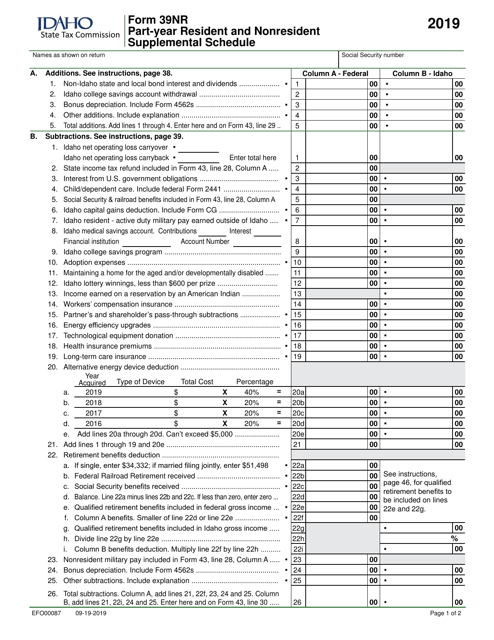

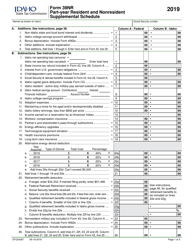

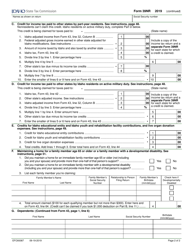

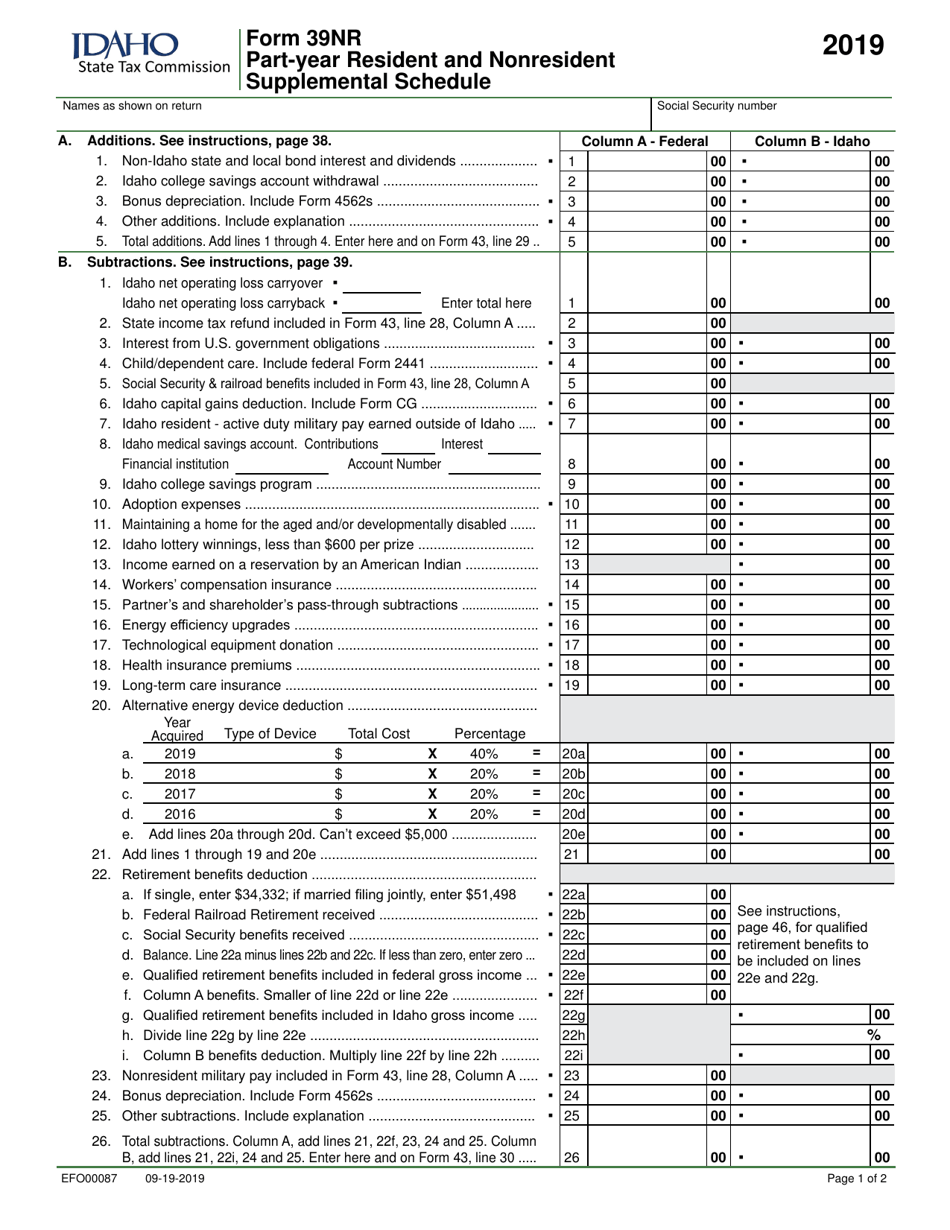

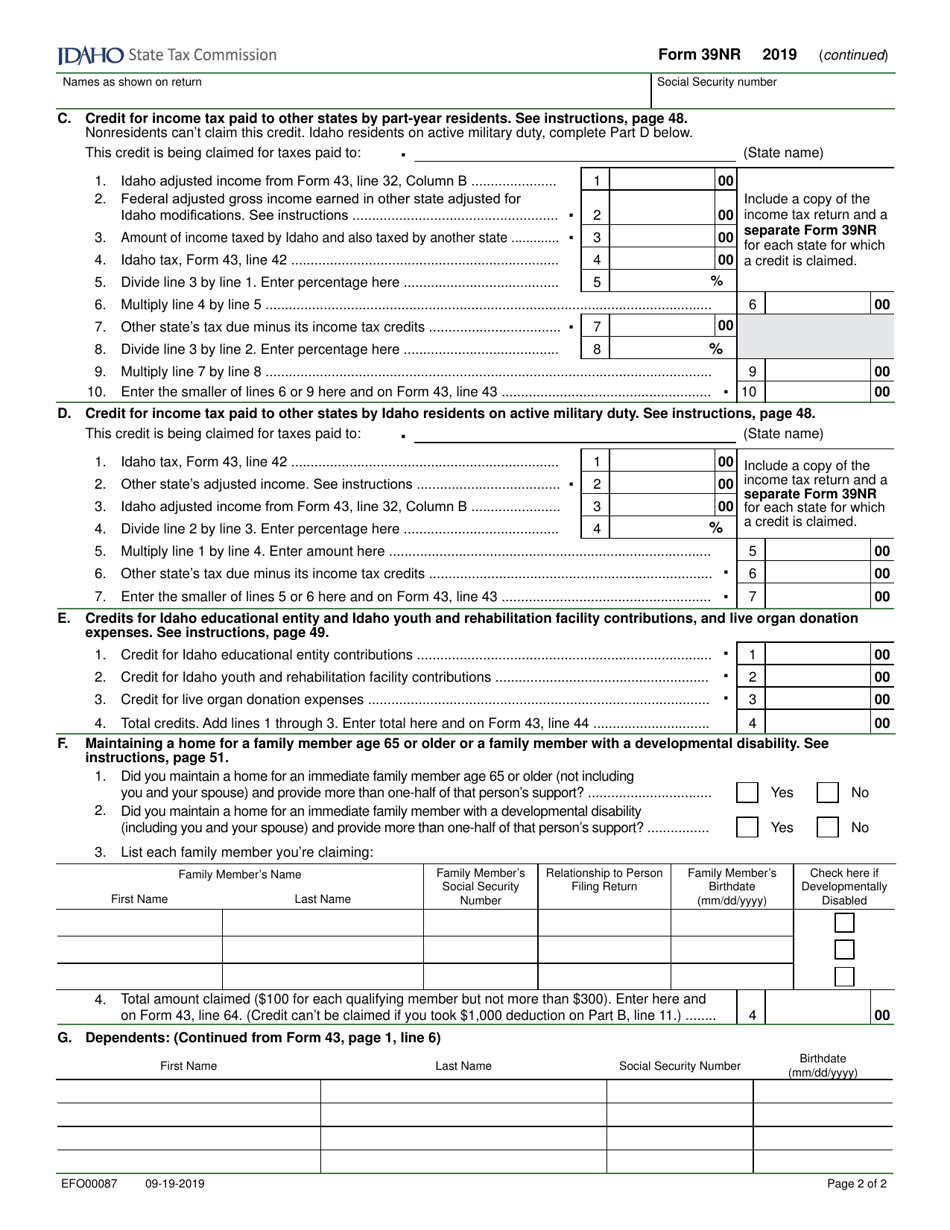

Form 39NR Part-Year Resident and Nonresident Supplemental Schedule - Idaho

What Is Form 39NR?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 39NR?

A: Form 39NR is the Part-Year Resident and Nonresident Supplemental Schedule for Idaho state taxes.

Q: Who should file Form 39NR?

A: Form 39NR should be filed by individuals who were part-year residents or nonresidents of Idaho during the tax year.

Q: What is the purpose of Form 39NR?

A: The purpose of Form 39NR is to report income and deductions for individuals who were part-year residents or nonresidents of Idaho.

Q: What kind of income should be reported on Form 39NR?

A: Any income earned in Idaho should be reported on Form 39NR, including wages, self-employment income, and rental income.

Q: Are there any deductions or credits available on Form 39NR?

A: Yes, you can claim deductions and credits on Form 39NR, such as the standard deduction or itemized deductions, and any applicable tax credits.

Q: When is the deadline to file Form 39NR?

A: The deadline to file Form 39NR is the same as the deadline for filing your federal income tax return, typically April 15th.

Q: Is Form 39NR only for Idaho state taxes?

A: Yes, Form 39NR is specifically for reporting income and deductions related to Idaho state taxes.

Q: Do I need to file Form 39NR if I was a full-year resident of Idaho?

A: No, Form 39NR is only required for individuals who were part-year residents or nonresidents of Idaho during the tax year.

Q: Can I e-file Form 39NR?

A: Yes, you can e-file Form 39NR if you choose to file your Idaho state taxes electronically.

Form Details:

- Released on September 19, 2019;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 39NR by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.