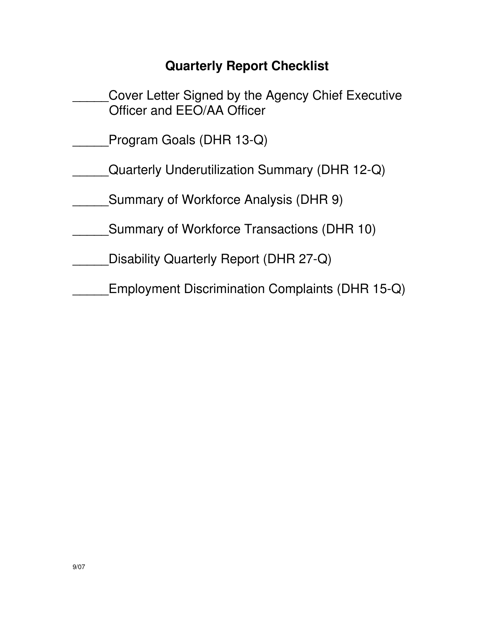

Quarterly Report Checklist - Illinois

Quarterly Report Checklist is a legal document that was released by the Illinois Department of Human Rights - a government authority operating within Illinois.

FAQ

Q: What is a quarterly report?

A: A quarterly report is a summary of the financial performance of a company or organization over a three-month period.

Q: Who needs to file a quarterly report in Illinois?

A: Certain businesses and organizations in Illinois may be required to file quarterly reports, such as those with sales tax liabilities or employers with withholding tax obligations.

Q: What information is typically included in a quarterly report?

A: A quarterly report usually includes financial statements, such as an income statement and balance sheet, as well as details on sales, expenses, and other relevant financial data.

Q: When are quarterly reports due in Illinois?

A: The deadline for filing quarterly reports in Illinois depends on the specific requirements for each type of report. It is important to check the deadlines for the specific report you are filing.

Q: What are the consequences of not filing a quarterly report in Illinois?

A: Failure to file a required quarterly report in Illinois may result in penalties and interest charges, as well as potential legal consequences. It is important to fulfill all reporting obligations.

Q: Do I need to include supporting documentation with my quarterly report?

A: Depending on the specific requirements for the report, you may need to include supporting documentation, such as receipts or invoices, to substantiate the information included in the report.

Q: Can I amend a quarterly report after it has been filed?

A: In some cases, it may be possible to amend a quarterly report after it has been filed if there are errors or changes that need to be corrected. Check the specific guidelines for amending reports in Illinois.

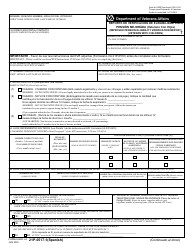

Form Details:

- Released on September 1, 2007;

- The latest edition currently provided by the Illinois Department of Human Rights;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Illinois Department of Human Rights.