This version of the form is not currently in use and is provided for reference only. Download this version of

Form TPT-R

for the current year.

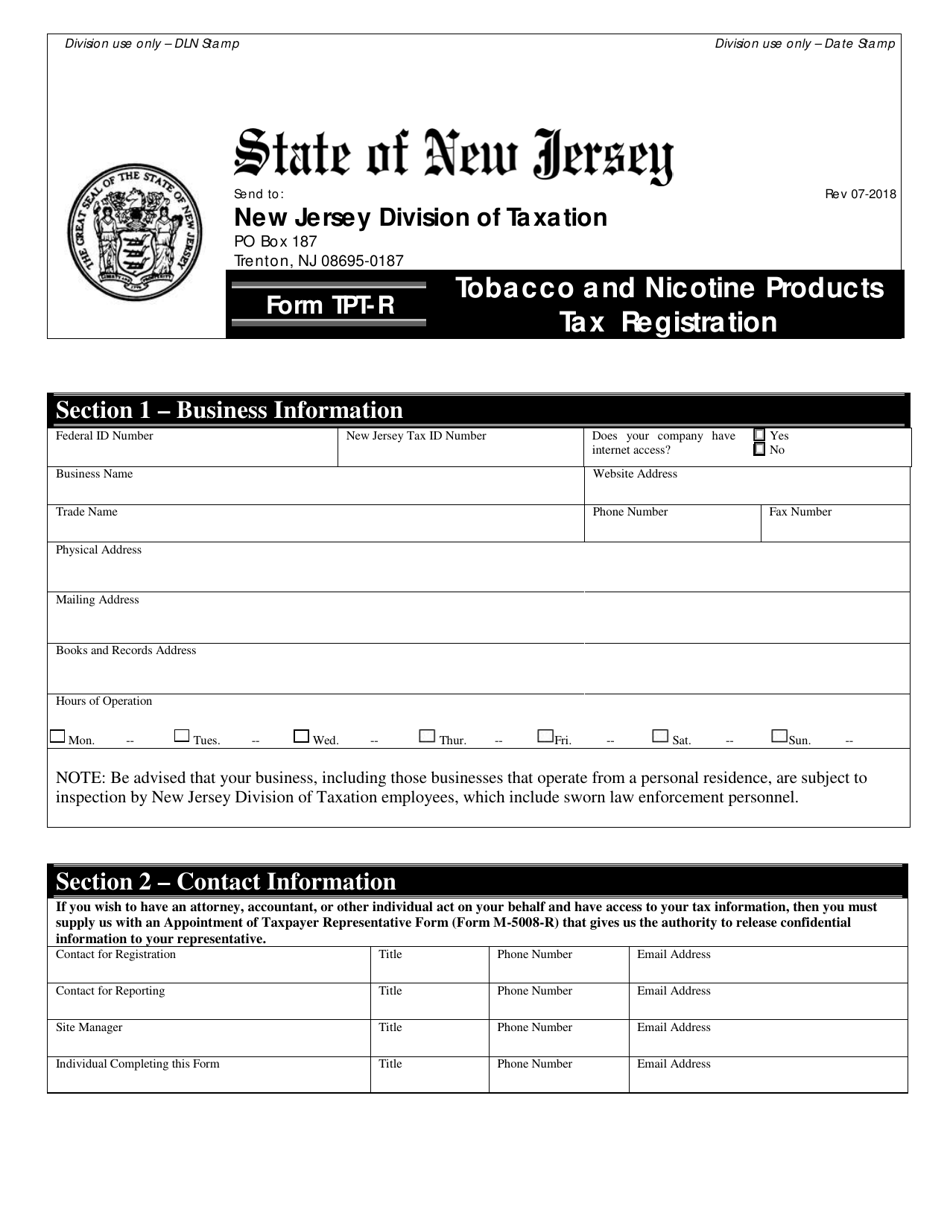

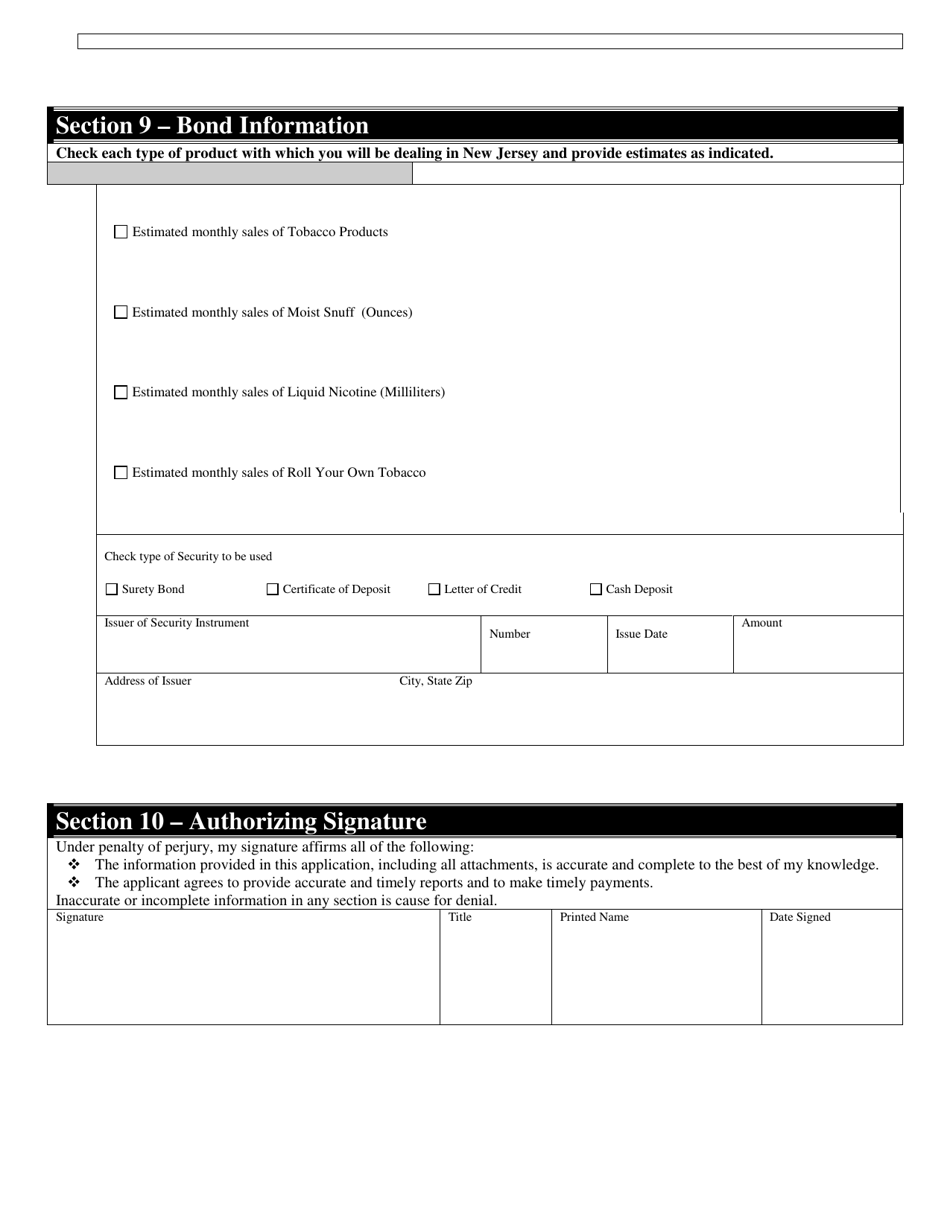

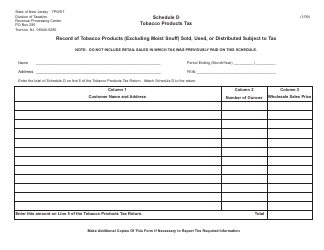

Form TPT-R Tobacco and Nicotine Products Tax Registration - New Jersey

What Is Form TPT-R?

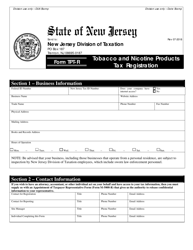

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TPT-R?

