This version of the form is not currently in use and is provided for reference only. Download this version of

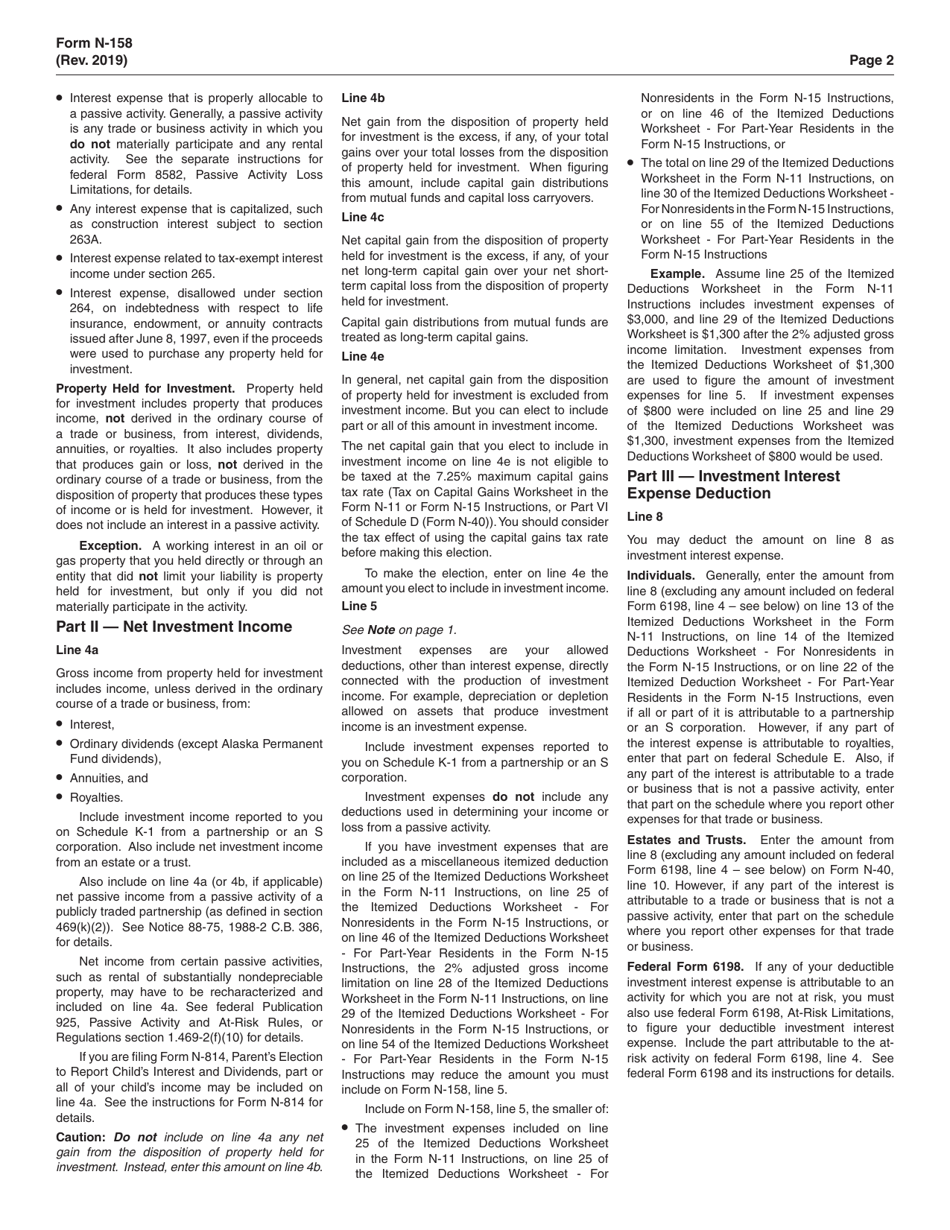

Form N-158

for the current year.

