This version of the form is not currently in use and is provided for reference only. Download this version of

Form NJ-2450

for the current year.

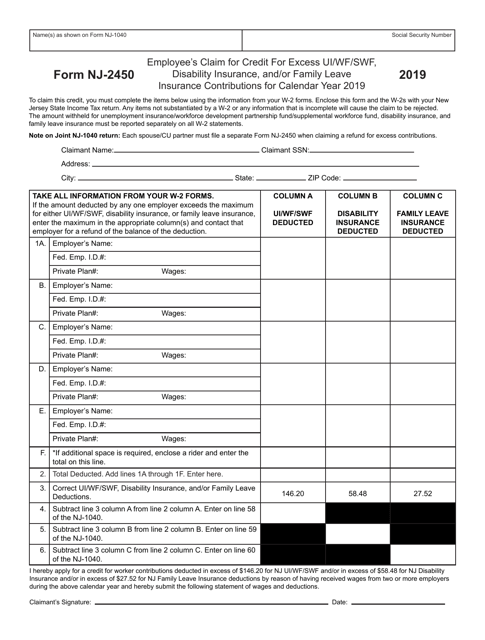

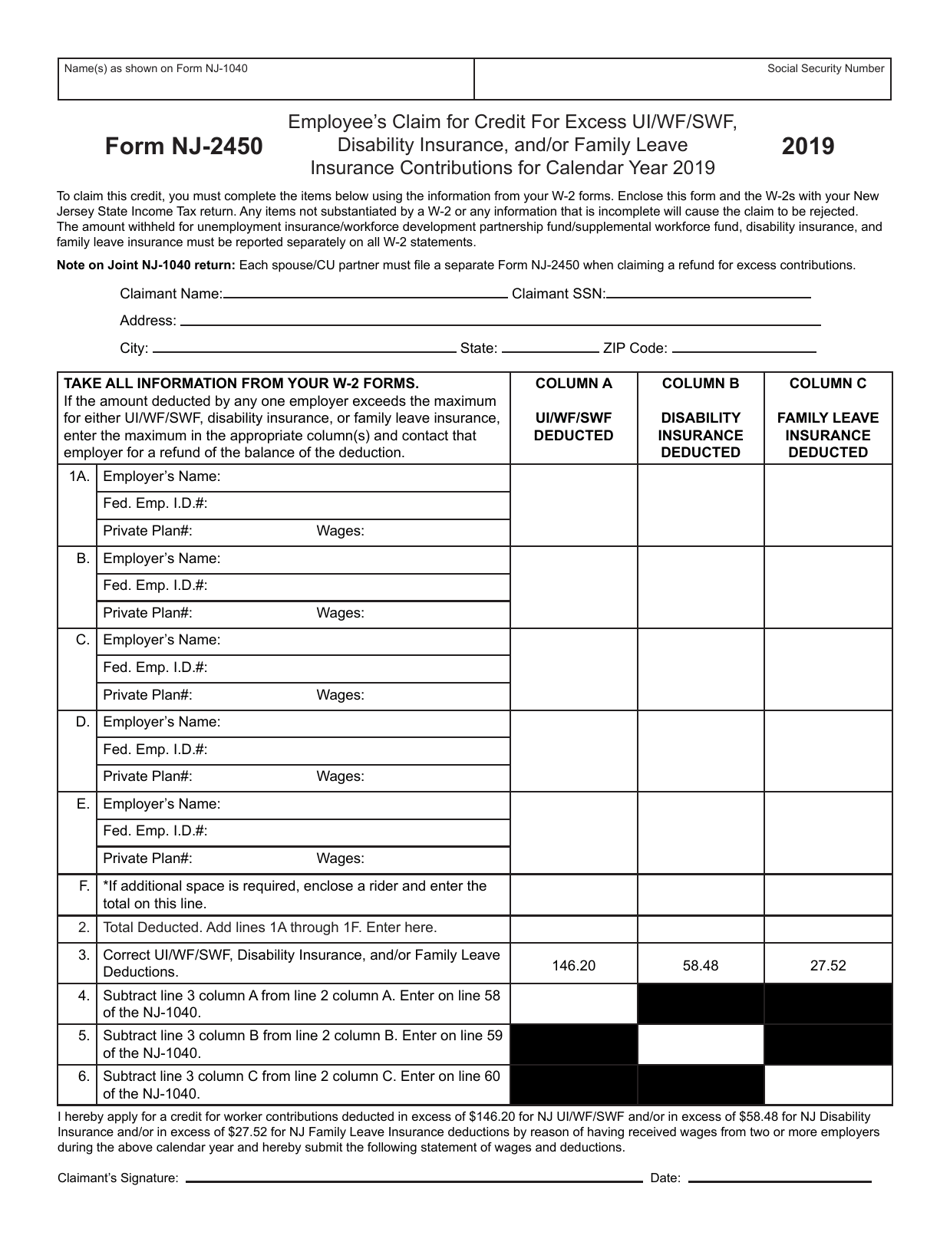

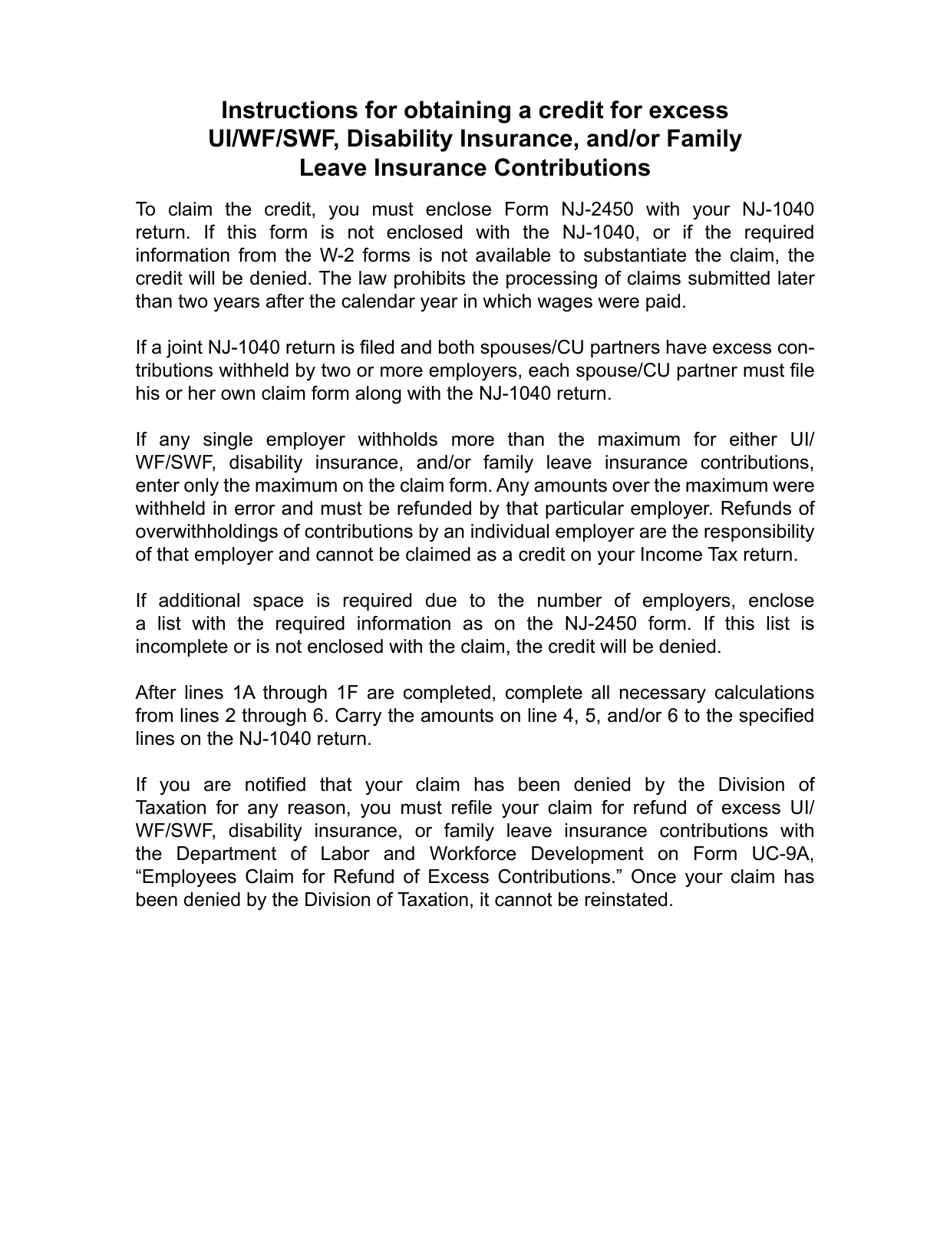

Form NJ-2450 Employee's Claim for Credit for Excess UI / WF / SWF, Disability Insurance, and / or Family Leave Insurance Contributions - New Jersey

What Is Form NJ-2450?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-2450?

A: Form NJ-2450 is the Employee's Claim for Credit for Excess UI/WF/SWF, Disability Insurance, and/or Family Leave Insurance Contributions in New Jersey.

Q: What is the purpose of Form NJ-2450?

A: The purpose of Form NJ-2450 is to claim a credit for excess contributions made towards unemployment insurance (UI), workforce development (WF), state disability insurance (SDI), and/or family leave insurance (FLI) in New Jersey.

Q: Who can use Form NJ-2450?

A: Form NJ-2450 can be used by employees who have made excess contributions towards UI, WF, SDI, and/or FLI in New Jersey.

Q: What are excess contributions?

A: Excess contributions are the amount of UI, WF, SDI, and/or FLI deductions that exceed the maximum amount required by law.

Q: How can I claim a credit for excess contributions in New Jersey?

A: To claim a credit for excess contributions in New Jersey, you need to fill out Form NJ-2450 and submit it to the New Jersey Division of Taxation.

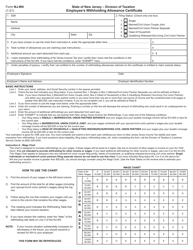

Q: What information do I need to provide on Form NJ-2450?

A: On Form NJ-2450, you will need to provide your personal information, details of your excess contributions, and any supporting documentation.

Q: When is the deadline to submit Form NJ-2450?

A: The deadline to submit Form NJ-2450 is generally the same as the deadline for filing your New Jersey income tax return, which is April 15th.

Q: Can I claim a credit for excess contributions from previous years?

A: Yes, you can claim a credit for excess contributions from previous years by filing an amended tax return.

Q: Are there any limitations or restrictions on claiming a credit for excess contributions?

A: Yes, there are certain limitations and restrictions on claiming a credit for excess contributions. It is recommended to review the instructions provided with Form NJ-2450 or consult a tax professional for guidance.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-2450 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.