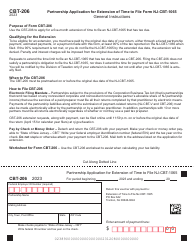

This version of the form is not currently in use and is provided for reference only. Download this version of

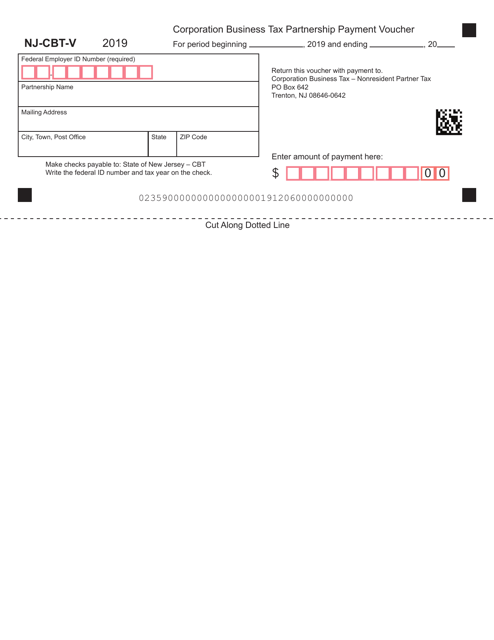

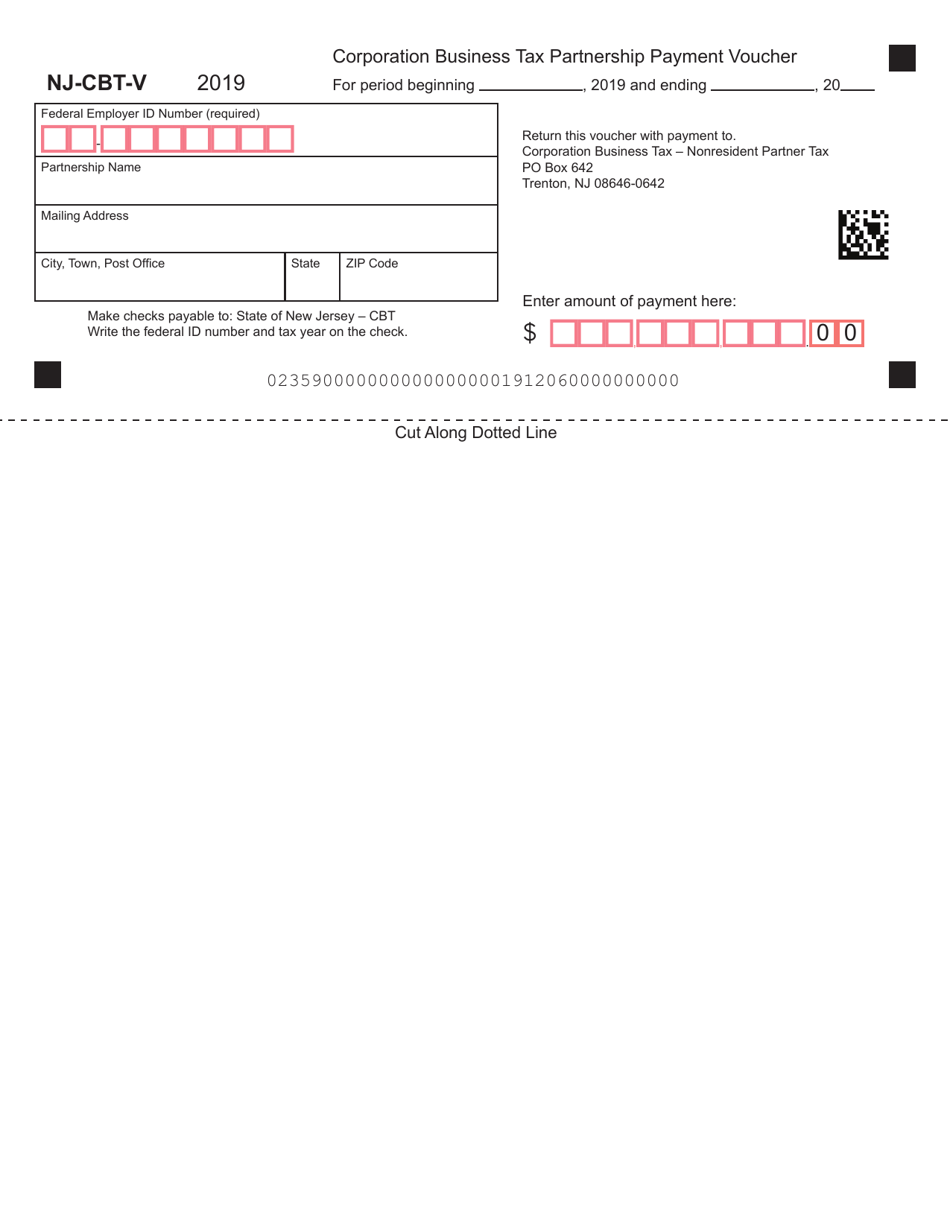

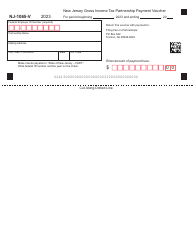

Form NJ-CBT-V

for the current year.

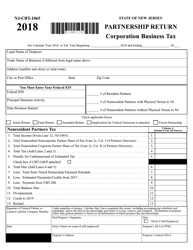

Form NJ-CBT-V Corporation Business Tax Partnership Payment Voucher - New Jersey

What Is Form NJ-CBT-V?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

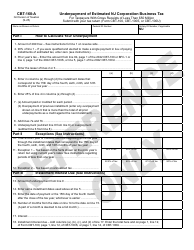

Q: What is NJ-CBT-V?

A: NJ-CBT-V is a form used to submit payment voucher for Corporation Business Tax Partnership in New Jersey.

Q: Who needs to use NJ-CBT-V?

A: Anyone who is required to pay Corporation Business Tax Partnership in New Jersey needs to use NJ-CBT-V.

Q: What information is required on NJ-CBT-V?

A: NJ-CBT-V requires you to provide information such as the tax period, taxpayer identification number, payment amount, and contact details.

Q: Are there any penalties for late payment?

A: Yes, there may be penalties for late payment as determined by the New Jersey Division of Taxation. It is important to submit your payment by the due date to avoid penalties.

Q: Can I make partial payments with NJ-CBT-V?

A: Yes, you can make partial payments with NJ-CBT-V. However, you should ensure that the full payment is made by the due date to avoid penalties.

Q: Is NJ-CBT-V only for corporations?

A: No, NJ-CBT-V is also used for partnerships that are subject to Corporation Business Tax in New Jersey.

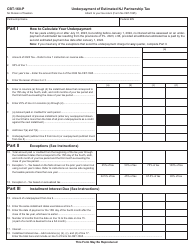

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-CBT-V by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.