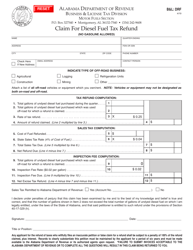

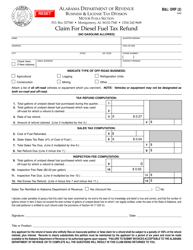

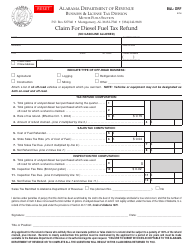

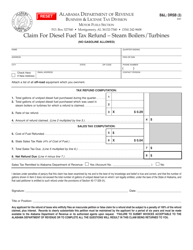

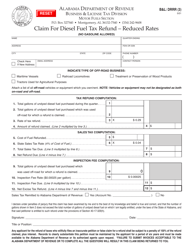

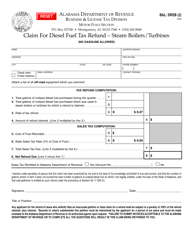

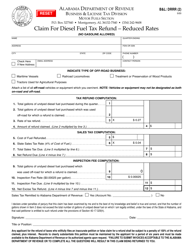

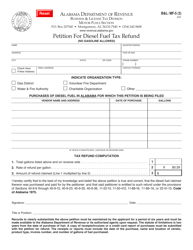

Instructions for Form B&L: DRF Claim for Diesel Fuel Tax Refund - Alabama

This document contains official instructions for Form B&L: DRF , Claim for Diesel Fuel Tax Refund - a form released and collected by the Alabama Department of Revenue. An up-to-date fillable Form B&L: DRF is available for download through this link.

FAQ

Q: What is Form B&L: DRF Claim for Diesel Fuel Tax Refund?

A: Form B&L: DRF Claim for Diesel Fuel Tax Refund is a form used in Alabama to claim a refund of diesel fuel taxes.

Q: Who can use Form B&L: DRF Claim for Diesel Fuel Tax Refund?

A: Any individual or entity who paid diesel fuel taxes in Alabama can use Form B&L: DRF Claim for Diesel Fuel Tax Refund.

Q: What is the purpose of Form B&L: DRF Claim for Diesel Fuel Tax Refund?

A: The purpose of Form B&L: DRF Claim for Diesel Fuel Tax Refund is to request a refund of diesel fuel taxes paid in Alabama.

Q: What information do I need to fill out Form B&L: DRF Claim for Diesel Fuel Tax Refund?

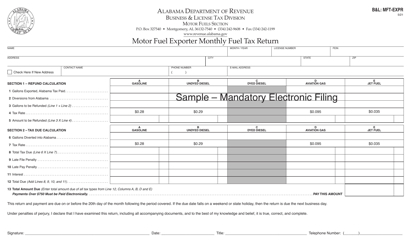

A: You will need to provide information such as the amount of diesel fuel taxes paid, the date of purchase, and supporting documentation.

Q: Is there a deadline for filing Form B&L: DRF Claim for Diesel Fuel Tax Refund?

A: Yes, the deadline for filing Form B&L: DRF Claim for Diesel Fuel Tax Refund is typically the 20th day of the month following the end of the calendar quarter.

Q: How long does it take to receive a refund after submitting Form B&L: DRF Claim for Diesel Fuel Tax Refund?

A: The processing time for refunds can vary, but it is typically within a few weeks to a few months.

Q: Are there any conditions or requirements to qualify for a refund with Form B&L: DRF Claim for Diesel Fuel Tax Refund?

A: Yes, you must meet certain conditions and requirements set by the Alabama Department of Revenue to qualify for a refund using Form B&L: DRF Claim for Diesel Fuel Tax Refund.

Q: Can I claim a refund for diesel fuel taxes paid in previous years?

A: No, Form B&L: DRF Claim for Diesel Fuel Tax Refund can only be used to claim refunds for taxes paid in the current year.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Revenue.