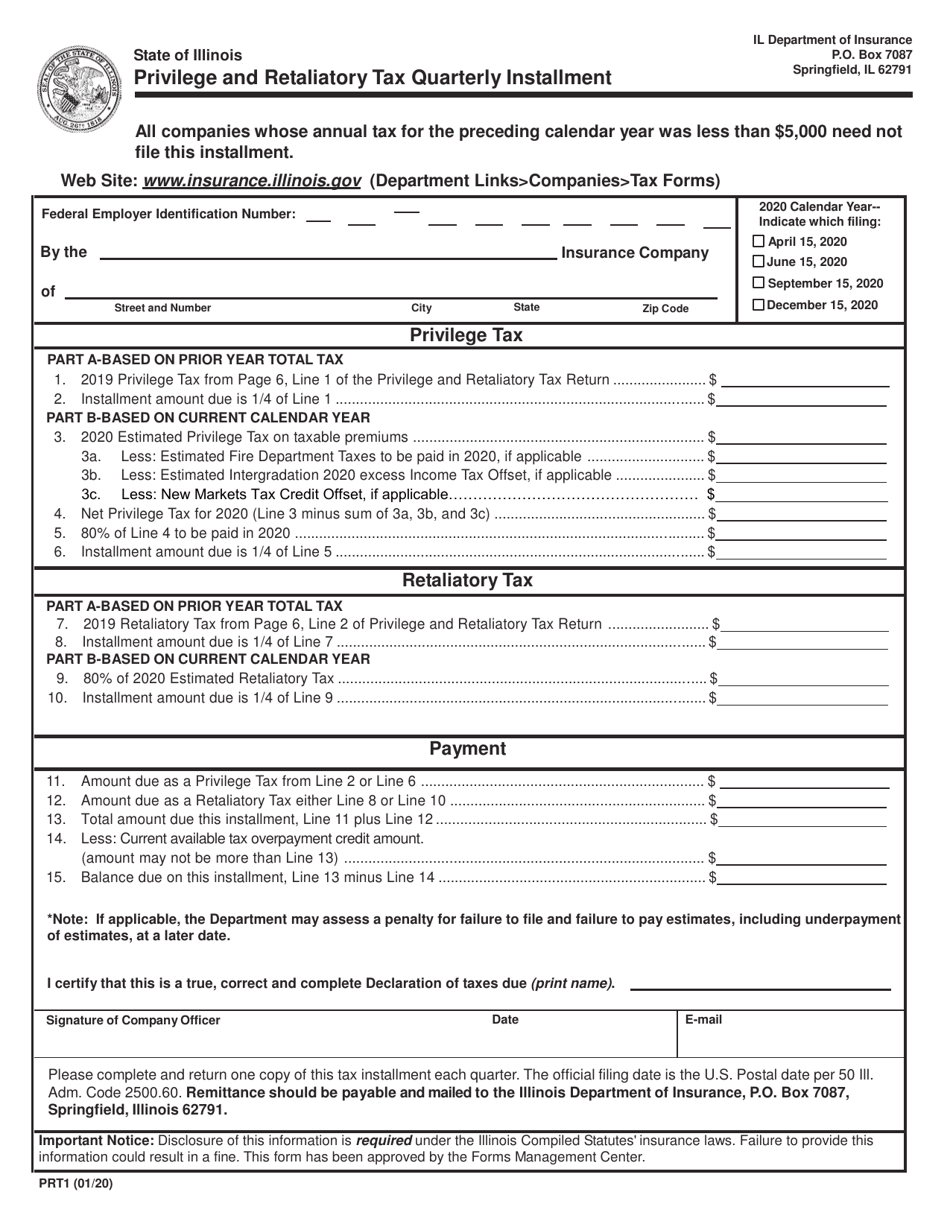

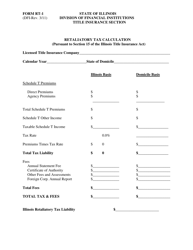

Q: What information is required on Form PRT1?

A: Form PRT1 requires businesses to provide information about their gross premiums, deductions, credits, and the amount of Privilege and Retaliatory Tax owed.

Q: When is Form PRT1 due?

A: Form PRT1 is due on the 15th day of the month following the end of the quarter.

Q: Are there any penalties for late filing of Form PRT1?

A: Yes, there are penalties for late filing of Form PRT1. It is important to file the form on time to avoid penalties and interest charges.

Q: Can I make estimated tax payments instead of filing Form PRT1 quarterly?

A: No, businesses subject to the Privilege and Retaliatory Tax in Illinois must file Form PRT1 quarterly.

Q: Is there any help available for filling out Form PRT1?

A: Yes, the Illinois Department of Insurance provides assistance and guidance for filling out Form PRT1.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Illinois Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PRT1 by clicking the link below or browse more documents and templates provided by the Illinois Department of Insurance.