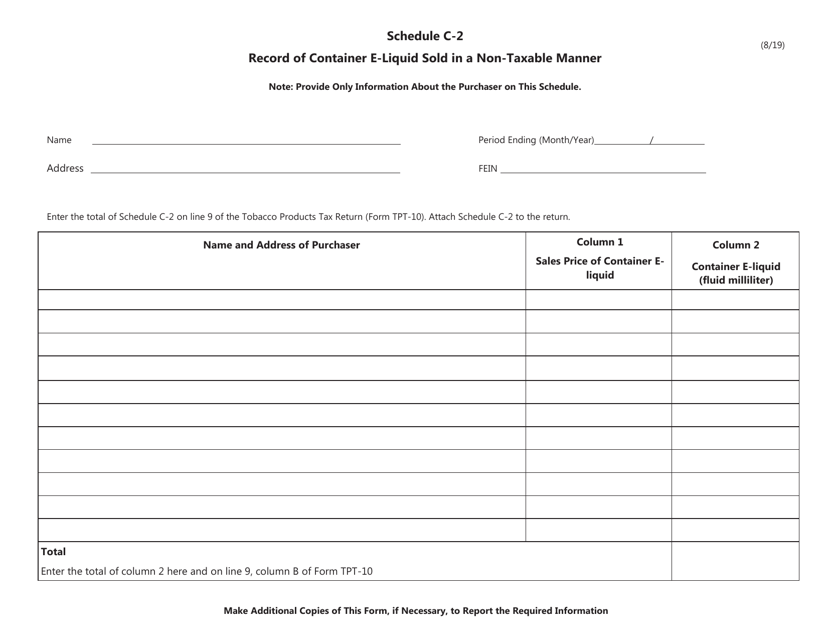

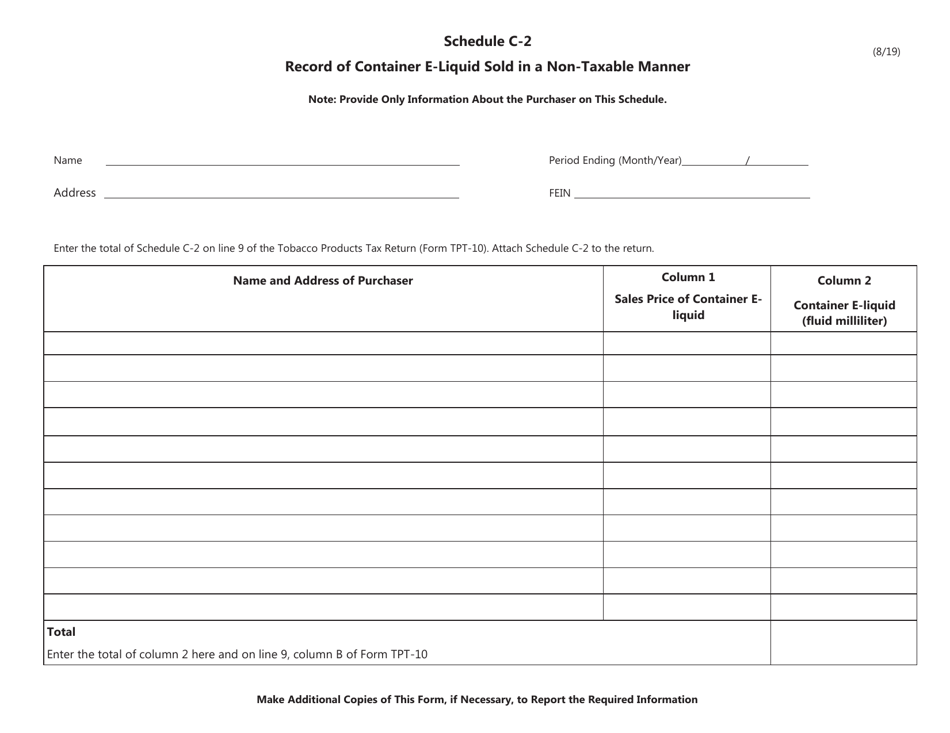

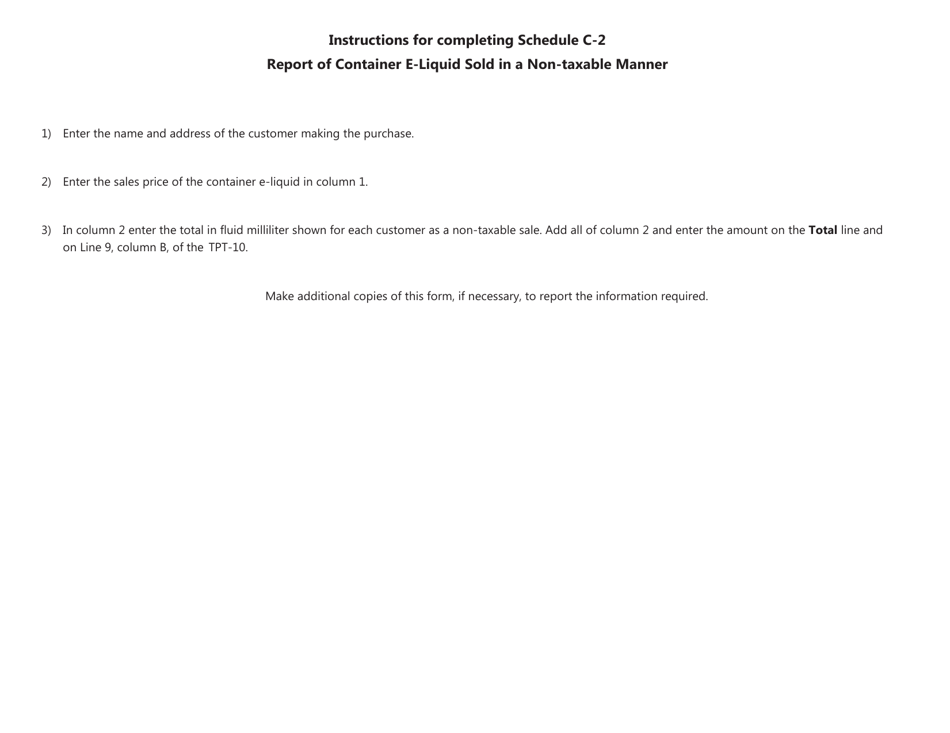

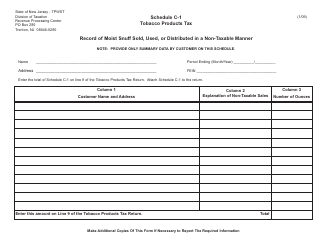

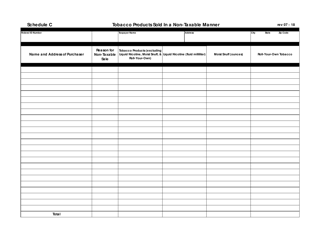

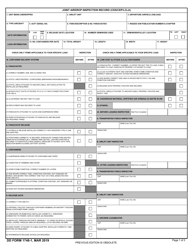

Schedule C-2 Record of Container E-Liquid Sold in a Non-taxable Manner - New Jersey

What Is Schedule C-2?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule C-2?

A: Schedule C-2 is a record of container e-liquid sold in a non-taxable manner in New Jersey.

Q: What does Schedule C-2 show?

A: Schedule C-2 shows the details of container e-liquid sales that are exempt from taxation in New Jersey.

Q: Why is Schedule C-2 important?

A: Schedule C-2 is important for businesses to maintain accurate records of non-taxable container e-liquid sales to comply with New Jersey tax regulations.

Q: Who needs to fill out Schedule C-2?

A: Businesses engaged in the sale of container e-liquid in New Jersey, where the sales are exempt from taxation, must fill out Schedule C-2.

Q: When should Schedule C-2 be filled out?

A: Schedule C-2 should be filled out on a regular basis, typically monthly or quarterly, depending on the reporting requirements of the New Jersey tax authorities.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule C-2 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.