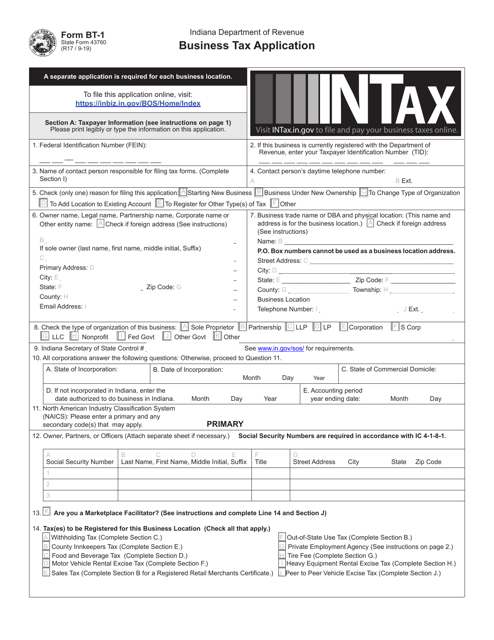

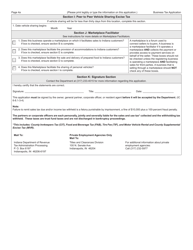

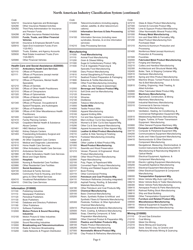

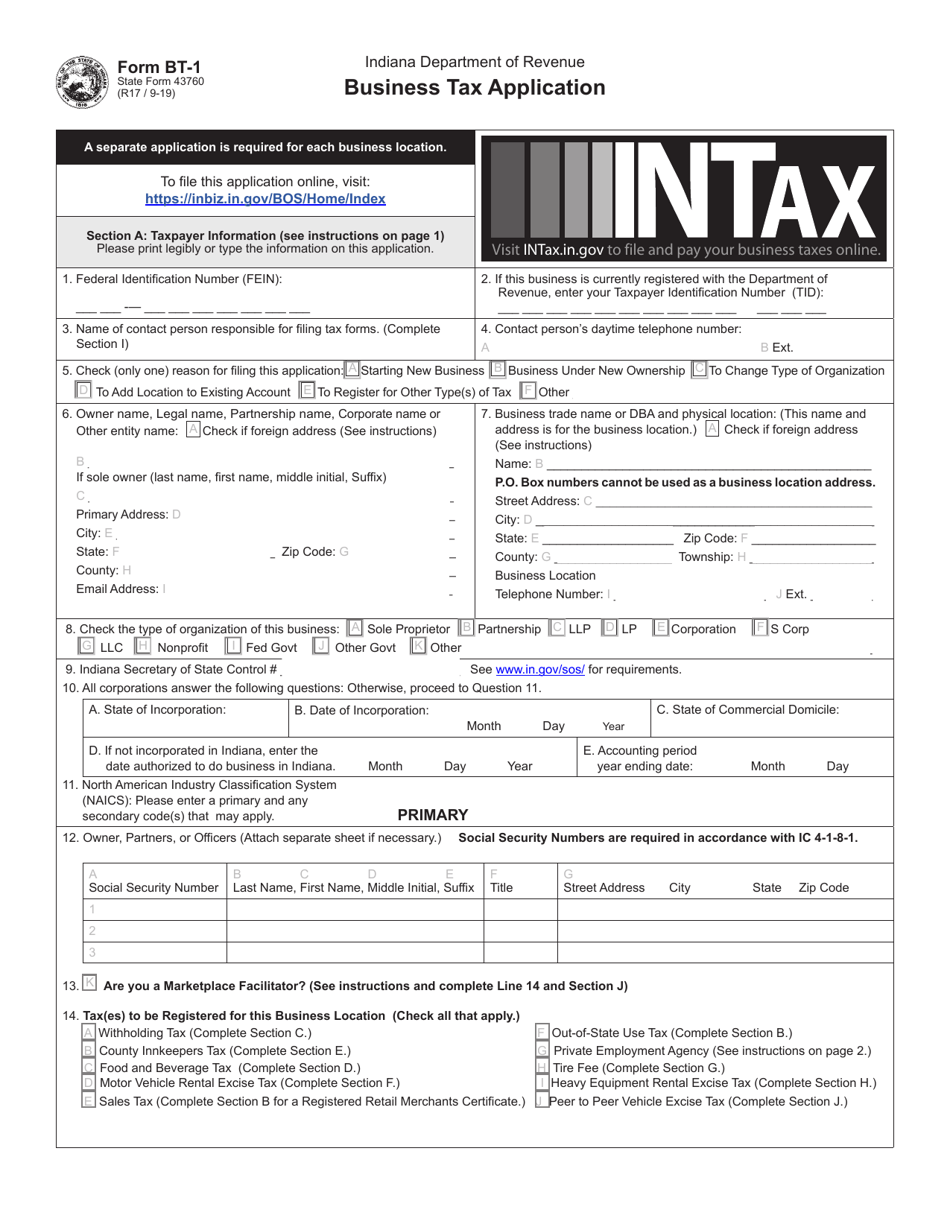

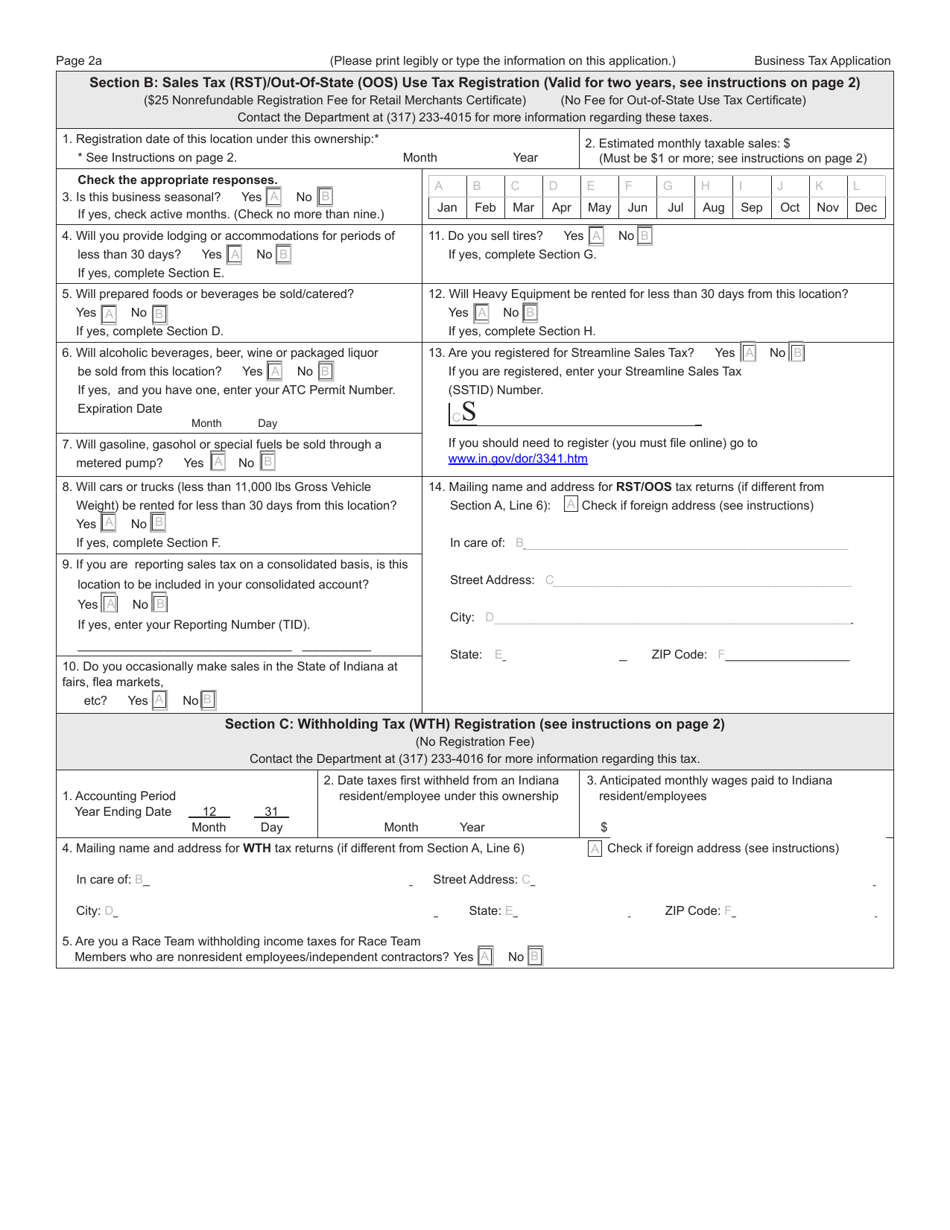

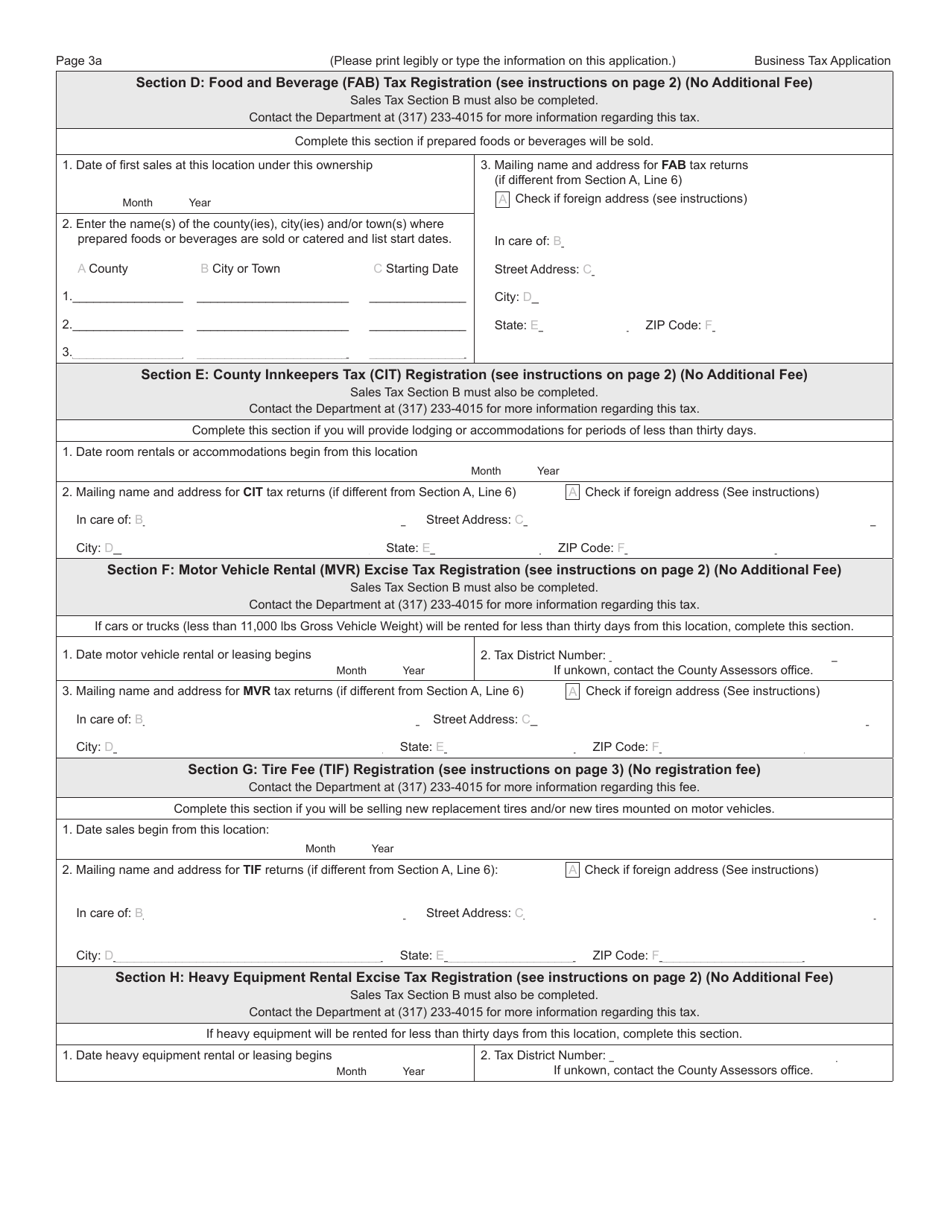

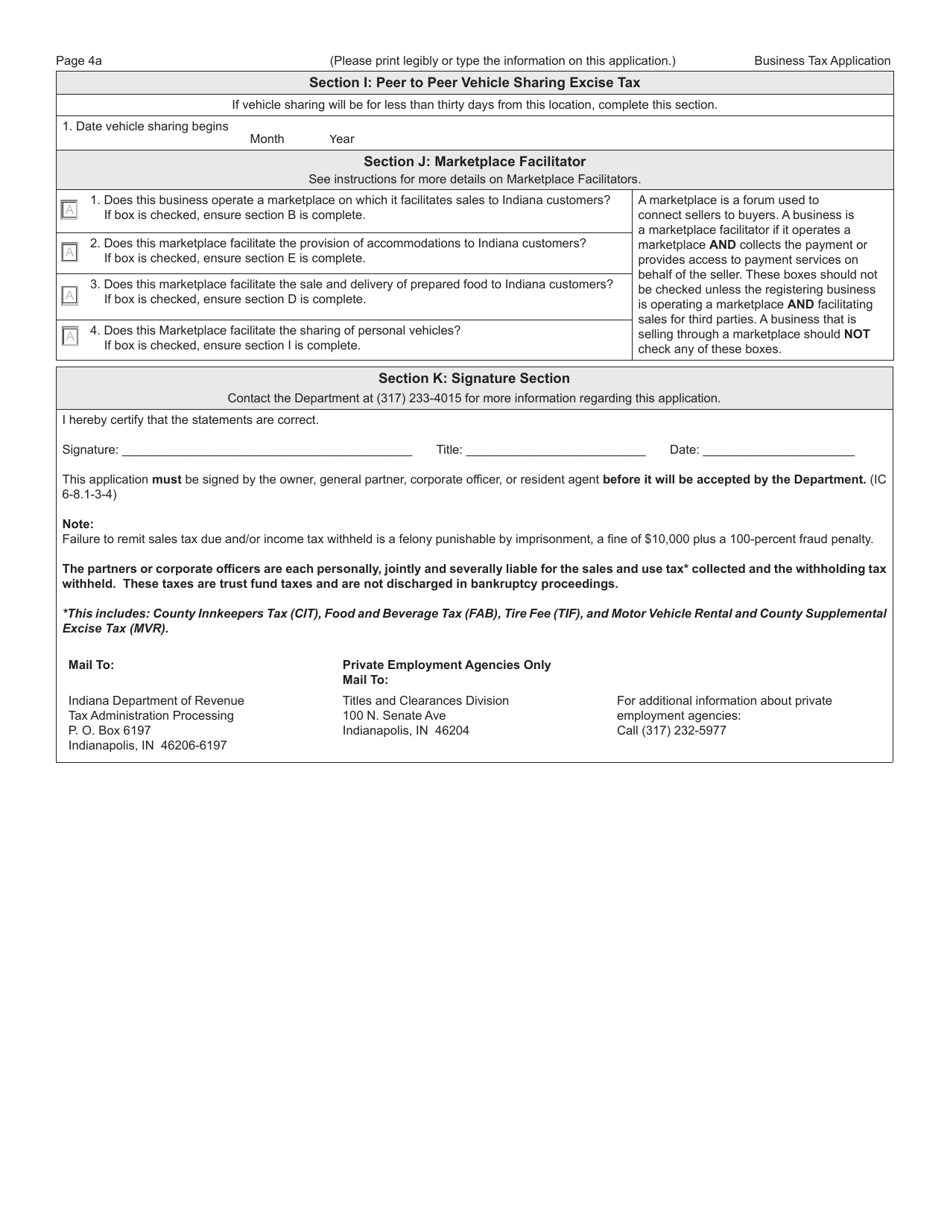

