This version of the form is not currently in use and is provided for reference only. Download this version of

Form M-18

for the current year.

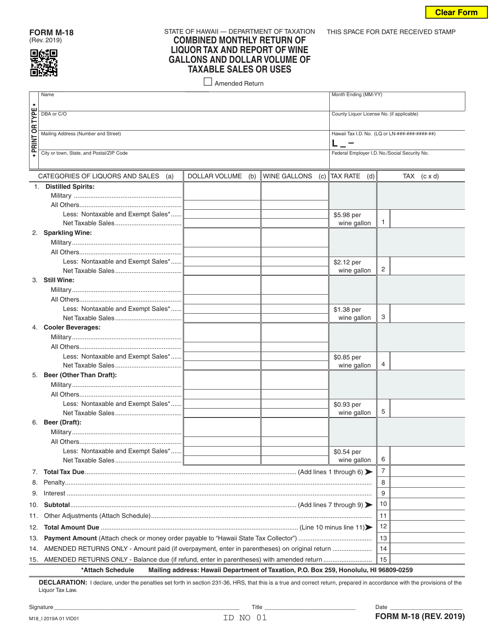

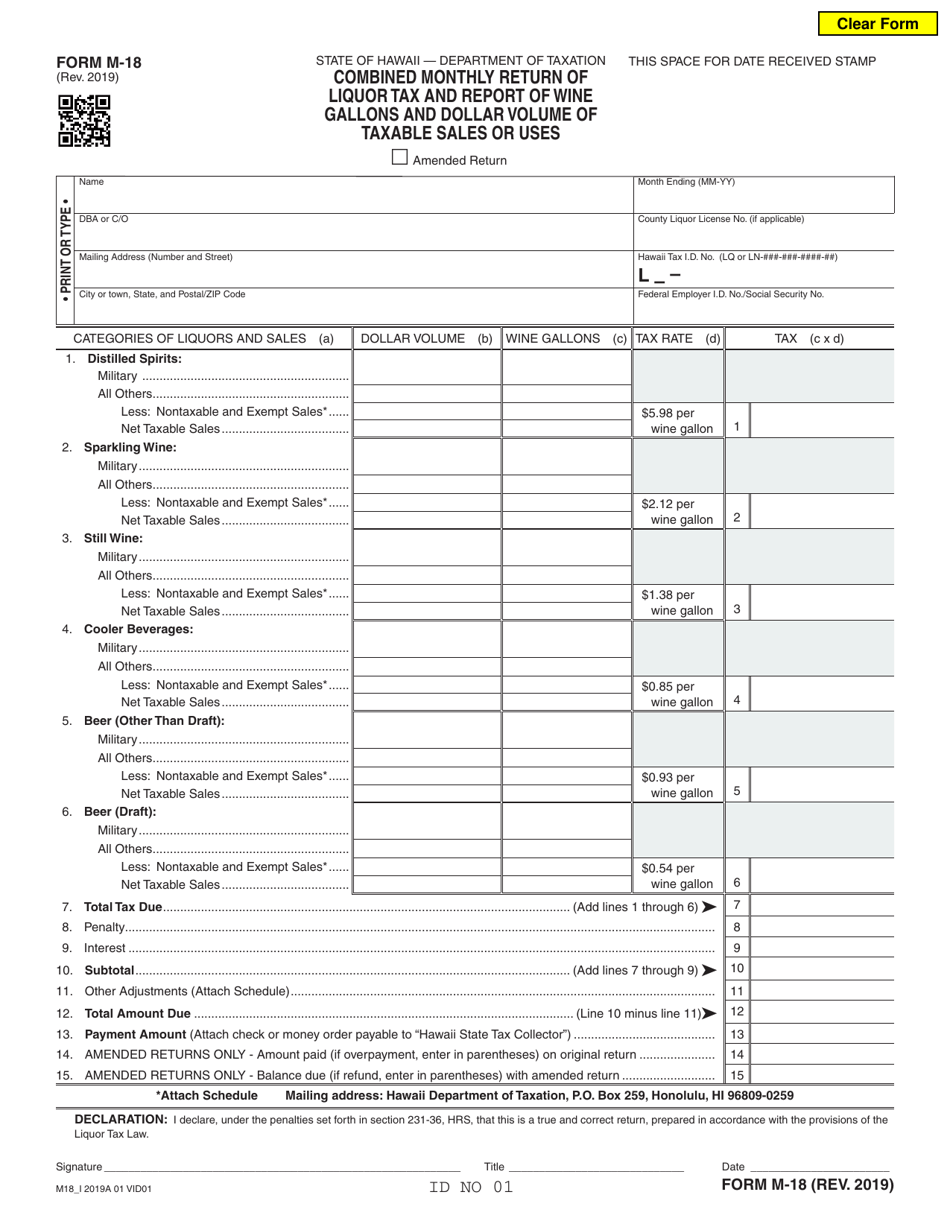

Form M-18 Combined Monthly Return of Liquor Tax and Report of Wine Gallons and Dollar Volume of Taxable Sales or Uses - Hawaii

What Is Form M-18?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-18?

