This version of the form is not currently in use and is provided for reference only. Download this version of

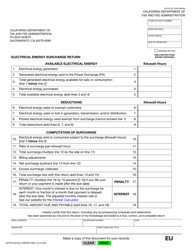

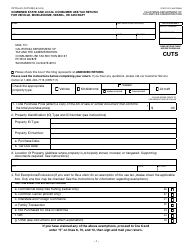

Form CDTFA-501-EC

for the current year.

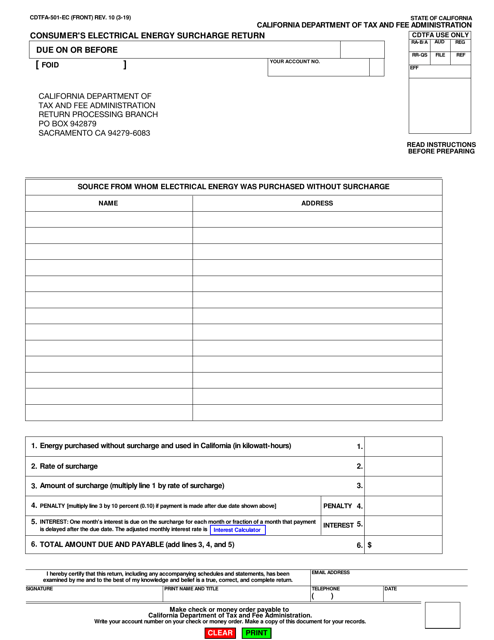

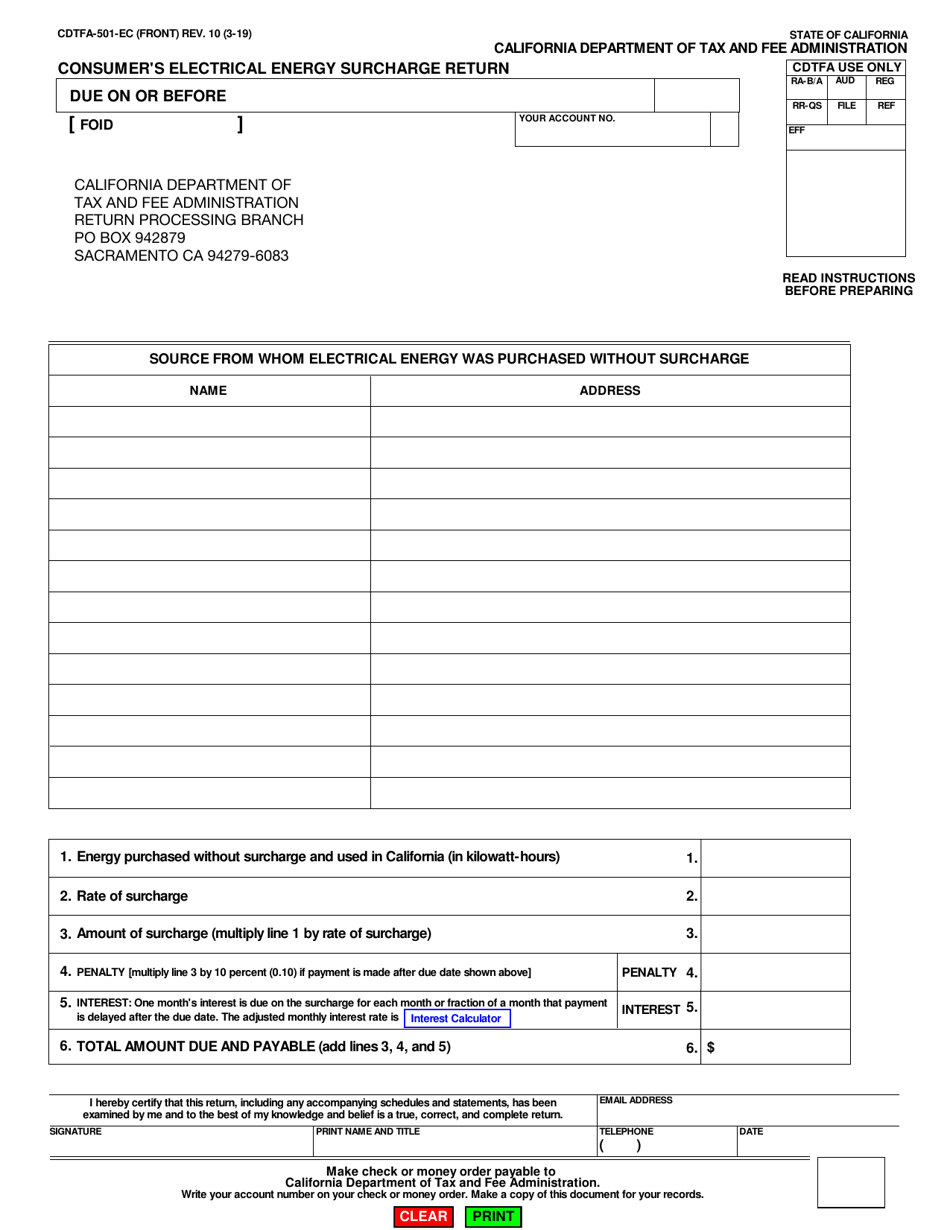

Form CDTFA-501-EC Consumer's Electrical Energy Surcharge Return - California

What Is Form CDTFA-501-EC?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-501-EC?