A: Form TPT-R is the Tobacco and Nicotine Products Tax Registration form in New Jersey.

Q: Who needs to file Form TPT-R?

A: Anyone who sells tobacco or nicotine products in the state of New Jersey needs to file Form TPT-R.

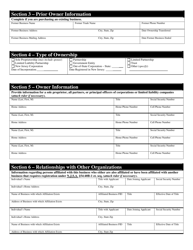

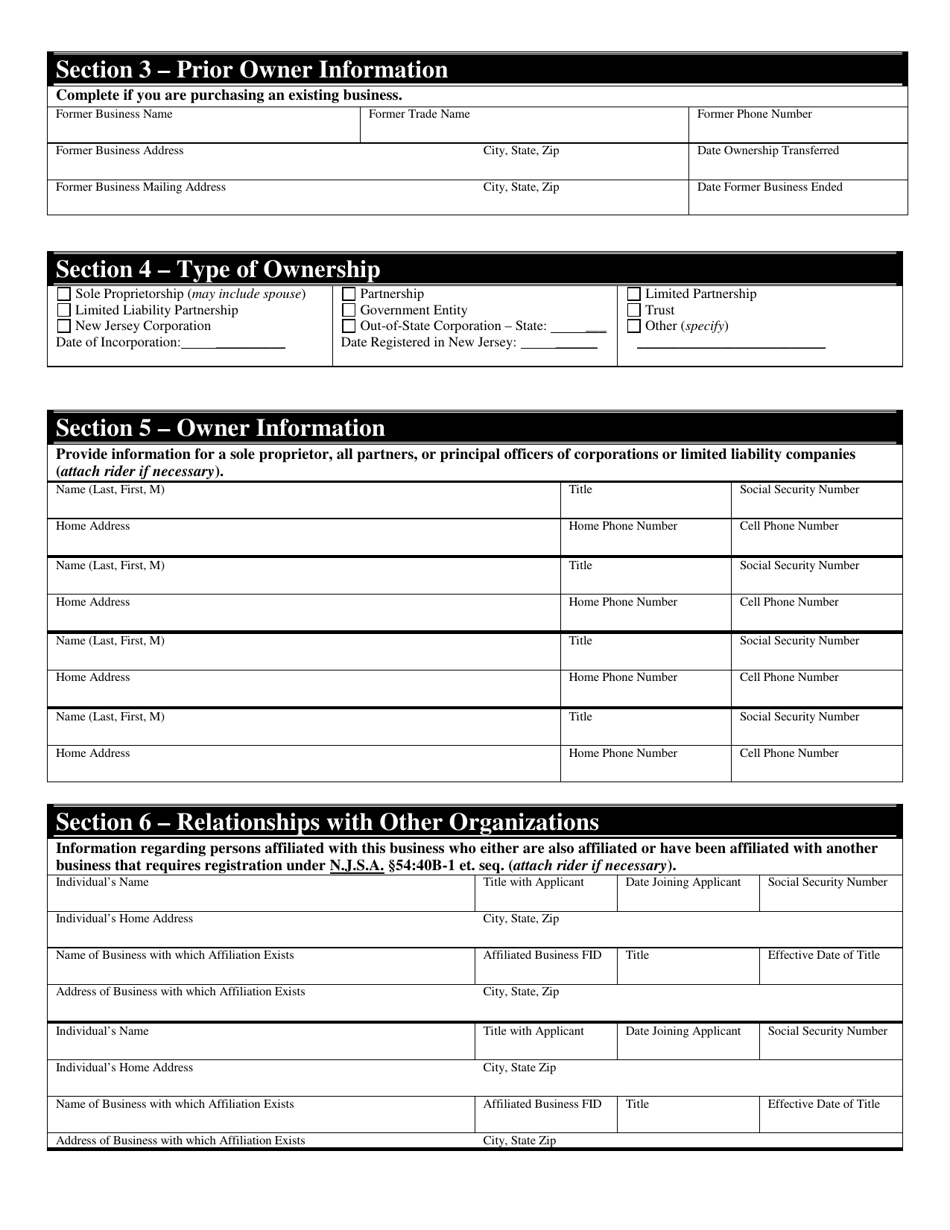

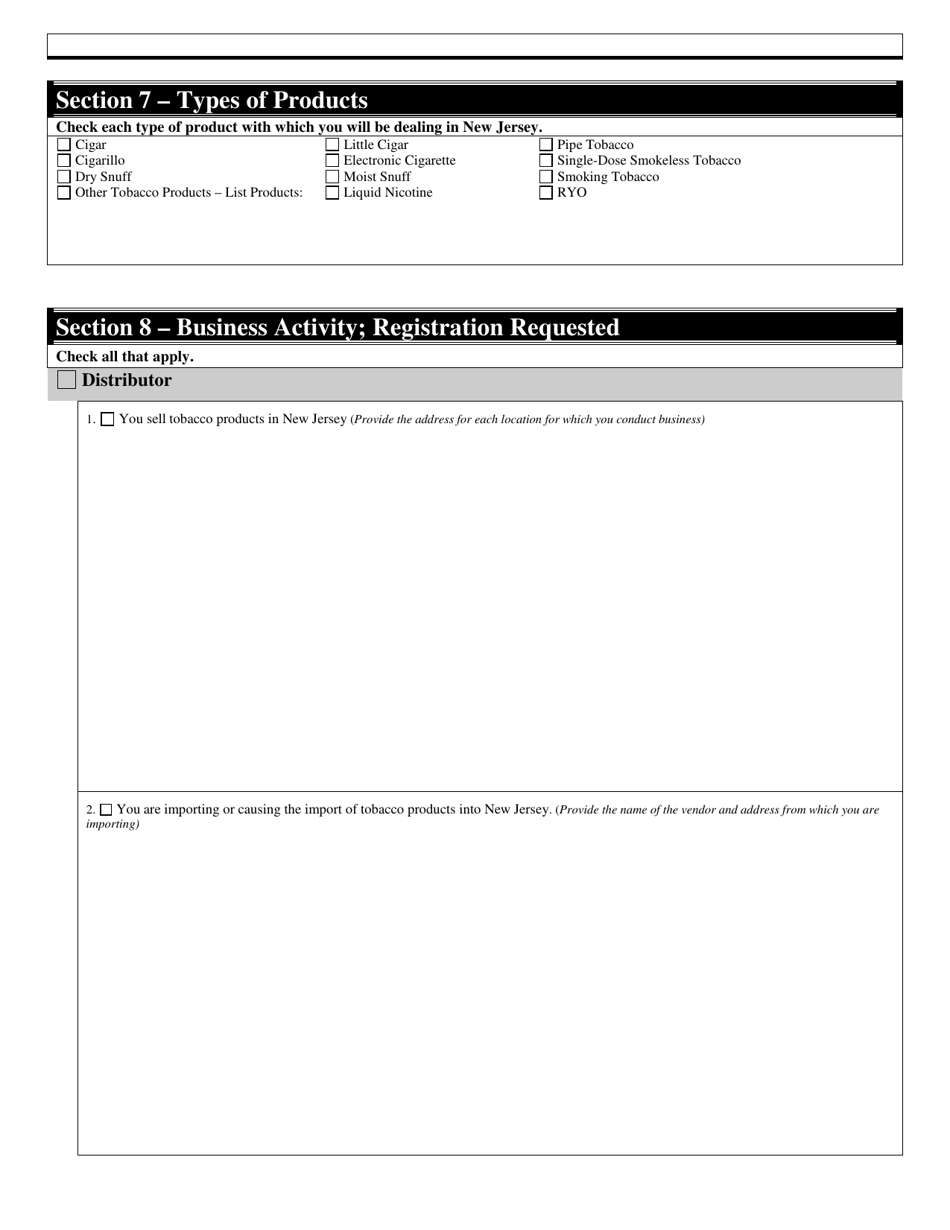

