This version of the form is not currently in use and is provided for reference only. Download this version of

Form V.S.S.

for the current year.

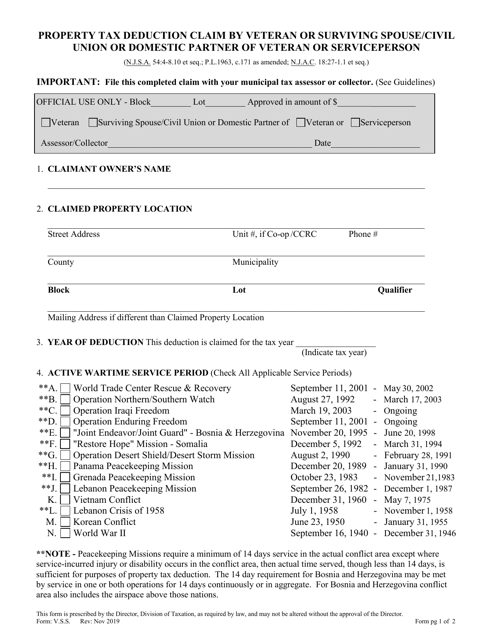

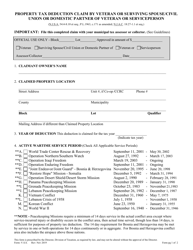

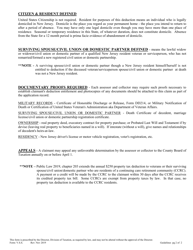

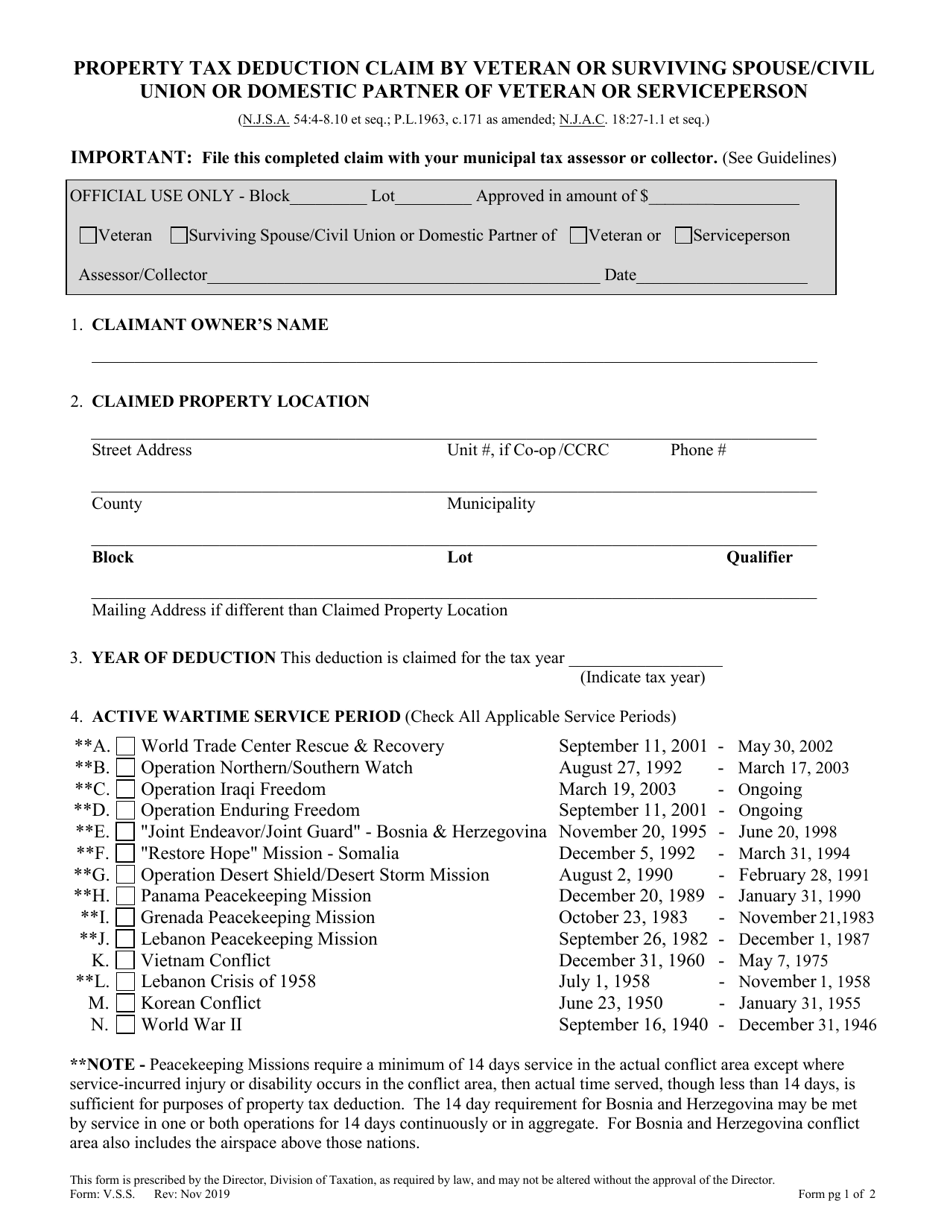

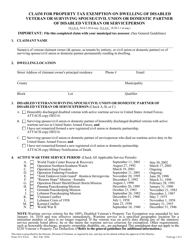

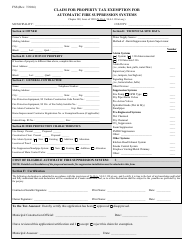

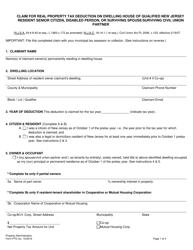

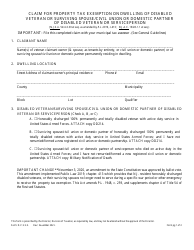

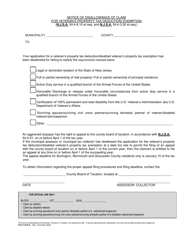

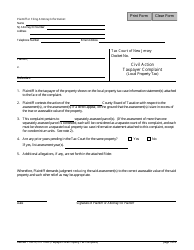

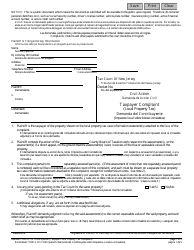

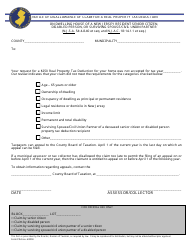

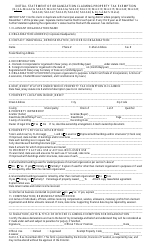

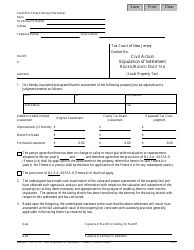

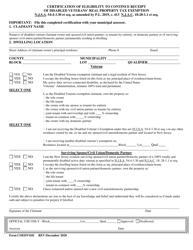

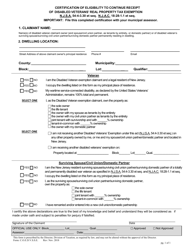

Form V.S.S. Property Tax Deduction Claim by Veteran or Surviving Spouse / Civil Union or Domestic Partner of Veteran or Serviceperson - New Jersey

What Is Form V.S.S.?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the V.S.S. Property Tax Deduction Claim?

A: The V.S.S. Property Tax Deduction Claim is a tax deduction specific to New Jersey for veterans or surviving spouses/civil unions/domestic partners of veterans or servicepersons.

Q: Who is eligible for the V.S.S. Property Tax Deduction?

A: Veterans or surviving spouses/civil unions/domestic partners of veterans or servicepersons are eligible for the V.S.S. Property Tax Deduction.

Q: What is the purpose of the V.S.S. Property Tax Deduction?

A: The purpose of the V.S.S. Property Tax Deduction is to provide property tax relief for eligible individuals in New Jersey.

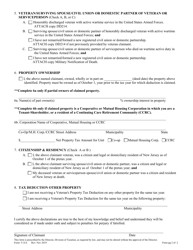

Q: How do I apply for the V.S.S. Property Tax Deduction?

A: You can apply for the V.S.S. Property Tax Deduction by filling out the appropriate claim form and submitting it to the New Jersey Division of Taxation.

Q: What documents do I need to submit with my V.S.S. Property Tax Deduction claim?

A: You will need to submit a copy of your DD-214 (military discharge document) and other supporting documentation specified on the claim form.

Form Details:

- Released on November 2, 2019;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form V.S.S. by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.