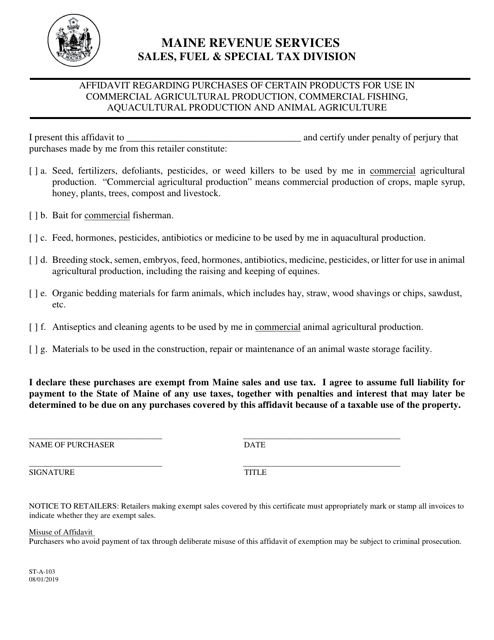

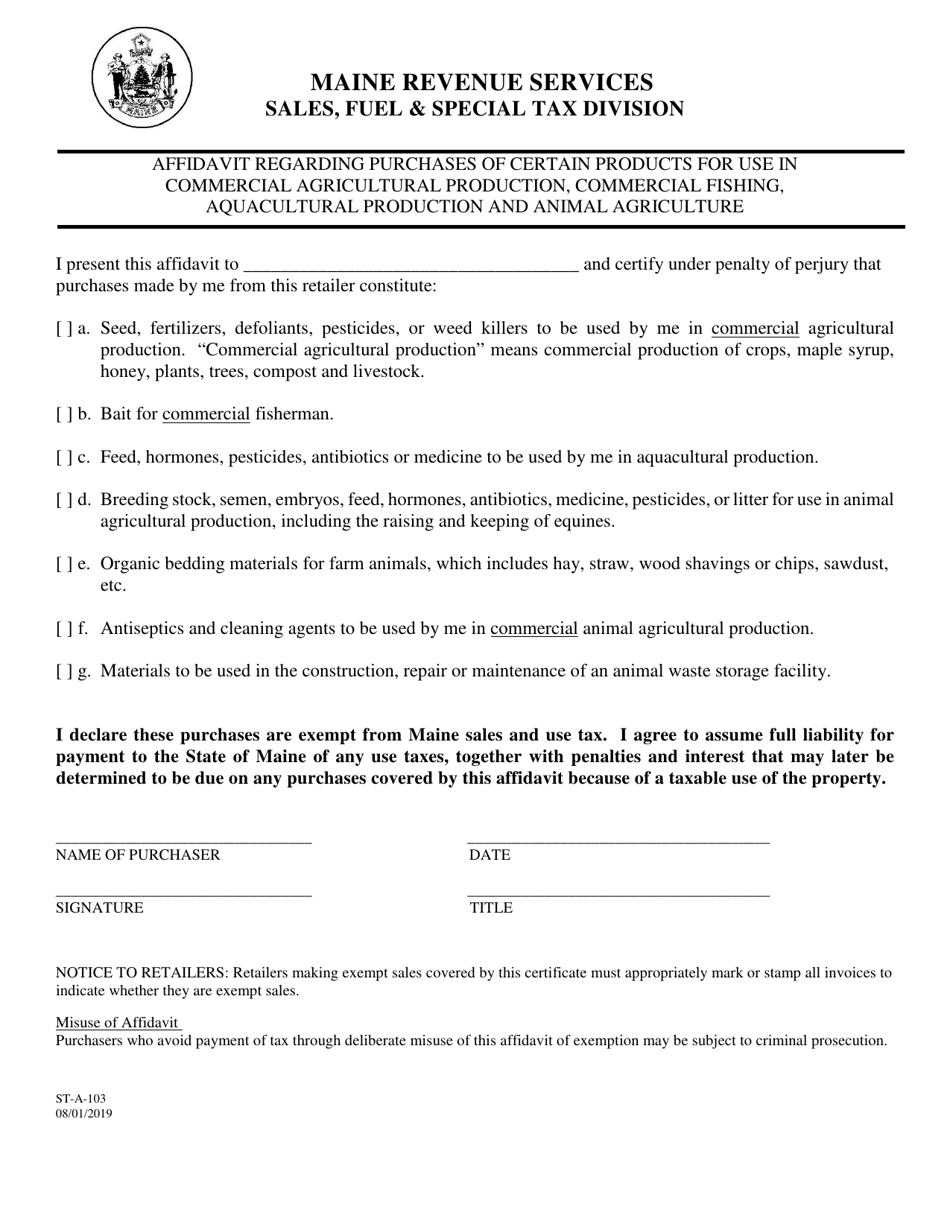

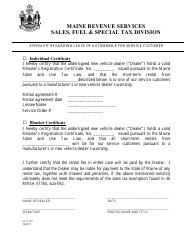

Form ST-A-103 Affidavit Regarding Purchases of Certain Products for Use in Commercial Agricultural Production, Commercial Fishing, Aquacultural Production and Animal Agriculture - Maine

