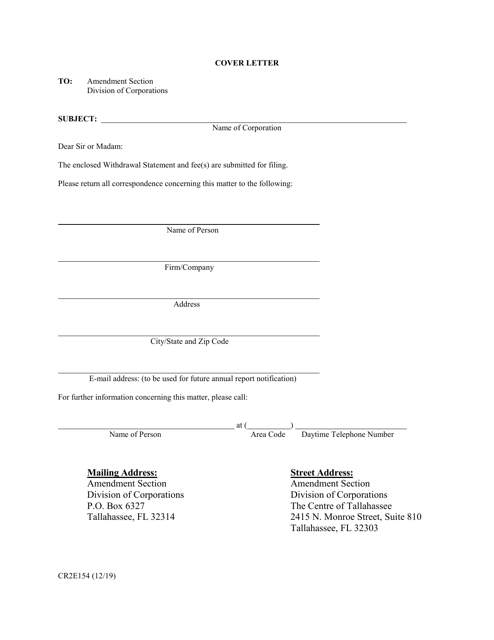

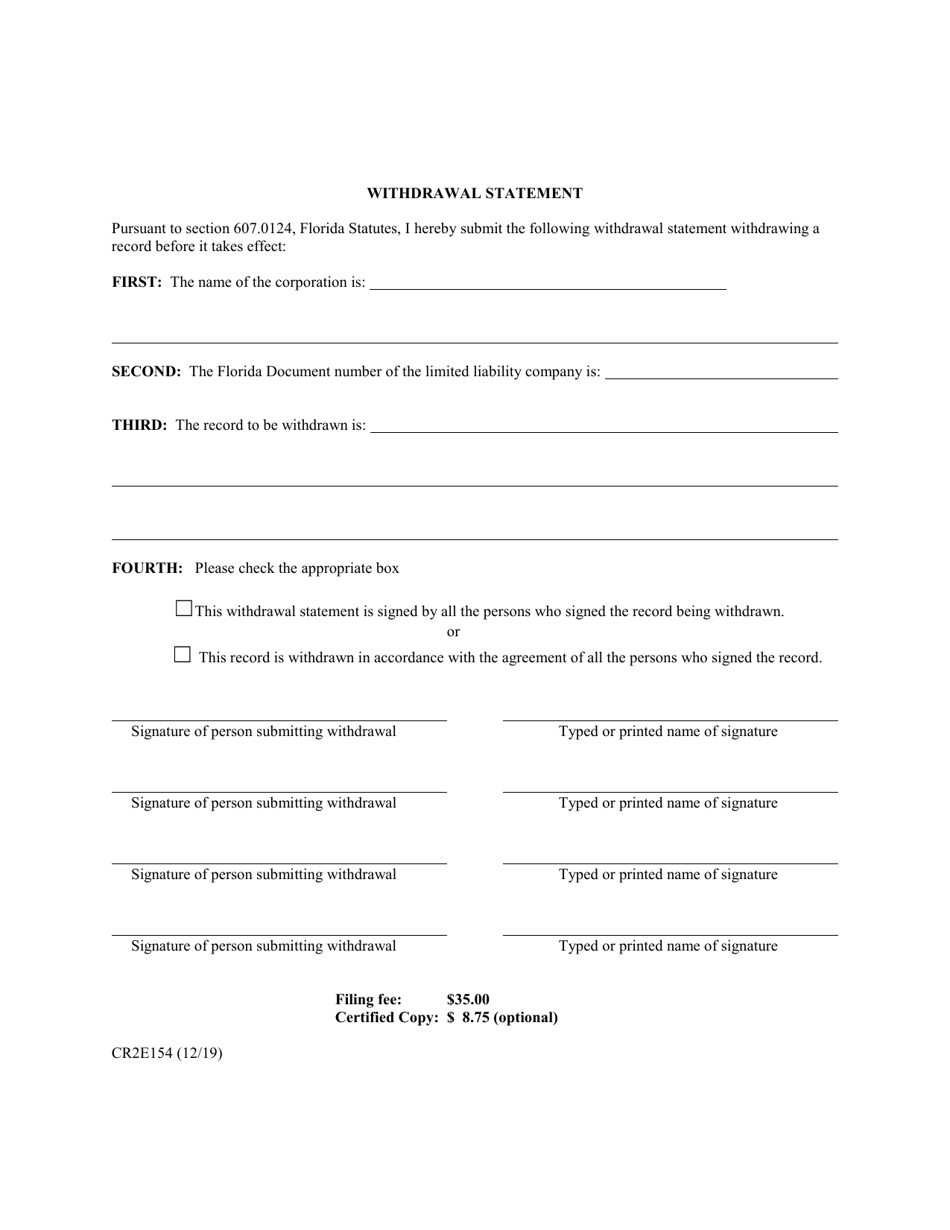

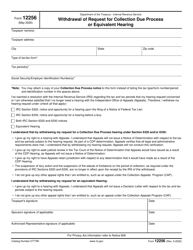

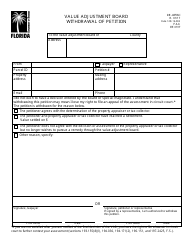

Form CR2E154 Withdrawal Statement - Florida

What Is Form CR2E154?

This is a legal form that was released by the Florida Department of State (Secretary of State) - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CR2E154?

