This version of the form is not currently in use and is provided for reference only. Download this version of

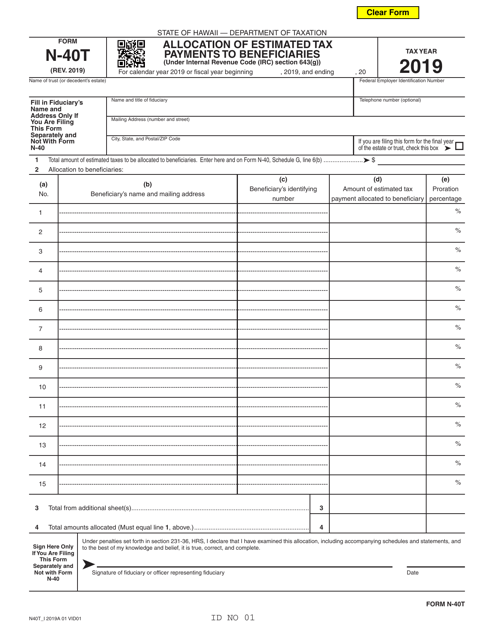

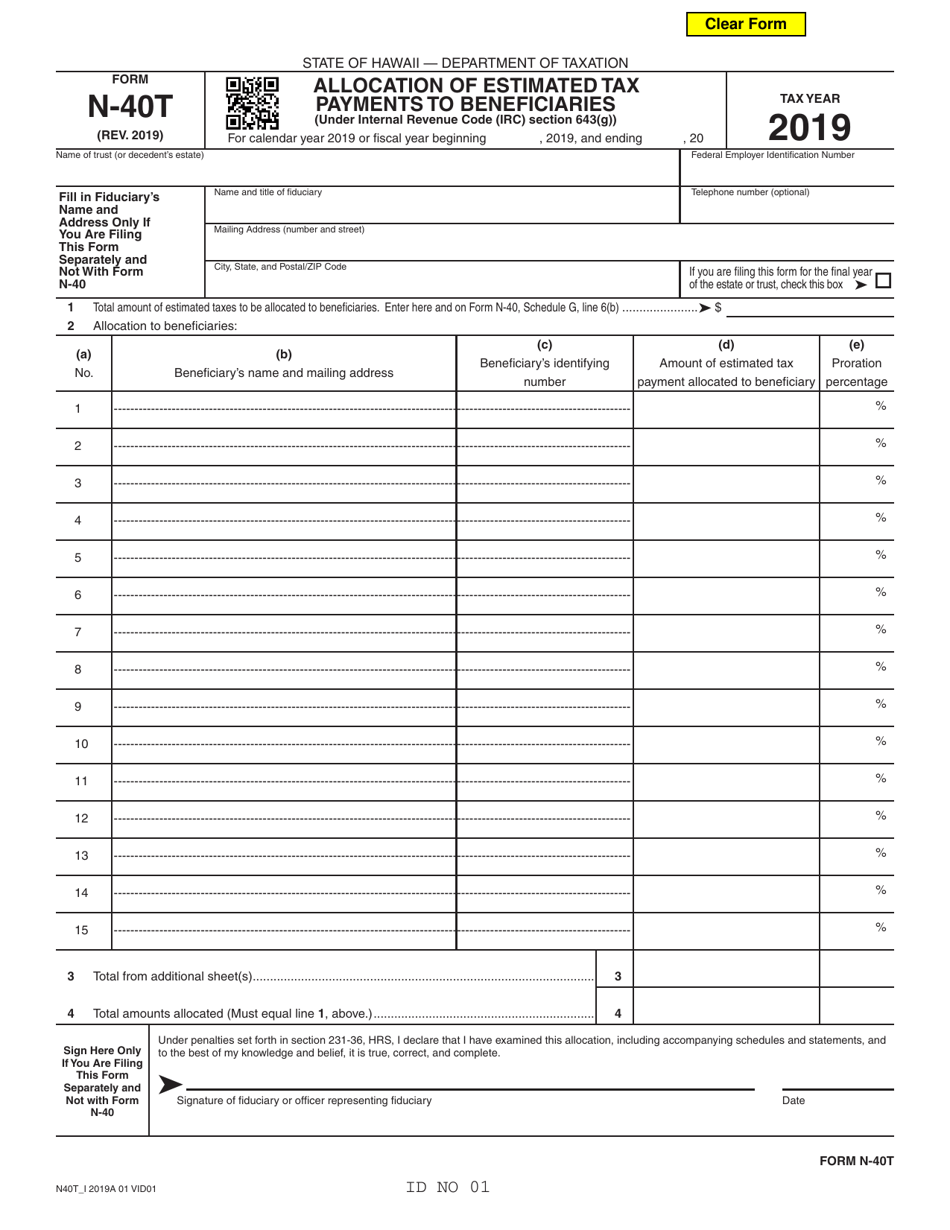

Form N-40T

for the current year.