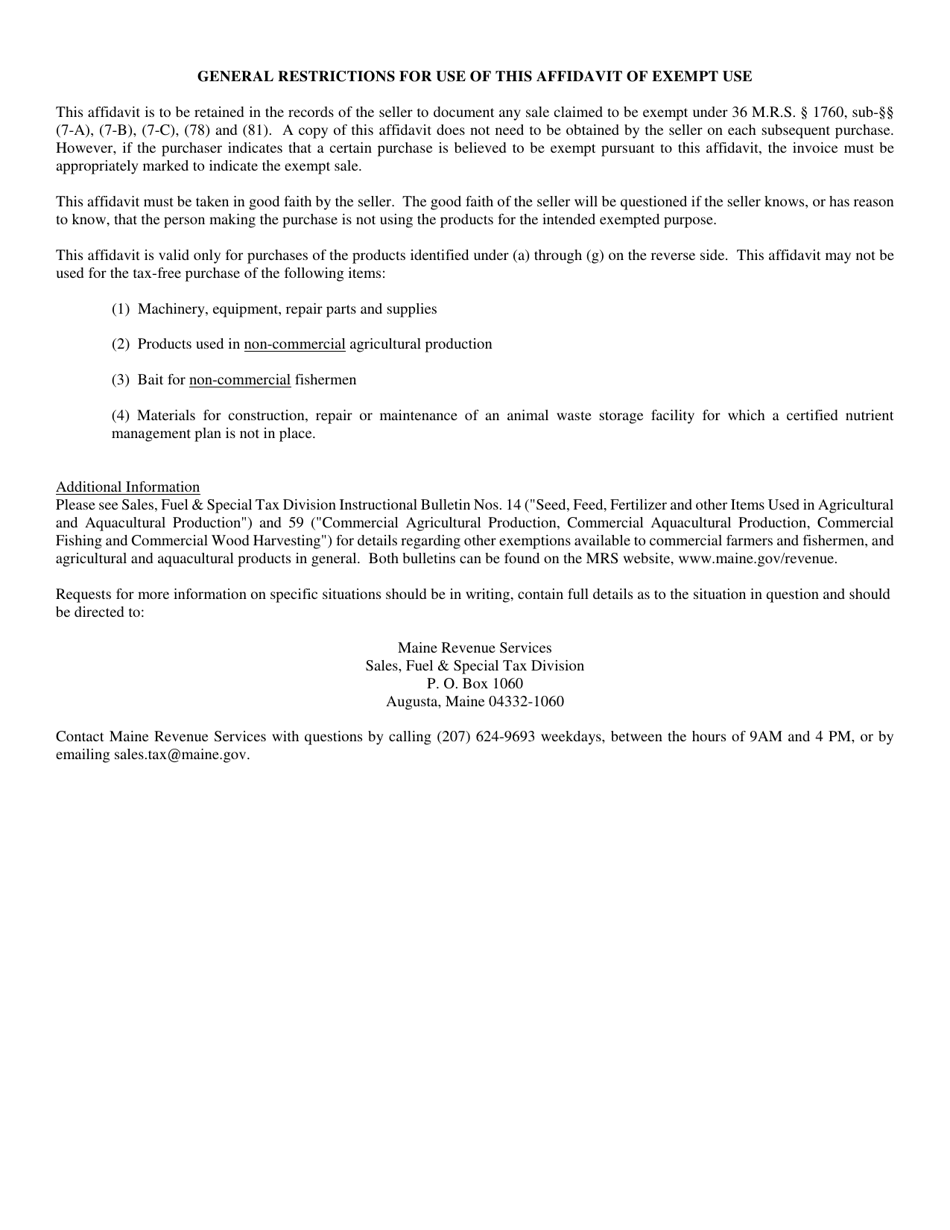

What Is Form ST-A-103?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-A-103?

A: Form ST-A-103 is an affidavit regarding purchases of certain products for use in commercial agricultural production, commercial fishing, aquacultural production, and animal agriculture in Maine.

Q: Who needs to fill out Form ST-A-103?

A: Individuals and businesses that make purchases of certain products for use in commercial agricultural production, commercial fishing, aquacultural production, and animal agriculture in Maine.

Q: What is the purpose of Form ST-A-103?

A: The purpose of Form ST-A-103 is to certify that the purchases made are eligible for exemption from certain sales and use taxes in Maine.

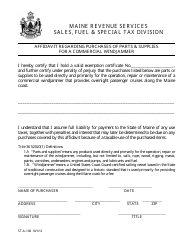

Q: What are the eligible products for exemption?

A: The eligible products for exemption include specific fuels, propane, electricity, machinery, equipment, and supplies used in commercial agricultural production, commercial fishing, aquacultural production, and animal agriculture in Maine.

Q: How often do I need to fill out Form ST-A-103?

A: Form ST-A-103 needs to be filed annually or when there are changes in the information provided on the form.

Q: Are there any fees associated with filing Form ST-A-103?

A: No, there are no fees associated with filing Form ST-A-103.

Q: What should I do with the completed form?

A: The completed Form ST-A-103 should be kept on file and available for inspection by the Maine Revenue Services.

Q: What happens if I do not file Form ST-A-103?

A: Failure to file Form ST-A-103 may result in the denial of the sales and use tax exemption for qualifying purchases.

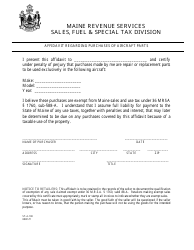

Q: Can I claim a refund for taxes already paid on eligible products?

A: Yes, if taxes were paid on eligible products, a refund can be claimed by filing an amended return or by contacting the Maine Revenue Services.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-A-103 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.