This version of the form is not currently in use and is provided for reference only. Download this version of

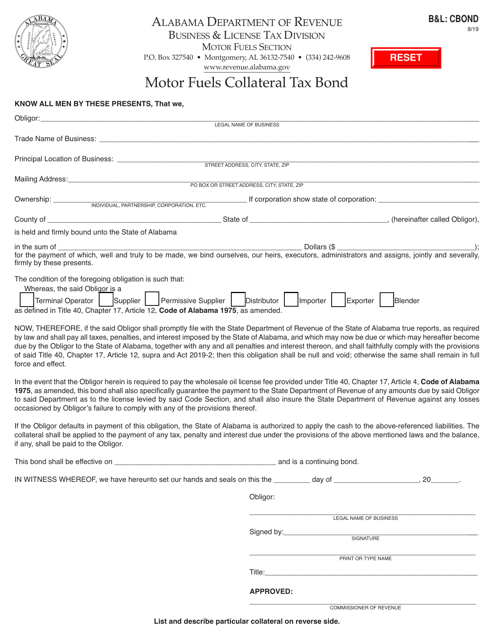

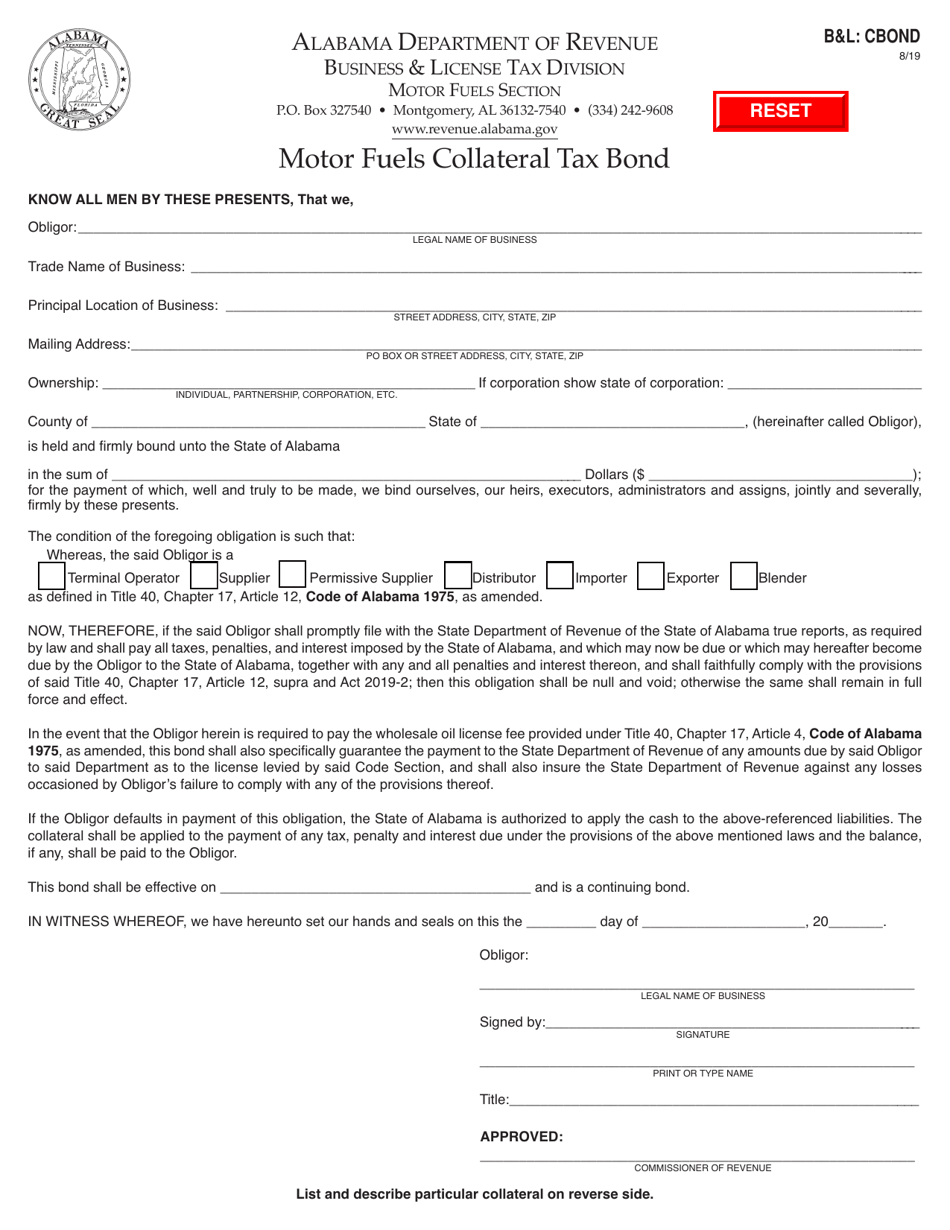

Form B&L: CBOND

for the current year.

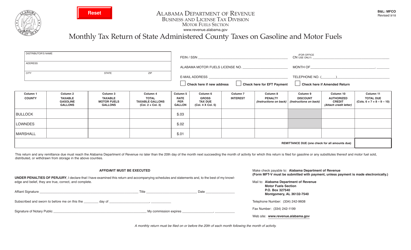

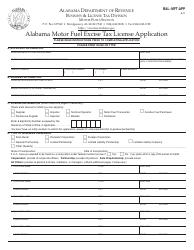

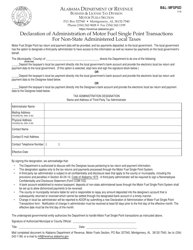

Form B&L: CBOND Motor Fuels Collateral Tax Bond - Alabama

What Is Form B&L: CBOND?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a CBOND Motor Fuels Collateral Tax Bond?

A: A CBOND Motor Fuels Collateral Tax Bond is a type of surety bond required by the state of Alabama to guarantee payment of motor fuels taxes.

Q: Who needs a CBOND Motor Fuels Collateral Tax Bond?

A: Motor fuel distributors or suppliers in Alabama who are required to pay motor fuels taxes need a CBOND Motor Fuels Collateral Tax Bond.

Q: Why do I need a CBOND Motor Fuels Collateral Tax Bond?

A: Alabama requires motor fuel distributors or suppliers to obtain a CBOND Motor Fuels Collateral Tax Bond to ensure the payment of motor fuels taxes.

Q: How much does a CBOND Motor Fuels Collateral Tax Bond cost?

A: The cost of a CBOND Motor Fuels Collateral Tax Bond varies based on the bond amount required by the state and the applicant's creditworthiness.

Q: How long does a CBOND Motor Fuels Collateral Tax Bond remain in effect?

A: A CBOND Motor Fuels Collateral Tax Bond remains in effect until the bond is canceled or terminated by the surety company or the state.

Q: What happens if I don't get a CBOND Motor Fuels Collateral Tax Bond?

A: Failure to obtain a CBOND Motor Fuels Collateral Tax Bond as required by Alabama law can result in penalties, fines, and the inability to operate as a motor fuel distributor or supplier.

Q: Can I cancel a CBOND Motor Fuels Collateral Tax Bond?

A: Yes, a CBOND Motor Fuels Collateral Tax Bond can be canceled by the surety company or the bondholder by providing written notice to the Alabama Department of Revenue.

Q: Can I use a CBOND Motor Fuels Collateral Tax Bond in other states?

A: No, a CBOND Motor Fuels Collateral Tax Bond is specific to the state of Alabama and cannot be used for any other state's motor fuels tax requirements.

Q: What is the purpose of a CBOND Motor Fuels Collateral Tax Bond?

A: The purpose of a CBOND Motor Fuels Collateral Tax Bond is to ensure the payment of motor fuels taxes by distributors or suppliers in Alabama.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B&L: CBOND by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.