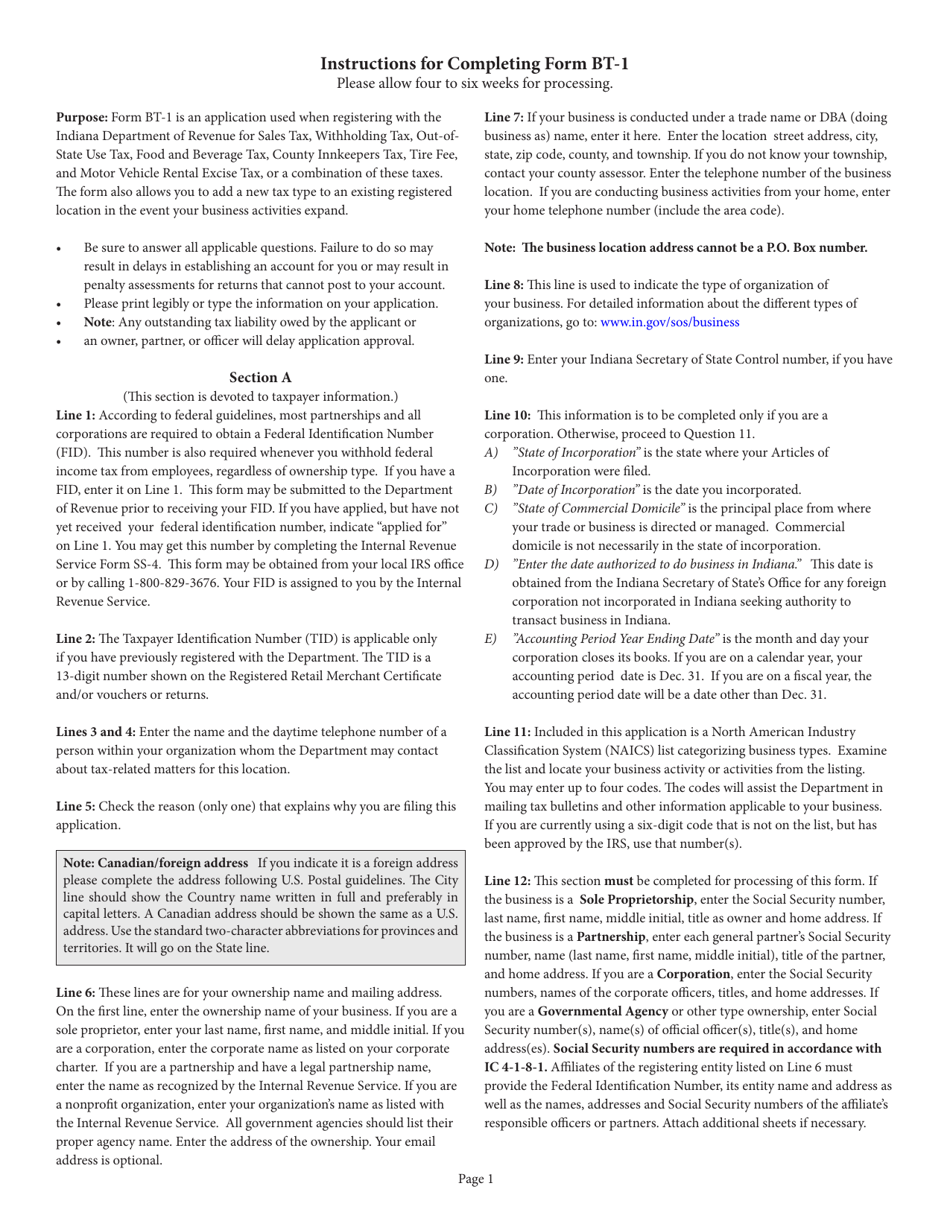

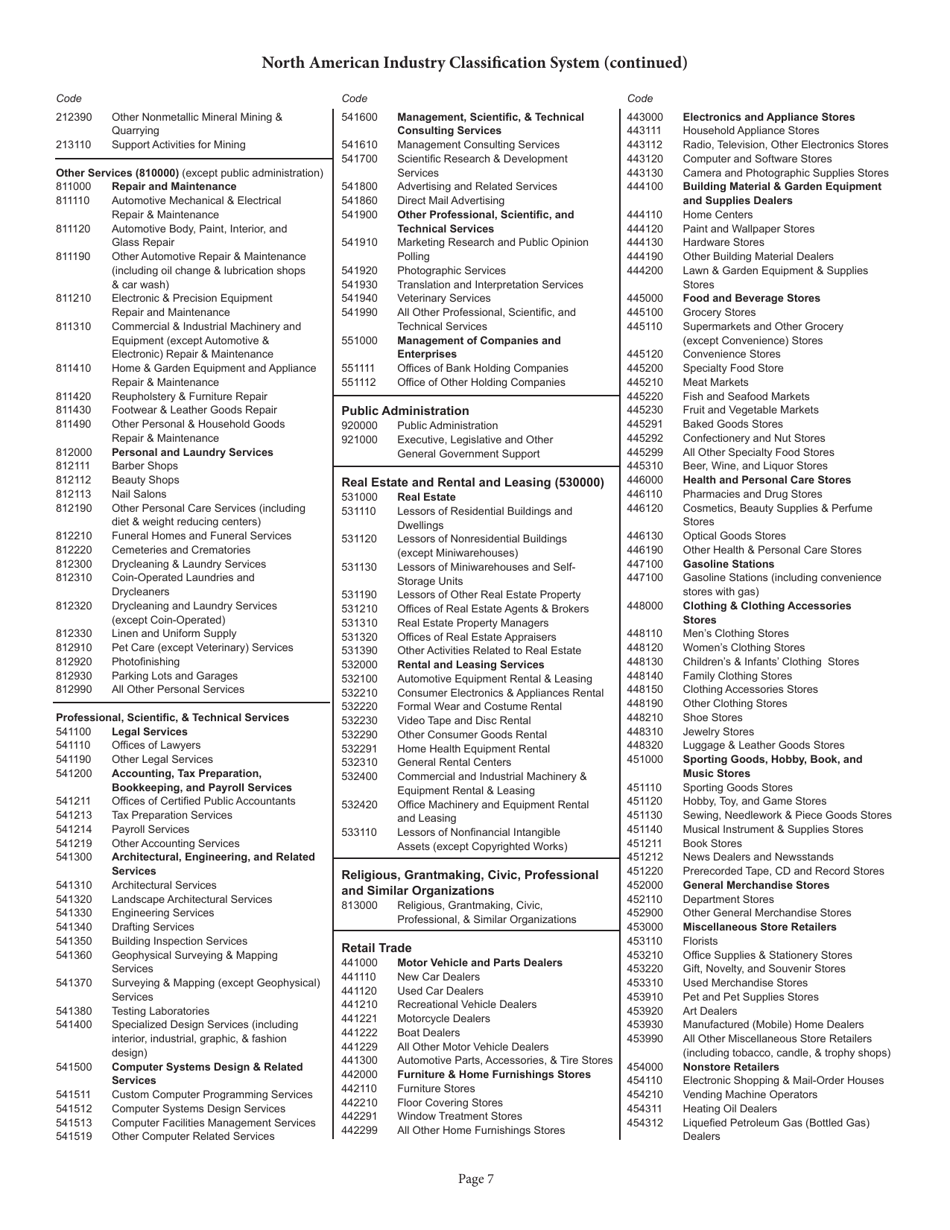

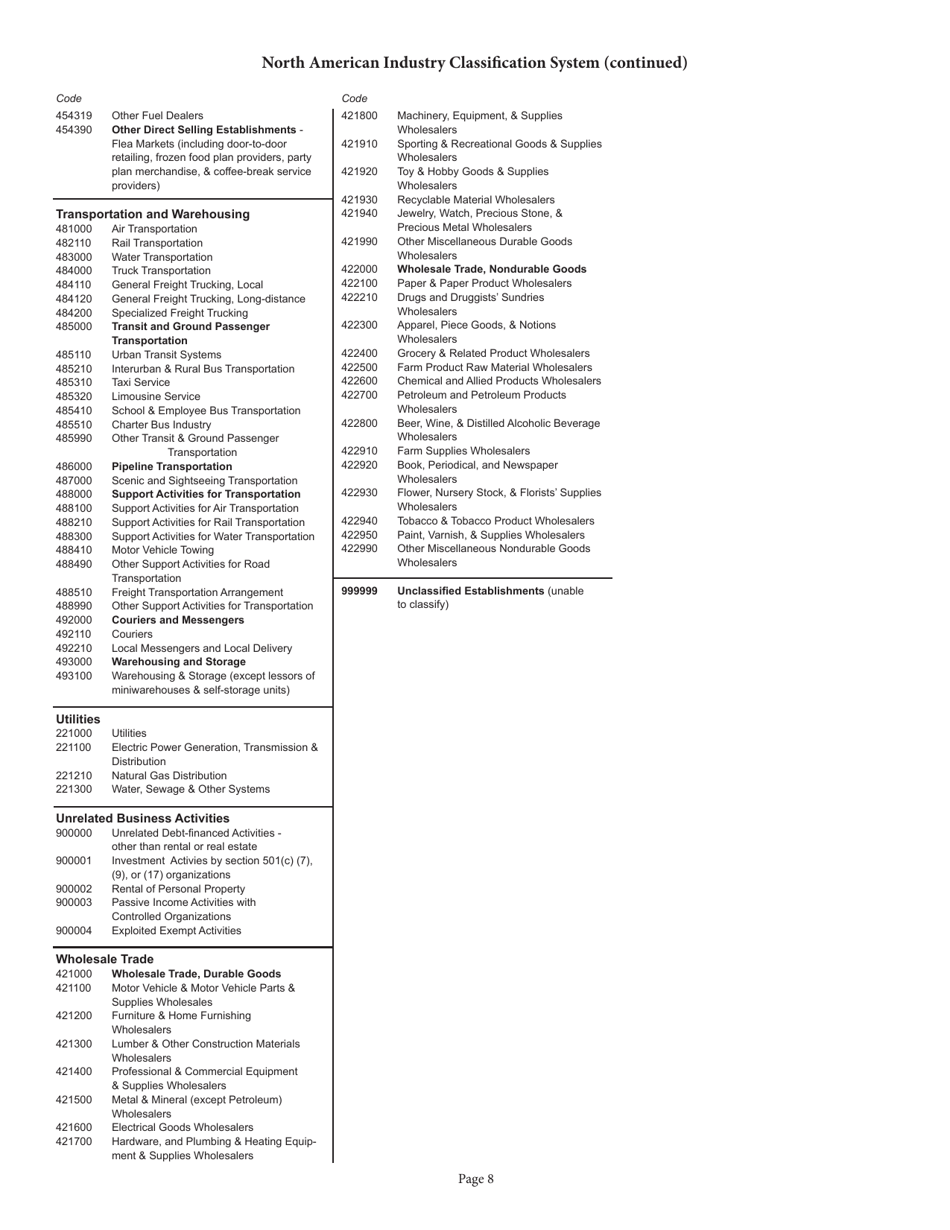

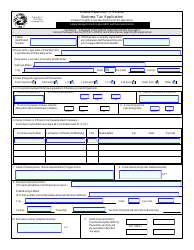

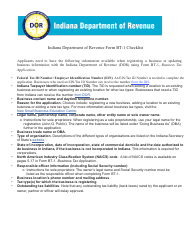

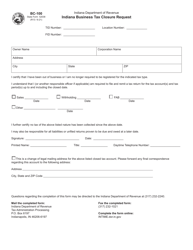

State Form 43760 (BT-1) Business Tax Application - Indiana