Form N-40T Allocation of Estimated Tax Payments to Beneficiaries - Hawaii

What Is Form N-40T?

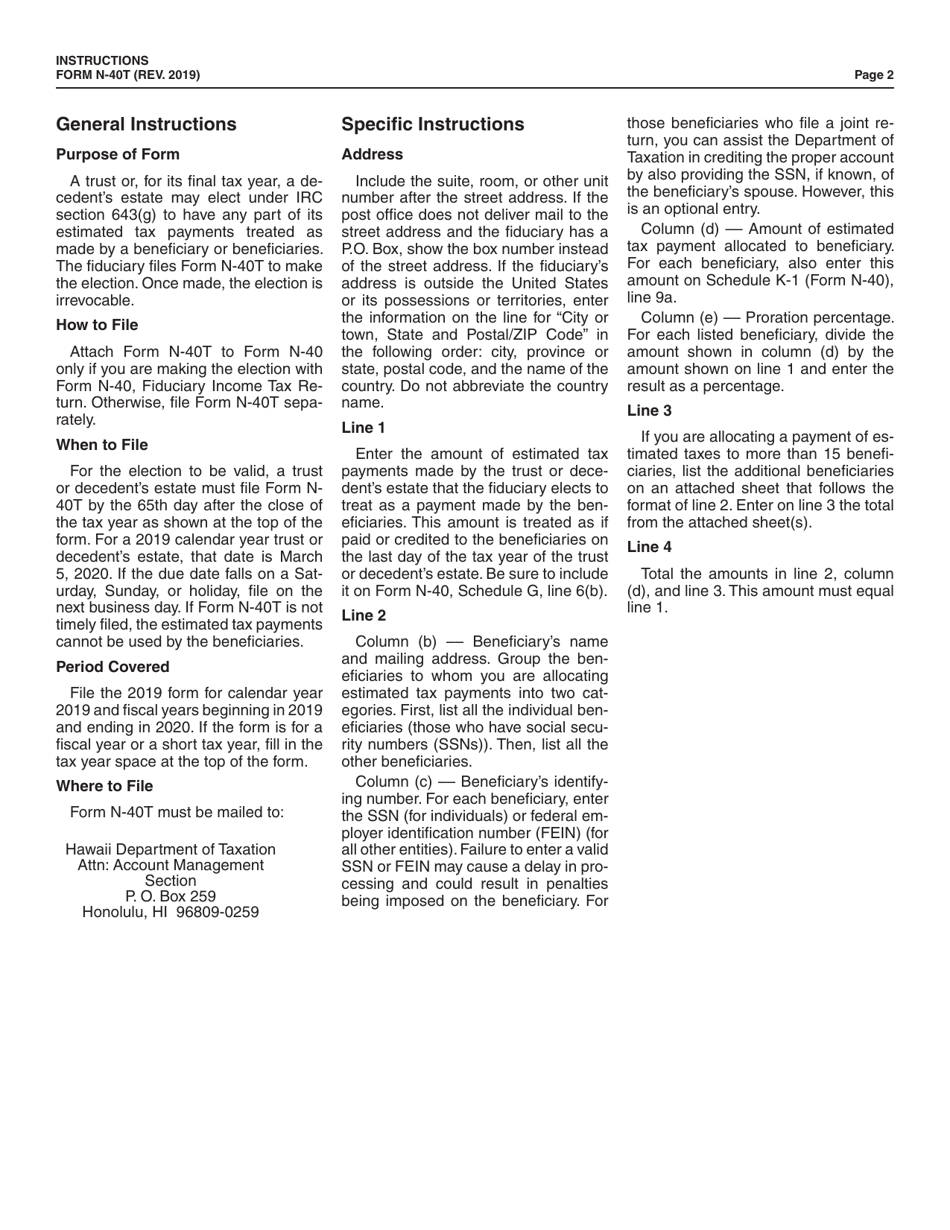

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-40T?

A: Form N-40T is a form used in Hawaii to allocate estimated tax payments to beneficiaries.

Q: Who should use Form N-40T?

A: This form should be used by residents of Hawaii who need to allocate their estimated tax payments to beneficiaries.

Q: What is the purpose of Form N-40T?

A: The purpose of Form N-40T is to ensure that estimated tax payments are properly allocated to beneficiaries in accordance with Hawaii tax laws.

Q: When is Form N-40T due?

A: Form N-40T is typically due on the same date as your tax return, which is usually April 20th of the following year.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-40T by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.