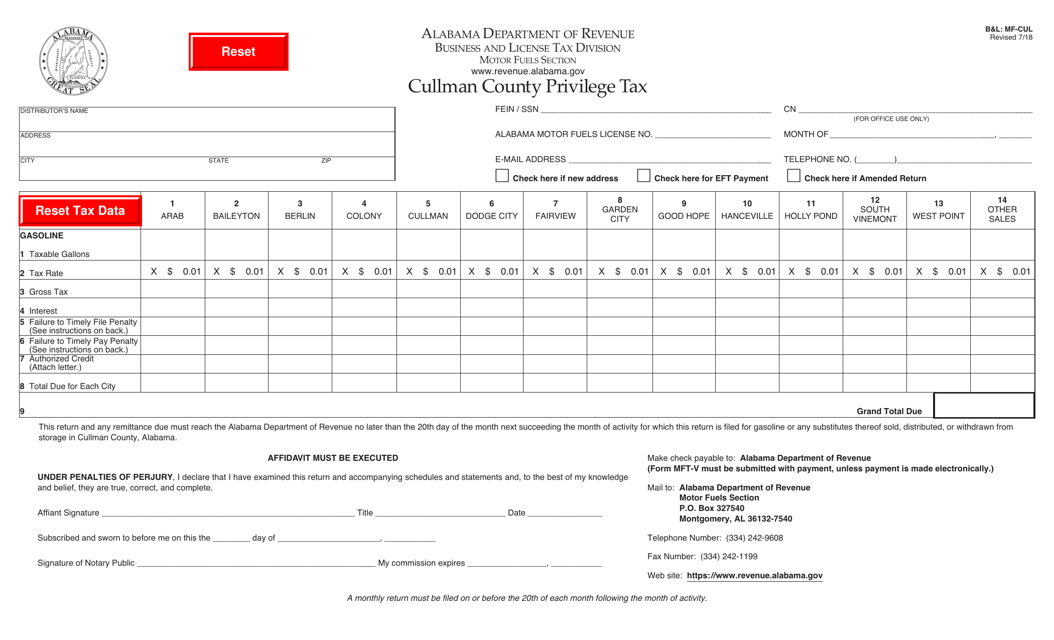

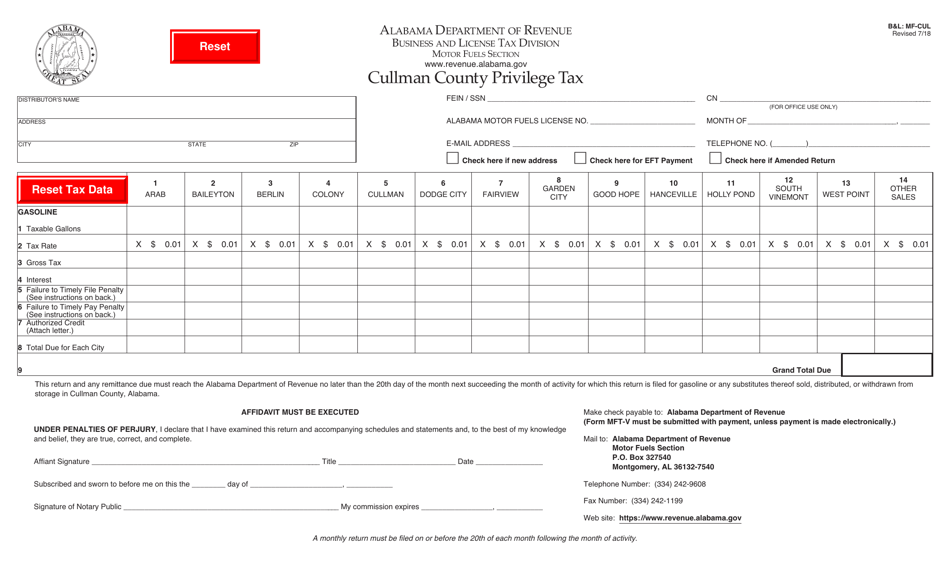

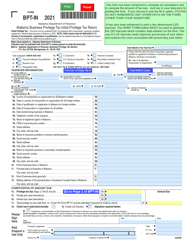

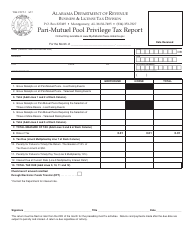

Form B&L:CUL Cullman County Privilege Tax - Cullman County, Alabama

What Is Form B&L:CUL?

