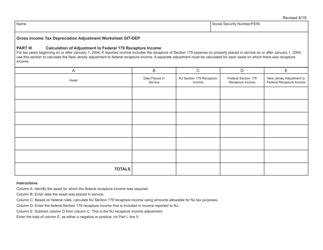

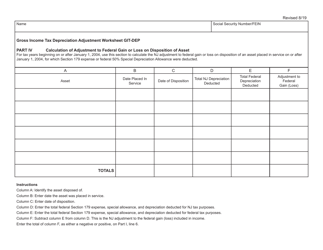

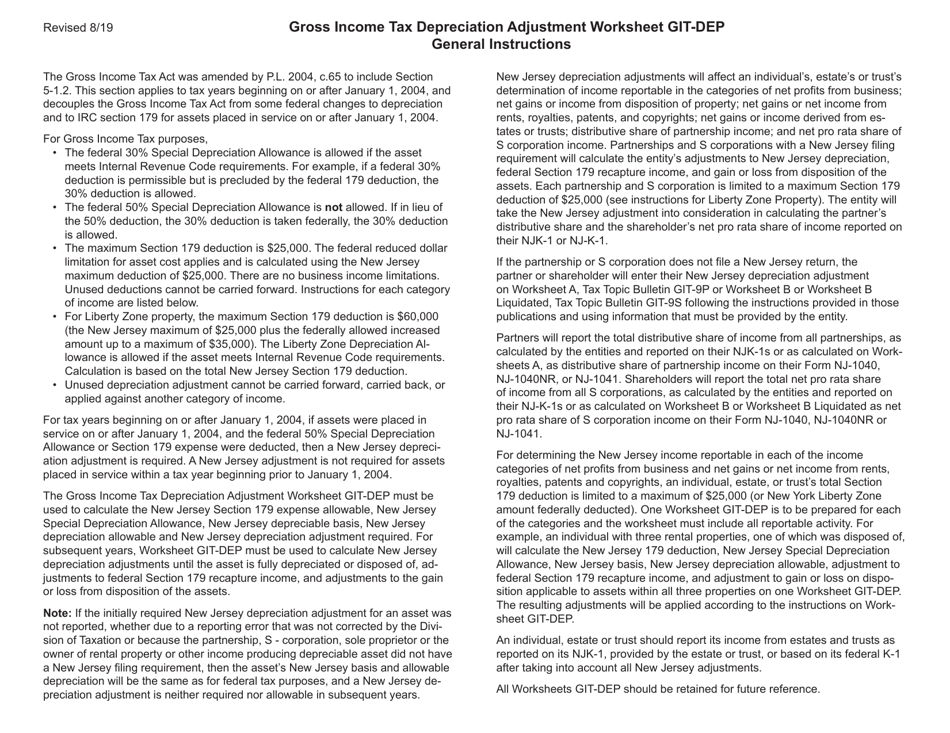

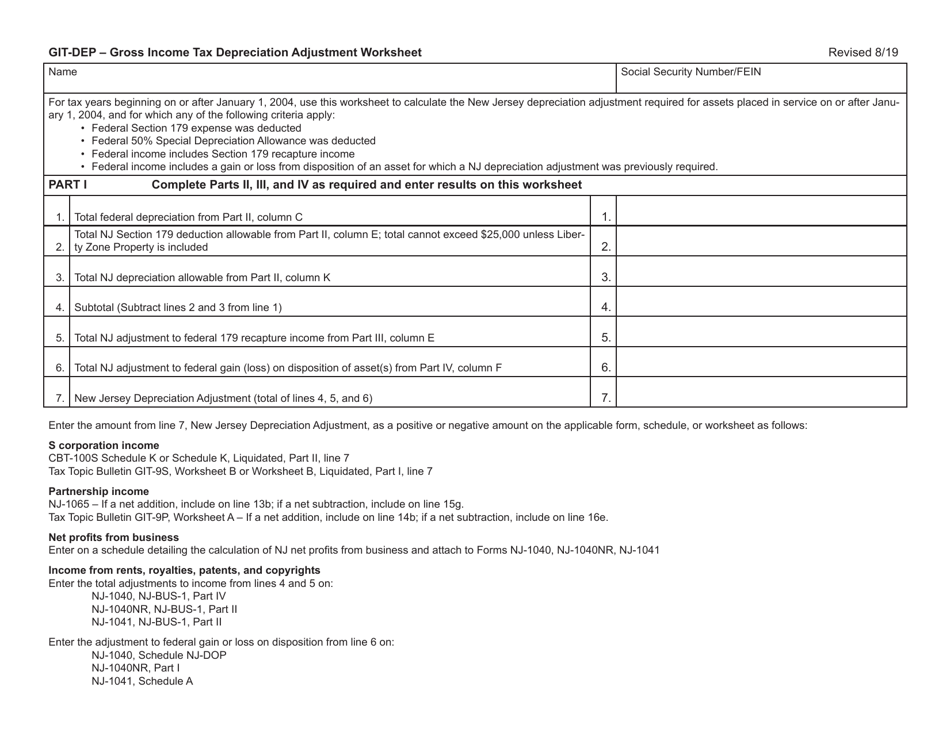

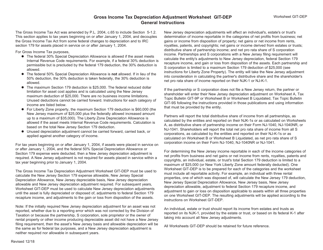

Worksheet GIT-DEP Gross Income Tax Depreciation Adjustment Worksheet - New Jersey

What Is Worksheet GIT-DEP?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the GIT-DEP?