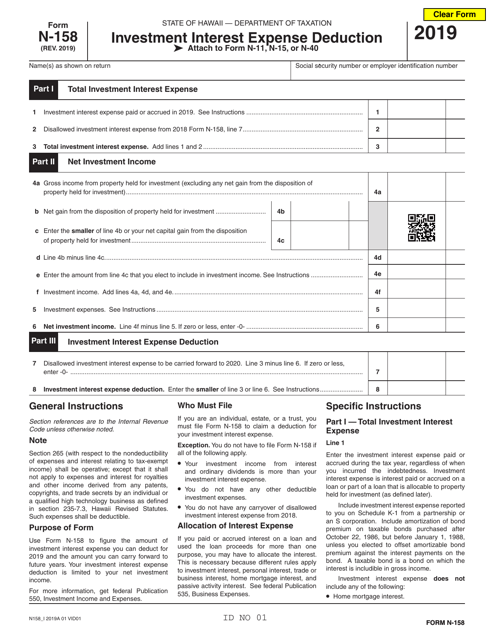

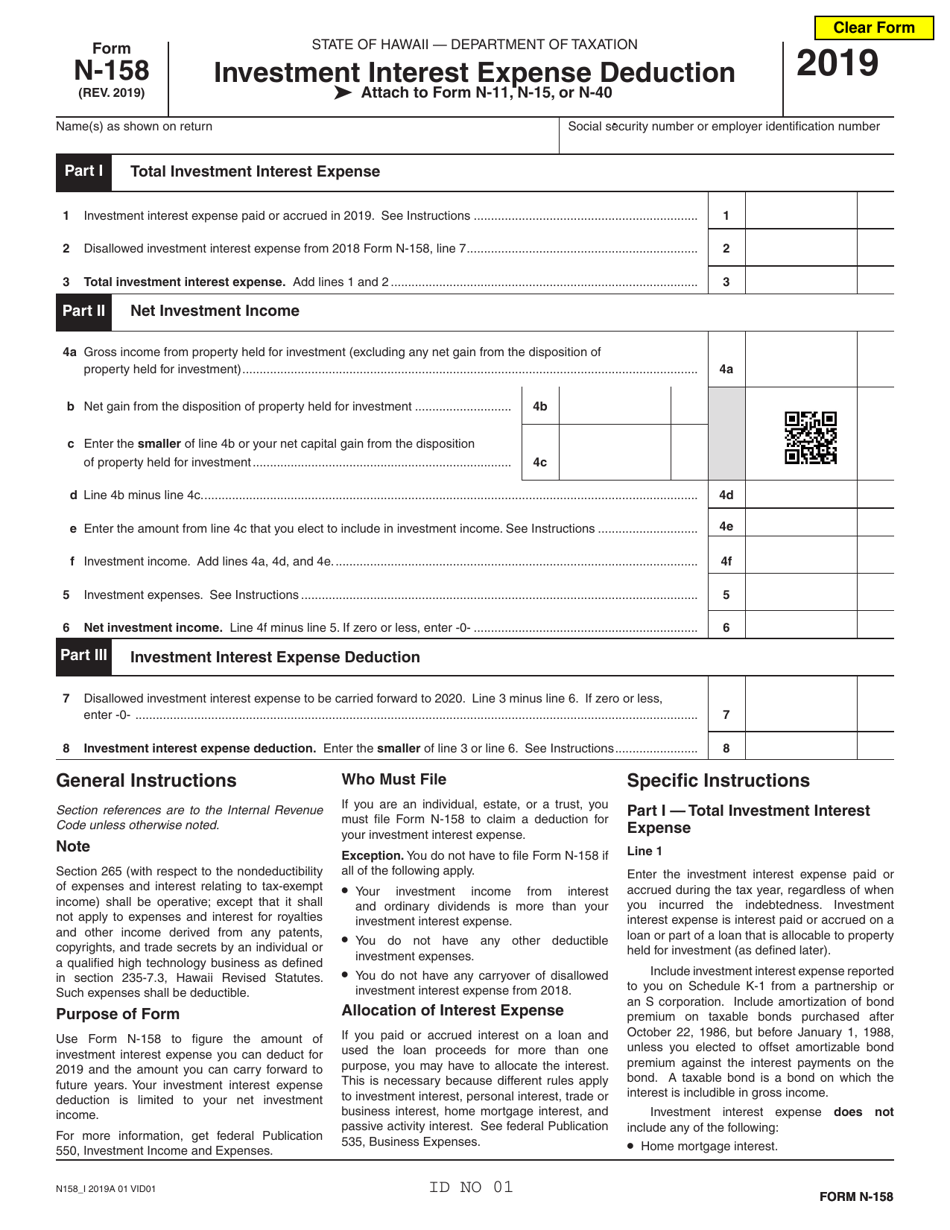

Form N-158 Investment Interest Expense Deduction - Hawaii

What Is Form N-158?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-158?

A: Form N-158 is used to claim the investment interest expense deduction.

Q: What is the investment interest expense deduction?

A: The investment interest expense deduction allows taxpayers to deduct interest paid on loans used to invest in taxable investments.

Q: Who can use Form N-158?

A: Form N-158 is specifically for residents of Hawaii who are eligible to claim the investment interest expense deduction.

Q: What information is required on Form N-158?

A: Form N-158 requires the taxpayer to provide information about their investment income and expenses.

Q: When is the deadline to file Form N-158?

A: The deadline to file Form N-158 is the same as the deadline to file your Hawaii state tax return.

Q: Is the investment interest expense deduction available in all states?

A: Yes, the investment interest expense deduction is available in all states, including Hawaii.

Q: Can I claim the investment interest expense deduction if I don't live in Hawaii?

A: No, Form N-158 is specifically for residents of Hawaii.

Q: Can I claim the investment interest expense deduction for personal loans?

A: No, the investment interest expense deduction only applies to loans used for taxable investments.

Q: Do I need to attach any supporting documents with Form N-158?

A: It is recommended to keep records of your investment income and expenses, but you do not need to attach them with the form.

Q: Can I e-file Form N-158?

A: Yes, you can e-file Form N-158 if you are filing your Hawaii state tax return electronically.

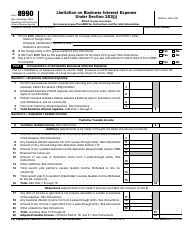

Q: Is the investment interest expense deduction subject to any limitations?

A: Yes, there are certain limitations on the amount of investment interest expense that can be deducted.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-158 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.