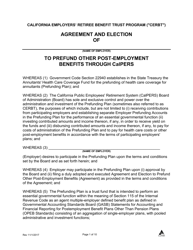

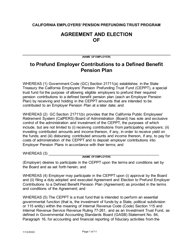

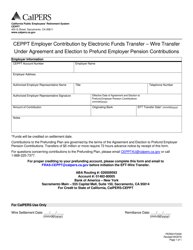

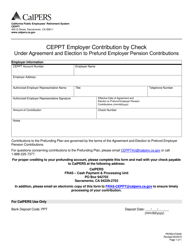

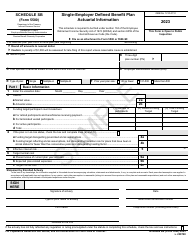

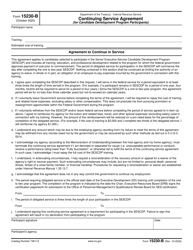

Agreement and Election to Prefund Employer Contributions to a Defined Benefit Pension Plan - California

Agreement and Election to Prefund Defined Benefit Pension Plan is a legal document that was released by the California Public Employees' Retirement System - a government authority operating within California.

FAQ

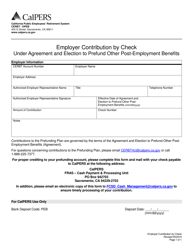

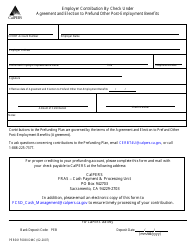

Q: What is the Agreement and Election to Prefund Employer Contributions to a Defined Benefit Pension Plan?

A: It is a document in California that allows employers to pre-fund their contributions to a defined benefit pension plan.

Q: What is a defined benefit pension plan?

A: A defined benefit pension plan is a retirement plan where an employer promises to pay a specified monthly benefit to retirees for life.

Q: Why would an employer want to pre-fund their contributions to a defined benefit pension plan?

A: Pre-funding allows the employer to set aside funds in advance to cover future pension obligations, reducing the risk of not having enough funds when retirees start collecting their benefits.

Q: What are the benefits of pre-funding employer contributions to a defined benefit pension plan?

A: Pre-funding can help to stabilize pension fund finances, provide greater financial security for retirees, and potentially lower overall pension costs for employers.

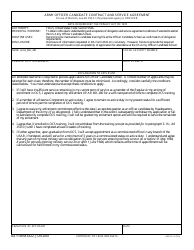

Q: Are there any legal requirements or limitations for pre-funding employer contributions?

A: Yes, there are legal requirements and limitations that vary by jurisdiction. The Agreement and Election to Prefund Employer Contributions to a Defined Benefit Pension Plan in California may outline specific requirements and limitations for employers in the state.

Q: Is the Agreement and Election to Prefund Employer Contributions to a Defined Benefit Pension Plan mandatory in California?

A: No, it is not mandatory. Employers can choose whether or not to pre-fund their contributions to a defined benefit pension plan.

Form Details:

- Released on June 17, 2019;

- The latest edition currently provided by the California Public Employees' Retirement System;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the California Public Employees' Retirement System.