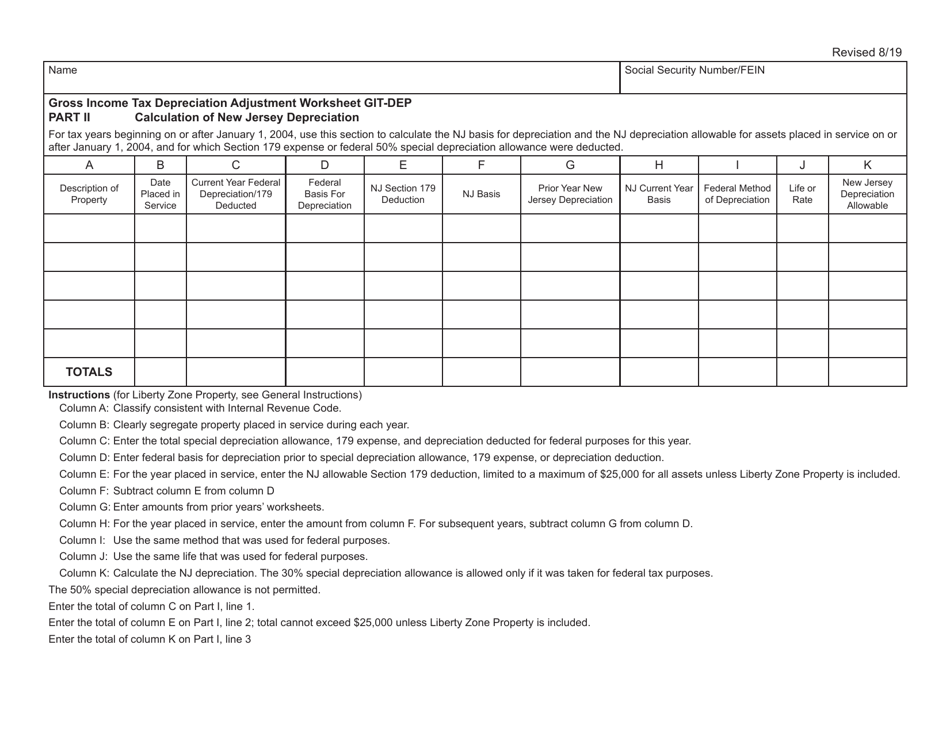

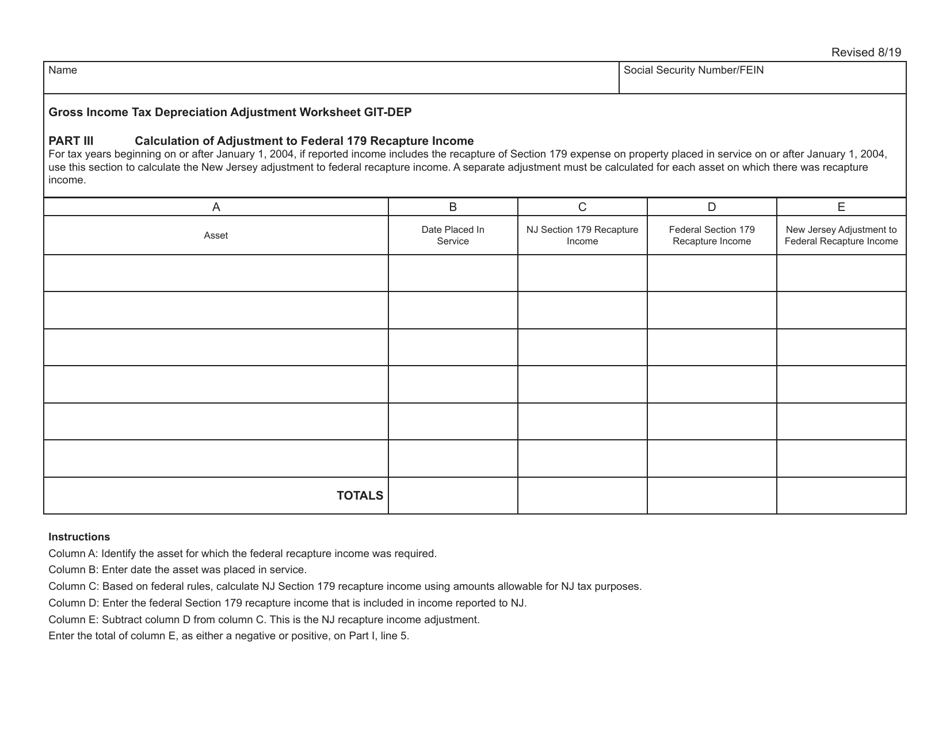

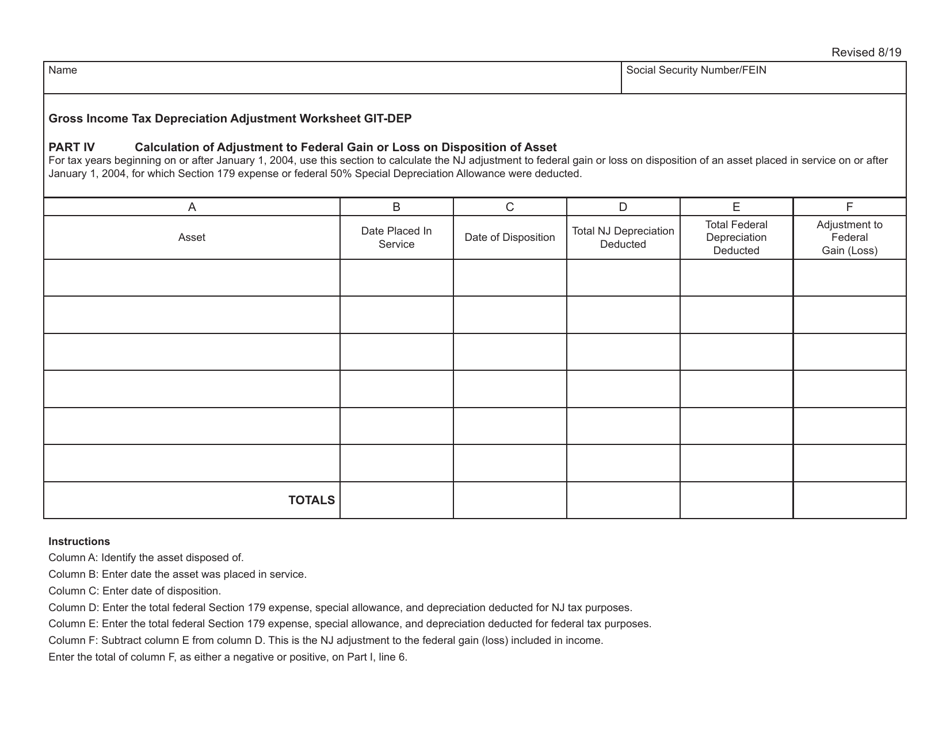

A: The GIT-DEP stands for Gross Income Tax Depreciation Adjustment Worksheet.

Q: What is the purpose of the GIT-DEP?

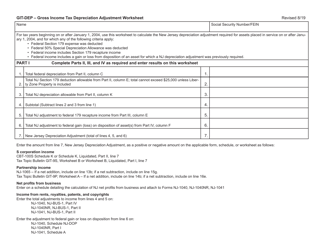

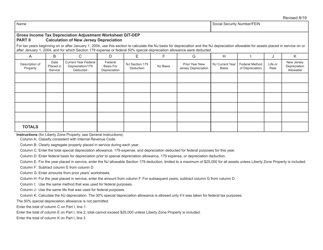

A: The purpose of the GIT-DEP is to calculate the depreciation adjustment for New Jersey Gross Income Tax.

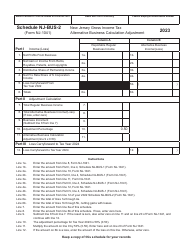

Q: Who needs to use the GIT-DEP?

A: Anyone who is subject to New Jersey Gross Income Tax and has assets subject to depreciation needs to use the GIT-DEP.

Q: What does the GIT-DEP calculate?

A: The GIT-DEP calculates the depreciation adjustment that must be included when calculating New Jersey Gross Income Tax.

Q: Is the GIT-DEP applicable only to individuals?

A: No, the GIT-DEP is applicable to both individuals and businesses subject to New Jersey Gross Income Tax.

Q: Is the GIT-DEP only applicable for New Jersey residents?

A: No, the GIT-DEP is applicable for both New Jersey residents and non-residents subject to New Jersey Gross Income Tax.

Q: Is the GIT-DEP a separate tax form?

A: No, the GIT-DEP is a worksheet that needs to be completed and attached to the New Jersey Gross Income Tax return.

Q: What should I do if I have questions or need assistance with the GIT-DEP?

A: If you have questions or need assistance with the GIT-DEP, you should contact the New Jersey Division of Taxation or consult a tax professional.

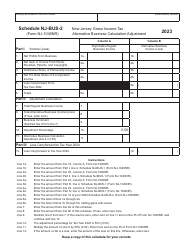

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Worksheet GIT-DEP by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.