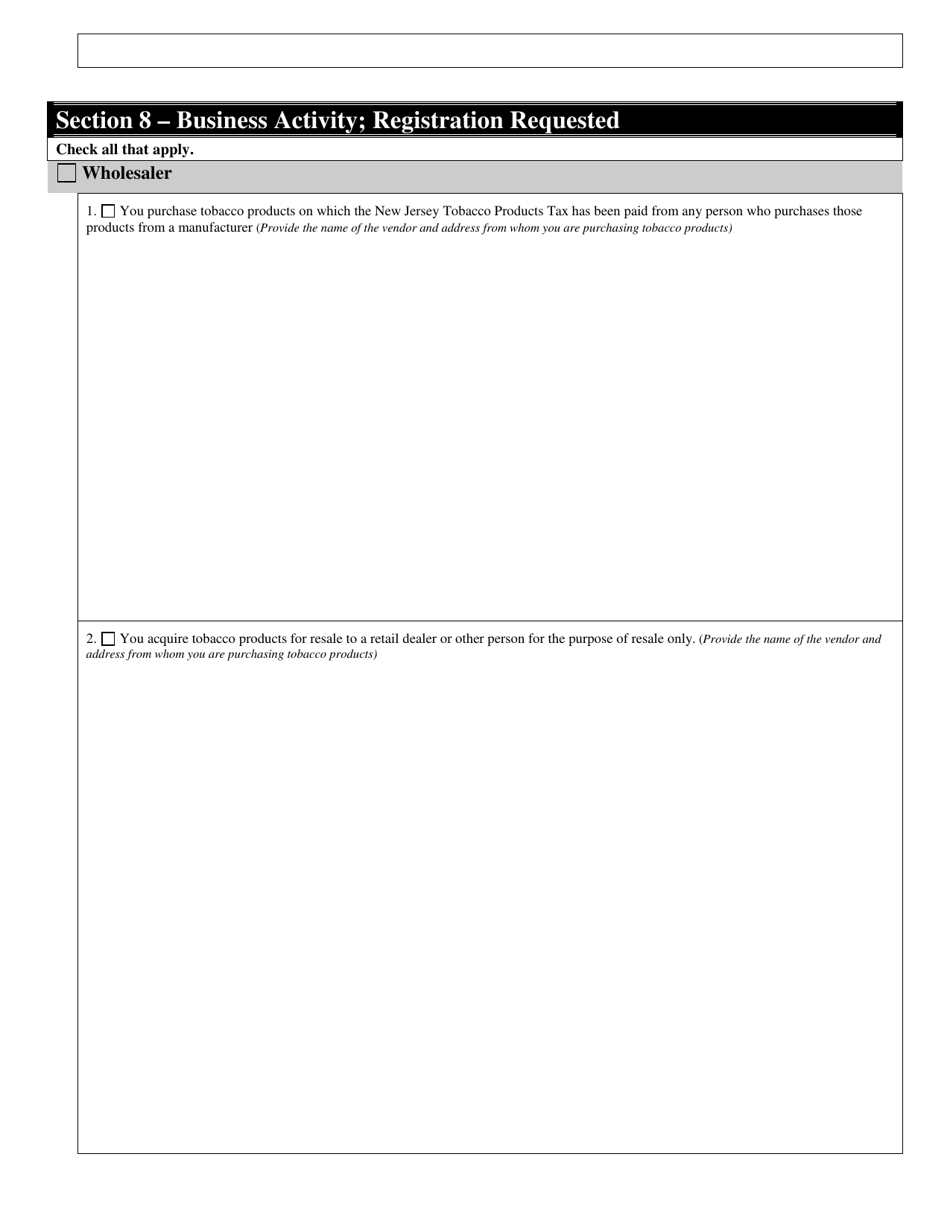

Q: What information is required on Form TPT-R?

A: Form TPT-R requires information about the business selling tobacco or nicotine products, including contact information and sales details.

Q: When is Form TPT-R due?

A: Form TPT-R is due by the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for late filing of Form TPT-R?

A: Yes, there are penalties for late filing of Form TPT-R, including interest on unpaid taxes.

Q: Can I request an extension for filing Form TPT-R?

A: Yes, extensions may be requested for filing Form TPT-R, but interest will still be charged on any unpaid taxes.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TPT-R by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.