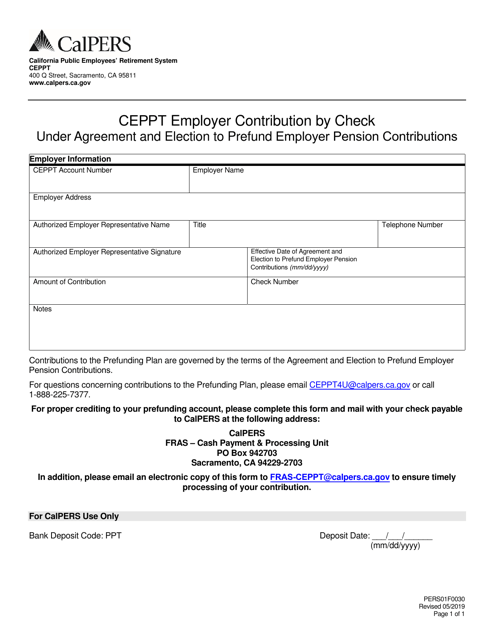

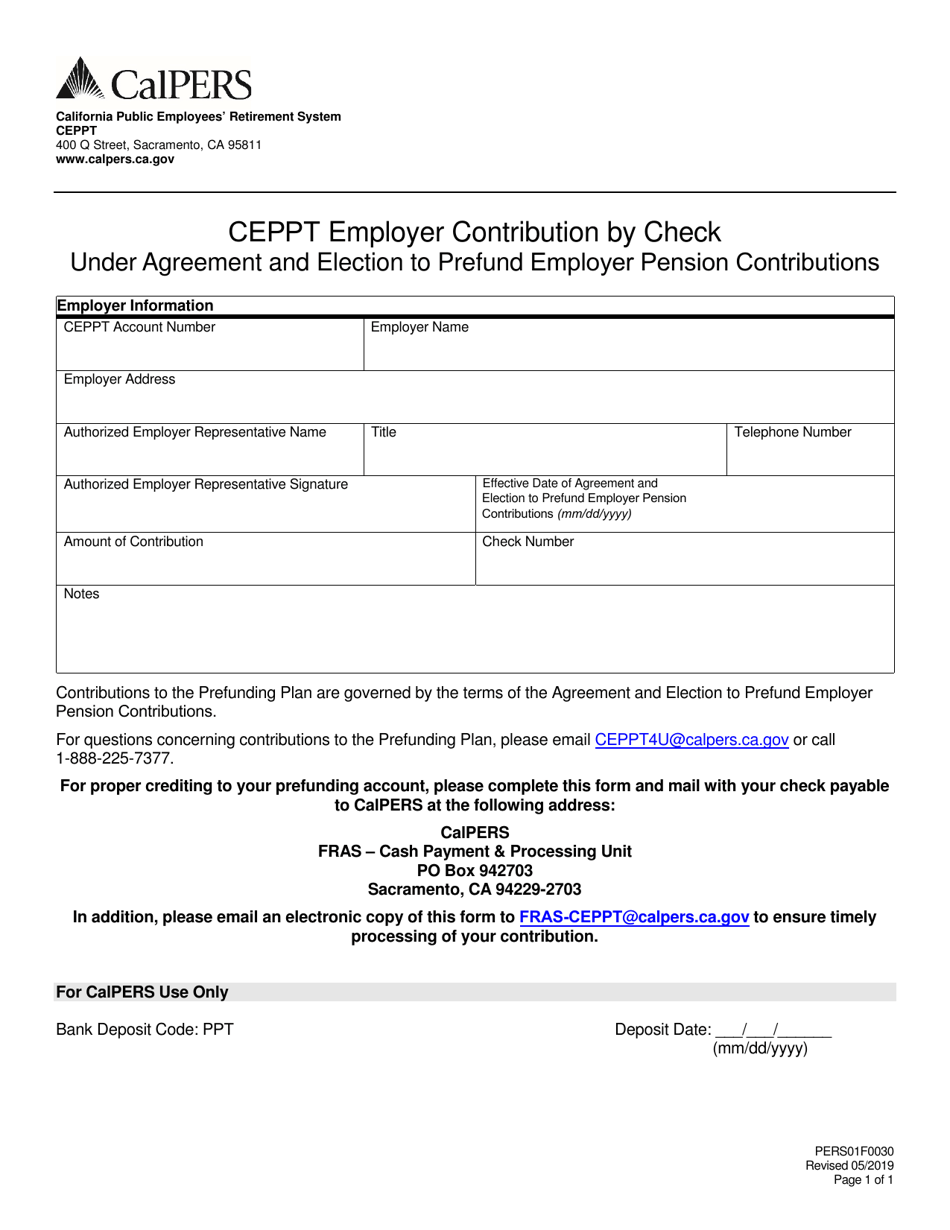

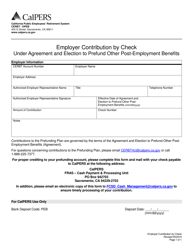

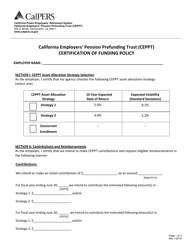

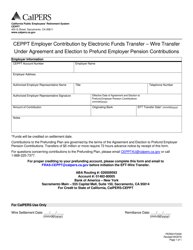

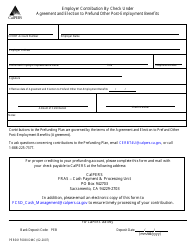

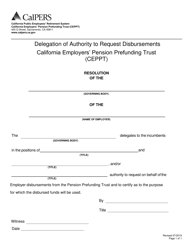

Form PERS01F0030 CEPPT Employer Contribution by Check Under Agreement and Election to Prefund Employer Pension Contributions - California

What Is Form PERS01F0030?

This is a legal form that was released by the California Public Employees' Retirement System - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PERS01F0030 CEPPT?

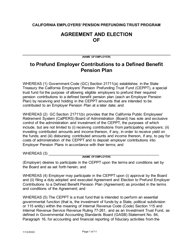

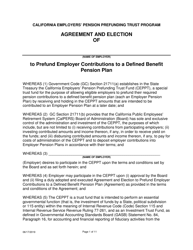

A: Form PERS01F0030 CEPPT is a form used for reporting employer contribution by check under agreement and election to prefund employer pension contributions in California.

Q: Who uses Form PERS01F0030 CEPPT?

A: Employers in California use Form PERS01F0030 CEPPT.

Q: What is the purpose of Form PERS01F0030 CEPPT?

A: The purpose of Form PERS01F0030 CEPPT is to report employer contribution by check and election to prefund employer pension contributions.

Q: What information is required on Form PERS01F0030 CEPPT?

A: Form PERS01F0030 CEPPT requires information such as employer details, contribution amounts, and election to prefund employer pension contributions.

Q: Is Form PERS01F0030 CEPPT specific to California?

A: Yes, Form PERS01F0030 CEPPT is specific to California.

Q: What is the abbreviation CEPPT in Form PERS01F0030 CEPPT?

A: CEPPT stands for Check Employer Contribution by Plan Term.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the California Public Employees' Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PERS01F0030 by clicking the link below or browse more documents and templates provided by the California Public Employees' Retirement System.