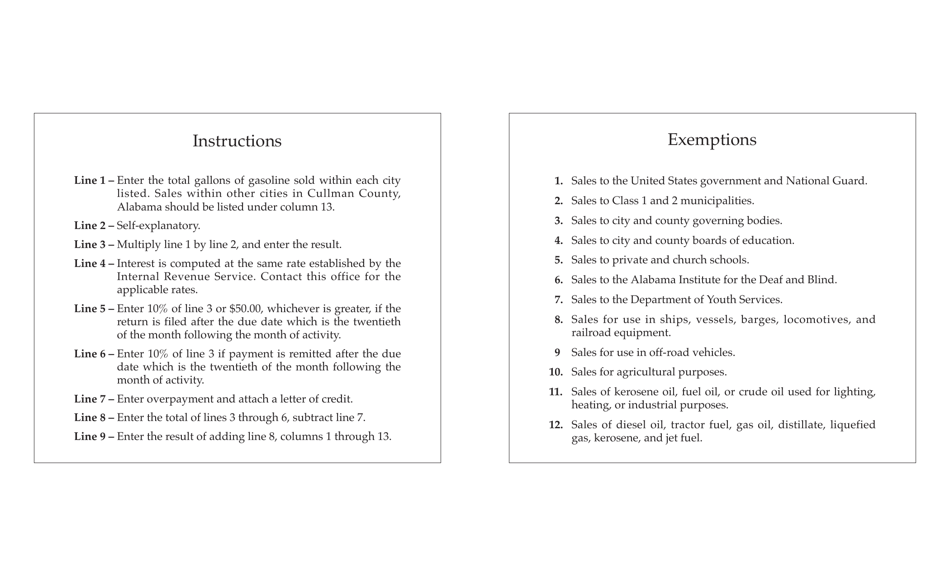

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. The form may be used strictly within Cullman County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the B&L:CUL Cullman County Privilege Tax?

A: The B&L:CUL Cullman County Privilege Tax is a tax imposed by Cullman County in Alabama.

Q: Who is required to pay the B&L:CUL Cullman County Privilege Tax?

A: Certain businesses and individuals engaged in specific activities within Cullman County are required to pay this tax.

Q: What activities are subject to the B&L:CUL Cullman County Privilege Tax?

A: Examples of activities subject to this tax include sales of alcoholic beverages, restaurants, retail businesses, and rental properties.

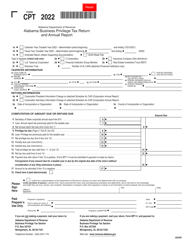

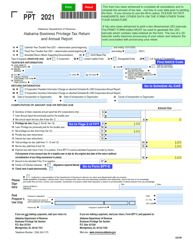

Q: How is the B&L:CUL Cullman County Privilege Tax calculated?

A: The tax rate for each activity is established by the Cullman County government and is based on the gross receipts or revenues generated by the activity.

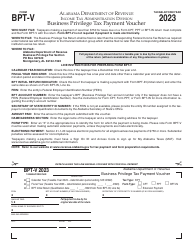

Q: When is the B&L:CUL Cullman County Privilege Tax due?

A: The tax is typically due on a monthly or quarterly basis, depending on the specific activity and the taxpayer's reporting frequency.

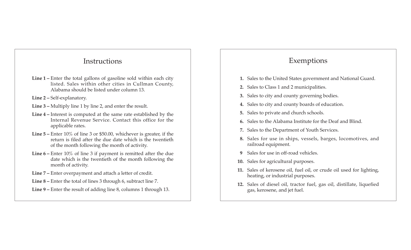

Q: Are there any exemptions or deductions available for the B&L:CUL Cullman County Privilege Tax?

A: Specific exemptions or deductions may be available depending on the nature of the activity and applicable laws. It is recommended to consult with a tax professional or the Cullman County Revenue Commissioner's office for more information.

Q: What happens if I fail to pay the B&L:CUL Cullman County Privilege Tax?

A: Non-payment or late payment of the tax may result in penalties and interest charges, as well as possible legal actions by the Cullman County government.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B&L:CUL by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.