This version of the form is not currently in use and is provided for reference only. Download this version of

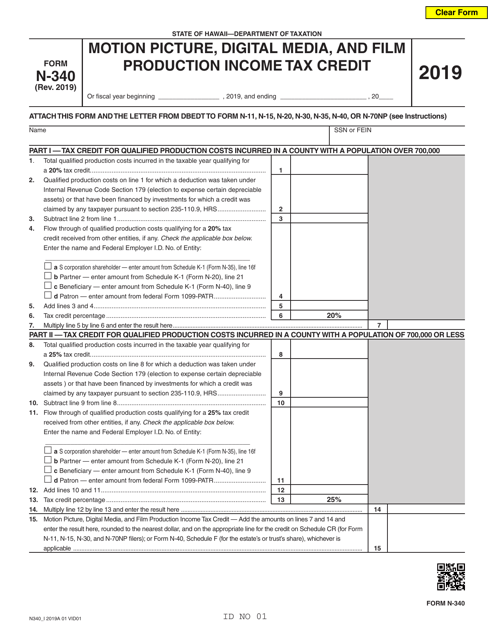

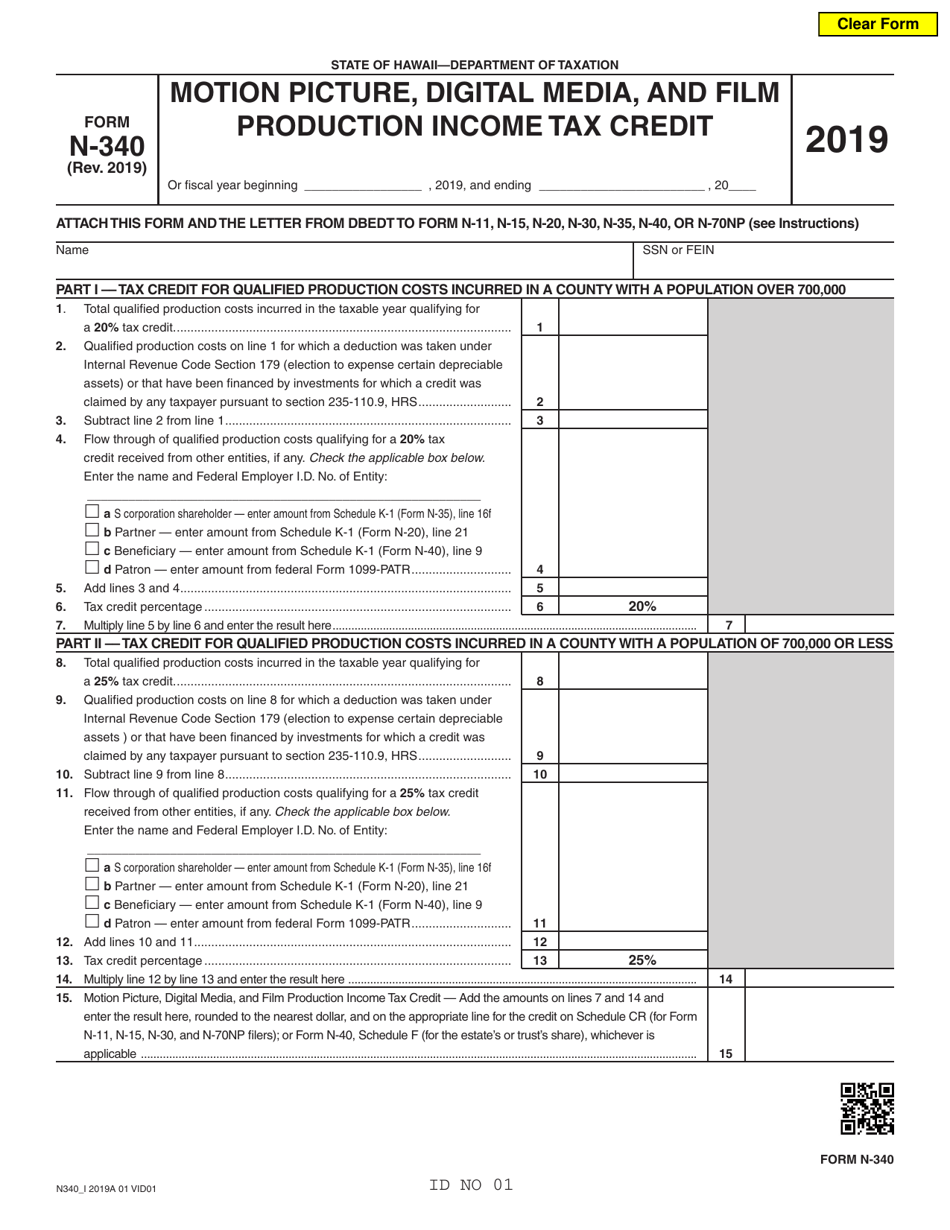

Form N-340

for the current year.

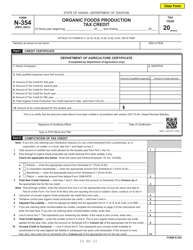

Form N-340 Motion Picture, Digital Media, and Film Production Tax Credit - Hawaii

What Is Form N-340?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-340?

A: Form N-340 is a tax form used for claiming the Motion Picture, Digital Media, and Film ProductionTax Credit in Hawaii.

Q: What is the Motion Picture, Digital Media, and Film Production Tax Credit in Hawaii?

A: The Motion Picture, Digital Media, and Film Production Tax Credit in Hawaii is a tax incentive program designed to promote and support the growth of the film and digital media industry in the state.

Q: Who can claim the tax credit?

A: Eligible production companies engaged in motion picture, digital media, or film production in Hawaii can claim the tax credit.

Q: What expenses qualify for the tax credit?

A: Qualifying expenses include wages paid to Hawaii residents, goods and services purchased in Hawaii, and expenditures for production facilities in Hawaii.

Q: How much is the tax credit?

A: The tax credit is 20-25% of qualified production expenses incurred in Hawaii, depending on the type of production.

Q: Are there any limits to the tax credit?

A: Yes, there are annual and per-project caps on the amount of tax credits that can be claimed.

Q: How do I file Form N-340?

A: Form N-340 should be attached to your Hawaii income tax return, along with all required supporting documents and certifications.

Q: Is there a deadline for filing the form?

A: Yes, the deadline for filing Form N-340 is the same as the deadline for filing your Hawaii income tax return.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-340 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.