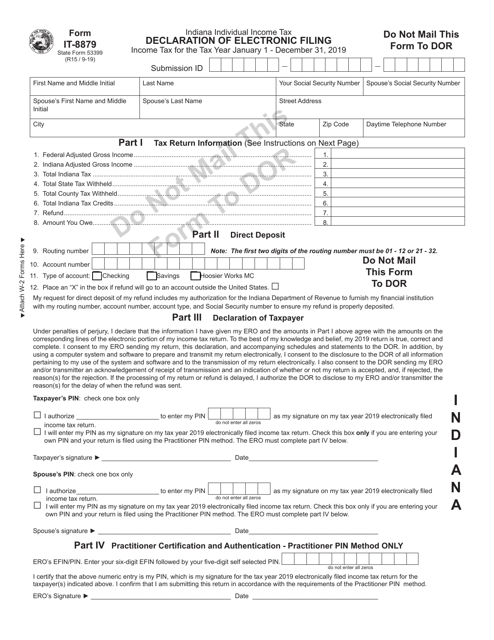

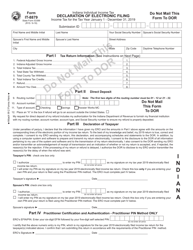

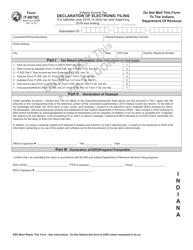

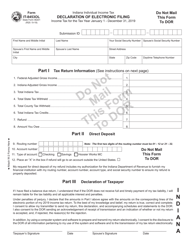

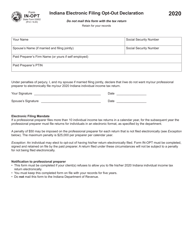

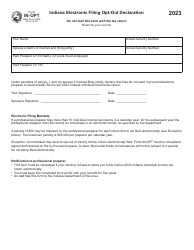

Form IT-8879 (State Form 53399) Declaration of Electronic Filing - Indiana

What Is Form IT-8879 (State Form 53399)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-8879?

A: Form IT-8879 is the Declaration of Electronic Filing for Indiana.

Q: What is the purpose of Form IT-8879?

A: Form IT-8879 is used to declare the electronic filing of tax returns in Indiana.

Q: When should Form IT-8879 be filed?

A: Form IT-8879 should be filed along with the electronically filed tax returns in Indiana.

Q: Is Form IT-8879 required for all electronic filings in Indiana?

A: Yes, Form IT-8879 is required for all electronically filed tax returns in Indiana.

Q: Are there any fees associated with filing Form IT-8879?

A: No, there are no fees associated with filing Form IT-8879.