What Is State Form 43760 (BT-1)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 43760 (BT-1)?

A: State Form 43760 (BT-1) is the Business Tax Application form used in the state of Indiana.

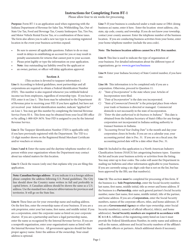

Q: What is the purpose of State Form 43760 (BT-1)?

A: The purpose of State Form 43760 (BT-1) is to apply for business tax in the state of Indiana.

Q: Is there a fee to submit State Form 43760 (BT-1)?

A: There is no fee to submit State Form 43760 (BT-1).

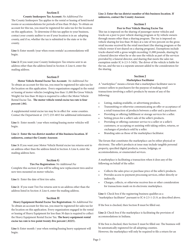

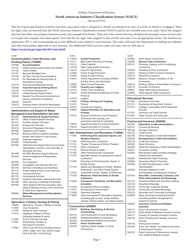

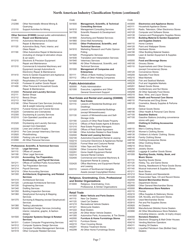

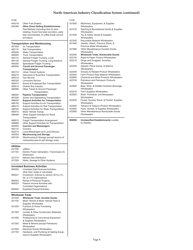

Q: What information is required on State Form 43760 (BT-1)?

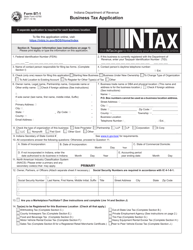

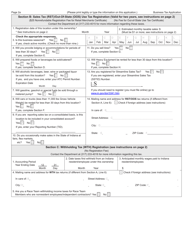

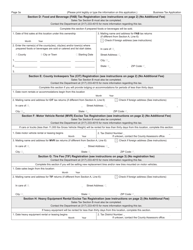

A: State Form 43760 (BT-1) requires information about the business, including name, address, type of business, and federal tax identification number.

Q: How long does it take to process State Form 43760 (BT-1)?

A: The processing time for State Form 43760 (BT-1) varies, but it is generally within a few weeks.

Q: Are there any additional forms that need to be filed along with State Form 43760 (BT-1)?

A: Depending on the type of business, additional forms may need to be filed along with State Form 43760 (BT-1). It is best to consult with the Indiana Department of Revenue for specific requirements.

Q: What taxes does State Form 43760 (BT-1) cover?

A: State Form 43760 (BT-1) covers various business taxes in the state of Indiana, including sales tax, withholding tax, and income tax.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

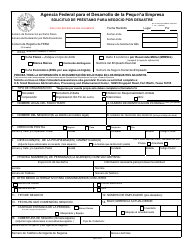

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 43760 (BT-1) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.