This version of the form is not currently in use and is provided for reference only. Download this version of

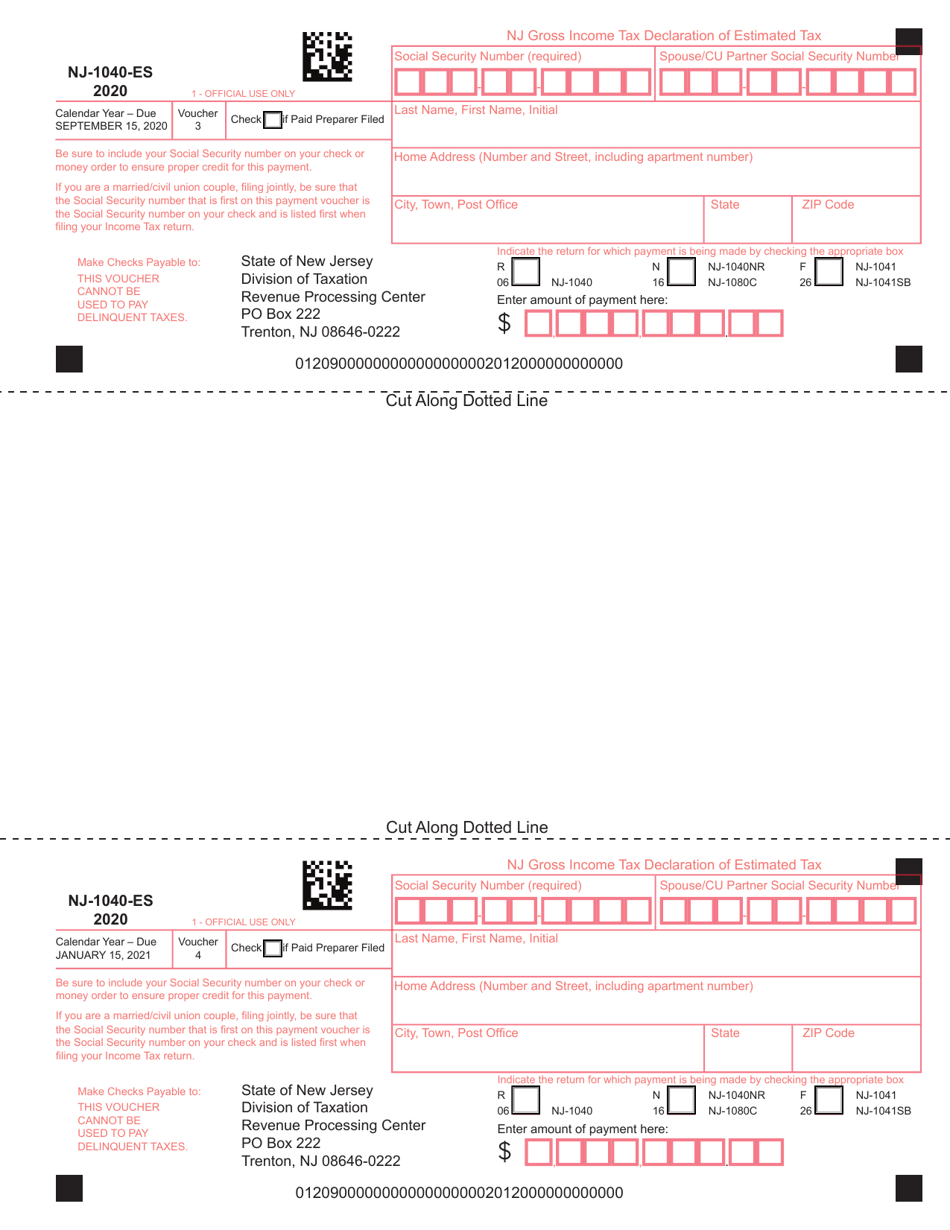

Form NJ-1040-ES

for the current year.