A: Form M-18 is a document used in Hawaii to report the monthly liquor tax and wine sales or uses.

Q: What information does Form M-18 require?

A: Form M-18 requires information about liquor tax and wine sales or uses, including quantities and dollar volumes.

Q: Who needs to file Form M-18?

A: Businesses in Hawaii that sell or use liquor and wine are required to file Form M-18.

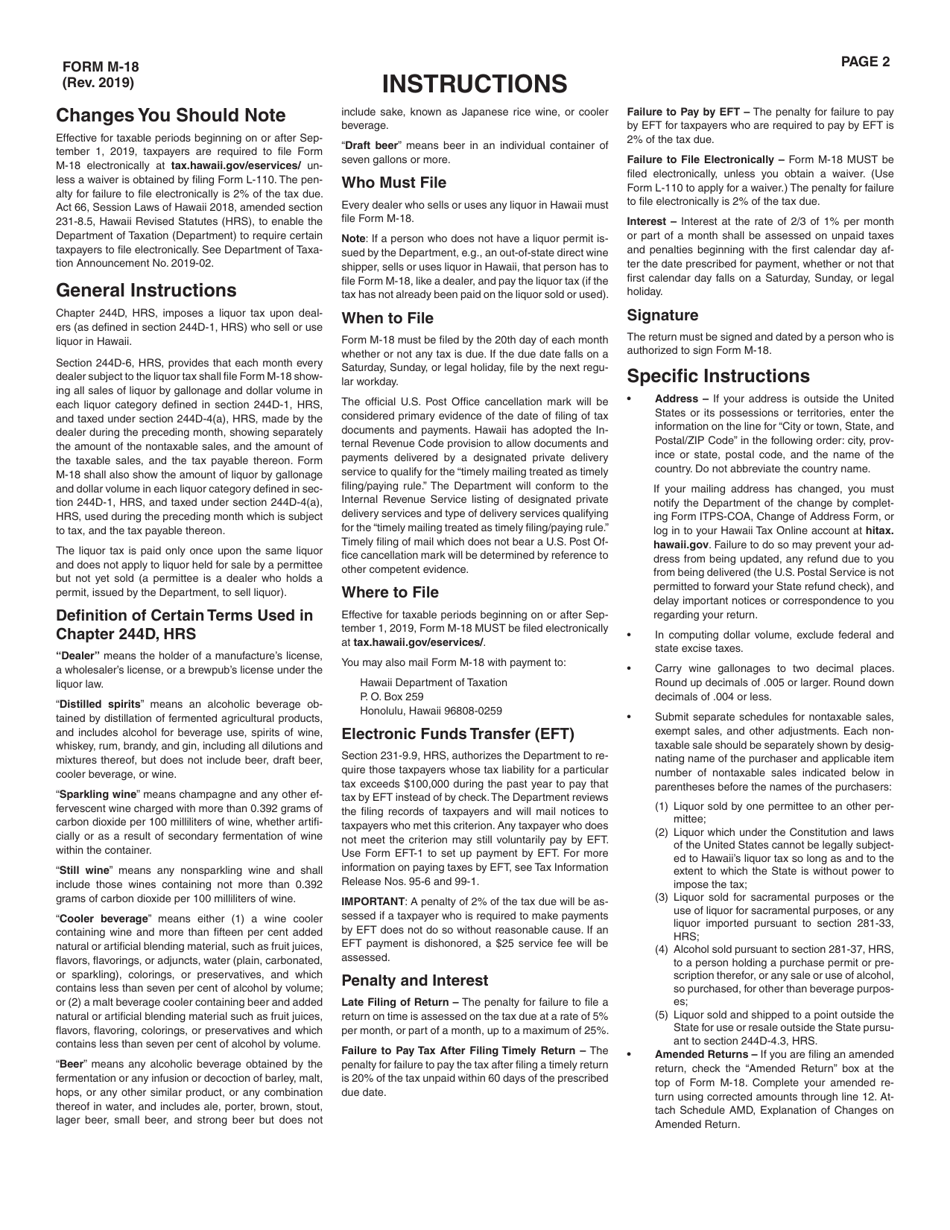

Q: When is Form M-18 due?

A: Form M-18 is due on the 20th day of the month following the end of the reporting period.

Q: Is there any penalty for late filing of Form M-18?

A: Yes, there may be penalties for late filing or failure to file Form M-18.

Q: Are there any instructions available for filling out Form M-18?

A: Yes, the Hawaii Department of Taxation provides instructions for filling out Form M-18.

Q: What if I have questions or need assistance with Form M-18?

A: You can contact the Hawaii Department of Taxation for assistance with Form M-18 or any related questions.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-18 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.