This version of the form is not currently in use and is provided for reference only. Download this version of

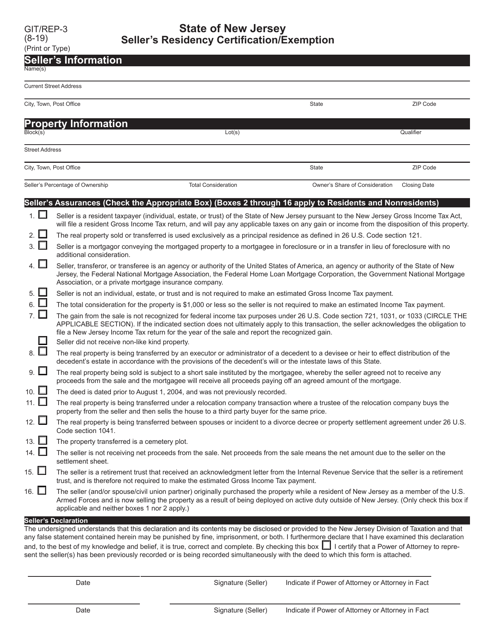

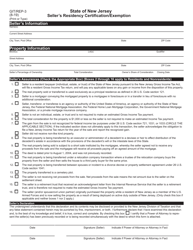

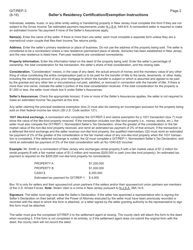

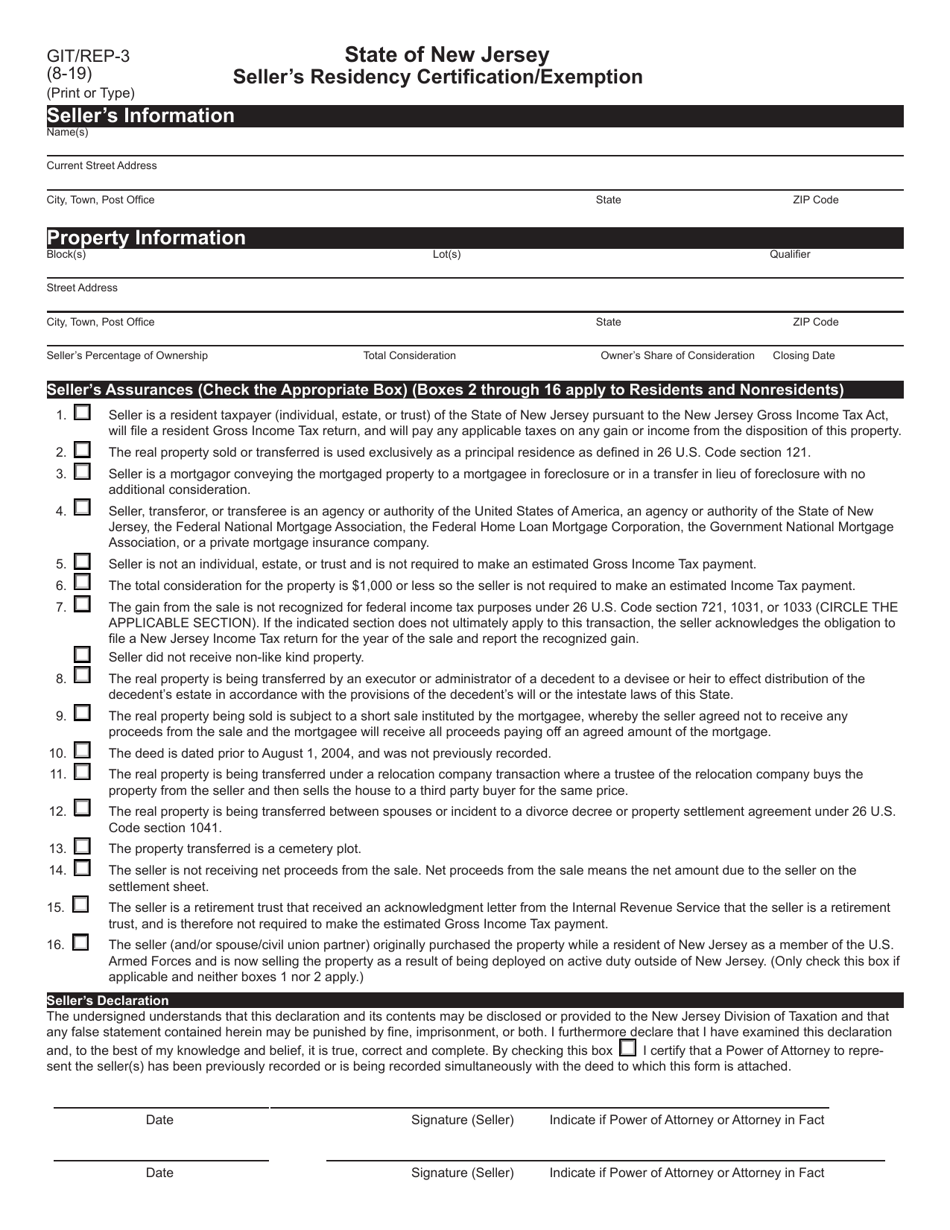

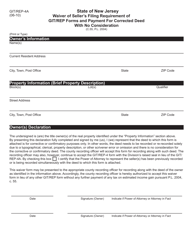

Form GIT/REP-3

for the current year.