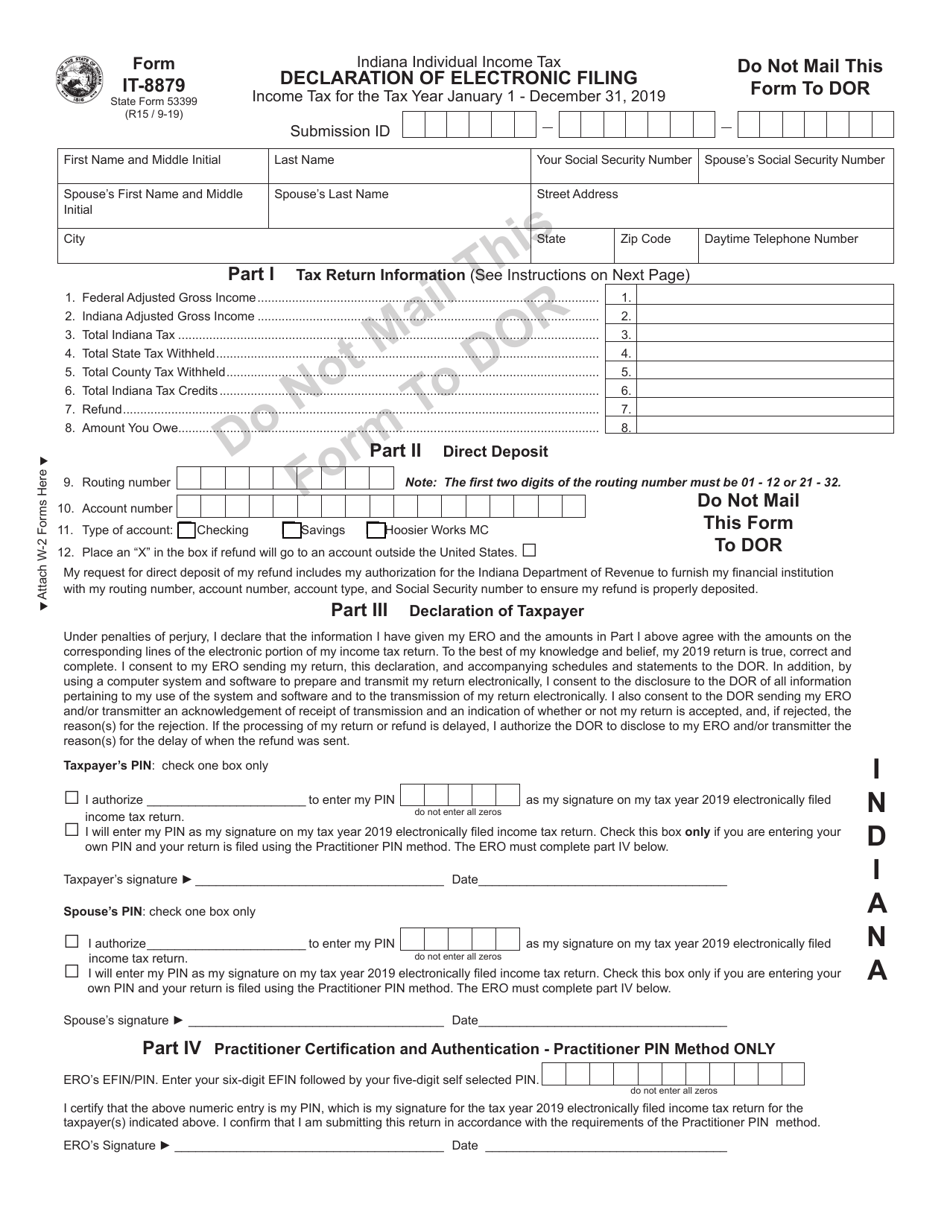

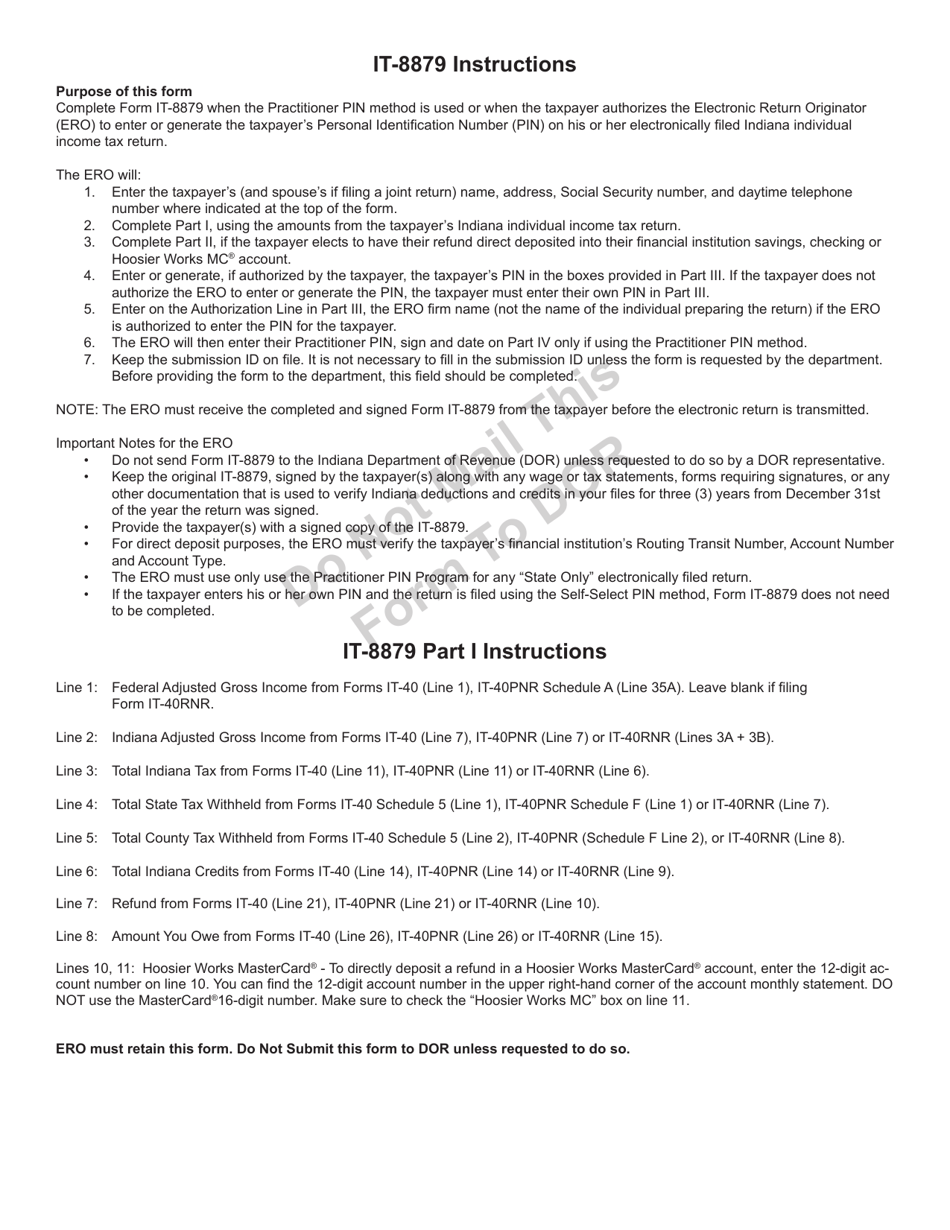

Q: Are there any special instructions for completing Form IT-8879?

A: Yes, please refer to the instructions provided with the form for guidance on how to complete it.

Q: Can I file Form IT-8879 electronically?

A: Yes, Form IT-8879 can be filed electronically along with the tax returns.

Q: What should I do after filing Form IT-8879?

A: After filing Form IT-8879, you should retain a copy for your records.

Q: Is there a deadline for filing Form IT-8879?

A: The deadline for filing Form IT-8879 is the same as the deadline for electronically filing your tax returns in Indiana.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-8879 (State Form 53399) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.