A: Form CDTFA-501-EC is the Consumer's Electrical Energy Surcharge Return for the state of California.

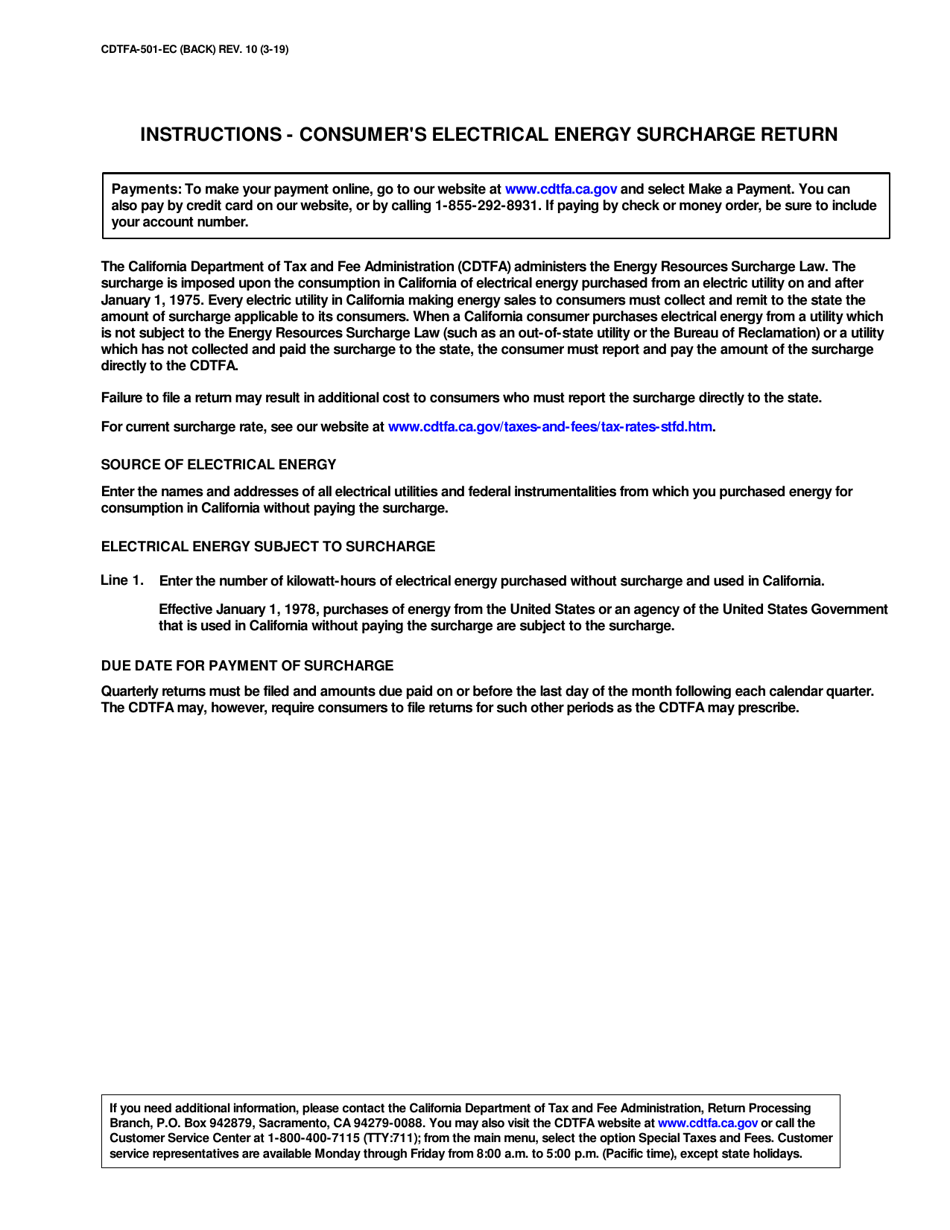

Q: Who needs to file Form CDTFA-501-EC?

A: Businesses engaged in the sale or consumption of electrical energy in California need to file Form CDTFA-501-EC.

Q: What is the purpose of Form CDTFA-501-EC?

A: The purpose of Form CDTFA-501-EC is to report and remit the Consumer's Electrical Energy Surcharge, which is a tax imposed on the sale or consumption of electrical energy in California.

Q: How often do I need to file Form CDTFA-501-EC?

A: Form CDTFA-501-EC is filed on a quarterly basis, with the due date falling on the last day of the month following the end of the quarter.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-EC by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.