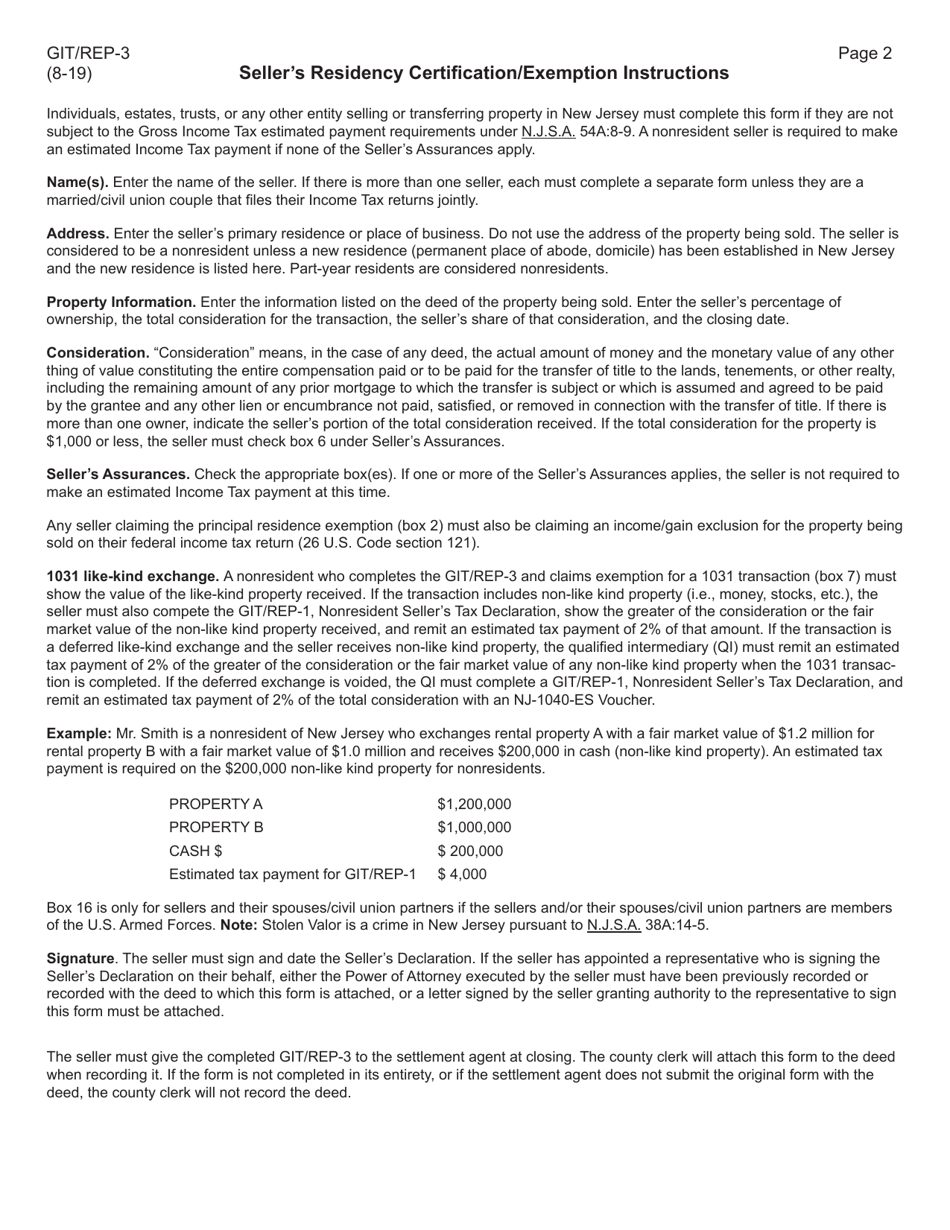

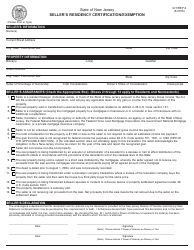

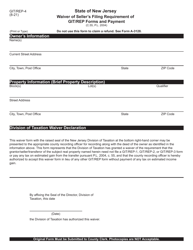

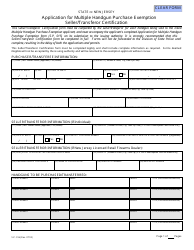

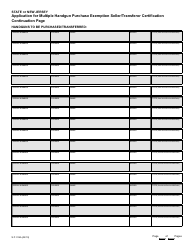

Form GIT / REP-3 Seller's Residency Certification / Exemption - New Jersey

What Is Form GIT/REP-3?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

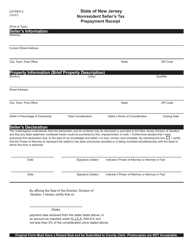

Q: What is GIT/REP-3?

A: GIT/REP-3 is a Seller's Residency Certification/Exemption form.

Q: What is the purpose of GIT/REP-3?

A: The purpose of GIT/REP-3 is to certify a seller's residency status or claim an exemption in New Jersey.

Q: Who needs to fill out GIT/REP-3?

A: Sellers who are not residents of New Jersey or are claiming an exemption need to fill out GIT/REP-3.

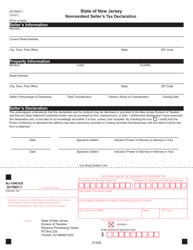

Q: What information is needed to fill out GIT/REP-3?

A: You will need to provide your personal and business information, as well as details about the real property being sold.

Q: Can a seller be exempt from paying the New Jersey realty transfer fee?

A: Yes, certain exemptions exist. Sellers should consult the GIT/REP-3 form and instructions for more information.

Q: How should I submit the completed GIT/REP-3 form?

A: The completed GIT/REP-3 form should be submitted to the County Clerk's Office where the property is located.

Q: Are there any fees associated with submitting GIT/REP-3?

A: Yes, there is a fee for filing the GIT/REP-3 form. The fee amount may vary by county.

Q: What happens if I do not submit GIT/REP-3?

A: Failure to submit the GIT/REP-3 form may result in the imposition of penalties or interest by the New Jersey Division of Taxation.

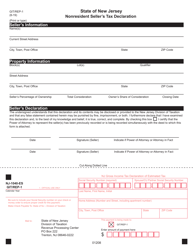

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GIT/REP-3 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.