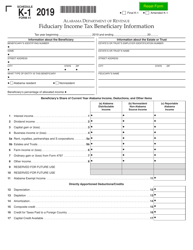

This version of the form is not currently in use and is provided for reference only. Download this version of

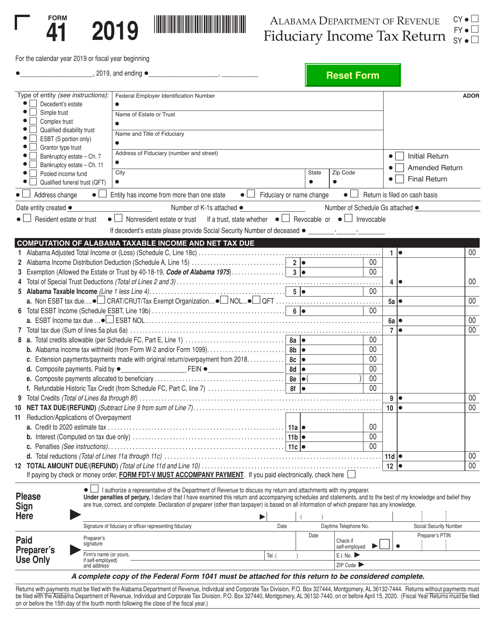

Form 41

for the current year.

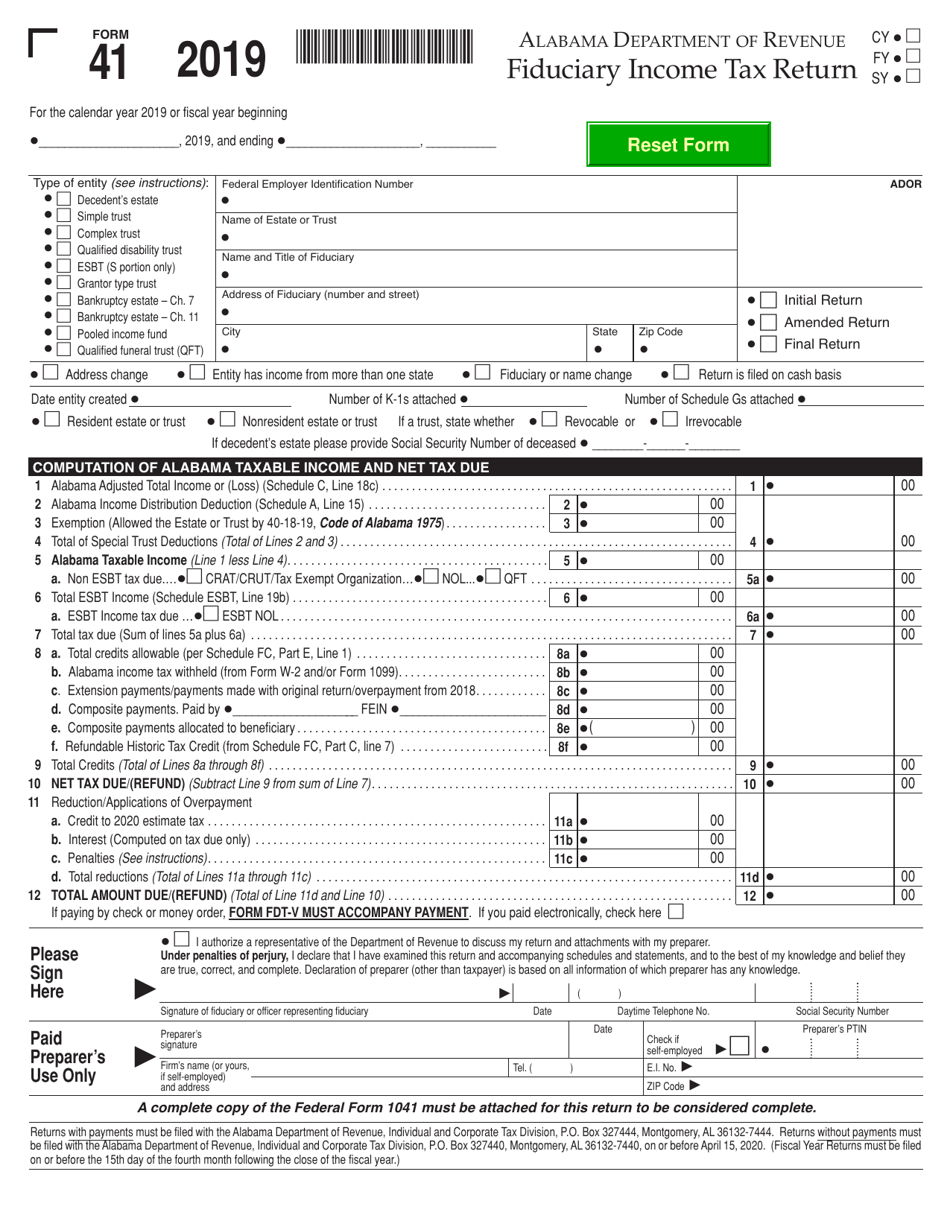

Form 41 Fiduciary Income Tax Return - Alabama

What Is Form 41?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 41?

A: Form 41 is the Fiduciary Income Tax Return for the state of Alabama.

Q: Who needs to file Form 41?

A: Individuals or entities acting as a fiduciary, such as executors, administrators, or trustees, who have taxable income from an estate or trust in Alabama need to file Form 41.

Q: What is the purpose of Form 41?

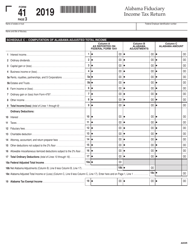

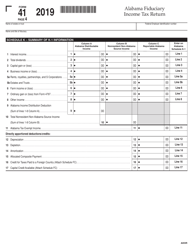

A: The purpose of Form 41 is to report and calculate the taxable income, deductions, and tax liability of an estate or trust in Alabama.

Q: When is Form 41 due?

A: Form 41 is due on or before the 15th day of the 4th month following the close of the taxable year.

Q: Are there any extensions available for Form 41?

A: Yes, Alabama provides an automatic 6-month extension to file Form 41. However, any tax liability must be paid by the original due date to avoid penalties and interest.

Q: Is there a minimum income threshold for filing Form 41?

A: Yes, if the estate or trust has gross income of $600 or more for the taxable year, then Form 41 must be filed.

Q: Are there any specific instructions for completing Form 41?

A: Yes, the Alabama Department of Revenue provides detailed instructions on how to complete Form 41.

Q: What happens if Form 41 is filed late?

A: If Form 41 is filed late without an approved extension, penalties and interest may be assessed on any unpaid tax liability.

Q: Is Form 41 the only tax form required for fiduciary income in Alabama?

A: No, in addition to Form 41, fiduciaries may also need to file federal tax forms and other state-specific tax forms, if applicable.

Q: Are there any special considerations for out-of-state fiduciaries?

A: Yes, out-of-state fiduciaries who have income from an Alabama estate or trust may have additional filing requirements and should consult the Alabama Department of Revenue for guidance.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 41 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.