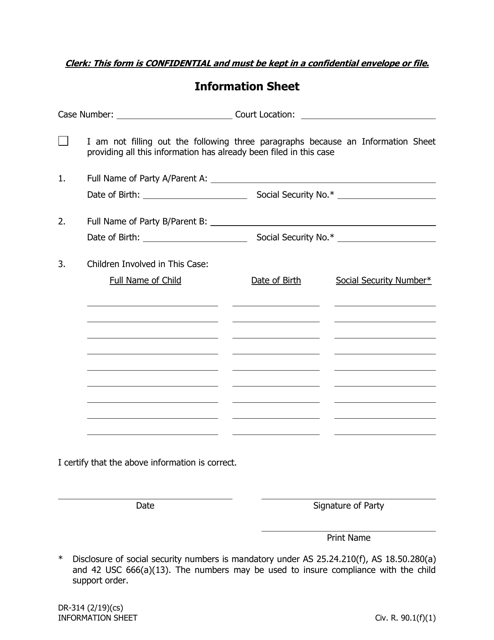

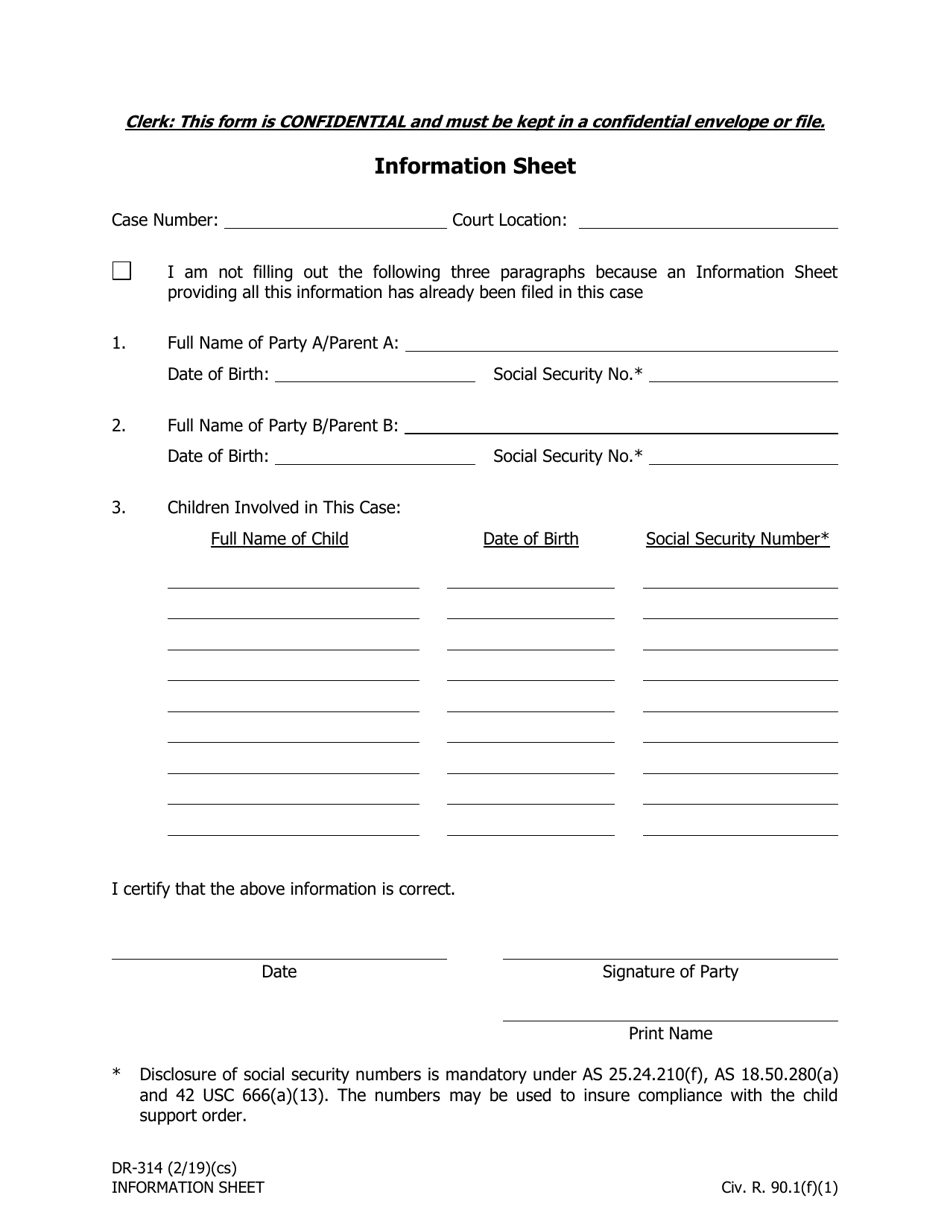

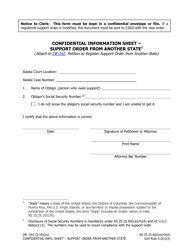

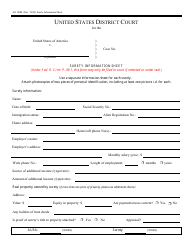

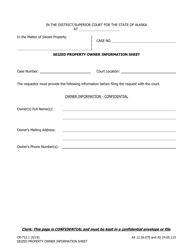

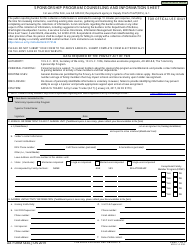

Form DR-314 Information Sheet - Alaska

What Is Form DR-314?

This is a legal form that was released by the Alaska Court System - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-314?

A: Form DR-314 is an information sheet specific to Alaska.

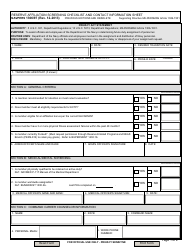

Q: What is the purpose of Form DR-314?

A: The purpose of Form DR-314 is to provide information about taxes in Alaska.

Q: Who needs to fill out Form DR-314?

A: Anyone who is required to pay taxes in Alaska may need to fill out Form DR-314.

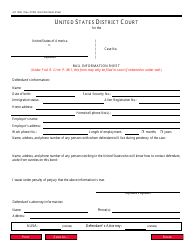

Q: What information is required on Form DR-314?

A: Form DR-314 requires information about your income, deductions, and any other relevant tax information.

Q: When is Form DR-314 due?

A: The due date for Form DR-314 varies depending on your tax situation. It is important to check with the Alaska Department of Revenue for the specific deadline.

Q: Are there any penalties for not filing Form DR-314?

A: Yes, there can be penalties for not filing Form DR-314 or for filing it late. It is best to file on time to avoid any penalties.

Q: Is there a fee to file Form DR-314?

A: There is no fee to file Form DR-314.

Q: What if I have questions about Form DR-314?

A: If you have any questions about Form DR-314, you can contact the Alaska Department of Revenue for assistance.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the Alaska Court System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR-314 by clicking the link below or browse more documents and templates provided by the Alaska Court System.