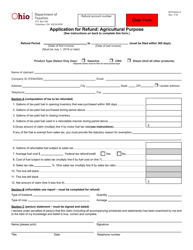

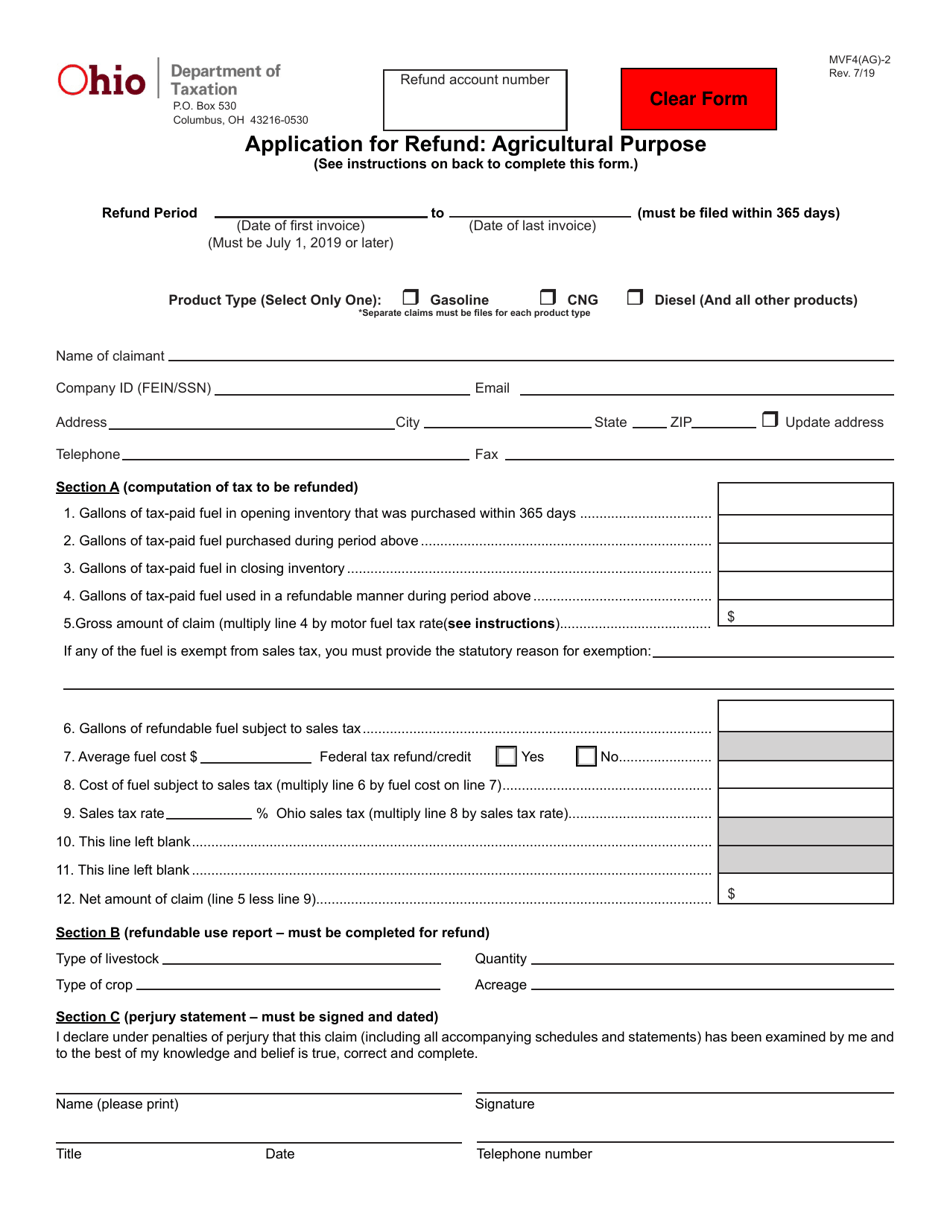

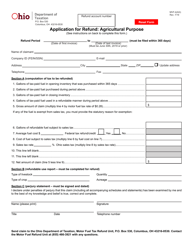

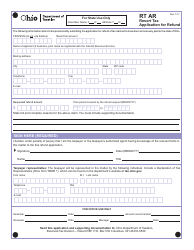

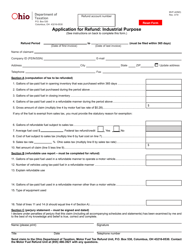

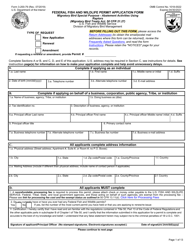

Form MVF4(AG)-2 Application for Refund: Agricultural Purpose - Ohio

What Is Form MVF4(AG)-2?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MVF4(AG)-2?