A: Form CR2E154 is a Withdrawal Statement used in Florida.

Q: Who needs to file Form CR2E154?

A: Form CR2E154 needs to be filed by businesses or entities that are withdrawing from doing business in Florida.

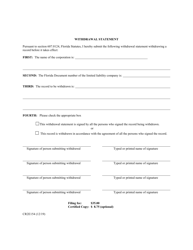

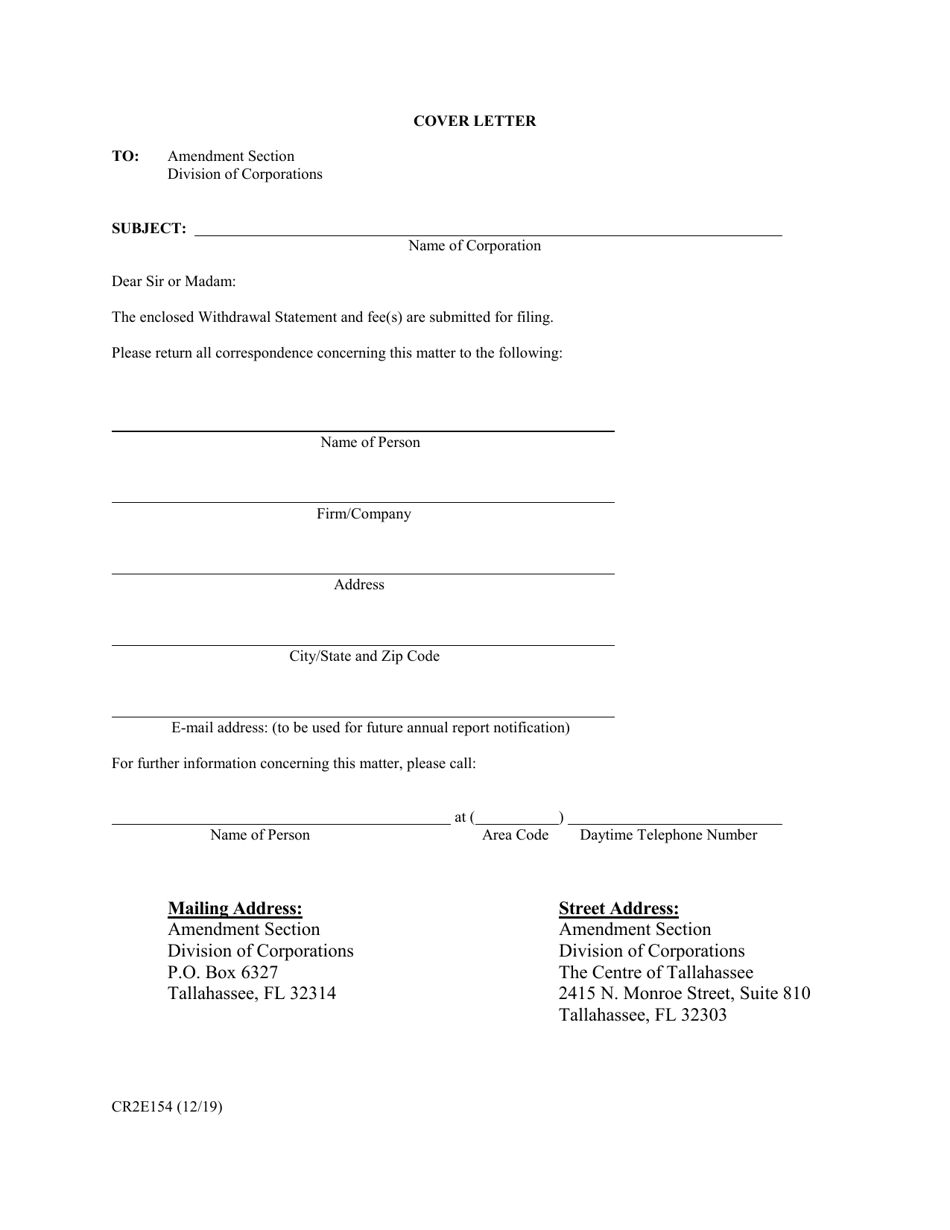

Q: What information is required on Form CR2E154?

A: Form CR2E154 requires information such as the entity's name, address, date of withdrawal, and reason for withdrawal.

Q: Is there a fee for filing Form CR2E154?

A: Yes, there is a filing fee associated with Form CR2E154. The fee amount may vary.

Q: When should Form CR2E154 be filed?

A: Form CR2E154 should be filed within a certain period of the entity's withdrawal from doing business in Florida. The exact timeframe may vary.

Q: Are there any additional requirements or documents that need to be submitted with Form CR2E154?

A: Yes, there may be additional requirements or documents depending on the specific circumstances of the entity's withdrawal. It is recommended to consult with a professional or the Florida Department of State for guidance.

Q: What happens after Form CR2E154 is filed?

A: After Form CR2E154 is filed and processed, the entity's status in Florida will be updated to reflect its withdrawal from doing business.

Q: Can I cancel or revoke a filed Form CR2E154?

A: No, once Form CR2E154 is filed and processed, it cannot be canceled or revoked. The withdrawal from doing business in Florida will be effective.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Florida Department of State (Secretary of State);

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CR2E154 by clicking the link below or browse more documents and templates provided by the Florida Department of State (Secretary of State).