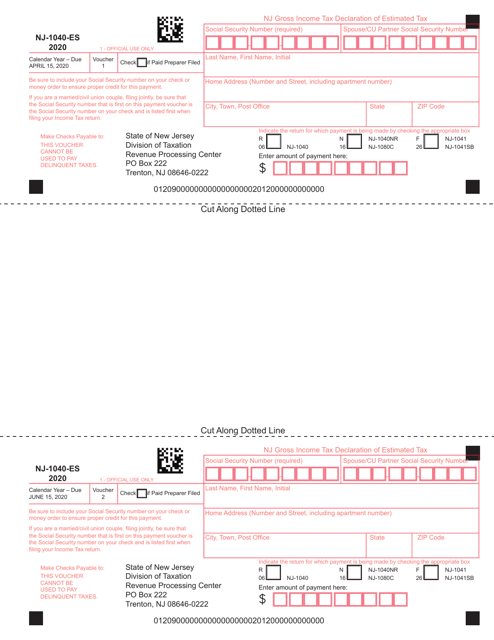

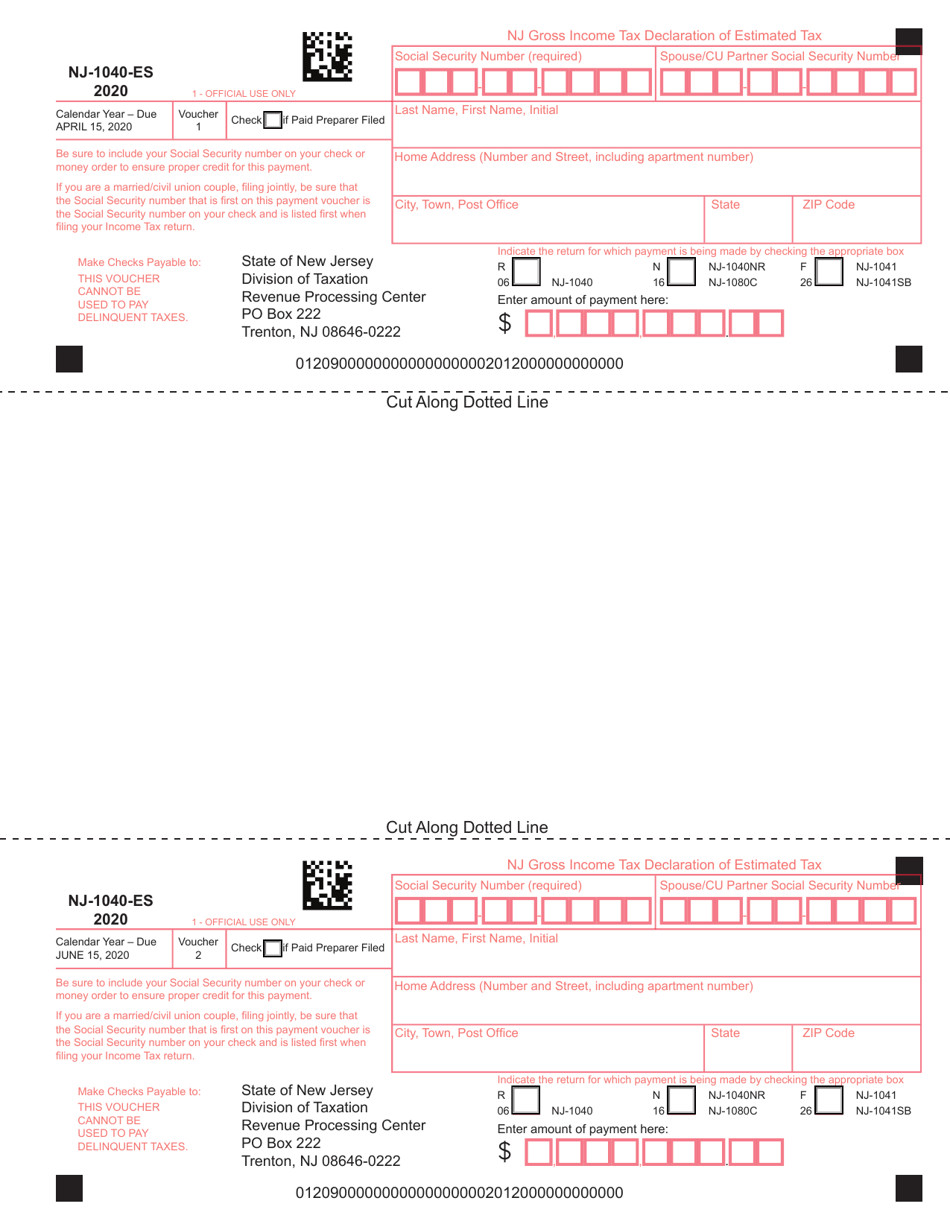

Form NJ-1040-ES Nj Gross Income Tax Declaration of Estimated Tax - New Jersey

What Is Form NJ-1040-ES?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is NJ Form NJ-1040-ES?

A: NJ Form NJ-1040-ES is the New Jersey Gross Income Tax Declaration of Estimated Tax.

Q: Who is required to file NJ Form NJ-1040-ES?

A: Individuals who expect to owe more than $400 in gross income tax for the year or do not have taxes withheld from their income are required to file NJ Form NJ-1040-ES.

Q: What is the purpose of NJ Form NJ-1040-ES?

A: The purpose of NJ Form NJ-1040-ES is to declare and pay estimated income tax for the current tax year.

Q: When is NJ Form NJ-1040-ES due?

A: NJ Form NJ-1040-ES is due on April 15th of the following year.

Q: What information is required to complete NJ Form NJ-1040-ES?

A: To complete NJ Form NJ-1040-ES, you will need to provide your name, Social Security number, mailing address, estimated taxable income, and estimated tax liability.

Q: What happens if I don't file NJ Form NJ-1040-ES?

A: If you are required to file NJ Form NJ-1040-ES and fail to do so, you may be subject to penalties and interest on the unpaid tax.

Q: Can I change my estimated tax payments?

A: Yes, you can change your estimated tax payments by filing an amended NJ Form NJ-1040-ES.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1040-ES by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.