A: Form MVF4(AG)-2 is an application for refund for agricultural purposes in Ohio.

Q: What is the purpose of Form MVF4(AG)-2?

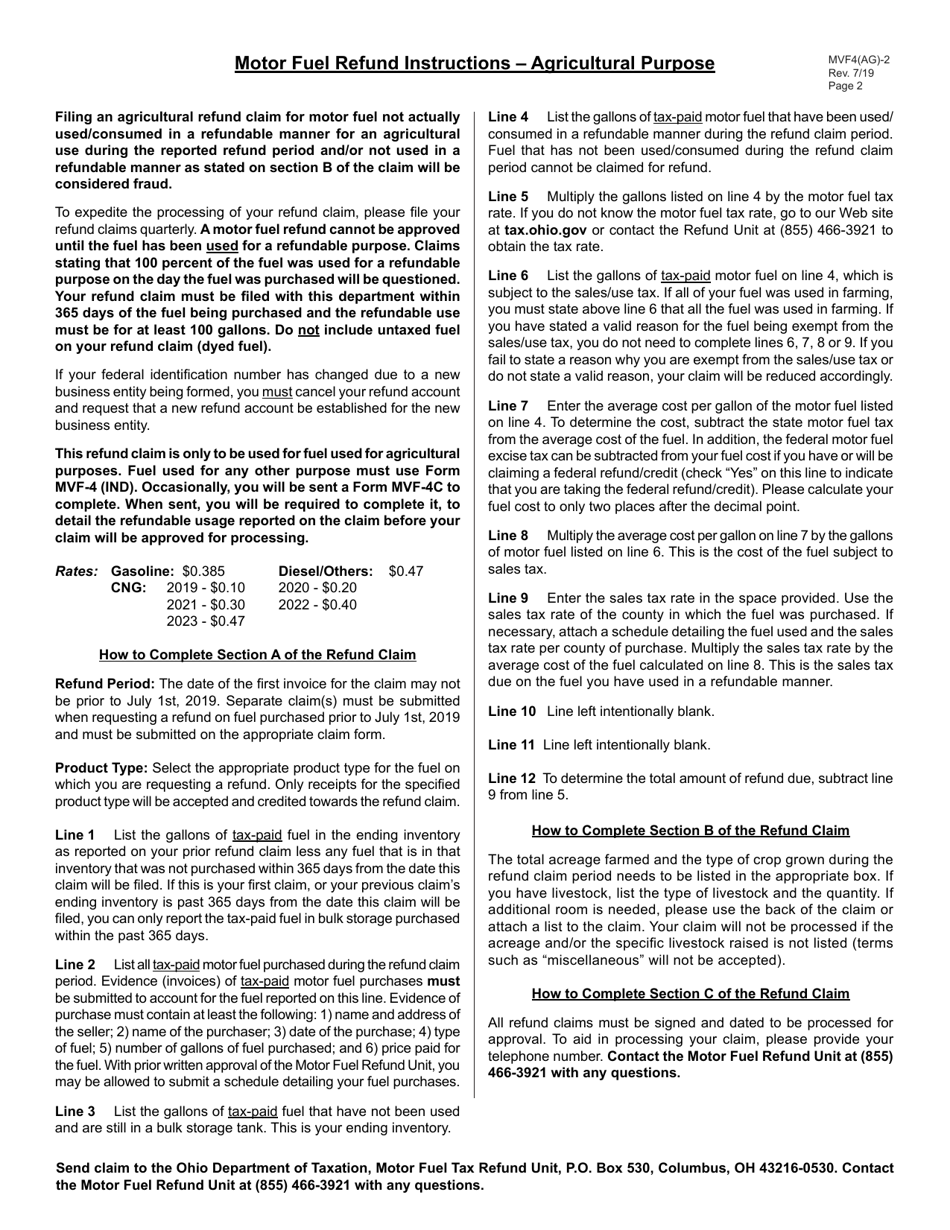

A: The purpose of Form MVF4(AG)-2 is to apply for a refund on taxes paid on fuel used for agricultural purposes in Ohio.

Q: Who can use Form MVF4(AG)-2?

A: Form MVF4(AG)-2 can be used by individuals or entities engaged in agricultural activities in Ohio.

Q: What expenses are eligible for a refund using Form MVF4(AG)-2?

A: Expenses related to fuel used for agricultural purposes, such as farming operations, are eligible for a refund using Form MVF4(AG)-2.

Q: Are there any deadlines for submitting Form MVF4(AG)-2?

A: Yes, Form MVF4(AG)-2 must be submitted within three years from the date of the fuel purchase.

Q: Is there a fee for filing Form MVF4(AG)-2?

A: No, there is no fee for filing Form MVF4(AG)-2.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MVF4(AG)-2 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.